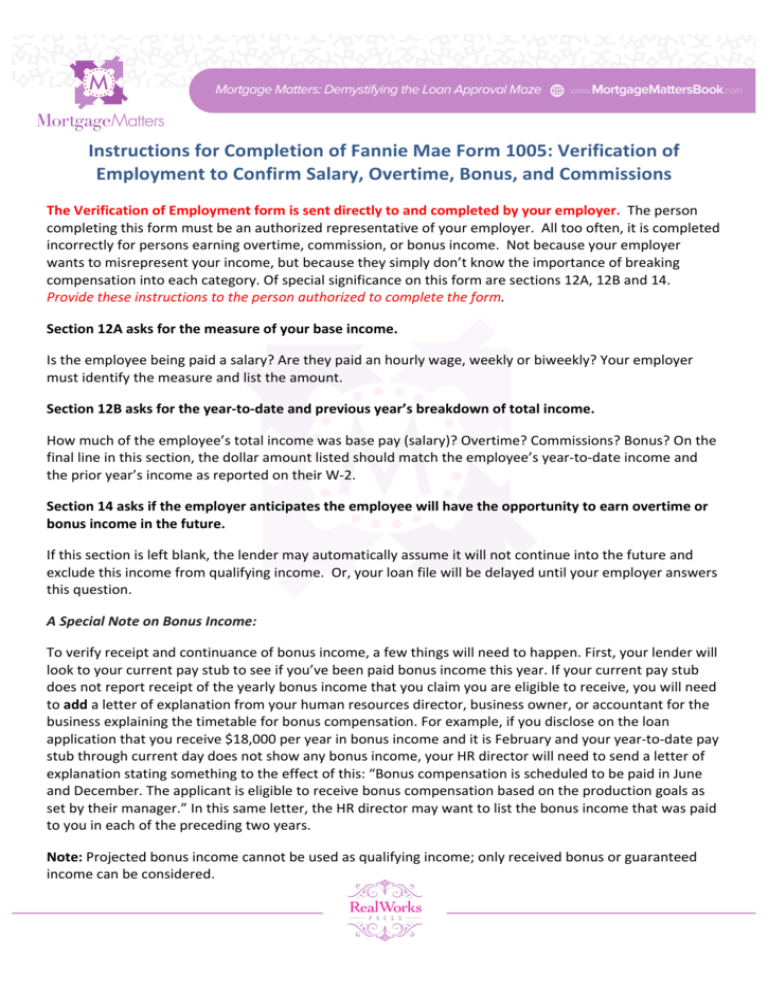

Instructions for Completion of Fannie Mae Form

advertisement

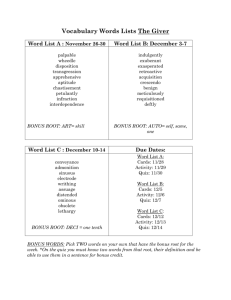

Mortgage Matters: Demystifying the Loan Approval Maze www.MortgageMattersBook.com Instructions for Completion of Fannie Mae Form 1005: Verification of Employment to Confirm Salary, Overtime, Bonus, and Commissions The Verification of Employment form is sent directly to and completed by your employer. The person completing this form must be an authorized representative of your employer. All too often, it is completed incorrectly for persons earning overtime, commission, or bonus income. Not because your employer wants to misrepresent your income, but because they simply don’t know the importance of breaking compensation into each category. Of special significance on this form are sections 12A, 12B and 14. Provide these instructions to the person authorized to complete the form. Section 12A asks for the measure of your base income. Is the employee being paid a salary? Are they paid an hourly wage, weekly or biweekly? Your employer must identify the measure and list the amount. Section 12B asks for the year-­‐to-­‐date and previous year’s breakdown of total income. How much of the employee’s total income was base pay (salary)? Overtime? Commissions? Bonus? On the final line in this section, the dollar amount listed should match the employee’s year-­‐to-­‐date income and the prior year’s income as reported on their W-­‐2. Section 14 asks if the employer anticipates the employee will have the opportunity to earn overtime or bonus income in the future. If this section is left blank, the lender may automatically assume it will not continue into the future and exclude this income from qualifying income. Or, your loan file will be delayed until your employer answers this question. A Special Note on Bonus Income: To verify receipt and continuance of bonus income, a few things will need to happen. First, your lender will look to your current pay stub to see if you’ve been paid bonus income this year. If your current pay stub does not report receipt of the yearly bonus income that you claim you are eligible to receive, you will need to add a letter of explanation from your human resources director, business owner, or accountant for the business explaining the timetable for bonus compensation. For example, if you disclose on the loan application that you receive $18,000 per year in bonus income and it is February and your year-­‐to-­‐date pay stub through current day does not show any bonus income, your HR director will need to send a letter of explanation stating something to the effect of this: “Bonus compensation is scheduled to be paid in June and December. The applicant is eligible to receive bonus compensation based on the production goals as set by their manager.” In this same letter, the HR director may want to list the bonus income that was paid to you in each of the preceding two years. Note: Projected bonus income cannot be used as qualifying income; only received bonus or guaranteed income can be considered.