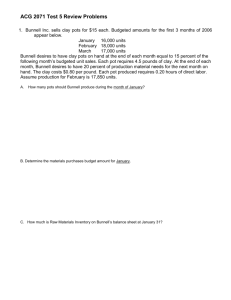

Printing HOCK ExamSuccess

advertisement