The Senate fully approved energy reform secondary laws

advertisement

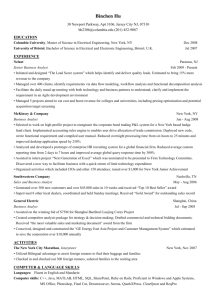

Economic Research Mexico The Senate fully approved energy reform secondary laws The Senate approved the secondary laws of the energy reform The main features of the secondary laws approved yesterday are: (1) The percentage of profits to be paid to the original land owners for the “temporary occupancy” of the land for exploration and production of hydrocarbons (2) The Energy Regulatory Commission (CRE) will have the power to regulate electricity prices (3) The establishment of a new legal regime for PEMEX and CFE, in which these are defined as “Productive Firms of the Mexican State” (4) Amendments to the Organic Law of the Federal Public Administration which establishes that regulations for contracts, permits, licenses, purchases, leases, and services will be subject to the Federal Anti-Corruption Law The energy committee in the Lower House has already approved the first set of laws As we have mentioned earlier, we believe that the energy reform will increase Mexico's long-run potential GDP by 1%-pt, and will boost investment in this sector between US$10-12bn in 2016, and up to US$50bn by 2020 July 22, 2014 www.banorte.com www.ixe.com.mx @analisis_fundam Gabriel Casillas Chief Economist and Head of Research gabriel.casillas@banorte.com Delia Paredes Executive Director of Economic Analysis delia.paredes@banorte.com Alejandro Cervantes Senior Economist, Mexico alejandro.cervantes@banorte.com Saúl Torres Analyst, Mexico saul.torres@banorte.com Yesterday, the Senate fully approved the secondary laws of the energy reform. From the four set of amendments derived from the energy reform, the first was approved with 90 votes in favor and 28 against it. Similarly, the second set of laws was approved with 92 votes in favor (27 against), while the third was approved with 89 votes in favor and 27 against it. Finally, the fourth and final set of laws was approved with 85 votes in favor and 26 votes against it. What does each set of laws encompass? Within the amendments made in the past four days, the Senate made several modifications to the set of laws approved in the joint committees (please refer to our Research note: Senate joint committees approved the secondary laws derived from energy reform [here]). Below are the main features regarding each set: (1) The main modifications regarding the first set of laws were the approval of the share of profits oil companies would have to pay to the original land owners for the exploration and production of hydrocarbons (between 0.5% and 2% of the profits generated by these projects). Document for distribution among public 1 (2) The second set of amendments contains the proposals to: i. Eliminate the concept of “expropriation of land” for the development of the electric industry; ii. the rejection of the President's power to design strategies to manage subsidies; iii. the Energy Regulatory Commission (CRE) will have the power to regulate electricity prices; but iv. the President will have the power to set final electricity prices for special vulnerable groups. (3) The third set of amendments include: i. The approval of a new legal regime for PEMEX and CFE, in which these are defined as “Productive Firms of the Mexican State”; ii. Pemex and its subsidiaries will enjoy financial independence and will be liable only to the financial statement and personal services ceilings approved by the Congress; iii. CFE and PEMEX will be subject to the Securities Exchange Act thereby ensuring their adequate performance and accountability; iv. the creation of a public database system which will contain information regarding PEMEX and CFE suppliers and the contracts celebrated by these entities concluded in the last five years; and v. an amendment to the new regime of PEMEX and CFE that keeps the current rights of its active and pensioned workers. (4) The last set encompasses the amendments to the Organic Law of the Federal Public Administration which establishes that regulations for contracts, permits, licenses, purchases, leases, and services will be held responsible to the Anti-Corruption Federal Law. The amendment also created the National Security Agency for Industrial as well as the Environmental Protection of the Hydrocarbon Sector. What comes next? Since last Friday, the set of laws that had already been approved by the Senate were sent to the Lower House for discussion and approval. In fact, the Energy Committee in the Lower House has already approved the first amendment. Once such committee ends the discussion of the secondary laws, these will be voted in a plenary session of the Lower House. Once approved by the Lower House, the set of laws shall be sent to the President for publication and implementation. We believe that the energy reform will increase Mexico's long-run potential GDP growth rate by 1%-pt. As we have mentioned in previous notes, if the secondary laws regarding the energy reform are approved in the next few days by the Lower House, we believe that this reform could add up 3 to 5%-pts to GDP in a three-year timespan, beginning on 2016, while its permanent effects will increase Mexico's long-run potential GDP by 1%-pt. Even though we believe local markets have already priced-in part of the approval of the secondary laws package, market reaction should be favorable once the Lower House approval is achieved, particularly in the FX market. 2 Capital spending in the energy sector US$bn; % of GDP 90 80 70 60 50 40 30 20 10 0 Private Sector Pemex 4.8 6 5 4.4 Pemex+PI (% GDP) 3.8 4 50 3.3 40 2.9 29 3 2.7 20 2.2 2.2 12 2.0 2.1 7 2.2 2 2.0 2.0 1.9 1.9 2 2.1 3 2.0 1.8 1 31 31 31 1 30 30 29 25 25 23 Pemex (% GDP) 0 2012 2013 2014 2015 2016 2017 2018 2019 2020 Source: Marcos y Asociados Disclaimer The information contained in this document is illustrative and informative so it should not be considered as an advice and/or recommendation of any kind. BANORTE is not part of any party or political trend. 3 GRUPO FINANCIERO BANORTE S.A.B. de C.V. Research and Strategy Gabriel Casillas Olvera gabriel.casillas@banorte.com (55) 4433 - 4695 Executive Director of Economic Analysis Senior Economist, Mexico Senior Global Economist Economist, U.S. Economist, Europe delia.paredes@banorte.com alejandro.cervantes@banorte.com katia.goya@banorte.com julia.baca.negrete@banorte.com livia.honsel@banorte.com (55) 5268 - 1694 (55) 1670 - 2972 (55) 1670 - 1821 (55) 1670 - 2221 (55) 1670 - 1883 Economist, Regional & Sectorial miguel.calvo@banorte.com (55) 1670 - 2220 Analyst Analyst (Edition) Assistant Assistant saul.torres@banorte.com lourdes.calvo@banorte.com raquel.vazquez@banorte.com julieta.alvarez@banorte.com (55) 1670 - 2957 (55) 1103 - 4000 x 2611 (55) 1670 - 2967 (55) 5268 - 1613 Chief Economist and Head of Research Economic Analysis Delia María Paredes Mier Alejandro Cervantes Llamas Katia Celina Goya Ostos Julia Elena Baca Negrete Livia Honsel Miguel Alejandro Calvo Dominguez Rey Saúl Torres Olivares Lourdes Calvo Fernández Raquel Vázquez Godinez Julieta Alvarez Espinosa Fixed income and FX Strategy Alejandro Padilla Santana Juan Carlos Alderete Macal Santiago Leal Singer Head Strategist – Fixed income and FX FX Strategist Analyst Fixed income and FX alejandro.padilla@banorte.com juan.alderete.macal@banorte.com santiago.leal@banorte.com (55) 1103 - 4043 (55) 1103 - 4046 (55) 1103 - 2368 Equity Strategy Manuel Jiménez Zaldivar Victor Hugo Cortes Castro Marissa Garza Ostos Marisol Huerta Mondragón José Itzamna Espitia Hernández María de la Paz Orozco García Senior Equity Research Analyst Telecommunications / Media Equity Research Analyst Senior Equity Research Analyst – Conglomerates/Financials/ Mining/ Chemistry Equity Research Analyst – Food/Beverages Equity Research Analyst – Airports / Cement / Infrastructure / Fibras Analyst mjimenezza@ixe.com.mx (55) 5004 - 1275 victorhugo.cortes@ixe.com.mx (55) 5004 - 1231 marissa.garza@banorte.com (55) 5004 - 1179 marisol.huerta.mondragon@banorte.com (55) 5268 - 9927 jespitia@ixe.com.mx (55) 5004 - 5144 mporozco@ixe.com.mx (55) 5268 - 9962 Corporate Debt Tania Abdul Massih Jacobo Hugo Armando Gómez Solís Idalia Yanira Céspedes Jaén Senior Corporate Debt Analyst Analyst, Corporate Debt Analyst, Corporate Debt tabdulmassih@ixe.com.mx hgomez01@ixe.com.mx icespedes@ixe.com.mx (55) 5004 - 1405 (55) 5004 - 1340 (55) 5268 - 9937 Marcos Ramírez Miguel Luis Pietrini Sheridan Armando Rodal Espinosa Head of Wholesale Banking Managing Director – Private Banking Managing Director – Corporate Banking marcos.ramirez@banorte.com lpietrini@ixe.com.mx armando.rodal@banorte.com (55) 5268 - 1659 (55) 5004 - 1453 (81) 8319 - 6895 Victor Antonio Roldan Ferrer Managing Director – Transactional Banking vroldan@ixe.com.mx (55) 5004 - 1454 Managing Director – Government Banking carlos.martinez@banorte.com (55) 5268 - 1683 Managing Director – Asset Management pimentelr@ixe.com.mx (55) 5268 - 9004 Wholesale Banking Carlos Eduardo Martinez Gonzalez René Gerardo Pimentel Ibarrola