Equity Income Fund brochure

advertisement

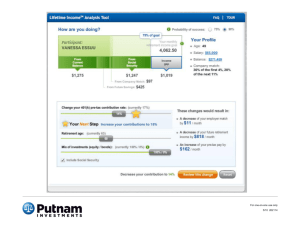

Q4 | 2015 Putnam Equity Income Fund A large-cap value fund that seeks to harness the power of dividends Managed by Darren A. Jaroch, CFA putnam.com/equityincome Class A Class B Class C Class M Class R Class Y PEYAX PEQNX PEQCX PEIMX PEQRX PEIYX Pursuing greater returns with experience, discipline, and dividends A seasoned investment manager Seeking income potential in dividends Portfolio Manager Darren A. Jaroch, CFA, has The fund’s portfolio includes companies that been investing for over 20 years and has been a pay dividends — which are excess profits member of Putnam’s U.S. and international value distributed to shareholders. In addition to their teams since 1999. His experience as manager income potential, dividends can be a sign that of Putnam Global Dividend Fund and Putnam a company’s management is confident in the International Value Fund provides critical global ongoing health of the business. insight for analyzing the large-cap equity universe. In addition to seeking dividend-paying A disciplined value strategy With an investment process grounded in fundamental research, Darren seeks growth potential from large U.S. companies across a range of sectors. A value-investing veteran, companies, Darren looks for companies that have the potential to grow their dividends over time. Dividends have historically represented a significant portion of the total return of S&P 500 companies. he looks for attractively priced stocks that he believes will appreciate as the market recognizes their long-term worth. 9.8% S&P 500 annual return (1926–2015) 4.0% from income 5.8% from capital appreciation Source: Morningstar Direct/Ibbotson Associates. $10,000 invested in Putnam Equity Income Fund 6/15/77 0 Data as of 12/31/15. $405,272 with capital gains and dividends reinvested 10.08% annualized return before sales charge 98% A focus on positive performance for over 38 years Highlights of five-year performance periods* (6/15/77–12/31/15) % positive periods s 21.64% t -2.36% Best 5-year return Worst 5-year return s 10.30% Average 5-year return .................... .................... .................... .................... ............... 98% % positive periods 132 3 .................... .................... .................... ............... positive periods negative periods 1Based on annualized returns before sales charges for quarterly rolling periods. Dividends can help you pursue greater returns. $391,252 The benefit of reinvested dividends and capital gains Annualized total returns Class A shares Inception 6/15/77 Before sales charge 1 year -3.18% -8.75% -3.83% 3 years 12.74 10.54 13.08 5 years 11.66 10.34 11.27 10 years 7.72 7.08 6.16 10.08 9.91 — Life of fund Total expense ratio: 0.98% After sales charge Russell 1000 Value Index Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. After-sales-charge returns reflect a maximum load of 5.75%. To obtain the most recent month-end performance, visit putnam.com. The Russell 1000 Value Index is an unmanaged index of those companies in the large-cap Russell 1000 Index chosen for their value orientation. You cannot invest directly in an index. $14,020 with $31,574 in dividends and capital gains taken in cash 12/31/15 Consider these risks before investing: Value stocks may fail to rebound, and the market may not favor value-style investing. Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the fund invests. A BALANCED APPROACH Since 1937, when George Putnam created a diverse Stock prices may fall or fail to rise over time for several reasons, including general financial market conditions and factors related to a specific issuer or industry. You can lose money by investing in the fund. mix of stocks and bonds in a single, professionally Request a prospectus or summary prospectus from your financial representative or by calling Putnam at 1-800-225-1581. The prospectus includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. A WORLD OF INVESTING managed portfolio, Putnam has championed the balanced approach. Today, we offer investors a world of equity, fixedincome, multi-asset, and absolute-return portfolios to suit a range of financial goals. A COMMITMENT TO EXCELLENCE Our portfolio managers seek superior results over time, backed by original, fundamental research on a global scale. We believe in the value of experienced financial advice, in providing exemplary service, and in putting clients first in all we do. One Post Office Square Boston, MA 02109 Putnam Retail Management FB529 297443 2/16 putnam.com