Canada Food & Drink Market Overview

advertisement

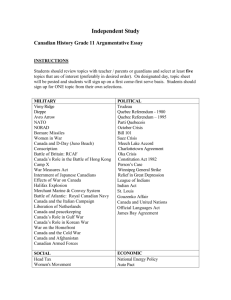

Canada Food & Drink Market Overview December 2009 Content 1. Canada Demographics & Economic Data 2. Canada Food & Drink Market Overview Grocery Retailers Specialty Retailers Liquor Control Boards 3. Irish Foods in Canada Market Issues Opportunities Canada • World’s 2nd largest country by area • Population: 33 million • Capital: Ottawa • Largest City: Toronto (5m people) • Official Languages: English & French • Major Industries: Energy, Agriculture, Mining, Manufacturing • GDP CAN$1.5 trillion = 9th largest economy in world Copyright: bestbuywindow.com Canada Geography • A federation of 10 provinces & 3 territories • Can be grouped into 4 regions: Western (BC, Alberta, Saskatchewan, Manitoba) Central (Ontario, Quebec) Atlantic (New Brunswick, Nova Scotia, Prince Edward Island, Newfoundland and Labrador) Northern (the 3 territories of Yukon, Northwest Territories & Nunavut ) Canada Population • Major Cities: Toronto, Ontario 5.1m Montreal, Quebec 3.6m Vancouver, British Columbia 2.1m Ottawa-Hull, Ontario-Quebec 1.1m Calgary, Alberta 1m • 70% of pop live within 150km of US border • 20% of pop are foreign born • Growing population, due to immigration, primarily from Asia & Middle East (Source: 2006 Census) Canada Ethnicity • The historically strong European influence is seen in the language and more conservative cultural tendencies. Also in food culture. Source: Census 2006 Canadian Food Market Overview: Small Number of Retail Grocery Players • Small concentration of retailers. Dominated by Loblaws with 17 banners. Predominately Canadian / domestic retailers plus Walmart & Costco Dollar Share of Retail Grocery Trade 30.0 Loblaws 13.0 Sobey's 12.5 Metro Inc. Walmart 7.2 Costco 7.1 5.7 Safeway 0 Source: CSG 2008 5 10 15 20 $ Share 25 30 35 Canadian Market Overview: Top Domestic Retailers 2008 Parent Co. Main Supermarket Banners Total CAN Grocery Sales ($b) Total No. of Stores owned by Parent Co. Loblaw Inc Loblaws, Real Canadian Superstore, Zehrs, Fortinos, No Frills, Independent, Valu-mart, T&T, Maxi, Provigo 22 1,501 Sobeys Inc Sobeys, IGA, Thrifty Foods, Foodland 13 1,351 Metro Inc Metro, Super C, Les 5 Saisons, A&P, Food Basics, Marche Richelieu 9 1,483 Federated Co-ops Ltd Co-op 6 548 Canada Safeway Ltd Safeway 4.5 214 Overwaitea Food Group Save on Food, Overwaitea Foods, Price Smart, Coopers Foods, Urban Fare 2.2 113 Source: 2009 Supermarket Chain Guide Canadian Food Market Overview: Loblaw • Loblaw Companies Limited (TSX: L) (LCL) is the largest food retailer in Canada, with over 1,500 supermarkets operating under 17 regional banners • Canada's largest retailer with total sales of +CAN$30 billion in 2008 (CAN$22b grocery) • Headquartered in a new, 37,000 m2 office tower located in Brampton, Ontario • Their President’s Choice private label is the no. 1 grocery brand in Canada • In July 2009, purchased T & T Supermarket Inc., Canada's largest Asian food retailer • Loblaw stores can sell Alcohol in Quebec, Alberta and recently PEI. • Quebec LCL sells in their own stores, but only beer and wine (bottled in Quebec). The government SAQ stores sell everything else • In Alberta LCL have their own Liquor stores located in the Parking Lots of their Superstores. They are not allowed to have them attached. These stores are full line wine, beer and spirits. • PEI there is one location LCL owns Canadian Food Market Overview: Loblaw’s Banners • 70 stores avg.60,000 sq. ft • Bakery, dairy, deli, frozen, produce, grocery • 107 stores averaging 140,000- 210,000 sq. ft • Depts. as above & Non-Food (stationary, general merchandise, etc.) • Liquor outlets in W. Canada • Chain of 40 grocery stores located in south western Ontario • Average 25,000 – 40,000 sq. ft. • Full service traditional grocery stores • 20 stores / avg. 35-50,000 sq.ft. • Most are franchised traditional Italian influenced grocery stores • Chain of franchised "hard discount" grocery stores currently located in the provinces of Ontario, Alberta, British Columbia / 30,000- 50,000 sq. ft. Canadian Food Market Overview: Loblaw’s Banners • 53 franchised grocery stores in eastern Ontario • Avg. 25-40,000sq ft • 60 small town Ontario grocery stores • Avg. 20,000 sq ft • Now Canada's largest Asian supermarket chain • 13 stores averaging 35,000 sq. ft. • 10 more planned for E. Canada • A grocery retailer based in Quebec • Quebec equivalent of No Frills, a chain of franchised discount grocery stores • Based in Quebec consisting of over 300 stores and franchises throughout the province / most in or near Montreal Canadian Food Market Overview: Sobey’s • • • • • • • Wholly-owned subsidiary of Empire Company Limited, headquartered in Stellarton, Nova Scotia In 1998, Sobeys became no. 2 grocer in the country after purchasing the Oshawa Group, owners of the IGA franchise across Canada, along with several regional chains in Ontario Though Sobeys remains the second largest grocery chain in Canada, it is the third place chain in most of the provinces outside the Atlantic region In 2007, announced a $260 million takeover offer for the Thrifty Foods chain in British Columbia. Has more than 1,300 stores in 10 provinces with retail banners that include Sobeys, IGA, Foodland, Price Chopper and Thrifty Foods The company also operates 75 Lawtons Drug stores in Atlantic Canada Across the Country Sobeys: • has more than 1325 stores / approximately 60% Corporate and 40% Franchised • 27.5 million sq. ft. of retail space • operates in 862 different communities from 23 individual distribution facilities • has 28 stores that sell spirits in Western Canada, with their IGA Extra’s in Quebec selling beer and wine in the stores Canadian Food Market Overview: Sobey’s Banners Atlantic Ontario West Modern food stores offering full-service meat and seafood departments, farm-fresh produce, in-store bakeries, prepared foods and florists. Québec Full service food stores with extra focus on fresh food and an emphasis on customer service serving the Québec market West Serving Vancouver Island and the Lower Mainland of British Columbia, A wide range of fresh offerings in a full service food store. Groceries can be purchased online for home delivery. West Ontario High quality fresh product offerings, serving suburban and mid-sized communities in Western Canada and Ontario(West) Ontario Atlantic Neighbourhood stores focusing on community and customers while offering a wide variety of conventional products with friendly customer service Canadian Food Market Overview: Metro • Metro Inc. (TSX: MRU.A) is a food retailer operating in Quebec and Ontario. The company is based in Montreal. • No. 2 grocer in both Ontario and Quebec, after Loblaw Companies Limited. There are 243 namesake stores in Quebec, averaging 22,300 square feet and 135 namesake stores in Ontario • In 2005, Metro Inc. purchased A&P Canada for C$1.7 billion • In August 2008, Metro announced it would rename the company's Dominion, A&P, Loeb, The Barn and Ultra food stores as Metro stores at a cost of C$200 million • Metro operates its food stores under the banners Metro, Metro Plus, Super C, A&P, Food Basics, Marché Ami and Les 5 Saisons Canadian Food Market Overview: Metro Banners • The Metro banner, with its 339 stores including 91 newly launched Metro Plus stores, is a leading Québec and Ontario (118) supermarket chain. 2009 - July Number of stores Average floor area 339 31,100 • Operating in the discount supermarket segment, the Super C banner operates stores with an average retail space of 43,100 square feet 2009 - July Number of stores Average floor area 63 43,100 • A&P operates 34 stores throughout Ontario, committed to providing customers with the freshest products in a convenient shopping environment. 2009 - July Number of stores Average floor area 34 41,900 • Food Basics is a discount format providing low priced quality products to value-seeking customers in 117 locations across Ontario. 2009 - July Number of stores Average floor area 117 32,800 • Over the years, the 5 Saisons markets have earned an enviable reputation as grocers who specialize in popular, high-end products from different countries. • These stores are known for their friendly atmosphere and the freshness of products produce, baked goods, prepared foods and premium quality meats prepared by experienced butchers. 2009 - July Number of stores Average floor area 97 5,900 Canadian Food Market Overview: Safeway • Canada Safeway was established in 1929 in Winnipeg, Manitoba HQ is now in Calgary, Alberta. 100% owned by Kohlberg, Kravis, Roberts of New York. Parent company Safeway is one of the leading supermarket operators in the US • Canada Safeway has 214 stores located primarily in Alberta, British Columbia, Manitoba, and Saskatchewan • All stores carry Lucerne, Empire and Safeway Select private label products • Safeway has about 25% of the grocery market in Western Canada • Canada Safeway serves independent grocery stores and institutional customers through four distribution centers (operated by third parties) • • Also owns approx. 12 Canadian plants that make or process meat, dairy products, fruits and vegetables, bread, and other foods Canadian Food Market Overview: Overwaitea Food Group & Banners • The Overwaitea Food Group (OFG) is a part of the Jim Pattison Group, Canada’s third largest privately held company • OFG operates 115+ stores under the Save-On-Foods, Overwaitea Foods, Urban Fare, Cooper's Foods, PriceSmart Foods and Bulkley Valley Wholesale banners • All stores support the OFG private label brand “Western Family” • 15 mid-size format stores in smaller communities throughout British Columbia • 75 stores larger format stores (53 in British Columbia and 22 in Alberta) • 14 small to mid sized format Discount grocery stores with limited # of lines • 3 mid-sized trendy-gourmet stores located in Vancouver that carry a mix of traditional grocery products with a vast array of unique specialty food products • 15 stores in communities through the British Columbia Interior and B.C.’s Lower Mainland • Bulkley Valley Wholesale offers customers a unique combination of wholesale and retail shopping with very competitive prices in one store in a Cash & Carry / Club store format in Smithers, BC Canadian Food Market Overview: Costco • Canada Costco Wholesale Corporation (NASDAQ: COST) is the largest membership warehouse club chain in the world based on sales volume • Headquartered in Issaquah, Washington, US, with flagship store in nearby Seattle. • As of October, 2009 Costco has 77 stores in Canada (48 East / 29 West) • Costco East operations are based in Ottawa, Ontario and service the following stores: • Ontario – 26 • Quebec – 18 • New Brunswick – 1 • Nova Scotia – 2 • Newfoundland – 1 • Costco West operations are based in Richmond, British Columbia and services the following stores: • Manitoba – 3 • Saskatchewan – 2 • Alberta – 11 • British Columbia – 13 Canadian Food Market Overview: Walmart • Walmart Canada is the Canadian division of Walmart. Founded in 1994 in Mississauga, Ontario with the purchase of the Canadian Woolco stores from Woolworth Canada • In Autumn 2006, Walmart opened new Supercentres in select Canadian cities with 14 new stores operational by the end of 2007 • Supercentres devote approximately 30% of floor space to traditional grocery store products including produce, dairy and frozen foods • Stores •312 retail units (asat May 2009). Includes 122 former Woolco and Walmart Supercentres locations: •255 Walmart Discount Stores •57 Walmart Supercentres (34 - ON. 19 - AB. 4 - BC) Canadian Food Market Overview: Retailer Focus • Common to most North American retailers, key ‘hot’ issues include: – – – – – – EDLP Private Label development including Organic Nutrition / Healthier products Food Traceability Green Packaging Sustainability Canadian Liquor Market • Canadian Annual Alcohol Consumption per capita (over 15 years of age) is 8.1 litres. Compares with 13.4 litres in Ireland and 8.6 litres in the U.S. (Source: OECD Health Data 2009) • Legal drinking age in Canada is 19 (18 in Quebec, Alberta and Manitoba) • The four largest Provinces in population terms, Ontario, Quebec, British Columbia and Alberta account for approximately 90% of alcohol sales • Because of the market structure, where Provincial Liquor Control Boards manage the alcoholic beverage market in each Province, the biggest drawback from a supplier perspective of doing business in Canada, is the low profitability the market offers Canadian Liquor Market • Beer is the most popular alcoholic beverage with total consumption in 2008 of just under 23m hectolitres. Beer consumption has very small growth in the ten years from 1999 to 2008 (CAGR +1.1%) • Irish beers available in Canada include Guinness, Kilkenny, Murphy’s and O’Hara’s • Cider consumption in Canada is negligible at 193,000 HL in 2008. Ireland consumed 720,000 HL of Cider by comparison • Magner’s cider is now available in Canada Canadian Liquor Market • Spirits consumption has grown annually by 2.3% CAGR in the 20 years to 2008 – primarily driven by vodka • Whisk(e)y sales have been fairly static and dominated by Canadian whisky (accounts for 75% of category volume) • The fastest growing category of whisk(e)y in Canada, albeit from a small base is Irish Whiskey (CAGR +8.6% from 1999 to 2008) • The majority of Irish whiskey brands are sold in Canada, but Jameson dominates the group, followed by Bushmills Canadian Liquor Market • Cream Liqueurs have been the fastest growing sub-category of Liqueurs over the last 10 years (CAGR 6.5% vs. CAGR 4.1% for Total Liqueurs) • Growth in Cream Liqueurs has been led by Diageo’s Bailey’s Irish Cream Liqueur, which now sells 394,000 cases (9 litres), and has 50% share of Imported Cream Liqueurs • Irish Cream Liqueurs in total sold 626,000 cases in 2008, representing 79% market share of Cream Liqueurs • Other Irish brands available include Carolan’s, O’Darby’s, O’Casey’s, Feeney’s and Sheridan’s Canadian Liquor Control Boards LCBO (Ontario) • The Liquor Control Board of Ontario (LCBO) is the largest single purchaser of alcoholic beverages in the world. The LCBO is an arm of the Ontario Provincial Government • There are 604 LCBO stores plus 216 privately owned agency stores • The LCBO has 50.8% value share of alcohol sales in the Province, which totalled C$1.345 billion in fiscal year 2007-08 • The LCBO stocks a strong range of Irish alcoholic brands – 75 SKU’s across all key Irish beverage categories from 7 suppliers Canadian Liquor Control Boards SAQ (Quebec) • The Société des Alcools du Québec (SAQ) is a state-owned corporation responsible for the trade of alcoholic beverages in Quebec • There are 379 SAQ stores, and 303 agency stores (plus a further 9,200 retail outlets in grocery and convenience stores for wines) • Quebec accounts for approx. 15% of all Irish Whiskey sales and 20% of all Irish Cream Liqueur sales in Canada • SAQ carries approx. 42 active Irish SKUs Canadian Liquor Control Boards LCLB & LDB (British Columbia) • Two government bodies have responsibility for the B.C. liquor industry • The Liquor Control and Licensing Branch (LCLB) issues licences for making and selling liquor and supervises the service of liquor in licensed establishments • The Liquor Distribution Branch (LDB) is responsible for the importation, distribution and retailing of beverage alcohol in B.C. • The LDB operates more than 190 government liquor stores (BC Liquor Stores). It has licensed 674 Licensee Retail Stores in the Province and also authorizes the sale of liquor in rural communities via Rural Agency stores totalling 424 stores in 229 cities (source: bcliquorstores.com) • BC Liquor stores had 62 active SKUs from Ireland (12 mths to April 2009) Canadian Liquor Market Alberta Province • Alberta is the only Canadian province which has completely privatised the distribution and retail of liquor (since 1993) • There are currently 1,201 retail outlets offering 15,433 products • Alberta had 84 active Irish SKUs in the year to April 2009 Irish Food Products in Canada: What Products Are Typically Available? • While 4m Canadian’s claim Irish ancestry, due to the long time since the last wave of Irish immigration, a strong demand for Irish sourced products does not exist • Irish products that are available include: Àlcoholic Drinks Beer: Guinness, Harp, Smithwick’s, Kilkenny, Magners Spirits: Jameson's, Tullamore Dew, Kilbeggan, Connemara Liqueurs: Baileys, O’Darby’s, Carolan’s, O’Casey’s, Feeney’s, Sheridan’s, Irish Mist Dairy Kerrygold Butter and Cheddar Cheese Range Farmhouse Cheeses Opportunities & Challenges For Irish Food & Drink Enablers Constraints 1. Wealthy market that has weathered global recession well 1. Distance from Ireland (food miles, distribution costs, key account management) 2. Concentration of population in a few urban centres 3. Proximity of large population centres close to US border 4. Low alcohol profitability has to be balanced with the high volume opportunity Canada offers, particularly for Irish whiskey 2. Physically huge market with no retailer or wholesaler having complete national coverage 3. Price sensitive market 4. Dual language labelling (Eng & Fr) 5. Importation tariffs & dairy quotas Opportunities For Irish Foods Largest Opportunity Alcohol Premium Private Label Foods Specialty Packaged Foods (Chocolate, Oatmeal) Cheese / Butter Mainstream Packaged Foods Smallest Opportunity Bord Bia Activities • Can advise clients planning to visit / assess opportunities in Canadian Market - Recommendations for store visit itineraries Additional market information Key grocery trade shows dates Introductions to distributors / brokers Mentoring Canadian Market Overview End/