a pdf of the 4/1/15 merger welcome to NCB customers

advertisement

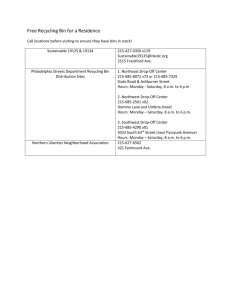

April 1, 2015 Dear Valued Customer: We are pleased to announce that the merger of Northampton Cooperative Bank and Greenfield Cooperative Bank became effective on April 1st. The combination of our financially strong institutions solidifies our position as one of the few remaining independent community banks in the region. Our top priority is to make this transition as smooth as possible for you, our valued customer. To accomplish this, you will continue to be served by the same knowledgeable and courteous staff at the same convenient locations. Furthermore, your account numbers will not be changing and your existing checks, ATM/debit cards and credit cards may continue to be used. You will benefit by gaining access to 6 new branch locations, 7 new ATM locations, a mobile banking app, our ID SafeChoice® protection, an expanded commercial lending team, and a wide array of investment products and services. To accommodate the consolidation of our computer systems, all offices of both Northampton Cooperative Bank and Greenfield Cooperative Bank will be closed on Saturday, April 25th. When we open for business on the morning of Monday, April 27th, customers of both banks will be able to complete transactions at any of our combined 10 branch locations and 11 ATM locations. On that same day, we will also be introducing our newly redesigned website. Going forward, Northampton Cooperative Bank will continue to operate under its own name as a division of Greenfield Cooperative Bank. As a customer of the combined bank, FDIC insurance will continue to protect your deposits up to $250,000 with amounts in excess of $250,000 insured in full by the Share Insurance Fund (“SIF”), a private excess insurer owned by Massachusetts cooperative banks. To help answer any questions you may have, the pages that follow contain more details on the changes you can expect from the partnership formed by our two “customer focused” community banks. We are proud to be your financial partner and look forward to delivering products and services that exceed your expectations! Sincerely, William T. Stapleton Chairman of the Board Michael E. Tucker President and CEO BestLocalBank.com • Reach all of our locations at (877) 682-0334 Amherst - Florence - Greenfield - Northampton - Northfield - Shelburne Falls - Sunderland - Turners Falls Important Information All branches will be closed on Saturday, April 25th to allow our dedicated, hard-working staff to consolidate the systems of both banks. Regular business hours will resume on Monday, April 27th. To accommodate the systems consolidation, our online banking and bill payment systems will be unavailable beginning at 3:00 p.m. on Friday, April 24th and will return to service at approximately 1:00 p.m. on Monday, April 27th. All scheduled bill payments for this day will be sent out as scheduled and no action is required on your part. Our Easy Access 24/7 automated telephone banking service will also be unavailable beginning at 4:00 p.m. on Friday, April 24th and will return to service at approximately 10:00 a.m. on Monday, April 27th. On April 27th, the telephone number for our Easy Access 24/7 telephone banking service will be changing to (888) 780-4401. At that time, you will need to reset your personal identification number (“PIN”) in order to access your account information. Effective Monday, April 27th, you will have access to all 10 of our branch offices and 11 ATMs located throughout Hampshire and Franklin counties. A complete listing of our branch and ATM locations can be found on page 12. 2 General Information You will continue to be served by the same knowledgeable and caring staff at the same convenient branch locations. There will be no changes made to the hours of operation at any of our branches. Your account numbers will not change. You can continue to use your existing checks, ATM/debit cards and credit cards. Direct deposit authorizations will not change. Pre-authorized payments made to or from your checking or savings accounts will not change. To make the transition easy for you, we have transferred your Bill Payee Information and 12 months of your existing Bill Pay history over to the new system. Funds Availability: If you make a deposit in person with a Bank teller before the end of a business day, we will consider that day to be the day of your deposit. However, if you make a deposit at a branch on a Saturday, or at a Greenfield Cooperative Bank or a Northampton Cooperative Bank ATM after 2:00 P.M., or on any day the Bank is not open, or an electronic deposit or remote check deposit is received by us after 4:00 P.M., we will treat the deposit as if it were made or received on the next business day that we are open. FDIC insurance will continue to protect your deposits up to $250,000 with amounts in excess of $250,000 insured in full by the Share Insurance Fund (“SIF”), a private excess insurer owned by Massachusetts cooperative banks. At the end of the year, you will only receive one combined IRS 1099 Form. 3 New Website and Online Banking We will be launching our new and improved website on Monday, April 27th. A snapshot of our new home page is displayed below. You can access our new website by continuing to visit www.northamptoncoop.com, www.greenfieldcoopbank.com or by using www.BestLocalBank.com. We will also be launching a redesigned Internet Banking site on Monday, April 27th. New features will be made available to you including a free mobile banking app for Apple and Android devices with remote check deposit capture functionality. Ask us for more information about this great new service! 4 Account Statements You will receive an interim statement in late April. This statement will reflect all of your account activity from the date of your last statement through the close of business on April 24, 2015. If you have a checking account, your statement cycle will change from the 5th of every month to the 15th of every month. You will receive your first statement after the interim statement shortly after May 15th. If you have a savings account, your statement cycle will change from the 5th of every month to the last business day of every month. You will receive your first statement after the interim statement shortly after May 31st. E-statement customers with loan accounts appearing in their online banking profile will begin receiving electronic bills through the estatement system instead of paper bills after April 27th. 5 Changes to Deposit Accounts Changes to Tiered Rate Products If you currently have a Coop Gold Money Market Savings Account or a Tiered Savings Account, it will change to a Regular Money Market Account effective April 27th. In addition, at that time, the balance tiers for Regular Money Market Accounts and Business Money Market Accounts will change effective Monday, April 27th. The new balance and rate tiers will be as follows: $1,000 - $9,999 $10,000 - $24,999 $25,000 - $49,999 $50,000 and up A minimum balance of $1,000 will be required to earn interest. Passbook and Statement Savings Accounts The minimum balance requirement will drop from $300 to $10. The monthly fee for falling below the minimum balance will decline from $3 to $1. Going forward, interest on all deposit accounts will be calculated based on a 366 day year during leap years. Beginning on Monday, April 27th, we will begin to issue new passbooks for all existing savings accounts that currently have passbooks associated with them. Checking Accounts Our ID SafeChoice® Program is available to all personal checking account customers. The Basic Family Plan is provided FREE of charge. If you ever become the victim of identity theft, primary checking account owners are eligible to receive full identity restoration services. No registration is necessary. This benefit is automatic for the primary owner on every Northampton Cooperative Bank checking account, their spouse and any children under 25 years of age who reside in the home. Great News! Your daily debit card limit will be increasing to $1,500 effective Monday, April 27th. Your daily ATM limit will remain at $500. Going forward, interest on all deposit accounts will be calculated based on a 366 day year during leap years. 6 Certificates of Deposit and IRA Accounts There will be no changes to the terms of your certificate of deposit prior to its maturity date. Your existing certificate of deposit will continue to earn the same rate of interest and mature on the same schedule as you selected when you opened your account. You will receive an interim statement in late April. This statement will reflect all of your account activity from the date of your last statement through the close of business on April 24, 2015. You will continue to receive your statements on an annual basis. After your next renewal date, you will then begin to receive statements on a quarterly basis. Individual Retirement Account holders will now receive statements semiannually instead of annually. You will receive your next IRA statement shortly after June 30th. Going forward, interest earned on renewing certificates of deposit will be calculated based on a 366 day year during leap years. Beginning on Monday, April 27th, we will begin to issue new passbooks for all existing certificate of deposit accounts that currently have passbooks associated with them. Please see the chart below for more information on changes being made to our certificate of deposit products: Northampton Cooperative Bank Current CD / IRA CD Terms 7 Month Coop Gold Certificate 12 Month Flexible Certificate 12 Month Flexible Coop Gold Certificate Easy Saver Certificate 7 Month Coop Gold IRA Certificate New CD / IRA CD Product Name Upon Next Renewal 6 Month Certificate No Penalty Certificate No Penalty Certificate No Penalty Certificate 6 Month IRA Certificate 7 New CD / IRA CD Term Upon Renewal 6 Month 6 Month 6 Month 6 Month 6 Month Mortgage and Home Equity Loans Loan account numbers will not change and all loan terms will remain the same. You can also expect your new statement to look very similar to the one you currently receive. E-statement customers with loan accounts appearing in their online banking profile will begin receiving electronic bills through the e-statement system instead of paper bills after April 27th. The address for mailing in loan payments after April 27th will be as follows: Greenfield Cooperative Bank P.O. Box 1345 Greenfield, MA 01302-1345 You can make loan payments at any of our 10 conveniently located branch offices. A complete listing of our branch locations and hours can be found on page 12. If you are thinking of buying a new home or refinancing your current loan, we have an extensive menu of competitively priced, fixed and adjustable rate loans that can meet your every need. You can apply by visiting one of our knowledgeable and helpful loan specialists or you can apply online by visiting us at www.northamptoncoop.com and then clicking on Loans and Applying for a Mortgage. After April 27th, you can apply online by visiting our newly redesigned website at www.BestLocalBank.com. We are one of the few banks in the area with the ability to offer Mass Save Heat loans. Under this program, Massachusetts residential or business customers may qualify for a Mass Save interest-free loan to help you make energy efficiency improvements. 8 Business Accounts and Lending Business accounts will receive an interim statement in late April. This statement will reflect all of your account activity from the date of your last statement through the close of business on April 24, 2015. Business accounts will continue to receive statements on the last business day of the month. You will receive your next statement shortly after April 30th. The monthly fee for Business Checking Accounts will drop from $6.00 to $5.00. In addition, we will no longer assess a per deposit fee of $0.65. The fee for each deposited item will increase slightly from $0.06 to $0.08. The combined bank will have an expanded commercial lending team with Small Business Administration Preferred Lender status. Meet our Commercial Lending Team Bill Ahlemeyer Senior Vice President (413) 773-6113 Dave Ahearn Vice President (413) 773-6119 Anthony Worden Vice President (413) 773-6125 Wolfgang Adametz Barbara Campbell Shannon Menko Loan Analyst Loan Officer Loan Administrator (413) 773-6110 (413) 772-5000 X224 (413) 772-5000 X223 9 The GCB Financial Services consultants can assist you in developing strategies to manage your savings and other assets to reach your financial goals. Working with them, you can address personal planning, business services, investments and insurance. Personal Planning GCB Financial Services can help you reach your personal financial goals by assisting with retirement planning, college planning, investment planning services and overall estate planning. Business Services GCB Financial Services can help you manage your business by assisting with corporate benefit services, business and personal tax analysis and business succession planning. Insurance and Investments Once you have developed a financial strategy, GCB Financial Services can also make available to you a wide variety of investment and insurance products such as mutual funds, variable and fixed annuities, long-term care insurance, life insurance and periodic portfolio reviews. Contact Michael Johnson or Edward Zadworny at (413) 773-1816 to learn how GCB Financial Services can help you reach your financial goals. Michael S. Johnson, CFS Vice President – Senior Financial Consultant Edward M. Zadworny Senior Financial Consultant Investments and/or insurance products offered by GCB Financial Services ARE NOT insured by the FDIC or any other federal government agency AND ARE NOT bank deposits or other obligations of or guaranteed by the bank AND ARE subject to investment risks, including the possible loss of principal amount invested. 10 Customer Service How can we be of assistance? We have a number of convenient ways for you to reach us …… by phone, online, and in person. We will do our absolute best to deliver products, services and customer service that always exceed your expectations! By Phone Contact us toll-free at (877) 682-0334 to speak with one of our knowledgeable and friendly professionals who will answer your questions, help you select a product and assist with your transactions. They’ll be glad to help six days a week during our normal business hours (please refer to the next page for all branch locations and business hours). We also offer 24/7 e-access Internet Banking customer service! Simply call the same toll-free number anytime you need assistance with e-access. Lastly, our toll-free 24/7 automated telephone banking service, called easy-access, allows you to access your accounts from virtually anywhere. Once established, you can just pick up your touch-tone phone and call (888) 780-4401. Online - 24 Hours A Day / 7 Days A Week Our newly redesigned website, which will be introduced on Monday, April 27th, will allow you to open new accounts, apply for a loan, pay your bills and much more! Visit us online at www.BestLocalBank.com. Or Stop Into One of Our Convenient Branch Offices If you would prefer to meet with us in person, please drop by one of our convenient branch offices that now extend from Northampton to Northfield. A complete listing of our locations and hours can be found on page 12. Our dedicated and knowledgeable staff is waiting to assist you with all of your financial needs. Pictured above: Front row, left to right, Jennica Gallagher - Amherst Branch Manager, Maureen Bowler - Amherst Branch Manager and Dawn Hibbert - Florence Branch Manager. Back row, left to right, Christine Gagnon - Northampton Branch Manager and Lisa Kmetz - Vice President of Branch Administration. 11 Branch Locations and Hours Northampton 67 King Street, Northampton, MA 01060 (413) 584-4474 Monday – Friday: 8:30 – 5:00 Saturday: 9:00 – 12:00 Amherst 390 College Street, Amherst, MA 01002 (413) 658-0073 Monday – Friday: 8:30 – 5:00 Saturday: 9:00 – 12:00 Amherst 253 Triangle Street, Amherst, MA 01002 (413) 549-6622 Monday – Friday: 8:30 – 5:00 Saturday: 9:00 – 12:00 Florence 6 Main Street, Florence, MA 01062 (413) 584-5266 Monday – Friday: 8:30 – 5:00 Saturday: 9:00 – 12:00 Greenfield 63 Federal Street, Greenfield, MA 01301 (413) 772-0293 Monday – Friday: 8:30 – 4:30 Saturday: Closed Greenfield 277 Federal Street, Greenfield, MA 01301 (413) 772-5001 Monday – Wednesday: 9:00 – 5:00 Thursday and Friday: 9:00 – 7:00 Saturday: 8:30 – 12:00 Northfield 144 Main Street, Northfield, MA 01360 (413) 498-5301 Monday – Thursday: 9:30 – 5:00 Friday: 9:30 – 6:00 Saturday: Closed Shelburne Falls 33 Bridge Street, Shelburne Falls, MA 01370 (413) 625-6357 Monday – Wednesday, Friday: 8:30 – 4:30 Thursday: 8:30 – 6:00 Saturday: 9:00 – 12:00 Sunderland 18 Amherst Road, Sunderland, MA 01375 (413) 665-6744 Monday – Thursday: 8:30 – 4:30 Friday: 8:30 – 6:00 Saturday: 8:30 – 12:00 Turners Falls 176 Avenue A, Turners Falls, MA 01376 (413) 512-5012 Monday – Thursday: 8:30 – 4:30 Friday: 8:30 – 6:00 Saturday: 8:30 – 12:00 Shelburne 24 Hour Drive-Up ATM 1229 Mohawk Trail, Shelburne, MA 01370 Member SIF 12