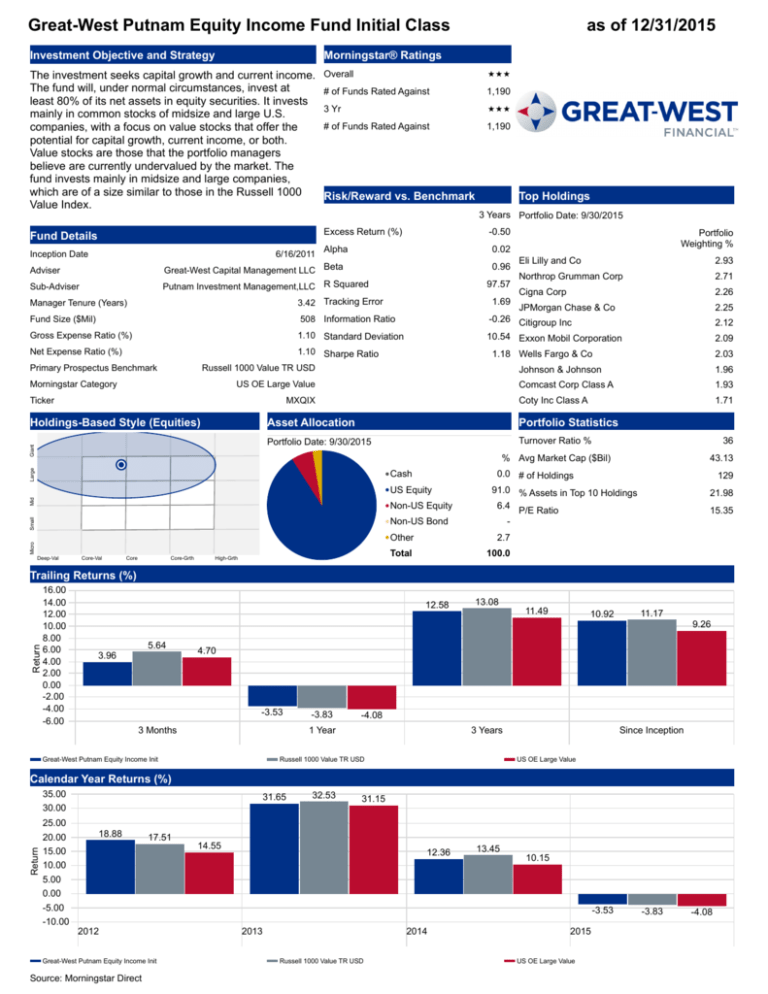

Great-West Putnam Equity Income Fund Initial Class

as of 12/31/2015

Investment Objective and Strategy

Morningstar® Ratings

The investment seeks capital growth and current income.

The fund will, under normal circumstances, invest at

least 80% of its net assets in equity securities. It invests

mainly in common stocks of midsize and large U.S.

companies, with a focus on value stocks that offer the

potential for capital growth, current income, or both.

Value stocks are those that the portfolio managers

believe are currently undervalued by the market. The

fund invests mainly in midsize and large companies,

which are of a size similar to those in the Russell 1000

Value Index.

Overall

ÙÙÙ

# of Funds Rated Against

1,190

Fund Details

Excess Return (%)

3 Yr

ÙÙÙ

# of Funds Rated Against

1,190

Risk/Reward vs. Benchmark

3 Years Portfolio Date: 9/30/2015

Adviser

6/16/2011 Alpha

Great-West Capital Management LLC Beta

Sub-Adviser

Putnam Investment Management,LLC R Squared

Inception Date

-0.50

0.96

97.57

3.42 Tracking Error

Fund Size ($Mil)

508 Information Ratio

Gross Expense Ratio (%)

1.10 Standard Deviation

Net Expense Ratio (%)

1.10 Sharpe Ratio

1.69

MXQIX

Holdings-Based Style (Equities)

Asset Allocation

2.71

Cigna Corp

2.26

JPMorgan Chase & Co

2.25

2.12

2.09

2.03

Johnson & Johnson

1.96

Comcast Corp Class A

1.93

Coty Inc Class A

1.71

Portfolio Statistics

Turnover Ratio %

Portfolio Date: 9/30/2015

Giant

2.93

Northrop Grumman Corp

1.18 Wells Fargo & Co

US OE Large Value

Ticker

Eli Lilly and Co

-0.26 Citigroup Inc

10.54 Exxon Mobil Corporation

Russell 1000 Value TR USD

Morningstar Category

Portfolio

Weighting %

0.02

Manager Tenure (Years)

Primary Prospectus Benchmark

Top Holdings

36

Large

% Avg Market Cap ($Bil)

Cash

Mid

US Equity

Non-US Equity

6.4

Micro

Small

Non-US Bond

Deep-Val

Core-Val

Core

Core-Grth

High-Grth

43.13

0.0 # of Holdings

91.0 % Assets in Top 10 Holdings

129

21.98

P/E Ratio

15.35

-

Other

2.7

Total

100.0

Return

Trailing Returns (%)

16.00

14.00

12.00

10.00

8.00

6.00

4.00

2.00

0.00

-2.00

-4.00

-6.00

12.58

5.64

3.96

13.08

11.49

10.92

11.17

9.26

4.70

-3.53

3 Months

-3.83

-4.08

1 Year

Great-West Putnam Equity Income Init

3 Years

Russell 1000 Value TR USD

Since Inception

US OE Large Value

Calendar Year Returns (%)

Return

35.00

30.00

25.00

20.00

15.00

10.00

5.00

0.00

-5.00

-10.00

31.65

18.88

17.51

32.53

31.15

14.55

12.36

13.45

10.15

-3.53

2012

Great-West Putnam Equity Income Init

Source: Morningstar Direct

2013

2014

Russell 1000 Value TR USD

2015

US OE Large Value

-3.83

-4.08

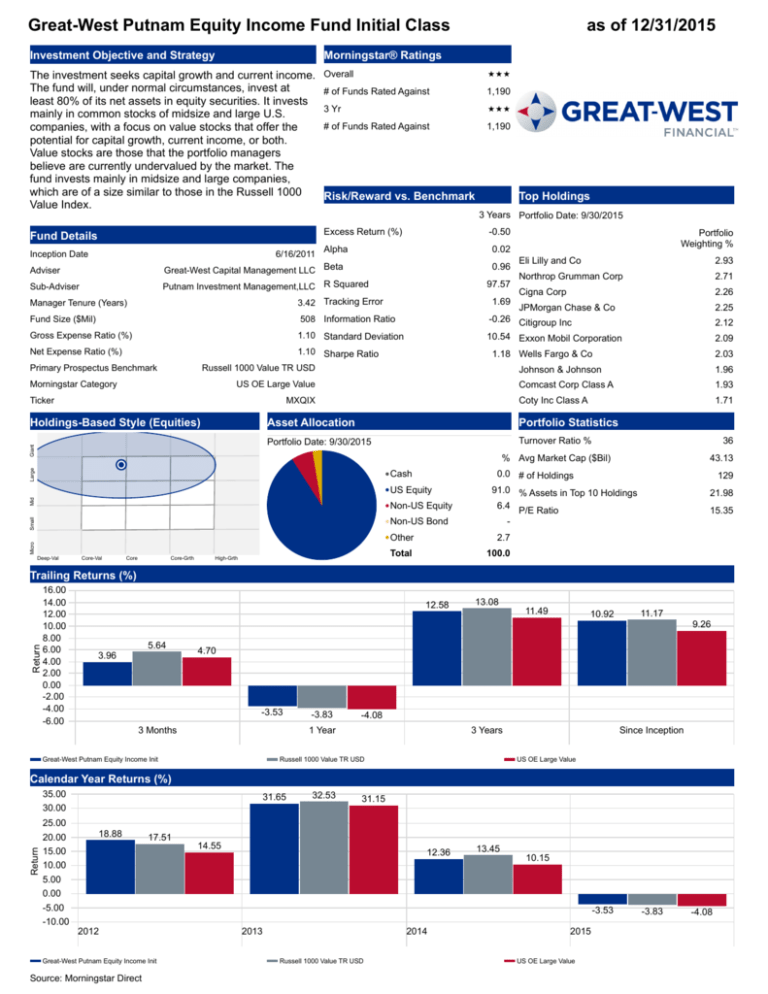

Great-West Putnam Equity Income Fund Initial Class

As of 12/31/2015

Rolling 3 Year Returns Relative to Peer Group (%)

Time Period: 7/1/2011 to 12/31/2015

Top Quartile

2nd Quartile

3rd Quartile

Bottom Quartile

30.0

Return

25.0

20.0

15.0

10.0

5.0

J

J

A

S

O

N

D

J

F

M

A

M

J

J

A

S

O

N

D

2015

Current performance may be lower or higher than performance data shown. Performance data quoted represents past performance and is not a

guarantee or prediction of future results. The investment return and principal value of an investment will fluctuate so that, when redeemed, shares may be

worth more or less than their original cost. The returns and fund operating expenses are expressed as percentages. 3, 5 and 10 Year/Since Inception

returns shown are annualized. For 10 Year/Since Inception, if the fund was not in existence for 10 years, returns shown are since inception. If the fund is

less than one year old, returns are not annualized. Performance current to the most recent month-end can be found at www.greatwestfunds.com.

Performance does not include any fees or expenses of variable insurance products, if applicable. If such fees or expenses were included, returns would

be lower. Past performance is no guarantee of future results.

Holdings subject to change. The holdings listed should not be considered recommendations to purchase or sell a particular security. It should not be

assumed that securities bought or sold in the future will be profitable or will equal the performance of the securities in this portfolio.

The Fund’s benchmark index is the Russell 1000® Value Index. The Russell 1000® Value Index measures the performance of the large-cap value

segment of the U.S. equity universe. It includes those Russell 1000® Index companies with lower price-to-book ratios and lower expected growth values.

Russell 1000® is a registered trademark of Russell Investments. A benchmark index is not actively managed, does not have a defined investment

objective, and does not incur fees or expenses. Therefore, performance of a fund will generally be less than its benchmark index. You cannot invest

directly in a benchmark index.

Although data is gathered from reliable sources, including but not limited to Morningstar, Inc., the completeness or accuracy of the data shown cannot be

guaranteed. Where data is obtained from Morningstar: ©2016 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary

to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither

Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

About Risk: Stock investments tend to be more volatile than bond, stable value or money market investments.

The Holdings-Based Style Map displays the weighting of the investment’s underlying holdings for the reporting period by investment style and size. 1.

The inner circle represents the weighted average holdings and 2. the outer radar representing 75% of the investment’s holdings.

Morningstar Rating™ - For each fund with at least a 3-year history, Morningstar calculates a Morningstar Rating™ based on a Morningstar RiskAdjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption fees),

placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next

22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. (Each share class is counted as a

fraction of one fund within this scale and rated separately, which may cause slight variations in the distribution percentages.) The Overall Morningstar

Rating for a fund is derived from a weighted average of the performance figures associated with its three-, five-, and ten-year (if applicable) Morningstar

Rating metrics.

For additional information regarding investment terms and definitions, please access glossary at :

https://dcprovider.com/Great-West_Funds/PDF/Glossary.pdf

Please consider the investment objectives, risks, fees and expenses carefully before investing. For this and other important information you may obtain

mutual fund prospectuses from your registered representative or at www.greatwestfunds.com. Read them carefully.

Portfolio Date - The Portfolio Date is the effective date for certain data. The As-Of Date is the effective period run date for which the sheet is being

produced.

Shares of the Fund are sold only through its currently effective prospectus. Shares are not available to the general public but are offered only to insurance

company separate accounts for certain variable annuity contracts and variable life insurance policies, to individual retirement account ("IRA") custodians

or trustees, and to plan sponsors of certain qualified retirement plans. The Fund may be available to college savings programs and to asset allocation

funds that are series of Great-West Funds. An individual investor cannot purchase shares of the Fund directly; rather, you must own a variable annuity

contract, variable life insurance policy or IRA, or participate in a qualified retirement plan or college savings program that makes one or more of the Fund

available for investment.

The Fund is managed by a sub- adviser who manages retail mutual funds having similar names and investment objectives. While their investment

management may be similar to or modeled from those retail mutual funds, the Fund is not directly related to any mutual funds. Consequently, investment

performance and other features of retail mutual funds and any similarly named Great-West Fund may differ substantially.

Putnam Investments, LLC, distributor of Putnam Fund(s) is an affiliate of Great-West Life & Annuity Insurance Company, Great-West Life & Annuity

Insurance Company of New York, White Plains, New York and their subsidiaries and affiliates.

The Net expense ratio shown is net of any fee waivers or expense reimbursements.

The principal underwriter of Great-West Funds, Inc. is GWFS Equities, Inc., an affiliate of Great-West Funds, Inc. GWFS Equities, Inc., Member

FINRA/SIPC, is a wholly owned subsidiary of Great-West Life & Annuity Insurance Company.

Great-West Financial® refers to products and services provided by Great-West Life & Annuity Insurance Company (GWL&A) and its subsidiaries and

affiliates including Great-West Funds, Inc. and GWCM.

Morningstar® is a registered mark and Morningstar® DirectSM is a service mark of Morningstar, Inc. Unless indicated otherwise, all other trademarks,

logos, service marks and design elements used are owned by GWL&A. ©2016 Great-West Capital Management, LLC. All rights reserved. 1/2016

PT#254092

Source: Morningstar Direct