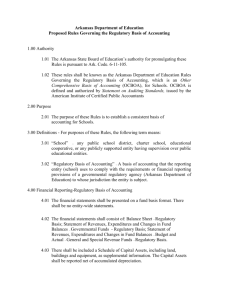

Publication No. 117-34 (Revised August 2015) Illustrative Financial

advertisement