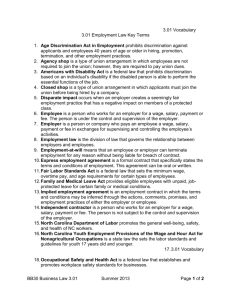

State Payroll Tax Desktop Reference guide

advertisement