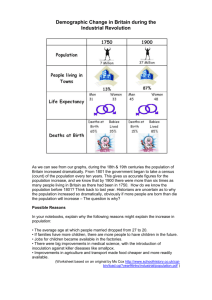

HOW DID DEVELOPED COUNTRIES INDUSTRIALIZE?

advertisement