our 15th annual industry salary survey

2014

SALARY

GET WHAT YOU

DESERVE

OUR 15TH ANNUAL INDUSTRY SALARY SURVEY

BY MICHELLE WARREN

F ive years ago, Arnaud Van de Voorde was a typical digital superstar in an environment where the focus was strictly on building brand experiences and content that lived online. Today, as a vice-president at Toronto-based Jackman Reinvents, Van de Voorde is hiring the next generation of superstars whose

"digital" skills are completely different. Back then nobody was talking about Big Data and predictive analytics. In just five years, digital has completely broken out of its niche and lives across all brand experiences.

“It’s changed tremendously and it continues to evolve and accelerate because digital is so pervasive in our lives today,” says Van de Voorde.

Aside from the fascination with the potential of data and analytics, the entire business world is more concerned about digital strategy and customer experience.

Van de Voorde has been building a team at Jackman that reads like a top 10 list of today’s hot jobs—digital strategists, user experience experts, hardware experts, designers and analysts.

“It is definitely a jungle out there in terms of trying to get to the talent, because digital is such a powerful force of disruption and transformation,” says Van de Voorde.

“I think a lot of companies are coming to grasp with what digital means to their busines. Everyone is fighting for talent.”

The 2014 Salary Benchmarks report is designed to be a key weapon in that fight, delivering Marketing ’s 15th annual spotlight on who is making what and why. We’ve asked 21 high-profile industry-specific recruitment professional to tap into their first-hand experiences to provide data and salary ranges for 89 key positions, up from 72 last year.

These experts shared the starting and top salaries for most major positions, as well as typical ranges, based on actual hiring data for the last 12 months (salaries of specific individuals or companies were not shared). The result is a comprehensive snapshot of the modern marketing job landscape.

That landscape has changed. For instance, the 17 new positions listed reflect an increased demand for this year’s hot candidates: those with analytical, strategic and e-commerce expertise.

“Analytics and data continue to be a strong focus as companies spend on hiring those who can help to mine consumer insights for a competitive edge,” says Bruce Powell of IQ Partners.

The marketer’s chart reflects the biggest evolution, with 11 new positions, among them research and analytics managers.

In addition, it illustrates a growing trend.

“On the client side, we are seeing more and more companies hiring digital specialists in-house,” says Caroline Starecky of

La Tête Chercheuse in Montreal. As a result, agencies and their clients are now competing for the same talent.

Things are happening so quickly on the technology front that some digital jobs are already obsolete, says Powell. “Programmatic digital media management has radically affected the digital media space and jobs within it—and roles and salaries are lesser than they were before.”

34

NOVEMBER/DECEMBER 2014 | MARKE TINGMAG.CA

Our experts agree, however, that while standout talent will always command the big bucks, overall industry remuneration this year is, for the most part, stable with relatively little movement in the starting and top salaries.

Of course there are some exceptions. On the agency side, for instance, salaries in the mid-senior to senior levels are up.

“As many other portions of the agency offering continue to become commoditized, the demand for competitive strategic advantage is increasing,” insists Mark Rouse of IQ Partners.

“Agencies are under pressure to deliver insights, ideas and campaigns that generate measurable improvements in their clients’ business.”

As a result, experts emphasize that smart agencies—digital, traditional and media—are reinventing themselves and willing to reward talent that will give them the competitive edge.

“The talk of the town is ‘integration’ across digital and mass advertising and media touch points, yet very few agencies have figured how to make it work,” says Ari Aronson of Ari Agency.

“Agencies want to show them that they can integrate, yet most mass TV producers and directors have yet to cross the line into the digital world and teams remain divided.

Those who are not embracing digital media as the primary focus on how to connect with the Gen Y consumers will be replaced by those who do,” he warns.

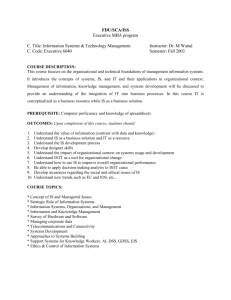

AGENCY SALARIES BY AGENCY SIZE

($ IN 000s)

LARGE

(Revenue over $10 million)

MID-SIZED

(Revenue $4 to $10 million)

TITLE START TOP START TOP TYPICAL

RANGE

ADDITIONAL

COMP*

200 1,350 350-600 30-100%

120 300 200-275 10-35%

150 600

100 250

TYPICAL

RANGE

ADDITIONAL

COMP*

250-350 20-100%

175-225 10-35%

President/CEO

Director of Client Services/

Managing Director (often

VP level)

Group Account Director

Account Director

Account Supervisor

Account Executive

Account Planner/Strategic

Planner

Executive Creative Director

Creative Director

Associate Creative Director

Copywriter

Junior Copywriter

Art Director

Junior Art Director

Media Director

Account Director - Media

Media Supervisor

Media Planner

Media Buyer

Digital Media Strategist

Digital Media Buyer

Social Media Strategist

Search Marketing Strategist

Web Producer

Director Analytics

PR Director

300

45

60

50

50

55

40

35

55

130

80

125

90

50

35

50

35

90

80

100

70

55

35

60

225 130-175

160 90-125

95

70

65-85

45-60

300 110-160

500 250-400

120

250

140

80

100

120

100

175

100

650 200-350

250 120-175

250

75

80-135

45-60

250

75

80-135

45-60

400 125-180

120 90-110

120 75-100

60-75

40-75

75-110

55-75

75-100

85-100

90-100

90-120

85-95

0-25%

0-25%

0-10%

0-10%

0-15%

10-25%

10-25%

0-25%

0-20%

0-20%

0-20%

0-20%

0-20%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

80 180

65 160

50

35

95

65

40 225

250 400

95 450

80 225

50 200

35 75

50 200

35 75

80 250

75 115

50 90

35 120

35 100

45 170

35 100

60 120

40 150

50 120

120 75

125-150

80-120

60-80

40-55

80-150

200-350

50-70

40-60

50-75

45-65

70-100

75-100

60-100

80-110

175-300

100-150

80-125

40-50

80-100

45-50

120-160

85-110

60-70

0-15%

0-10%

0-10%

0-10%

0-15%

10-25%

10-25%

0-25%

0-20%

0-20%

0-20%

0-20%

0-20%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

225

30

50

35

50

100

45

30

30

35

30

35

30

60

70

75

70

35

75

65

45

35

40

SMALL

(Revenue under $4 million)

START TOP

120

85

400

220

TYPICAL

RANGE

ADDITIONAL

COMP*

225-275 20-100%

120-175 10-50%

140

125

90

65

180

300

100

135

100

50

120

100

120

100

150

75

250

100

85

300

200

150

75

95-120

75-100

50-70

40-50

80-100

200-250

50-65

40-55

50-75

45-65

70-90

45-80

65-85

60-75

125-200

85-125

50-90

35-50

50-90

35-50

100-150

80-100

55-65

0-15%

0-10%

0-10%

0-10%

10-25%

10-25%

0-25%

0-20%

0-20%

0-20%

0-20%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

0-5%

0-10%

0-5%

Bonuses and/or Profit Sharing

* At senior levels the value of non-salary compensation can far eclipse base salary. The percentage included with this chart is the value of all elements of additional non-salary compensation and is considered the general minimum level for the position. The specific elements listed are not all inclusive, but are considered the most common for the position.

SOURCE: All figures are estimates compiled by Marketing based on a consensus of ranges from recruitment professionals specializing in the marketing and advertising sectors.

MARKE TINGMAG.CA

| NOVEMBER/DECEMBER 2014

35

DIGITAL

IS DEAD .

LONG LIVE

DIGITAL!

BY BRUCE POWELL , MANAGING

PARTNER AT IQ PARTNERS

EXPERT ADVICE

QUESTIONS ABOUT THE CURRENT JOB MARKET?

SALARY SHIFTS? EMPLOYEE EXPECTATIONS?

OUR 21 RECRUITMENT EXPERTS WEIGH IN

JOANNE ACRI

EXECUTIVE RECRUITER, ARI

AGENCY, TORONTO

“Traditional media is no longer traditional. Media agencies and publishers are trying to keep up by offering everything from realtime bidding to staffing digital marketing, social media and analytics departments. Media is definitely driving the future of digital.” insights is ever more apparent throughout CPG. Experience and knowledge of digital is a must for all brand-marketing roles, as manufacturers rely on data to support strategic marketing decisions. There has been a slight increase in headcount across the CPG marketplace, but for the most part headcount has held firm, which is a positive compared to previous years.

Work-life balances and lack of opportunity to progress continue to be the main reasons for employee departures.

FOR ALMOST TWO DECADES, digital has driven job growth and rampant salary advancement in the marketing sector.

Demand for talent with digital experience regularly exceeded supply, and people with digital experience were repeatedly paid a premium over the rest of the marketplace. This was particularly evident in digital media where—whether you were developing content, managing the deal flow or selling the ads—you regularly made more on the digital side of the fence than your traditional peers.

That changed this year.

Programmatic ad buying redefined the digital media market and margins have consolidated dramatically. Now both the roles and premium salaries that were supported by those margins are rarer than they were before. The industry isn’t going away, but it is evolving rapidly; the demand for talent and premium salaries have come back down to earth.

On the flip side, Canada has finally caught the e-commerce bug. For those of us who were around in the early days of the internet, e-commerce is the digital nirvana we always envisioned—but for some reason Canada lagged horribly in this area.

We were quick to embrace online banking and many of us were regularly buying from U.S. sites, but our e-commerce activity lagged our U.S. cousins by almost 50%.

Perhaps it was our risk-averse Canadian nature, our logistical issues or lack of national scale, but Canadian retailers weren’t giving us much to be excited about. Now they’re finally catching up. In fact, more organizations have built or grown e-commerce teams in Canada this past year than in the previous five years before. Of course that’s creating a new talent/demand equation. And the evolving integrated content/commerce models are accelerating this growth even more.

Mobile development continues to be a focus, but it hasn’t grown so rapidly that talent demand exceeds supply. On the other hand, the pursuit of experienced e-commerce specialists is now starting a new round of musical chairs and the salaries and incentives necessary to attract and retain top talent are beginning to rise.

Digital experience in itself is no longer unique, it’s a baked-in expectation of every 21st-century employee.

ARI ARONSON

FOUNDER & EXECUTIVE

RECRUITER, ARI AGENCY,

TORONTO

“Digital salaries continue to climb as specialized, niche digital marketing, strategy and design hires push up the demand and competition for talent. The next generation of digital marketers comes armed with incredible exposure to social communities, technology, user experience and design thinking.”

RICK CHAD

PRESIDENT, CHAD

MANAGEMENT GROUP,

TORONTO

“2014 has proven to be a challenging year. In the digital/ social/interactive areas there has been continued growth with upward pressure on salaries for those with skills in demand.

Digital strategists, digital buyers and senior project directors

(particularly with backend capabilities) continue to be in demand. Agencies that are not

“naturally” integrated are having their challenges. Those that are integrated are doing well. Big data, analytics, CRM, SEO and social media continue to be growing areas.”

MAURIZIO CALCONI

PARTNER, IQ PARTNERS INC.,

TORONTO

“Many of our clients are seeking marketers/brand managers who are digitally savvy… If you want to be top of your game, become a digital SME. Take risks, be a disruptive marketer.

If you believe in your product, if you are passionate about your accomplishments, then be bold. Four years ago, people scoffed at Steve Jobs when he introduced the iPad. 'We have laptops and desktops. Who will want a monitor without a keyboard?' He was fearless.”

STUART CALVERT

PRESIDENT, OASIS SEARCH

GROUP, TORONTO

“The market continues to be driven by data and analytics, and the use of consumer

MICHAEL GATES

MANDRAKE, TORONTO

“We have seen a lot of interesting hires in the media agency business over the last 24 months. They have been hiring from creative and digital agencies as well as client side as they look outside of their immediate competitors for talent.

Analytics and data is an area of growth in terms of investment by marketers and their agencies.

Big data is an overused term, but there are more opportunities than ever to better understand your customer. Telecom has slowed as an area of hiring growth with the new wireless entrants all struggling and

Rogers undergoing significant change with a new CEO.”

36

NOVEMBER/DECEMBER 2014 | MARKE TINGMAG.CA

2014

SALARY

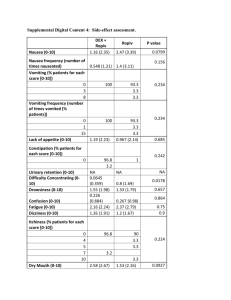

DIGITAL SALARIES BY SIZE

($ IN 000s)

LARGE

(Revenue over $10 million)

TITLE START TOP TYPICAL

RANGE

ADDITIONAL

COMP*

MANAGEMENT

President/CEO

GM, MD, SVP

300

200

800 300-600 30-100%

400 200-300 0-50%

ACCOUNT MANAGEMENT

Director of Client Services,

(Often VP level)

Group Account Director

Account Director

Account Supervisor

Account Executive

Account Coordinator

150

100

80

60

35

30

300 175-275

185 130-150

145 90-125

100

65

50

70-80

50-60

35-45

PROJECT MANAGEMENT

Director/VP Production

Senior Digital Project

Manager/Producer

Intermediate Digital Project

Manager/Producer

CREATIVE

Executive Creative Director

Creative Director

Associate Creative Director

Art Director

Designer (Jr-Sr)

Copywriter (Jr-Sr)

STRATEGY/PLANNING

110

80

60

175

150

100

55

35

35

200

175

80

300

130

125-175

90-110

70-80

230-250

225 150-175

140 120-130

125 100-110

90 50-75

60-90

Executive Director/VP Strategy

Senior Strategist/Planner

Web Strategist

Account Planner/Strategic

Planner

150

110

70

75

300 150-225

190 120-150

100

110 75-85

SOCIAL MEDIA

VP/Director Social Media

Community Manager

Content Strategist

80

45

40

175 100-150

100

100

60-80

70-90

MEASUREMENT/ANALYTICS

Director/VP

Analyst

SEO Manager

TECHNOLOGY

Director/VP Technology

100

55

70

INFORMATION ARCHITECH/USER EXPERIENCE DESIGN

Director/VP User Experience 90 175 130-150

Information Designer

Information Architect

User Experience Specialist/

Architect

User Experience Designer

60

60

60

60

130

140

140

130

90-110

90-110

90-110

90-110

100

200 120-150

120 70-100

135 100-115

Creative Technologist

Senior Developer

Developer

Senior Front End Developer

Front End Developer

Senior Back End Developer

Back End Developer

85

80

45

75

45

80

45

300 140-180

150 120-130

150 90-100

90

100

75

120

80

65-80

80 - 90

50 - 70

75 - 95

65 - 80

10-25%

0-20%

0-20%

0-20%

0-20%

0-20%

0-15%

0-20%

0-20%

0-10%

0-20%

MID-SIZED

(Revenue $4 to $10 million)

START TOP TYPICAL

RANGE

ADDITIONAL

COMP*

250 450

175 250

140 250

100 180

80 140

65

35

30

85

60

45

100 155

80 130

55 80

175 300

125 200

100 125

45 100

35 75

35 95

120 225

90 150

70 100

70 100

80 140

45 80

40 100

90 150

55 110

70 135

80 150

60 120

60 120

60 120

60 120

100 175

85 130

75 120

50 85

75 100

45 70

80 110

45 80

250-300

200-225

150-180

120-140

90-115

70-80

45-55

30-45

100-130

90-110

60-70

200-225

125-150

100-115

85-95

50-65

50-85

140-175

100-125

70-80

90-130

55-70

70-80

110-125

65-85

80-90

120-130

90-110

90-110

90-110

90-110

120-150

110-120

80-100

65-70

80 - 90

50 - 70

80 - 90

65 - 75

20-50%

0-30%

10-25%

0-20%

0-15%

0-20%

0-20%

0-20%

0-20%

0-20%

0-20%

0-15%

SMALL

(Revenue under $4 million)

START TOP TYPICAL

RANGE

ADDITIONAL

COMP*

120

120

110

100

80

55

35

30

90

75

50

175

100

90

35

35

35

90

80

65

80

55

60

60

100

75

70

45

75

45

75

45

90

50

60

75

45

40

60

300

200

180

125

100

70

175

120

90

125

85

100

140

120

120

120

120

150

150

75

50

40

230

180

120

90

70

85

150

110

90

80

90

70

110

80

90

75

80

180-250 20-100%

150-175 20-100%

130-150

120-130

80-100

60-70

40-45

30-40

90-110

80-90

55-65

185-210

110-125

90-115

75-85

50-65

55-80

125-150

90-105

65-75

75-85

55-60

65-75

90-110

60-75

65-75

85-130

80-100

80-100

80-100

80-100

115-125

100K

70-85

60-70

75 - 85

50 - 70

80 - 90

65 - 75

GET WHAT YOU

DESERVE

0-50%

0-50%

0-40%

0-40%

0-50%

0-50%

0-20%

0-50%

0-20%

0-20%

0-20%

0-20%

0-50%

0-10%

MARKE TINGMAG.CA

| NOVEMBER/DECEMBER 2014

37

MANDY GILBERT

FOUNDER & CEO, CREATIVE

NICHE, TORONTO

“Agencies are facing an identity crisis as their clients increasingly build internal teams. The war for talent has intensified. The winners will be those organizations with great leaders and interesting business models, as well as flexible cultures that focus on getting out of the commodity game and communicating an incredibly clear vision for success in their market niche.

The ones that will lose are the agencies that take a dictatorial approach to leadership. Those cultures are generally unbalanced in terms of work-life balance expectations, and will continue doing business in the same antiquated ways. Many think that a beer fridge and one or two cool accounts are all they need to retain talent.

They’re wrong.”

MARTIN KINGSTON

PRESIDENT, MARTIN KINGSTON

AND ASSOCIATES, AND

MANAGING PARTNER, NEXT

STEPS CANADA, TORONTO

“Following another year of relatively lacklustre hiring and slow growth, I’m predicting average base salary increases across the country to be in the 2.5-

3% range in 2015. In general, companies will be feeling more stable and more confident about their outlooks. The overlapping of technology and marketing will be a fertile environment for jobs in the marketing field.

Professionals in either camp who haven’t plunged into the new media of marketing will likely feel less in demand going forward. People with multimedia user experience will be in the highest demand.”

NORMAND LEBEAU

PRÉSIDENT & GARDIEN EN

CHEF DE L’EXPÉRIENCE

MANDRAKE, MONTREAL

“From a Quebec perspective, the advertising/communication industry continues to evolve on many fronts. Industry consolidation has meant the global groups (Japanese, American or French) bring a corporate approach to compensation discussions, and everything becomes a 'war of ratios' where hiring policies are dictated by ratios put in place by CFOs from half way around the world who, most of the time, are disconnected from reality.”

HOT STUFF:

UP-AND-COMING

JOBS

BY MANDY GILBERT, CEO

AT CREATIVE NICHE

CRAIG LUND

PRESIDENT, MARKETING

TALENT, TORONTO

“2014 has proven to be a humble year as far as hiring goes. The mid-level seemed to see the most traction. Most client-side marketing roles tended to be more technical and tactical in nature, which is a trend that has continued for the past few years—the difference being these roles are becoming more senior. Unfortunately we are still not productive enough as an economy to see salaries move, the exception being those newer technical roles that are being elevated internally.”

DEANNA MACDOUGAL

PRESIDENT, MERLIN GROUP

INC., TORONTO

“The trend toward 'people without jobs, jobs without people' poses the single biggest long-term threat to Canadian economic growth, according to recent reports. It exacerbates

Canada’s already lagging productivity and innovations. But attempts to head off calamity are so far being met with the usual obstacles.”

SALARIES TYPICALLY CORRELATE directly with growth cycles and market trends, so analyzing the rise and fall in the value of creative professionals pay packets can provide invaluable insights into where we are—and where we’re heading— as an industry. With that in mind, the big question is which marketing and communications professionals will be in high demand over the next decade. Here are my four picks for the top up-and-coming positions, as well as the approximate salary expectations for each.

MOBILE ADVERTISING PROFESSIONALS

If analyst predictions are to be believed, there will be a time in the not-so-distant future when every computing or communications device will be mobile. That means a lot of advertising-friendly real estate to monetize on everything from smartphones to tablets. Expect to see an even greater explosion in demand for positions ranging from mobile developers to mobile strategists.

WHAT YOU SHOULD EXPECT TO PAY: Anywhere from $80,000 to $100,000 for a mobile developer, or $60,000 to $90,000 for a mobile strategist.

SYLVIA MCARTHUR

PRESIDENT, MADISON

MCARTHUR, TORONTO

“On the client side of the business, we have seen continued contraction in the consumer goods industry with acquisitions and companies continuing to move onto a North American platform. While that has not particularly impacted on salaries or the number of mid-management roles, it has affected the number of senior management roles in

Canada. On the agency side of the business, digital, public relations and all areas of B2B marketing have seen the best growth. Essentially, anything that is

PROJECT MANAGERS

All of those cutting-edge digital initiatives your organization is about to start will need a skilled hand to ensure they get produced and deployed properly. Enter project managers, who are responsible not only for quarterbacking efforts such as these, but taking a big-picture view to make efficient use of talent and financial resources. Project managers with a combination of design, development and digital skills will be in high demand.

WHAT YOU SHOULD EXPECT TO PAY: Salaries for a senior digital project manager will range from about

$70,000 to $90,000, depending on their seniority and level of expertise.

38

NOVEMBER/DECEMBER 2014 | MARKE TINGMAG.CA

2014

SALARY

DATA ANALYSTS

Big data is quickly turning into a big business, and the demand for analysts is already beginning to spike. Expect the trend to gain momentum as organizations slowly determine what big data means to them, and how it can drive their success. To do that, they’ll need analysts, as well as visualization specialists and even media analysts to help sift through reams of data and pluck out the key nuggets that can offer organization-wide value.

CONTENT MANAGERS

GET WHAT YOU

DESERVE

We’ve all heard the “content is king” cliché spouted hundreds of times over the years.

But organizations will need to focus on developing engaging content to attract key target audience members/customers in a digital world. Everyone from copywriters to SEO specialists and content strategists will be in high demand as first-rate content becomes one of the major defining factors driving an organization’s online success.

WHAT YOU SHOULD EXPECT TO PAY: A junior- to intermediate-level analyst will earn $60,000 to $80,000, while a senior analyst will command a salary of anywhere from $80,000 to $120,000.

WHAT YOU SHOULD EXPECT TO PAY: $60,000 for an intermediate content strategist or producer, up to about

$90,000 for a senior-level professional.

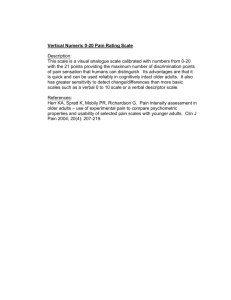

MARKETING COMPANY SALARIES BY SIZE

($ IN 000s)

LARGE

COMPANIES

(Revenue over $10 million)

MID-SIZED

TO SMALL

(Revenue $4 to $10 million)

TITLE START TOP START TOP TYPICAL

RANGE

250 1,600 300-500

130 600 200-335

ADDITIONAL

COMP*

30-60%

20-50%

180 850

100 300

TYPICAL

RANGE

200-375

180-220

ADDITIONAL

COMP*

20-50%

15-40%

President/CEO

Chief Marketing Officer/

Senior VP Marketing

VP Marketing

Director of Marketing/

Category Manager/ Group

Product Mgr

Senior Brand Manager

Brand Manager/ Product

Manager

Assistant Brand Manager/

Assistant Product Manager

Consumer Insight Manager/

Research Manager

Analytics Manager

Shopper Marketing Manager

Social Media Manager

Social Media Strategist

Search Marketing Strategist

Community Manager

Community Moderator

Digital Marketing Director

Digital Marketing Manager

Digital Product Director

Mobile Director

Content/Editorial Director

Content Manager

Marketing Automation

Manager

E-commerce Manager

110

100

95

70

50

70

100

70

100

100

100

60

50

50

65

60

40

70

70

70

80

300 180-225

225 120-170

140 100-125

135 85-100

85

150

60-80

90-110

140

135

140

150

150

140

120

225 120-160

100

225 120-160

225 120-160

225 120-160

85

100 55-90

80-110

80-110

80-110

70-110

75-90

70-120

55-90

120 80-120

20-40%

15-30%

10-25%

10-25%

0-10%

10-20%

10-20%

10-20%

10-20%

0-10%

0-15%

0-10%

0-10%

15-30%

15-30%

15-30%

15-30%

5-10%

90 225

70 175

95 140

55 110

50 75

65 140

65 140

65 130

65 140

40 150

60 150

50 120

30 100

70 200

70 200

70 200

70 200

50 100

165-190

100-140

100-120

70-85

60-70

75-110

75-110

80-100

75-110

55-90

70-90

60-110

55-80

100-120

100-120

100-120

100-120

55-85

15-30%

15-30%

10-25%

8-15%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

0-10%

15-30%

15-30%

15-30%

15-30%

5-10%

START TOP

120

100

90

60

85

50

40

60

40

60

50

30

60

60

60

60

60

60

60

SMALLER

ENTREPRENEURIAL

(Revenue under $4 million)

50

750

225

200

200

105

110

65

100

100

100

100

150

150

110

100

175

175

175

175

100

TYPICAL

RANGE

ADDITIONAL

COMP*

150-300 20-100%

135-180 15-40%

110-150

90-120

85-110

60-75

40-60

65-95

65-95

70-95

65-95

55-80

70-90

50-80

45-75

85-110

85-110

85-110

85-110

50-85

15-30%

15-30%

7-15%

8-15%

0-10

0-10

15-30%

15-30%

15-30%

5-10%

0-10

0-10

0-10

0-10

0-10

0-10

0-10

15-30%

MARKE TINGMAG.CA

| NOVEMBER/DECEMBER 2014

39

STRETCHING

THE

FIELD

T he Salary Benchmarks report has, historically, looked at creative and media agencies, digital shops and marketers. To broaden the reach of this discussion to include PR and media companies, Marketing partnered with executive search firm Derhak Ireland &

Partners on its annual salary survey. Conducted by Georgian

College’s Research Analyst students, its 2014 National Salary Survey Report uses a different methodology than the rest of Salary Benchmarks: where Marketing polls recruitment professionals, Derhak Ireland’s responses are solicited from companies’ senior executives and completed by agency staff.

This year’s survey garnered 55 complete responses - a small sample size, but because we'd like to see this research grow, we've included it in our Salary Benchmarks package.

PR

TITLE

CORPORATE MANAGEMENT

CFO

President/CEO

CORPORATE FUNCTIONS

Accounts Payable/Receivable

Coordinator

Marketing Communications

Manager

Receptionist/Office Manager

Executive Assistant/

Administrative Assistant

Marketing Coordinator

IT/Technical Support

Specialist

Financial Office Manager

ACCOUNT MANAGEMENT

Account Coordinator

Associate Consultant

Public Affairs/

Communications Director

Account Director

Vice-President

MINIMUM

$107,000

$160,000

$35,000

$40,000

$35,000

$35,000

$50,000

$72,000

$37,000

$45,000

$90,000

$78,000

$127,000

MAXIMUM

$107,000

$228,000

$45,000

$45,000

$51,000

$60,000

$60,000

$90,000

$40,000

$50,000

$110,000

$125,000

$177,000

MEDIAN

$107,000

$194,000

$40,000

$42,500

$45,500

$47,500

$55,000

$81,000

$38,500

$47,500

$100,000

$101,500

$152,000

Salary tables are organized by the six identified sectors. For each table, the minimum, maximum and median salary information is displayed in columns and positions are displayed in rows. Positions are arranged by function and sub-functions, and sorted in ascending order by median salary.

THERE'S MORE ONLINE!

VISIT MARKETINGMAG.CA

FOR EVEN MORE JOB MARKET

COMMENTARY FROM OUR RECRUITMENT EXPERTS.

SALARY TABLES: PUBLISHERS,

BROADCASTERS & MEDIA COMPANIES

TITLE

CORPORATE MANAGEMENT

MINIMUM MAXIMUM MEDIAN

President/Owner/CEO

Partner/Managing Partner

CFO/VP Finance

$48,000

$45,000

$60,000

$375,000 $59,400

$185,000 $100,000

$252,000 $218,000

$585,000 $232,500 Vice-President/Senior/VP $117,000

CORPORATE FUNCTIONS

Receptionist/Administrative

Assistant

Marketing/Product Coordinator

Accounts Payable/Receivable

Coordinator

Marketing/Product Manager

Accountant

PR/Communications Consultant/

Supervisor/Manager

Director Public Relations/

Commnications

Office Manager

$26,800

$35,000

$30,000

$28,467

$20,338

$36,000

$20,338

$66,000

$58,500

$58,000

$159,824

$86,000

$60,020

$80,000

$31,500

$38,705

$41,000

$42,723

$44,000

$47,445

$50,169

$33,960 $68,500 $51,230

Executive Assistant/

Administrator

Systems Administrator

Financial Manager/Officer

Controller

Marketing/Product Director

HUMAN RESOURCES

Human Resources Director

Benefits/HR Manger

Vice-President of Human

Resources

CREATIVE EDITORIAL & CONTENT

Graphics Designer

Copywriter

Editor-in-Chief

Art Director

Web Producer

Online Editor

Online Reporter/Writer

$52,520

$64,235

$30,000

$78,000

$147,864

$67,500

$95,200

$185,000

$35,400

$40,000

$33,212

$33,212

$38,720

$47,000

$66,880

$106,400

$86,000

$151,200

$78,000

$251,320

$231,800 $121,000

$162,400 $128,800

$185,000 $185,000

$71,393

$40,000

$57,500

$89,502

$65,457

$93,026

$74,392

$68,100

$70,486

$72,443

$78,000

$199,592

$37,232

$40,000

$46,000

$50,723

$52,089

$70,013

$70,636

SALES

Customer Service Rep

Account Manger/Sales

Executive

Senior Account Manager

Director, Client Services

MARKETING

Vice-President of Marketing

Product/Marketing/Brand

Manager

Marketing/Brand Director

DEVELOPMENT & TECHNOLOGY

$26,977

$34,000

$45,000

$145,000

$43,000

$83,104

$147,864

$61,900

$195,966

$201,401

$258,640

$52,800

$138,432

$232,532

$31,750

$44,624

$55,000

$161,255

$47,900

$110,768

$190,198

Database Manager

Web Designer

Product Manager

Application Developer

$32,000

$62,170

$50,000

$52,500

$33,000

$69,000

$87,000

$84,000

$32,500

$65,585

$65,920

$68,250

Web Developer

Interface Developer

$45,000

$68,000

$79,000

$100,000

$72,725

$84,000

Director, Technology $150,000 $213,622 $167,537

PAID SEARCH MARKETING & SEARCH ENGINE OPTIMIZATION

SEO/SEM Strategist $51,000 $85,000 $68,000

40

NOVEMBER/DECEMBER 2014 | MARKE TINGMAG.CA

measurable in one form or another is realizing the healthiest spend.”

GREG MCKINNON

PRESIDENT, MCKINNON

TARGETED RECRUITERS,

TORONTO

“Businesses are beginning to harvest big data. This enables companies to further analyze the behaviour of the marketplace and to, in turn, predict the behaviour of their customers and prospects through regression modeling. I continue to urge marketers to develop their knowledge of analytics as demand for talent continues to grow in this area.”

HARRY MANSON

CEO, 3 DEGREES CREATIVE

RESOURCING, TORONTO

“Digital has matured as a discipline to the point where it is less relevant to be a specialist and more compelling to have mass experience than in previous years.”

LISA PEIRSON

PARTNER, SEQUOIA GROUP,

TORONTO

“You may be a very competent marketer; you may even be great, but if you are not actively developing your network, you are not maximizing your value and you are likely missing out on great career opportunities.

Knowing your business is 50% of the equation. The value of your network is the other 50%.”

BRUCE POWELL

MANAGING PARTNER, IQ

PARTNERS INC. TORONTO

“For almost two decades, the

‘digital’ trend has driven job growth. And people with digital media experience have been able to demand compensation premiums. This year that changed. Programmatic digital media management has radically affected the digital media space and jobs within it—and roles and salaries are less than they were before.”

2014

SALARY

THE COST-BENEFIT

OF GEN Y

GET WHAT YOU

DESERVE

RETENTION STRATEGY

RANDY QUARIN

SENIOR PARTNER, IQ

PARTNERS INC., TORONTO

“Monetization, data analysis and 'e-commerce all-in-one' is what is trending hot right now. Marketing/sales candidates in high demand are those that have strong analytical skills and know how to convert visitors to buyers.”

MARK ROUSE

PARTNER, IQ PARTNERS INC.,

TORONTO

“In the agency world, very few offers going out below the VP level include bonus potential; those that do have reduced bonus potential from previous years. The majority of those with bonuses in their current package are not realizing any bonus; some are realizing bonus near the bottom of their range. Speculative causes are shifting client budgets, movement of accounts due to consolidation or mergers, and continuing economic volatility, which is making it difficult to forecast let alone attain profit margins.”

CAROLINE STARECKY

VICE-PRÉSIDENTE, STRATÉGIE

HUMAINE, LA TÊTE

CHERCHEUSE, MONTREAL

"In Montreal, we are seeing a lot of movement on all roles that pertain to digital on the agency and client side, with some of these roles shifting from agencies to clients. Indeed, on the client side, more and more companies are hiring digital specialists in-house, and the titles and roles vary enormously from one company to the next.

Also, there is a lot of competition for good digital talent, so salaries are also rising."

HARRY TEITELBAUM

PRESIDENT, INTERCOM

SEARCH INC., TORONTO

“Always keep your resumés updated, you never know when the best opportunity arrives.”

BY HARRY MANSON, CEO AT

3 DEGREES CREATIVE RESOURCING

IN MOST CASES, we’re losing Gen Y as quickly as we can hire them. Despite discussions of economic slowdown, we haven’t seen such a candidate-driven industry in years, and the millennial generation was born ready to exploit this.

We don’t want to admit that we need Gen Y. But we need their energy, their innovation . We need a succession plan that keeps new blood in their seats for more than eight months.

In Marilyn Pincus’s Managing Difficult People: A Survival

Guide for Handling Any Employee , the author discusses two employee types that best summarize the challenges today’s young protégé’s present: know-it-alls who really are wise beyond their years and know-it-alls who just think they are.

Telling the difference is the tricky part with Gen Y. On one hand we’ve all had to deal with the individual who truly is convinced their “my way or the highway” approach will revolutionize the industry. These individuals, if left unharnessed, often fall into patterns of overselling that can become disruptive.

However, we’ve also known truly exceptional individuals we’d be devastated to lose to the competition. Once you’ve decided which know-it-all your Gen Y embodies, you’ll need a strategy for making them effective.

In the latter case—the ones who know your business better than you do—it’s vital to understand that they crave information. While most managers leak high-level info on a need-to-know basis, this is the wrong strategy for retaining uber-sharp Gen Y. Transparency makes this type feel trusted, which leads to loyalty. Once they’re given insight into the company’s day-to-day operations, they’ll want to get more involved. This may mean awarding an accelerated title conveying a deeper sense of importance. Titles are free and letting mid-management in on your plan will usually calm protest if properly communicated.

For the second kind of know-it-all, management may initially require a strategy of containment. While this type of employee has a zeal for instant problem resolution, this behavioural trend can often have disastrous consequences if not filtered by the more experienced. The solution? Put a structured mentorship program in place that reinforces daily accountability. You may also want to limit client or customer interaction in the short term until a risk management approach brings a reality check. The benefit? An ability to foster their knowledge under guidance while not compromising eagerness. The costs? The time investment required of mentors.

Let’s not forget that, despite how they present themselves, most Gen Ys are new to their careers and, like all rookies, they will make mistakes.

MARKE TINGMAG.CA

| NOVEMBER/DECEMBER 2014

41