MERCANTILISM & 'LAISSEZFAIRE' CAPITALISM

advertisement

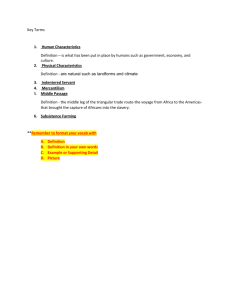

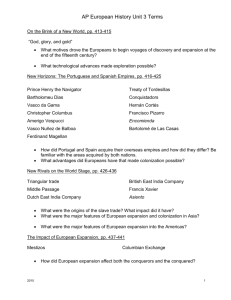

18th Century Liberties 3 MERCANTILISM & ‘LAISSEZ­FAIRE’ CAPITALISM ‘Mercantilism’ refers to the political­economic doctrine that informed British (& Western European) empire building into th the late 18 Century … Features of mercantilism Thomas Mun (1571­1541) is perhaps its most articulate theorist … Thomas Mun: ‘England’s Treasure by Forraign Trade (1664 posthumous) “The ordinary means … to increase our wealth and treasure is Forraign Trade, wherein wee must ever observe this rule; to sell more to strangers yearly than wee consume of theirs in value. … That part of our stock which is not returned to us in wares must necessarily be brought home in treasure.” Video: ‘Mercantilism’ Mercantilism Key features of ‘mercantilism’ … Building overseas colonies ● Forbidding colonies to trade with other nations ● Monopolizing markets with staple ports ● Banning the export of gold and silver, even for payments ● Key features of ‘mercantilism’ … ● Forbidding trade to be carried in foreign ships ● Export subsidies ● Promoting manufacturing with research or direct subsidies Key features of ‘mercantilism’ … Limiting wages ● Maximizing the use of domestic resources ● Restricting domestic consumption with non­tariff barriers to trade ● The image of Mercantilism? ‘Free market’ (‘laissez­faire’) capitalism arose alongside mercantilism and ‘merchant’ capitalsm and in turn fostered ‘industrial’ (factory) capitalism … With Adam Smith (‘Wealth of Nations’, 1776) liberal capitalism became the ‘winning’ political­economic outlook … Ricardo’s (19thC.)‘comparative advantage’ stated more strongly the case against (mercantilist) trade ‘protectionism’ … ‘Joint stock companies’ existed in diverse forms for centuries but the rules governing these as independent entities were not th codified fully until the 19 C. Many such companies grew out of the English ‘coffee houses’ … The first ‘company’ in the world was the Japanese construction company Kongō Gumi (578­2006) … The ‘East India Company’ (1600 – 1874) played a significant role in the formation and promotion of a ‘British Empire’ built on trade & commerce … The company paid an average dividend of over 16 percent per year from 1602 to 1650 … Wealthy merchants and aristocrats owned the Company’s shares. The company eventually came to rule large areas of India (1757­1858) with its own private armies, exercising military power and assuming administrative functions … Speculation in trade was such that market ‘bubbles’ were already occuring, e.g., the ‘South Sea Company’ bubble … William Hogarth: ‘The South Sea scheme’ 1721 The South Sea Company was created in 1711 to reduce the size of public debts, but was granted the commercial privilege of exclusive rights of trade, including slaves, to the Spanish Indies, based on the treaty of commerce signed by Britain and Spain … Video:‘Random walk down Wall Street South Seas Bubble’ South Sea company bubble South Sea Company Share Price Another bubble was the ‘Missisippi Company’ scheme that centred on the figure of John Law (1671–1729) … Video: ‘John Law: Dark Prince of Finance ‘ John Law Law played a significant role in the development of paper money … Richard Cantillon (1687?­1734?) Cantillon’s ‘Essay on the Nature of Commerce’ (1730) paved the way for the development of economics as a distinct science examining the interconnected flow of money and goods …