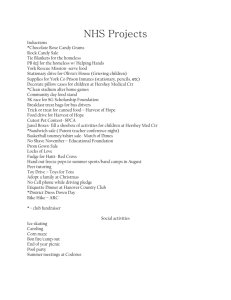

Contacts: Prepared by

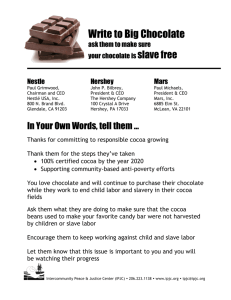

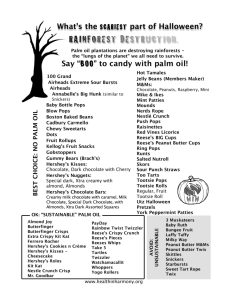

advertisement