Chapter 2 「Cost Management Concepts and Cost Behavior」

advertisement

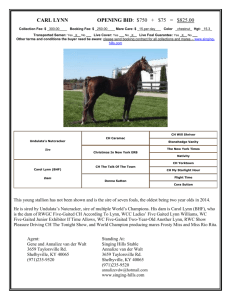

Management Accounting 2010 Second semester Takayuki Asada 1 Chapter2 Cost Management Concepts and Cost Behavior After reading this chapter, you will be able to: Explain why the appropriate way to calculate a cost depends on how the cost will be used Understand and be able to exploit the difference between direct and indirect costs Recognize different cost behavior patterns and use that knowledge to predict costs and profits with different sales levels Understand why management accountants and financial accountants use different approaches to classifying costs 2 Show why the concepts of opprtunity cost is used in shortrun decisions making and how opportunity cost related to conventional accounting costs Explain the notions of long-run and short-run costs and how these different costs are used in decision making Explain the modern approach of cost classifications based on activity levels 3 Short case Lynn’s landscaping Services 1)Her lanscaping business was in trouble about profit because it is to be declining. 2)Lynn was perplexed about the decline in profit. 3)Lynn has two options for charging the price,one is to use prevailing market price and also to use the monoply-like price which means the price she can charge. 4)Most conventional landscapeing services were competitive and other services are related with landscape design and planting. 5)There are two types of cost behavior,one to be variable and other to be fixed. 6)There are three kinds of fixed cost,such as salaries and eqipment costs. 7)Lynn knows that equipment deteriorates with use,so she figures that equipment costs should be allocated in propotion to revenue,which is a measure of use. 4 Exhibit 2.1 Lynn’s Landscaping Services Product Line Income Statement Lawn Mowing Revenue 230,000 Variable costs 125,000 Fixed costs Proift Layout Design Other Maintenance 175,000 56,000 250,000 145,000 105,343 80,153 114,504 -343 38,847 -9,504 5 2 What does cost mean? The most common definition of cost is the monetary value of goods and services expended to obtain current or future benefits. Different costs for different purposes. This suggest that there is no universal way to compute the cost of something. Management accountants define and compute costs that reflected identified decision making needs. A useful way to consider the different cost organing systems is whether The cost is needed for external(shareholders,creditors ,gorvernment ,employees) or internal (management) decision making. 6 3 How the use of product cost information defines its focus and form 1)Financial accoutants and management accountants define and think about cost very differently,particulary product costs. 2)Using product cost information outside the organization Since no one knows how the investors,etc. use the costs numbers in financial statements,generally accepted accoutning principles that specify the focus,content and form of financial statements focus on methods for computing costs rather than how they might be best caluculated to support a given decision. 7 Expenditures,Costs and Expenses Expenses are the costs of assets that the financial accoutants deems have been used up when goods or services are sold. Product Costs for manufacturing firms,financial accoutants include only manufacturing costs in the cost they report for product inventory,and threfore,as the expense they report for the goods sold. insummary,for a manufacturing firms,product cost reported on the balance sheet include only manufacturing costs ad almost always reflected historical costs. Using Product Cost Information inside the organization two broad categories which mean Planning and evaluation 1)Selling price based on cost as a reference point 2)budgeting use 3)planning and control use 8 Understanding Cost Behavior to Predict Costs understanding cost behavior allows the management accountants to develop estimates of product costs and to predict costs for various levels of production activity. you can understand the different behavior of cost when you know the notion of flexible resources and capacity related resouces. The cost of flexible resourses are called variable costs. Capacity-related resources are acquired and paid for in advance of when the work is done. The costs associated with capacity-related resources are called fixed costs. 9 Understanding Cost Behavior to cost Products Now we will turn to consider cost concepts that management accountants use when they compute product costs. Direct cost the cost of a resource or activity that is acquired for or used by a single cost object Indirect cost the cost of a resource that is used by more than one cost object. 10 Using Cost information to predict costs and profits Cost-Volume-Proft Analysis is a procedure for combining information about variable and fixed costs with revenue information for different levels of volume. Profit=revenue- costs (2.1) Profit = Revenue-variable costs – fixed costs (2.2) Profit=(units sold × revenue per unit) – (units sold × variable cost per unit) – Fixed costs (2.3) Profit = (unit sold × (revenue per unit – variable cost per unit) ) – fixed costs (2.4) Profit = (units sold × Contribution margin per unit ) –fixed costs (2.5) Units required to earn a target profit = (target profit + fixed cost) / contribution margin per unit (2.6) Breakeven unit sales = Fixed costs / cpntribution margin per unit (2.7) units required × revenue per unit = (target profit + fixed cost) × revenue per unit / contribution margin per unit (2.8) Revenue required = (target profit + fixed cost ) / contribution margin ratio (2.10) Breakeven sales revenue = (2.11) Fixed cost / contribution margin ratio 11 The CVP Chart: Executives ,analysts,and regulators track average yield and load factor for the industry and each airline very varefully since small changes in the load factor have large effects on profits(since fixed costs make up most of the total costs ,the total cost vurve has a small slope) and since most airlines operate near their breakeven load factor as shown in the practice box(p.40). 12 Extending CVP analysis for multiproduct organizations Lynn’s Landscaping Services,Lynn would construct an average product by weighting each of her company’s three real products-lawn mowing,layout design, and other maintenance-by their respective proportions in the estimated product mix. Exhibit 2-6 Lawn Mowing Layout Design unit total unit Total Units sold 4600 350 Revenues 50,000 230,000 500 175,000 Variable costs 27.17 125,000 160 56,000 Fixed Costs 105,343 80,153 Profit -343 38,847 Other maintenance Unit Total 1250 200 250,000 116 145,000 114,504 -9,504 13 Exhibit 2-7 Lynn’s Landscapeing Services:Composite Product Calculation Lawn Moving unit %Total Unit Sold 4,600 74.193548% unit Revenue 50.0 Variable costs 27.17 Contribution Margin Layout Design Other Maintenance Total unit %Total Unit %total 350 5.645161% 1,250 20.161290% 6200 weight unit weight unit weight total all 37.10 500.00 28.23 200.00 40.32 105.65 20.16 160.00 9.03 116.00 23.39 52.58 53.06 Noting that the total fixed costs at Lynn’s Landscaping is 300,000(105,343+80,153+ 114,504) ,use the breakeven formula (equation 2.7) to compute the breakeven level of sales for this composite product: Breakeven = Fixed cost / contribution margin per unit = 300,000/53.06 (2.15) unit sales 14 Exhibit 2-9 summarises these calculations and verifies that this mix and level of sales indeed provides a breakeven level of profits for Lynn’s Landscaping Services. To summarize ,CVP analysis provided decisions makers with a handy ,flexible and convenient way to model the relationship between volume and profits. 15 Using Cost Information to develop Product Costs We are faced with the problems of how to incorporate fixed costs into a product cost. 1)A widely used approach is to divide fixed costs by the number of units actually produced. This has the nice effect of including all the fixed costs in the product costs,but it has the unfortunate effect of increasing the computed cost of a product as demand goes down. 2)An alternative approach to including fixed costs in product costs is to divide the fixed cost by the practical level of capacity provided to get a cost per unit of capacity. 16 Do Different Costs for different Purpose cause costing chaos? One challenge of working with costs ,however, is that they are used in many different contexts. If the question were rephrased as “I promised to pay John’s admission to the movie he attended last Thursday.What was the cost?” all ambiguity is resolved,and a specific and relevant cost can be computed. Note that conventional accounting for external reporting avoids all these issues because it is understood that reported cost will be the historical cost for a particular transaction that has already occurred. 17 4.How Organization Create Costs :An Example 1)Starting up 2)Early growth 3)Reaching the boundaries of existing capacity 4)Expanding the product line and acquring more capacity resources 5)Redefining the business 5)Continued growth 18 5. Cost Structure Today In early 1900s,when many business first installed formal cost systemss,directlabour represented a large proportion of the total manufacturing costs. In today’s industrial environment,direct labour is often only a small proportion of manufacturing costs, The big change in cost structures of manufacturing entities today has been the much higher share of total costs represented by fixed costs. 1)Type of production Activities the following hierarchy,developed for manufacturing operations,give a broader framework for classifying an activity and its associated costs. (1)unit related ,(2)batch related, (3)product sustaing, (4)customer sustaing, (5)business sustaining 19 2)Unit-related activities 3)Batch-related activities 4)Product-sustaining activities 5)Customer-sustainning activities 20 6)Channel-sustaining activities 7)Business-sustaining activities 8)Other support activities 9)Using the cost hierarchy The cost hierarchy developed in this section is a model of cost behavior that can be used in two ways,to predict costs and to develop the costs. 10)Understanding the underlying behavior of costs There are short case for explaining behavior of costs. 11)Nonmanufacturing costs as product costs 21 6.Evaluating Profit Performance at Lynn’s Landscaping Services Exhibit 2-23 Lynn’s Landscaping Sevices :product-line income statement Lawn Moving Layout Design Other maintenance Total Revenue Direct costs Margin 230,000 125,000 105,000 Cost of used capacity Own equipment 24,000 Trucks 10,000 Cost of unused own capacity 6,000 Unit profit 65,000 Cost of unused shared capacity Business-sustaining costs Organization profit 175,000 56,000 119,000 250,000 145,000 105,000 655,000 326,000 329,000 120,000 10,000 50,000 10,000 194,000 30,000 0 -11,000 20,000 25,000 26,000 79,000 10,000 40,000 29,000 22 Summary This chapter introduced the important idea of “Different costs for different purposes”. This idea means that there is no one single best way to compute cost. This chapter discussed the ideas of short-run and long-run costs . This chapter turned to consider how unit and batch-related and product-,customer-,and business sustaining activities related can create organizational costs and provide an important introduction to cost behavior that modifies and extends the notions of variable and fixed costs. 23