2012 Annual Information Form

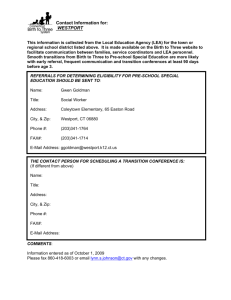

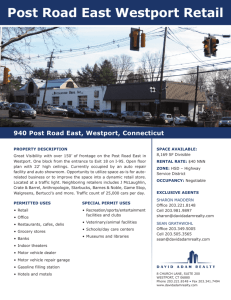

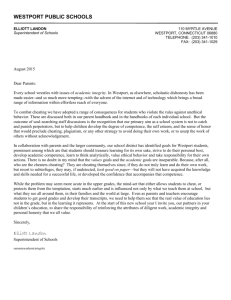

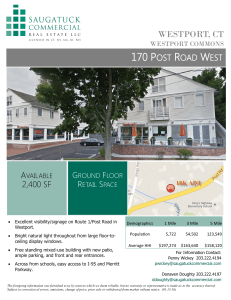

advertisement