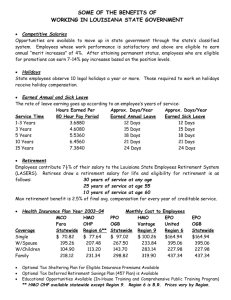

SUMMARY OF BENEFITS Executive

advertisement