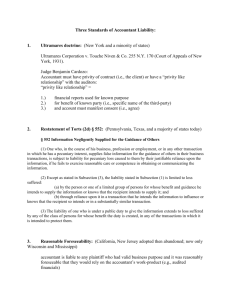

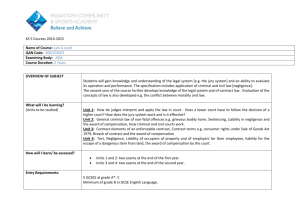

liability of lawyers and accountants to non

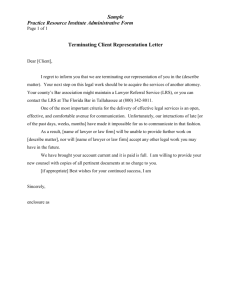

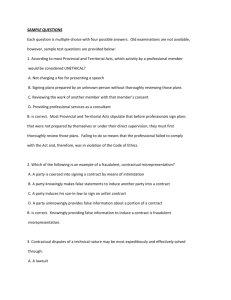

advertisement