PA TaxWise User Guide - Arizona AARP Tax-Aide

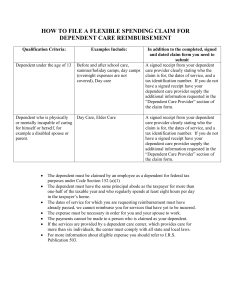

advertisement

Pennsylvania TaxWise® User Guide Personal Income Tax Return (PA-40) Local Earned Income Tax Return Property Tax/Rent Rebate Claim (PA-1000) Version 1c April 2014 Please send comments and suggestions to Steve Conary, PA1 Training Specialist AARP Foundation Tax-Aide TaxWise® is a registered trademark of CCH Small Firm Services AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Pennsylvania TaxWise® User Guide Table of Contents Introduction ....................................................................................................................................... 1 Taxpayer Information ........................................................................................................................ 1 School Code and School District Name ............................................................................................. 1 Filing Status ....................................................................................................................................... 2 Unreimbursed Allowable Employee Business Expenses (PA Schedule UE) ..................................... 2 Interest (PA Schedule A) .................................................................................................................... 2 Dividends and Capital Gains (PA Schedule B).................................................................................... 4 Net Profit from a Business (PA Schedule C) ...................................................................................... 4 Net Gain or Loss from Sale of Property (PA Schedule D) .................................................................. 5 Rents and Royalties (PA Schedule E) ................................................................................................. 5 Gambling Income............................................................................................................................... 5 Form W-2G ................................................................................................................................... 6 Other Income (Form 1040 Line 21) ................................................................................................... 6 Other Deductions (PA Schedule O) ................................................................................................... 6 Pensions and Annuities ..................................................................................................................... 7 Examples ....................................................................................................................................... 7 Wage Statement Summary (PA Form W-2S) ..................................................................................... 8 Sale of Principal Residence ................................................................................................................ 8 Estimated Tax Payments ................................................................................................................... 9 Special Tax Forgiveness (PA Schedule SP) ......................................................................................... 9 Credit for Income Taxed or Income Tax Paid to another State ....................................................... 10 Use Tax ............................................................................................................................................ 11 Underpayment of Estimated Tax (PA Rev 1630) ............................................................................. 12 E-Filing Return ................................................................................................................................. 13 Signatures (Form 8453) ................................................................................................................... 13 Refund/Payment Options ................................................................................................................ 13 Pennsylvania State Unemployment Insurance (SUI) ....................................................................... 14 Local Earned Income Tax ................................................................................................................. 14 Correct Employer Local EIT Withholding .................................................................................... 14 Incorrect Employer Local EIT Withholding ................................................................................. 15 Property Tax/Rent Rebate Claim (PA-1000) .................................................................................... 16 Nonresident Personal Income Tax Return ...................................................................................... 17 Appendix I – PA Taxable Interest..................................................................................................... 18 Appendix II – PA Tax-Exempt Interest ............................................................................................. 19 Appendix III – Returns if Spouse Died During Tax Year ................................................................... 20 Appendix IV – Returns for Same-Sex Couple................................................................................... 21 Appendix V – Amending Returns (Federal and State) ..................................................................... 22 Appendix VI – PA Addresses and Contact Information ................................................................... 23 Version 1c—April 2014 i AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Introduction This guide contains instructions for using TaxWise® to prepare a Pennsylvania Personal Individual Tax Return (PA-40), a Local Earned Income Tax Return and a Property Tax/Rent Rebate Claim (PA-1000) for the typical in-scope taxpayer that the AARP Foundation Tax-Aide program serves. It does not include detailed tax law – refer to the current Pennsylvania Personal Individual Tax Preparation Guide (DFO-02) and Property Tax/Rent Rebate Guide (DFO-3) for specific Pennsylvania tax law information. This guide follows the layout of each Pennsylvania form and schedule and presumes the taxpayer’s income and other information are properly entered on the Main Information Sheet and the other appropriate TaxWise forms for the federal return. Information that automatically flows to the Pennsylvania forms and generally requires no intervention by the counselor is not addressed in this guide. Also included are three appendices with detailed step-by-step instructions for special situations as noted in the table of contents. Taxpayer Information The city and/or occupation fields on the state return are shorter than those on the Federal return. If this information has been shortened on the form, the box under the address will be highlighted. If changes are needed, check the box and make the changes in the city and/or occupation fields. School Code and School District Name The school code and name are required entries. Copy and paste both from Help or use the dropdown box in the field. For TaxWise Online, enter the two digit county code and then either 1) use the keyboard down arrow key to highlight the correct code and name and then press Tab or Enter; or 2) click the x in the right corner of the entry box to remove the county code, then scroll down to the desired code and name and then press Tab or Enter to put the code on the form. Version 1c—April 2014 Page 1 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide If the taxpayer was a nonresident of Pennsylvania on the last day of the tax year, enter 99999 in the school code area. If the taxpayer died during the tax year, enter the information applicable at the time of death. Filing Status The Filing Status is pre- selected based on the federal status on the Main Information Sheet. Select Final as the status only if the taxpayer lived in Pennsylvania during the tax year, but permanently moved away or if for any other reason, the taxpayer will not have any PA taxable income (or loss) in the following tax year. Provide the reason, such as moved to another state. Do not use this status for a decedent. Unreimbursed Allowable Employee Business Expenses (PA Schedule UE) PA Schedule UE is used to report unreimbursed allowable employee business expenses. Add the schedule by linking from PA-40 line 1b. Use this schedule to report expenses such as union dues, work clothes, educator expenses including those reported on the 1040 as an adjustment to income, jury duty pay returned to the employer (use the second line in Part C) and to report education expenses the taxpayer’s employer or the law required the taxpayer to obtain to retain his/her present position or job in Part F. Do not lump expenses together as “miscellaneous” and do not use per diem rates – must be actual expenses incurred. A separate PA Schedule UE must be completed for each taxpayer and for each employer and occupation. Interest (PA Schedule A) Interest income may be taxable or tax-exempt (see Appendices I and II) and must be properly entered on the Interest Statement to transfer correctly to the Pennsylvania return. Note that Municipal Bond Funds may be partially taxable in PA – the payer will generally provide the tax exempt portion for each state. In that case, the state adjustment is a ‘+’ and the amount is equal to (100 – PA %) x Total Amount ÷ 100. Version 1c—April 2014 Page 2 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide A penalty for an early withdrawal will automatically offset the total interest on PA Schedule A. Taxable distributions from the earnings and profits of money market or mutual funds and investment trusts and companies must be reported as dividend income on PA Schedule B and are not considered interest income. PA Schedule A is required only if the total PA-taxable interest is more than $2,500. The schedule must show the recipient, the name of each payer and the amount from each payer. Therefore, a taxpayer and spouse must complete separate schedules unless all income is joint. However, selecting Taxpayer or Spouse on a Schedule A collapses the payer information to one line labeled PA TAXABLE INTEREST as shown below which does not meet PA reporting requirements: If the interest income for either the taxpayer or spouse is more than $2,500, ensure the recipient is properly identified on the Interest Statement and add and complete a PA Schedule A for each as follows: A. If the taxpayer’s interest income is not more than $2,500, click on Taxpayer as the owner for the first Schedule A and accept the one line entry of PA TAXABLE INTEREST. If the taxpayer’s interest exceeds $2,500, complete the following steps in order: Version 1c—April 2014 Page 3 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide 1. Check the “Check here to uncalculated entries” box. 2. Select Taxpayer as the owner 3. Edit the details so that only the taxpayer’s interest is listed ② ① ③ B. Add and complete a second Schedule A for the spouse. If the spouse’s interest income is not more than $2,500, click on Spouse as the owner and accept the one line entry of PA TAXABLE INTEREST. If the spouse’s interest income exceeds $2,500, complete the following steps in order: 1. Check the “Check here to uncalculated entries” box. 2. Select Spouse as the owner 3. Edit the details so that only the spouse’s interest is listed 4. Delete the last line in section 1 labeled ALL OTHERS. Dividends and Capital Gains (PA Schedule B) The same instructions apply to dividends and capital gains reported on PA Schedule B as described for PA Schedule A. Net Profit from a Business (PA Schedule C) A PA Schedule C will automatically be added if there is a Federal Schedule C. Enter the name of the business or the name of the owner on the Federal Schedule C even though not required as this is required on PA form but cannot be added without an override. Enter the number of the Federal Schedule C that corresponds to the PA Schedule C (1, 2, etc.) as shown below: Version 1c—April 2014 Page 4 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Net Gain or Loss from Sale of Property (PA Schedule D) The same instructions apply to net gain or loss from sale of property (typically stocks and bonds) reported on Schedule D as described for Schedule A. In addition, the taxpayer or spouse may not use the other’s loss to reduce his/her gain, i.e., each must file a separate Schedule D if one has a loss and the other a gain even if both totals are not more than $2,500. If less than $2,500 total gain, use a joint Schedule D if all three (TP, SP and JT) have gains or all have losses. Otherwise file separate Schedule Ds for taxpayer and spouse. Similar to the Schedule A instructions, check the uncalculate box, then select the owner and then enter information for the owner. Note: a PA Schedule D must be added and assigned to the taxpayer and/or spouse if there are any short-term or long-term gains or losses from Schedules(s) K-1 entered directly on Schedule D Lines 5 or 12 respectively. The income will otherwise not appear on the PA-40, Schedule SP or PA-1000. Rents and Royalties (PA Schedule E) PA Schedule E will automatically be added if there is a Federal Schedule E for rent or royalty. PA Schedule RK-1 will not be included since there will be no Federal K-1 in accordance with the instructions for entering in-scope K-1 income items (see Pub 4012). Gambling Income All taxable gambling winnings must be reported on PA Schedule T – add the schedule by selecting the radio box at Line 8: Version 1c—April 2014 Page 5 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Winnings reported on a Federal W2-G are automatically entered on the schedule. Add any winnings not reported on a W-2G (which would also be entered on TaxWise 1040 Wkt7 to flow to Form 1040 Line 21). Spouses must report gambling activities separately on separate Schedules T, and the losses of one spouse cannot be used to offset the winnings of the other. Pennsylvania Lottery losses (cost of non-winning tickets) may not be used to offset other gambling and lottery winnings. Also, no expenses attributable to gambling and lottery income are deductible, e.g., travel, parking, postage, entry fees. However, other gambling and lottery losses may be used to offset those gambling and lottery winnings. Form W-2G Mark the box labeled "*" at the bottom of the W-2G if the gambling winnings are not subject to Pennsylvania income tax (typically PA Lottery winnings). Other Income (Form 1040 Line 21) Other income from Form 1040 Line 21 such as Jury Duty Pay (but not gambling winnings reported on a W-2G) is shown below PA-40 Line 8: Select the “add to line 1” radio button to add this other income as gross compensation. If there is both other income that is gross compensation from Form 1040 Line 21 and gambling winnings, check the Schedule T box as described under Gambling Income above and add a scratch pad to the PA-40 Line 1 with the other (non-gambling) income. Other Deductions (PA Schedule O) Pennsylvania allows deductions for 529 Tuition Accounts and HSA contributions. Add and complete PA Schedule O. Version 1c—April 2014 Page 6 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Pensions and Annuities Distributions from retirement plans (pensions, IRAs, 401(k)s, 403(b)s) are generally not taxable by Pennsylvania, but some distributions reported on a 1099-R are taxable by Pennsylvania. • • • Mark Box 1 on the TaxWise 1099-R form to identify pension or annuity payments that must be added to compensation on Form 40, line 1a. Mark Box 2 on the TaxWise 1099-R form to identify income from life insurance contracts, annuities or endowments included in Federal income taxable income (code 7D for example). These will be listed on PA 40 Schedule A. Mark Box 3 on the TaxWise 1099-R form to identify income from charitable gift annuities included in Federal taxable income. These will be listed on PA 40 Schedule A. If the distribution reported on a 1099-R is not taxable by PA, do not complete the Box 13 entries even if the paper 1099-R has information in those fields. Otherwise, the PA Form W-2S will show incorrect information which may trigger an audit by the PA Department of Revenue. Examples • Box 7 Code 1 & 2 Early Distribution – taxable for PA purposes, unless (1) pension or retirement plan was an eligible plan for PA tax purposes, and (2) taxpayer retired after meeting the age conditions of the plan or years of service conditions of the plan. If the above are not true, then must determine the PA-taxable amount of the distribution. (Ex: $1,500 early distribution from 401(k) plan to which taxpayer contributed $1,000 previously taxed by PA. Check Box 1 and enter the net amount taxable in PA in the second state line for box 14 in the TaxWise 1099-R.) • Annuities, Life Insurance, or Endowment Contracts – distribution from an annuity that is not part of a retirement or pension plan such as an IRA, 401(k) or an employer-sponsored retirement program, is PA-taxable income and will often (but Version 1c—April 2014 Page 7 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide • • not always) have code D in box 7. Note: code D is typically used in combination with codes 1, 2, 3, 4, or 7. If taxpayer is required to report an amount from an annuity for federal income tax purposes, s/he must also report the amount as interest income for PA PIT purposes. Also, if taxpayer is required to report an amount from a life insurance and endowment contract for federal income tax purposes, s/he must also report the amount as interest income for PA personal income tax purposes. Check Box 2. This will include the taxable amount on PA Schedule A line 3 – Distributions from life insurance, annuity, or endowment contracts included in Federal taxable income. Charitable Gift Annuities – if taxpayer established a gift annuity to a charitable organization from which s/he is receiving periodic payments, s/he has PA-taxable income. Check Box 3. The taxable amount will be included on PA Schedule A line 4 – Distributions from charitable gift annuities included in Federal taxable income. Form 1099-R Box 7 distribution code 4 (Death Distribution) – these payments are not taxable for PA, however, must be included in the gross amount on line 4 of Part C: Eligibility Income on PA Schedule SP. Wage Statement Summary (PA Form W-2S) Part B of this form lists the Miscellaneous and Non-employee Compensation from Federal Forms 1099-R, 1099-MISC and other statements. The “Type” of income must be designated with the appropriate code in column b for each payer. See the top part of Part B for a list of codes. Sale of Principal Residence Gain on the sale of the taxpayer’s principal residence is generally excluded from PA taxable income. Add and complete PA Schedule 19 and PA Schedule D only if any or all of the gain does not qualify for the exclusion. However, excluded gain is included when determining eligibility for Special Tax Forgiveness and must be entered on line 8 of PA Schedule SP (see below). Version 1c—April 2014 Page 8 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Estimated Tax Payments All estimated tax payments and credits from the previous year PA return must be entered on the TaxWise F/S Tax Pd worksheet to properly carry over to the PA-40. If the taxpayer and spouse made separate estimated tax payments, enter the spouse’s payments in the bottom section of the TaxWise F/S Tax Pd worksheet. If there were separate payments that need to be reassigned between the taxpayer and spouse or if there were joint payments and the taxpayer and spouse are now filing separate returns, complete PA REV-459B Consent to Transfer, Adjust or Correct PA Estimated Personal Income Tax Account and include it with the return(s). Note: If the taxpayer expects to have more than $8,000 of taxable income in the next tax year not subject to withholding, he/she must make estimated tax installments payments. Add and complete Form PA-40ES. Special Tax Forgiveness (PA Schedule SP) Pennsylvania has a sliding scale of tax forgiveness for lower income taxpayers. Eligibility income for tax forgiveness includes income not taxed such as tax-exempt interest, insurance proceeds and inheritances and gain on sale of a residence and may not be offset by contributions to tuition account programs or health savings accounts. Some of this not taxed income will be automatically entered by TaxWise, but certain items such as inheritances (including a pension or IRA with distribution code 4), gain on sale of a residence and gifts must be manually added to this schedule. If the distribution from an annuity on a 1099-R has a code 4 or 4D and the taxable portion is taxable as interest by PA (see Annuities, Life Insurance, or Endowment Contracts above), the taxable portion is already included in Line 1. In this case, enter the difference between the gross distribution and the taxable portion in Line 4. Eligible dependents are dependent children (including foster children) and nieces, nephews and siblings if children and the custody of the nieces, nephews or siblings is assigned to the taxpayer by court order. Disabled and mentally challenged adults are also eligible dependents. All must be claimed as dependents on the taxpayer’s federal return. Parents and grandparents are not eligible dependents for tax forgiveness. If submitting a paper PA-40 which includes Special Tax Forgiveness credit, include a copy of page 1 of the federal return. Version 1c—April 2014 Page 9 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Credit for Income Taxed or Income Tax Paid to another State Pennsylvania gives credit for either the income taxed or the income tax paid to nonreciprocal states. The credit is based on either the income taxed if other state tax rate is higher than PA or the income tax paid if the other state rate is lower. For 2013, Pennsylvania also gives credit for foreign taxes paid. Complete the Federal return first, then the other state returns and then the PA return. Note: if deferred compensation such as a contribution to 401(k) or 403(b) plan that reduces the W-2 Box 1 federal wages is also allowed by the other state, the PA gross compensation will reflect the reduced amount. Link a scratch pad to PA-40 Line 1a and add back the deferred compensation. The amount on the PA-1000 (Property Tax or Rent Rebate Claim) Line 11a must also be adjusted to add back the deferred compensation. Add a PA Schedule G-S for each other state (or country for 2013) if the income taxed in the other entity is limited to compensation, interest and/or dividends – otherwise add a PA Schedule G-L. Separate schedules are required for the taxpayer and the spouse and there must also be separate PA Schedules A and/or B for the taxpayer and spouse as applicable. Adding the Schedule G-S or G-L will also add a Schedule G-R. Complete Part 1 with the name of the state or country and the two-letter code as instructed. Enter the income subject to tax in the other state or country in Column B in the appropriate Line 2 row. Column A will then populate with the data from the PA-40. Enter the tax due and the tax paid to the other state or country in 4a and 4b respectively. Version 1c—April 2014 Page 10 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide PA Schedule G-S Note: taxpayer may not claim credit for tax paid to another country after the 2013 tax year. The taxpayer must fax (using Form DEX 93) or mail the other state return or the documentation of the foreign tax paid to the PA Department of Revenue within fifteen days of e-filing the PA-40. If the foreign country requires an income tax return to be filed, fax or mail a copy of this return; if no tax return is required, fax or mail the statement from that foreign country stating tax due; or fax or mail the federal foreign tax credit Form 1116 plus a copy of the tax document showing the tax due. If taxes paid to another state are higher than the credit allowed on the PA-40, the difference may be applied to any local earned income tax due. Use Tax Use tax is the counterpart of sales tax and applies to taxable purchases made over the Internet, through toll-free numbers, from mail order catalogs and from out-of-state locations, or any other occasion where sales tax was not charged and collected by the seller. The use tax rate is the same as the sales tax rate: 6 percent state tax, plus an additional 1 percent local tax for items purchased or used in Allegheny County and 2 percent local tax for Philadelphia. Complete the worksheet on PA-40 page 2 to add the appropriate amount of Use Tax to the return. The first section applies to general purchases that are individually less than $1,000. The second section applies to individual purchases of $1000 or more. Note that sales tax paid to another jurisdiction can offset the sales tax due PA – enter on line 7. Version 1c—April 2014 Page 11 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Underpayment of Estimated Tax (PA Rev 1630) TaxWise will add PA 1630 if the tax due exceeds $245 and will show the interest due on Line 27 of the PA-40. If the taxpayer had no tax liability the prior year as shown on PA-40 Line 12 for that year, check the box at Line 12 on the PA 1630 to eliminate any interest due on the underpayment. If the taxpayer had a tax liability the prior year, enter the liability minus any tax forgiveness credit shown on PA-40 Line 21 in the 100% column at Line 12 on PA 1630. Also complete the Special Exception Information section at the bottom of page 2: Version 1c—April 2014 Page 12 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide and enter the date the taxpayer expects to pay the tax due in Part III on page 2. Ignore any other red fields on the PA 1630. E-Filing Return Select the Yes button at the bottom of PA-40 page 2 to electronically file the return. Note: the Pennsylvania return can be e-filed only if the federal return is e-filed. Signatures (Form 8453) Taxpayer (and spouse) must sign and date Form 8453 to verify the return has been examined and is true, correct and complete to the best of the taxpayer’s knowledge, to authorize Tax-Aide to e-file the return and to confirm the method of payment or refund. Refund/Payment Options The taxpayer may have a refund deposited in the same bank account selected for the federal return, deposited into a different bank account (which requires entry of the routing number and account number on Form 8453) or mailed to the home address. Payment for any amount due may be by check which the taxpayer mails with the voucher (PA-V) from TaxWise by April 15 or by an electronic debit to the taxpayer’s bank account if that option selected on Form 8453. If choosing electronic debit, the amount, payment date (not later than April 15) and the account information must be entered on Form 8453. Version 1c—April 2014 Page 13 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Pennsylvania State Unemployment Insurance (SUI) PA SUI, an entry in Box 14 on the W-2, is deductible on the Federal Schedule A as a State and Local Income Tax (Line 5a). If entered on the W-2 as PASUI, TaxWise will automatically carry it to Line 5a. If entered as SUI or PA SUI or in some other fashion, it must be manually entered on Line 5a using a scratch pad. Local Earned Income Tax Taxpayers are required to pay local earned income taxes at the higher of their work location nonresident rate or their home location resident rate (if either or both exist) and employers are required to withhold at the higher rate. Political Subdivision (PSD) codes and tax rates can be found at munstatspa.dced.state.pa.us/FindLocalTax.aspx. There is a link on that page to an Excel® list of all PSD codes in the state or enter the home address and work location address in the designated fields for the PSD codes and the current tax rates. Select Municipal Tax Information under Historical Tax Reports, then the tax year of interest and then the municipality for the rates for the applicable tax year. Correct Employer Local EIT Withholding The following instructions are based on the employer properly withholding local earned income for the entire tax year per the requirements above. See next section if this does not apply (taxpayer moved for example and rates changed). 1. Add the PA Local Income Tax form. TaxWise will automatically populate it with the earned income (compensation and self-employment income) and unreimbursed business expenses from the PA-40 and withholding from W-2s. Enter the Political Subdivision code and the local earned income tax rate for the taxpayer’s residence, estimated tax payments (if any), any credits, and any other required information in accordance with the instructions from the taxpayer’s tax collection administrator. 2. If the residency rate is equal to or higher than the work location rate for the taxpayer and spouse, go to step 4. 3. If the residency rate is lower than the work location rate for either the taxpayer or the spouse, check the direct entry box on the TaxWise form and adjust the taxwithheld amounts on Line 10 for both taxpayer and spouse to equal gross compensation (Line 1) times the residency earned income tax rate. These amounts will be lower than the amounts withheld if the residency rate is lower than the work location rate. Version 1c—April 2014 Page 14 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide 4. If the taxpayer or spouse has unused credit for tax paid to another state, that credit may be applied to the local earned income tax liability on Line 12 (Miscellaneous Credits). A copy of the other state return must be included with the local income tax return when mailed. 5. Print each completed return and have taxpayer (and spouse) sign it. Mail the return plus a copy of every W-2 plus a copy of the PA Schedule UE if used plus the form received from the tax collection agency plus a check for any balance due per tax collections agency instructions. 6. If the taxpayer and/or spouse made estimated payments for their local earned income tax and is itemizing deductions on the federal return, add the total of the local estimated payments to Schedule A Line 5a with a scratch pad. Incorrect Employer Local EIT Withholding The employer withholding could be incorrect through error or if the taxpayer moved during the tax year to a municipality with a different tax rate and did not promptly notify the employer of the change. If the employer under-withheld due to the employer’s error, the employer is liable for the tax due. If the employer under-withheld for other reasons or over-withheld, the taxpayer is liable for the tax due or is due a refund. 1. Add the PA Local Income Tax form. TaxWise will automatically populate it with the earned income (compensation and self-employment income) and unreimbursed business expenses from the PA-40 and withholding from W-2s. Enter the Political Subdivision (PSD) code for the taxpayer’s residence, estimated tax payments (if any), any credits, and any other required information in accordance with the instructions from the taxpayer’s tax collection administrator. 2. Calculate the total local earned income tax due based on the higher of the work location and residency rates for the portion of the tax year that each rate applies for each source of earned income (W-2s or self-employment). Then calculate the effective overall tax rate for the tax year by dividing the total tax due by total earned income. Enter this effective rate in the Local tax rate field in TaxWise and allow Version 1c—April 2014 Page 15 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide TaxWise to automatically populate the remaining fields. Do not check the direct entry box on the TaxWise form. 3. If the taxpayer or spouse has unused credit for tax paid to another state, that credit may be applied to the local earned income tax liability on Line 12 (Miscellaneous Credits). A copy of the other state return must be included with the local income tax return when mailed. 4. Print each completed return and have taxpayer (and spouse) sign. Mail the return(s) plus a copy of every W-2 plus a copy of the PA Schedule UE if used plus a copy of every W-2 plus the form received from the tax collection agency plus the worksheet used to determine the effective tax rate plus a check for any balance due per tax collections agency instructions. 5. If the taxpayer and/or spouse made estimated payments for their local earned income tax and is itemizing deductions on the federal return, add the total of the local estimated payments to Schedule A Line 5a with a scratch pad. Property Tax/Rent Rebate Claim (PA-1000) Add this form if the taxpayer or spouse appears to qualify for the rebate based on age (generally 65 or older) and income ($35,000 or less if property owner or $15,000 or less if renter). Enter the two-digit county code in the first section, select the appropriate items in section B and enter any untaxed income items in Lines 11a-g – note that an IRA or pension distribution that has a distribution code 4 is already included in Line 6 and does not need to be added to Line 11c. Note: if an adjustment for deferred compensation was required on the PA-40 (see Credit for Income Taxed or Income Tax Paid to another State on page 10 for more information), the same adjustment is required on PA-1000 Line 11a. Enter the property tax paid on the principal residence on a scratch pad linked to the “Real estate taxes on your principal residence, not listed above” field on the federal Schedule A even if the taxpayer is not itemizing federal deductions. Include all tax bills (generally school district, county and municipality) as homeowners whose income is $30,000 or less and whose property tax bills equal more than 15% of their income will receive an additional 50% of their base rebate. If the taxpayer wants to direct deposit the rebate, enter the routing transit number and account number for the bank account in the Direct Deposit section on page 2. Note: there is no crosscheck of these numbers with the numbers entered elsewhere so use extra care to ensure they are correct. Add and complete PA-1000 Schedules A and B if claimant owned more than one home or if widow(er) remarried. Add and complete PA-1000 Schedules D, E and F if renter Version 1c—April 2014 Page 16 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide received cash public assistance, or the residence was used for purposes other than a personal residence or if there are additional names on the deed. Finally, add and complete PA-1000RC – Rent Certificate and Rental Occupancy Affidavit – if the claimant is a renter or owner/renter. The claimant ‘s landlord must sign to certify the information or the claimant must complete the affidavit section stating why the landlord’s signature was not obtained and have it notarized before mailing. First time filers must include proof of age (copy of driver’s license for example), copy of spouse’s death certificate if a widow or widower under 65 or proof of disability (SSI award letter or letter from Veterans Administration as examples). All filers must include proof of income (page 1 of Form 1040 and page 1 of PA-40). Also include a copy of the PA Schedule E if taxpayer received gas lease or royalty payments and write “gas lease” or “royalty” beside the entry on the PA 1000 so that the PA Department of Revenue does not assume part of the property is rented. All claimants, except those residing in Philadelphia, must include copies of documents that show taxes due in the tax year and proof that taxes were paid in the tax year. Best is a copy of each tax bill with stamp by bank or municipality showing date paid or Form 1098 from Mortgage Company showing taxes paid if paid via escrow account. Otherwise include a copy of each tax bill and a copy of cancelled check for each payment. Again, include documentation for all tax bills (school district, county and municipality) so that homeowners whose income is $30,000 or less and whose property tax bills equal more than 15% of their income are eligible for the 50% additional rebate. Claimant must mail all documents in the PA-1000 envelope by June 30. Nonresident Personal Income Tax Return A nonresident of Pennsylvania is taxed on certain income derived from sources within Pennsylvania: • Compensation (unless the taxpayer is a resident of a state with a reciprocal tax agreement: Indiana, Maryland, New Jersey, Ohio, Virginia or West Virginia) • Net income from a business • Sale of property located in Pennsylvania • Net income from rents and royalties • Gambling winnings from a wager placed in Pennsylvania A nonresident files the same Form PA-40 as a resident for any of the above income items. A resident of a reciprocal state whose employer withheld PA income tax must file Form PA-40 reflecting no compensation on Line 1a and the PA tax withheld on Line 13. In addition, submit a signed copy of the other state’s resident income tax return (without any supporting documents) along with a copy of the actual W-2 and a statement that the taxpayer was a resident of a reciprocal state. Version 1c—April 2014 Page 17 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Appendix I – PA Taxable Interest • • • • • • • • • • • • • • • • • • • • • • • • • Savings and loan associations, credit unions, bank deposits, bonds, certificates of deposit, interest-bearing checking accounts, tax refunds, mortgages or other obligations Agricultural Credit Insurance Fund (Agricultural Credit) Bonneville Power Administration (Pacific Northwest Transmission) Electric and Hybrid Vehicle Development Fund Export-Import Banks Federal Financing Bank Federal Home Loan Mortgage Corporation (Freddie Mac) Federal National Mortgage Association (Fannie Mae) Federal Ship Financing Fund (Merchant Marine Act) Geothermal Resources Development Fund (Geothermal Research) Government National Mortgage Association (Ginnie Mae) Merchant Marine Obligations (Maritime Administration) U.S. Housing Authority - Low-Rent Housing Pension Benefit Guarantee Corporation Rural Development Insurance Fund Rural Housing Insurance Fund Rural Telephone Bank Securities Investor Protection Corporation (Securities Investor Production Fund) Small Business Administration Synthetic Fuels Corporation U.S. Railway Association Burial fund earnings Interest income on dividends from insurance companies, whether disbursed or not Distributions from IRC Section 529 qualified tuition account programs not used for educational purposes Distributions from health or medical savings accounts not used for medical expenses that are included in federal taxable income Version 1c—April 2014 Page 18 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Appendix II – PA Tax-Exempt Interest • • • • • • • • • • • • • • • • • • • • • • • • • • • • Pennsylvania Municipal and State Obligations Banks for Cooperatives Federal District Banks For Cooperatives Central Banks for Cooperatives Commodity Credit Corporation Farm Credit System Capital Corporation: Consolidated Obligations Farm Credit System Joint Stock Banks Farm Credit System Land Banks and Land Bank Associations Federal Deposit Insurance Corporation Federal Farm Credit Banks Federal Financing Bank 12 Federal Home Loan Banks Federal Crop Insurance Corporation Federal Land Bank Associations Financing Corporation General Insurance Fund: – Armed Services Mortgage Insurance – National Defense Housing Insurance – Rehabilitation and Neighborhood Conservation Housing Insurance – Rental Housing Insurance Fund – Rental Housing Insurance Fund Mortgage Insurance – War Housing Insurance Law – Insurance of Loans for Manufacturer of Houses – Mortgage Insurance Benefits – Government of Guam 48 – Government of Puerto Rico Government of the Northern Mariana Islands and covenant to establish a Commonwealth of the Northern Mariana Islands in a political union with the U.S. Government of Virgin Islands Public Building Trust Participation Certificates Mutual Mortgage Insurance Fund National Credit Union Administration Central Liquidity Facility Production Credit Associations Public Housing Agencies Resolution Funding Corporation (REFCORP) Student Loan Marketing Association (Sallie Mae) Tennessee Valley Authority U.S. Postal Service U.S. Treasury Notes, Bonds, Bills, Certificates and Savings Bonds Version 1c—April 2014 Page 19 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Appendix III – Returns if Spouse Died During Tax Year (Note: follow and complete these steps in order!) The following steps apply if the Filing Status on the Federal return is Married Filing Jointly (MFJ). If not MFJ, these steps do not apply. PA permits MFJ for the state return if fiduciary for decedent agrees. If s/he doesn’t agree, PA requires Single for surviving spouse and Deceased for decedent. However, TaxWise does not allow a Single state return if federal return is MFJ. But, PA will accept an MFS return for the survivor instead of a Single return. These steps detail preparation of MFJ Federal return and MFJ State return for both OR MFJ Federal, MFS State return for survivor and no return for decedent. In all cases, surviving spouse must be designated as taxpayer and decedent as spouse. 1. 2. 3. 4. 5. 6. 7. 8. Complete Federal return in normal fashion with Filing status MFJ plus enter % followed by one space followed by the name of the survivor or the executor in Name Line 2 on Main Info Sheet. Be sure to assign decedent’s income to spouse (code S). If PA Filing Status is not MFJ, assign joint income (typically interest, dividends, and capital gains and losses) to taxpayer (T) instead of joint (J). If taxpayer and spouse are filing state MFJ return, prepare PA 40 in normal fashion and then go to step 3. Otherwise, go to step 5. Select PA Sch SP (Taxpayer) in Forms Tree a. Click Married, Married and claiming tax forgiveness with spouse and Deceased in Part A b. Clear the red from the “If decedent is checked above…” box – do not check it c. Add scratch pad to Column A Line 2 in Part C d. Add to the scratch pad the difference between the annualized income for the decedent (that designated by code S only) for each item in each class (wages, interest, dividends, etc.) and the amount received while alive. e. Complete remainder of Part C for taxpayer. Complete PA 40 in normal manner and e-file. STOP If the taxpayer (survivor) is filing MFS state return: a. Verify taxpayer and joint income assigned to taxpayer (code T) and decedent’s income to spouse (code S) at federal level. b. Prepare normal federal MFJ return c. Select taxpayer in PA 40 state filing status area d. Open PA Schedules A, B, D, etc. as applicable and assign ownership to taxpayer Select PA Sch SP (Taxpayer) in Forms Tree a. Click Married, Married and filing separate PA returns, Certification and taxpayer in Part A (do not select Deceased). b. No annualization required. Complete PA 40 in normal manner and e-file. If MFS State return, estate for decedent must file decedent’s individual tax return Version 1c—April 2014 Page 20 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Appendix IV – Returns for Same-Sex Couple (Note: follow and complete these steps in order!) 1. Identify one partner as “Taxpayer” and other as “Spouse” for use later on Federal MFJ return. 2. Prepare individual Federal and PA returns for each person: a. Determine filing status of each person. Filing status options are Single or Head of Household. b. Cannot use same dependent twice if HH. c. Spouse may not need to have individual Federal and PA returns created if s/he does not meet the filing requirements for both. 3. Designate both Federal and both PA returns as paper (if paper is selected for federal, PA cannot be electronically filed). 4. Enter income, adjustments, deductions, etc. for each on individual returns. 5. Complete Quality Review for returns. 6. Run diagnostics. 7. Print one copy of each Federal return for taxpayer records and mark as “DID NOT FILE; USED ONLY TO CREATE PA RETURN”. 8. Print copy of each PA return for taxpayer records and copy of each for taxpayers to mail to PA Department of Revenue. 9. Open the Federal return for the partner identified as “Taxpayer”. a. b. c. d. e. f. g. h. i. Change filing status to MFJ. Change the Federal return type to “e-file” Change state return to none (no PA return). Add “Spouse” personal information including dependents, if any, to the return. Add “Spouse” income, adjustments, deductions, etc. Complete normal Quality Review. Run diagnostics and create federal e-file. Print the federal return for taxpayer records and mark as “E-FILED FEDERAL RETURN” E-file the MFJ federal return 10. Couple will leave with copies of a MFJ Federal return (e-filed), two individual Federal returns (not filed), two individual PA returns to mail in and two individual PA returns for their records. Version 1c—April 2014 Page 21 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Appendix V – Amending Returns (Federal and State) (Note: follow and complete these steps in order!) 1. Must use TaxWise® for the year being amended. Must have been trained on tax law and software for that year. 3. Add 1040X from Add Forms tab. 2. 4. 5. 6. 7. 8. 9. Obtain electronic copy of 2013 return actually e-filed (if possible). If not available or for earlier years, recreate original return(s) including errors and omissions. IMMEDIATELY check the “Check to override all original entries…” box on page 1 (usually in the Income and Deductions section). IF amending a PA return, add PA X from Add Forms tab and IMMEDIATELY check the “Check this box to override all original entries…” box in the Income section on page 1. Only after completing steps above, add missing information or update original information on normal forms and worksheets in TaxWise: new or changed W2s, 1099Rs, etc., updating interest on original Interest Statement, dividends on original Dividend Statement, etc. If combining two Federal returns into one Married Filing Jointly return: a. Change filing status to Married Filing Jointly on Main Information Worksheet. b. Complete PIN for spouse to authorize practitioner pin c. Enter all spouse data on the taxpayer’s return. d. If spouse originally had a balance due, enter amount paid on line 15 of Form 1040-X. If spouse received a refund on the original return, enter the amount of the refund as a negative number on line 15 of Form 1040X. Complete page 2 of the 1040X by adding explanation and date. Complete page 2 of PA-40X (if applicable) by adding explanation and date. 10. If applicable, check the “Once amended return is complete, check this box” box on page 1 of PA-40. 11. Print 1040X and any schedules that have changed and assemble in sequence number order with 1040X on top. Do not include the revised 1040. If combining two returns, also attach copies of the two original returns clearly marked as “Original”. These will all be mailed to the IRS by taxpayer along with check for any amount due. 12. Print amended PA-40, PA-40X and other schedules that have changed. These will be mailed to PA Department of Revenue along with check for any amount due. 13. Amended returns stand-alone – do not combine original return(s) amounts due or refunds with amended return(s) amounts due or refunds. 14. Mail amended returns before tax due date (generally April 15) if possible to avoid penalties and interest if money due. Version 1c—April 2014 Page 22 of 23 AARP Foundation Tax-Aide Pennsylvania TaxWise® User Guide Appendix VI – PA Addresses and Contact Information • For e-filed returns: – Fax documents to the PA Department of Revenue, using the DEX-93 Personal Income Tax Fax Cover Sheet Available at www.revenue.state.pa.us Send a separate fax with separate cover sheet for each return Fax e-file return attachments to: 717-772-4193 or 717-787-2840 Fax other state’s returns to: 717-705-6651 – • For paper returns: – – • • • Mail documents to: PA Department of Revenue Bureau of Individual Taxes PO Box 280507 Harrisburg PA 17128-0507 If there is more than $1 on Line 28 due – mail to: PA Department of Revenue Payment Enclosed 1 Revenue Place Harrisburg PA 17129-0001 If there is an overpayment – $1 or more on Line 29 – mail to: PA Department of Revenue Refund/Credit Requested 3 Revenue Place Harrisburg PA 17129-0003 – If there no tax due or overpayment – no amount on Line 28 or 29 – mail to: PA Department of Revenue No Payment/No Refund 2 Revenue Place Harrisburg PA 17129-0002 Mail Property Tax/Rent Rebate Claims to: PA Department of Revenue Property Tax or Rent Rebate Program PO Box 280503 Harrisburg PA 17128-0503 Mail Estimated Tax Vouchers to: PA Department of Revenue PO Box 280403 Harrisburg PA 17128-0403 PA Help Desk (for volunteers only, not for taxpayers): 717-787-4017 or 800-452-3108 Version 1c—April 2014 Page 23 of 23