Lowe's - Check Capital Management

Lowe’s

Research Report

November 2007

Price: $22

THE BUSINESS

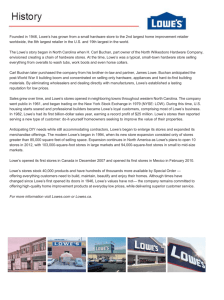

Lowe’s is the eighth-largest retailer and second-largest home-improvement retailer in the U.S., with over

1400 stores in 49 states. Lowe’s and Home Depot have created a virtual duopoly in the homeimprovement business. Lowe’s has a strong track record, averaging annual sales and EPS growth of 17% and 24% respectively over the last ten years.

$3,500

Net Income (in $ millions)

Until the early 1990s, the homeimprovement retail sector was dominated by regional and mom-andpop stores. As with many other product categories, such as home electronics, office supplies and pet products, these local players tended to be relatively inefficient. Home Depot and Lowe’s were able to achieve tremendous success rolling out efficient, userfriendly stores which allowed customers to find everything they needed under one roof. Each Lowe’s

$3,000

$2,500

$2,000

$1,500

$1,000

$500

$-

2500

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Home Improvement Stores

store stocks over 40,000 different items.

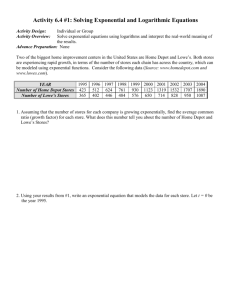

These “category-killing” retailers used economies of scale to push smaller chains out of business. The graph at right shows the growth in the number of

North American stores for Lowe’s and

2000

1500

1000

Home Depot.

Unfortunately Lowe’s past success hurts its future potential. The easiest locations have already been tapped, and

500

0

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

Lowe's Home Depot some markets are reaching saturation for big-box home-improvement stores. Lowe’s is opening about 140 new outlets this year. They currently have plans to open 400 more stores, at the rate of about 140 per year through 2010. Beyond that, there are 900 more locations which the firm thinks might be able to support stores. Nonetheless, even if all of these locations eventually do hold a Lowe’s store, the company can only increase its store base by about 80% from its current level. For comparison’s sake, the company has increased its store base by 80% since the beginning of 2002 alone. Lowe’s is pursuing growth outside the U.S. to augment its slowing domestic sales. The firm is about to open its first Canadian stores, and will begin opening stores in Mexico in 2009.

Lowe’s management estimates the size of its market in the U.S. at $755B, consisting of $587B in product and $168B in labor. With sales approaching $50 billion annually, this gives Lowe’s a 6% marketshare.

1

Check Capital Management Inc.

Costa Mesa, CA.

(714) 641-3579 (800) 710-5777

However, this number is deceptive because there are certain product categories where Lowe’s (and Home

Depot) have much higher marketshares, and others where their share is much lower.

The company is positioning itself to benefit from trends within the industry. Although the majority of sales are to do-it-yourself (DIY) customers, this segment is growing much slower than the do-it-for-me

(DIFM) segment. For this reason Lowe’s is offering more services including installations and repairs.

Installed sales account for only 6% of revenues but have grown more than 20% annually over the last three years.

Lowe’s operational excellence, focused merchandising and economies of scale have created a sustainable economic moat around its business. These core competencies have also translated into tremendous financial success. Lowe’s has consistently generated a return-on-equity above 20%, although it may miss this mark in 2007.

LOWE’S VS. HOME DEPOT

Although Lowe’s has always been runner-up to Home Depot in terms of size, it bests its bigger counterpart in other important ways. Lowe’s has superior

Lowe’s Home Depot financial metrics, as the table at right indicates. [ROA is a better

5-Year Avg. Sales Growth

5-Year Avg. EPS Growth

17.5%

25.5%

15.0%

18.0% metric for comparison than ROE because HD has heavily

2007 Same-Store sales

Gross Margin

-4.3%

34.2%

-6.2%

33.4% leveraged its balance sheet to repurchase stock].

Operating Margin

Return on Assets

11.7%

11.9%

10.0%

10.5%

Part of the reason for Lowe’s superior performance is continual missteps by Home Depot’s management, but much of it lies in Lowe’s focus and operational efficiency. Much like Target has managed to differentiate itself from Wal-Mart, Lowe’s has separated itself from Home Depot. Lowe’s competes very well against Home Depot head-to-head. Lowe’s puts a lot of emphasis into its store layout and design.

Its outlets are brighter and in many ways more user-friendly than Home Depot’s. Lowe’s attracts more female shoppers, who are making an increasing percentage of home-improvement decisions.

In recent customer satisfaction surveys Lowe’s scored higher than all other specialty retailers except

Costco. Home Depot meanwhile came in last in the survey. Although Home Depot’s new CEO Frank

Blake is working to improve customer satisfaction, Lowe’s success in this area has helped it to take marketshare from its bigger rival.

CURRENT MARKET ENVIRONMENT

The home-improvement market has fallen on hard times. Both Lowe’s and Home Depot’s results have slumped since late 2006, hurt by weakness in the housing market. Housing turnover is an important indicator for these firms, as new home owners tend to make changes to their homes which in turn drive sales. Furthermore, a weak housing market discourages homeowners from taking on big remodeling projects. Not only are consumers making fewer trips to home-improvement stores, they are spending less when they go. Lower housing prices and more stringent lending requirements also make it more difficult for consumers to tap home equity loans.

2

Check Capital Management Inc.

Costa Mesa, CA.

(714) 641-3579 (800) 710-5777

As the graph to the right shows,

Lowe’s earnings per share (EPS)

Lowe's Declining Growth

and same-store sales (SSS) were very strong until 2005, but are now in negative territory. There are several reasons for this weakness, including two consecutive mild hurricane seasons and price deflation in lumber and plywood. But by far the biggest factor is the collapsing housing market.

Management at both Lowe’s and

Home Depot have been surprised by the extent of the slowdown

50%

40%

30%

20%

10%

0%

-10%

SSS

2002

5.8%

EPS 43.1%

2003

6.7%

24.7%

2004

6.6%

17.2%

2005

6.1%

27.2%

2006

0.0%

15.0%

2007*

-4.4%

-7.0% and see weakness continuing into

2008. This is the industry’s worst operating environment since 1991.

Lowe’s is responding by lowering costs. The firm uses a flexible staffing system and offers a lot of incentive compensation, which saves money when results are poor. Lowe’s is also postponing the opening of a regional distribution center which would be an expensive expansion project during a weak market. Nonetheless, these efforts can only partially offset the current stagnation in sales.

There is no way to know how long the downturn in housing will last and when Lowe’s results will rebound. The company lowered its profit forecast on September 25 and then again on November 19.

Lowe’s now expects EPS for 2007 (fiscal year ends January 31, 2008) to be between $1.83 and $1.87.

This is a 7% decline from 2006. Actual net income will fall about 10%, but large share repurchases are buoying EPS. Home Depot’s forecasts are even worse: an 11% EPS decline. As bad as things are for

Lowe’s, they seem to be worse for the rest of the industry. Lowe’s is actually gaining marketshare in most of its product categories, especially from Home Depot.

Although very difficult to predict, it is likely that Lowe’s results in 2008 will mirror those of 2007. When the housing market begins to rebound, earnings will rise. But this may not occur until 2009.

VALUATION

Because of Lowe’s tepid results and continued weakness in the housing sector, the stock market has punished Lowe’s stock price.

Currently the stock is 38% below its all-time high and trades at a P/E ratio of less than 12, its lowest valuation since the 1991 recession.

Lowe’s has very capable and

40

35

30

P/E Ratio shareholder-oriented management. 25

CEO Robert Niblock leads a very experienced and stable senior team that continues to execute its proven

20

15 strategy. The firm has reduced its share count by 5% since 2003,

10 including $500 million in buybacks in

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07

3

Check Capital Management Inc.

Costa Mesa, CA.

(714) 641-3579 (800) 710-5777

the third quarter alone. Management has signaled that they think the stock is attractively priced and are likely to repurchase more.

Lowe’s generates strong cashflow. As the graph at right shows, operating cashflow consistently outpaces net income, which is indicative of healthy earnings and good accounting. The firm has used a high percentage of cash to fund new store expansion. [About 10% of capital expenditures can be classified as

“maintenance” in nature; the rest involves new store openings]. This focus on store growth made sense because new stores generated such high returns. However, as the next graph shows, Lowe’s is now devoting a higher portion of its cashflow to share repurchases and dividends.

5000

4000

3000

2000

1000

4000

3000

0

Net Income and Cashflow ($ Millions)

2004 2005

Net Income

2006

Operating Cashflow

2007 (Q1-Q3)

Uses for Cash ($ Millions)

Lowe’s has a strong balance sheet.

The company has never relied too much on debt. At the end of the third quarter the firm’s debt-to-equity ratio was 25%. It is worth mentioning the

Lowe’s (like many retailers) has $5.5

2000

1000

0

2004 2005 2006 2007 (Q1-Q3) billion of operating leases that it is responsible for, although these

CapEx Buybacks Dividends obligations are not included on the balance sheet. Even if they were included, however, the company’s debt-to-equity ratio would still be very manageable at 41%.

In summary, Lowe’s is an outstanding retailer with a strong management team and a proven track record of growth. The company is financially sound and has shown excellent performance over the long term.

Results are currently weak due to the housing market, and it is unclear how long this downturn will last.

However, Lowe’s poor current performance is clearly due to an industry wide phenomenon and is not a company-specific problem. In the long run the firm should be able to resume its growth, although probably at a slower pace than in the past. In the meantime, at its current valuation, Lowe’s stock price has an earnings yield of about 9%, a very attractive return for an excellent company going through a difficult period.

*The Company Profiles are for informational purposes only and are not an offer to sell or a solicitation to buy. They are not personal recommendations for any particular investor and do not take into account the financial circumstances of any individual investor. Check Capital, or one of its officers, may have a position in the securities discussed and may purchase or sell such securities from time to time. The Company Profiles utilize third-party data in the creation of the reports. While Check Capital believes such third-party information is reliable, we do not guarantee its accuracy, timeliness or completeness

Primary Sources: Lowe’s financial statements and conference calls; Home Depot financial statements and conference calls; Zacks Investment

Digest, SeekingAlpha.com, Fortune; Value Line

4

Check Capital Management Inc.

Costa Mesa, CA.

(714) 641-3579 (800) 710-5777