Contract Specifications EURUSD

advertisement

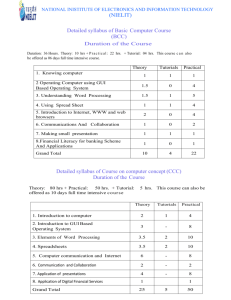

EUR-USD Futures Contract Type Product Symbol Instrument Type Contract Size Contract Listings Base Price Cash settled Futures EUR-USD Futures contracts EURUSD FUTCUR 12,500 EURO The Exchange will follow a quarterly expiry cycle of March, June, September and December expiry months. A new contract will be made available for trading on the first business day of the expiry month of the near month contract. At any point of time, there will be at least 2 contracts available for trading. The Exchange may introduce other maturities of the quarterly maturity cycle mentioned here subsequently. Price of an identical maturity international Futures contract on EURUSD currency pair will be used as base price for a newly created contract. For all other existing EUR-USD contracts, previous day close price on the respective contracts will be used as base price. Minimum Price Movement (Tick Size) Price Quotation Daily Price Limit Initial margin Special Margin USD 0.0001 per EURO, equivalent to USD 1.25 per contract U.S. dollars per EURO, quoted up to the forth decimal place Every contract will have an initial DPR of +/- 2% of the previous day close price / base price. Members may please refer to Circular No.023/2010/T&S/CuR/6 dated December 09, 2010 for further details on procedure for relaxation of the Daily Price Range (DPR) of contracts. 3% or the margin level determined based on SPAN, whichever is maximum In the presence of additional volatility, a special margin as deemed suitable by the exchange would be imposed on all open positions. Settlement Cash settlement Position Limits 1,000 Contracts or 5% of the market wide open interest at the client level and 5,000 Contracts or 10% of the market wide open interest at the member level, whichever is higher, across all the expiries, available for trading for EUR-USD currency pair. Funds Pay In Funds Pay Out Daily Settlement Price & Final Settlement Price Computation First pay in run to be conducted at 08:30 Hrs. (04:30 Hrs. GMT), followed by the second run at 11:00 Hrs. Mauritius Time (07:00 Hrs. GMT) on T+1 day, subject to revision. Any revision of these times will be conveyed to the Members in Clearing and Settlement Circulars. 13:00 Hrs. Mauritius Time (09:00 Hrs. GMT) on T+1 day. Any revision of these times will be conveyed to the Members in Clearing and Settlement Circulars. Any revision of these times will be conveyed to the Members in Clearing and Settlement Circulars. Daily Settlement Price will be the same as close price on the Exchange and will be computed as per the methodology determined by the Exchange. Members may refer to the Trading Circular No. 027/2013/T&S/CuR/70 for more details. On the day of expiry, the EUR-USD spot rate publicly disseminated by the European Central Bank at 14:15 Hrs. CET will be referred to as the Final Settlement rate. The Daily and the Final Settlement Prices so computed will be suitably rounded off to the nearest multiple of the tick size of the contracts. Trading on Bourse Africa Limited will be from 10:00 Hrs. to 22:00 Hrs. Mauritius Time (06:00 Hrs. till 18:00 Hrs. GMT), Monday to Friday. Trading hours Any Trading Holidays / Change in Trading Hours will be communicated to Market Participants through Trading circulars from time to time. On the day of expiry, trading on the expiring contract will halt at 17:15 Hrs. Mauritius Time to match the 14:15 Hrs. (CET) exchange rate announcement by European Central Bank. Central Bank to be referred to, time diff from Mauritius and the time of declaration of the exchange rate European Central Bank declares EUR-USD foreign exchange rates every day at 14:15 Hrs. CET, which is 2 Hrs. behind the Mauritius Time during April to October (12:15 Hrs. GMT) and 3 Hrs. behind the Mauritius Time during November to March (13:15 Hrs. GMT). Last Trading Day Two Business days prior to the third Wednesday of the expiring month.