epic corporation

advertisement

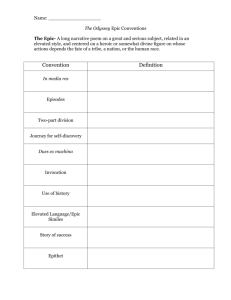

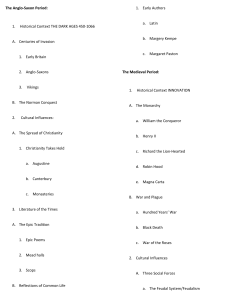

QUARTERLY REPORT FOR THE THIRD QUARTER ENDING JUNE 30, 2013. Commission File Number 0 - 30164 EPIC CORPORATION (FORMERLY TENSLEEP CORPORATION) (Changed September 2007) COLORADO (state or other jurisdiction of incorporation or organization) 33-0789960 (I.R.S. Employer Identification No.) 8000 Centre Park Drive, Suite 345, Austin, Texas 78784 (Address of Principal Executive offices, Zip Code) (888) 991-7237 (Issuer's Telephone Number, including area code) (949) 548-7005 (Issuer's Fax Number, including area code) www.epiccor.com (Issuers email address) Common Stock, No Par Value (Title of Class) The company is not now and never has been a shell corporation as defined in Rule 144(i). The number of shares of common stock authorized is 150,000,000 and the number of issued and outstanding shares of issuer’s class of Common Stock, no par value, was 25,594,726 and 5,297,368 on September 30, 2012 and 2011, respectively, and 10,669,355 on June 30, 2013. The public float on September 30, 2012 of 4,008,00 shares owned by approximately 500 – 600 beneficial owners and 241 owners of record. The common stock's CUSIP number is 29428L 205 and symbol is EPOR. The number of shares of preferred stock authorized is 10,000,000 and the number of designated $1 Series A 5% Convertible Preferred Stock is 8,000,000 of which 1,950,000 shares are issued and outstanding on June 30, 2013. There is one beneficial owner of record. Corporate Stock Transfer, Inc. 3200 Cherry Creek Drive South, Suite 430 Denver, Colorado 80209 (SEC Registered under the Securities Exchange Act of 1934 7/31/09 Page 1 of 6 INDEX Item 3. Financial Information . . . . . . . . . . . . . . . . Financial Statements for Epic Corporation: Balance Sheets . . . . . . . . . . . . . . . . . . . . Statements of Operations. . . . . . . . . . . . . . . . Statements of Shareholders' Equity . . . . . . . . . . Statements of Cash Flows . . . . . . . . . . . . . . . Notes to Financial Statements. . . . . . . . . . . . . Item 4. Management's Discussion and analysis or Plan of Operations Overview . . . . . . . . . . . . . . . . . . . . . . . Plan of Operation. . . . . . . . . . . . . . . . . . . Discussion and Analysis. . . . . . . . . . . . . . . . Item 5. Legal Proceedings. . . . . . . . . . . . . . . . . . . Item 6. Defaults Upon Senior Securities. . . . . . . . . . . . Item 7. Other Information. . . . . . . . . . . . . . . . . . . Item 8. Exhibits CERTIFICATIONS Financial Statements 7/31/09 Page 2 of 6 ITEM 3. FINANCIAL STATEMENTS The consolidate financial statements have been prepared by Epic Corporation, without audit, pursuant to the rules and regulations of the Securities and Exchange Commission. The Company believes that the disclosures are adequate to make the information presented not misleading when read with the Company's compiled financial statements for the years ended September 30, 2008 and 2007. The financial information presented reflects all adjustments, consisting only of normal recurring adjustments, which are, in the opinion of management necessary for a fair statement of the results from the periods presented. SEE EXHITBIT A ITEM 4. MANAGEMENTS DISCUSSION AND ANALYSIS OR PLAN OF OPERATIONS. OVERVIEW EPIC is a special purpose financial services company that provides corporate, business and financial services to its subsidiaries and joint ventures. The company's focus is on healthcare products and service companies. In 2006, the company developed the concept of building development stage companies through strategic relationships with small independent companies. EPIC believes that when this relationship is integrated with its subsidiary companies the capital requirements of the prospective joint venture company will be reduced and that company's business will expand at a greater rate than through its internal growth. EPIC was founded in October 1997, in the State of Colorado, under the name Tensleep Design, Inc., its name was changed In April 1999 to Tensleep Technologies, Inc, again in November 1999 to Tensleep.com, Inc., again in August 2000 to Tensleep Corporation, and again in September 2007 to EPIC Corporation (the “Company”). EPIC's principle place of business is located in Austin, Texas. The company has two subsidiaries, Tensleep Wireless Corporation (“Wireless”), and RX Healthcare Systems, Ltd. (“RX Healthcare”); and has one affiliate in which the Company has a minority interest, Tensleep Financial Corporation (“Tensleep Financial”), a formerly wholly owned subsidiary. These companies are engaged in three principal business areas: the production, sale, and distribution of healthcare products and providing of healthcare services in RX Healthcare; the research and product development of communication technologies for healthcare and consumer electronic products in Tensleep Wireless; and providing financial services and business and corporate development services in EPIC and Tensleep Financial. Business Plan 7/31/09 Page 3 of 6 EPIC's business is to provide corporate, business and financial services to its joint venture companies between EPIC subsidiaries and independent third parties. Part of EPIC's process is to acquire technology, rights to unique products, and interests in prospective growth company's. EPIC's business plan also includes the engagement of strategic relationships or joint ventures between our subsidiary companies, RX Healthcare and Tensleep Wireless, with third party research and development companies with healthcare products and services. The third party companies are to have developed technology for healthcare products or products in need of electronic components. The essence of the strategic relationships and joint ventures is to provide for product commercialization, including regulatory approval if necessary, product procurement, marketing and/or distribution. Epic by the nature of its business defines revenue as capital and revenue growth as capital growth. Epic, based on its primary purpose, obtains sustainable growth of capital and uses its capital efficiently. EPIC creates capital through equitable interests in subsidiaries and joint ventures, and by granting of Licenses to its acquired products or technologies whether developed by its engineers or other independent parties. EPIC is able to obtain sufficient funds for the next 12 months of operation from its CEO and President. Current Business AcuFAB® is an acupressure specially designed fabric produced for EPIC in the United States and is to be distributed to Original Equipment Manufacturers (OEM(s)) and EPIC contracts the production of AcuPAD products, renamed EPICpadtm which are made with AcuFAB® and distributed to RX Healthcare which markets, distributes, and sells the EPICpadtm products to consumers and healthcare institutions. The products currently produced include sleep pads, pressure overlay support surfaces, wheelchair and chair pads, auto and truck seat pads, pet pads, pillow sleeves and other healthcare products for consumers and healthcare enterprises. EPIC established the EPIC iStore, (www.epicistore.com), in order to sell our healthcare products to consumers. EPIC has spent more than one year reviewing and studying market segments for AcuFAB® and its EPICpadtm products, and looking for potential joint venture candidates for both making products with AcuFAB® or EPICpadtm products. EPIC discovered that AcuFAB® can be use to make many products in many market segments. The question has been how to penetrate the various market segments. EPIC's particular challenge is its lack of contracts with those segments and the resistance of existing distributors to new products in those segments from small unknown companies. EPIC, during the third quarter granted a License to a European Company, which is developing distribution of AcuFAB® fabric and EPICpadtm products, for a 27.3% interest in that Company, in addition EPIC will receive one-fourth (¼) of any sublicense granted by the European company. and a commission on purchases of fabric by the European company or its sublicensee’s. EPIC, Tensleep Wireless, has developed and is continuing to design and develop commercial and industrial energy management products and OEM wireless products , but Tensleep Wireless has limited sales in these items to date. 7/31/09 Page 4 of 6 Website EPIC's website is www.epiccor.com. ITEM 5. LEGAL PROCEEDINGS. None. ITEM 6. DEFAULTS UPON SENIOR SECURITIES None. ITEM 7. OTHER INFORMATION None ITEM 6. EXHIBIT A. Financial Statements for the nine months ending June 30, 2013. CERTIFICATIONS I, Ronald S. Tucker, certify that: 1. I have reviewed this Quarterly Report of EPIC Corporation; 2. Based on my knowledge, this disclosure statement does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made not misleading with respect to the period covered by this disclosure statement; and 3. Based on my knowledge, the financial statements, and other financial information included or incorporated by reference in this disclosure statement, fairly present in all material respects the financial condition, results of operations and cash flows of the issuer as of, and for, the periods presented in this disclosure statement. EPIC Corporation July 27, 2013 7/31/09 Page 5 of 6 By ____________________________ Chief Executive Officer and CFO EXHIBIT A FINANCIAL STATEMENTS FOR NINE MONTHS ENDING JUNE 30, 2013 AND 2012 7/31/09 Page 6 of 6 EPIC CORPORATION AND SUBSIDIARIES CONSOLIDATED FINANCIAL STATEMENTS For Nine Months Ending June 30, 2013 AND 2012 See Accompanying Notes: EPIC CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS As Of June 30, 2013 and 2012 ASSETS 2013 2012 CURRENT ASSETS Cash Accounts Receivable Inventory Prepaid Expense Total Current Assets $5,966 $18,219 - 14,345.00 12,461 7,645 18,427 4,933.00 45,142 3,150,465 1,062,521 1,040,100 1,040,100 130,000 131,008 100,000. 10,000 OTHER ASSETS Investments Deferred Tax (Note 5) License Organizational Costs -Net Note Receivable (Note - 6) Total Other Assets 2,243,629 4,420,565 TOTAL ASSETS $ 4,438,992 $ 2,288,771 LIABILITIES AND STOCKHOLDERS EQUITY 2013 2012 CURRENT LIABILITIES Accounts Payable Accrued Interest Loans Payable (Note 6) Total Current Liabilities $19,151 $8,821 280,031 157,540 106,276 405,458 76,158 242,519 800,000 800,000 1,205,458 1,042,519 1,950,000 - 106,693 255,947 LONG TERM LIABILITIES Loans Payable – Convertible Notes (Not 6) TOTAL LIABILITIES SHAREHOLDERS EQUITY Preferred Stock, $1 stated value 8,000,000 shares authorized, 1,950,000 Series A 5% Convertible Preferred shares issued and outstanding on June 30, 2013 Common Stock, $0.01 stated value, 150,000,000 shares Authorized, 10,669,294 and 25,594,726 shares issued outstanding as of June 30, 2012 and 2011 Additional Paid In Capital Accumulated Deficit Net Income (Loss) TOTAL SHAREHOLDERS EQUITY TOTAL LIABILITIES AND STOCKHOLDERS EQUITY See Accompanying Notes $ 5,644,923 7,281,100 (6,295,959) (6,207,168) 1,827,877 3,233,535 (83,628) 1,246,251 4,438,992 $ 2,288,771 F-1 EPIC CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS For the 9 months Ending June 30, 2013 and 2012 REVENUES License Fees Product Sales Total Revenues COST OF GOODS SOLD Cost of Products Freight Out Total Cost of Goods Sold GROSS PROFIT EXPENSES Advertising Automobile Expense Dues & Subscriptions Insurance Miscellaneous Equipment Outside Services Professional Fees Travel and entertainment Utilities Total Expenses TOTAL OPERATING PROFIT (LOSS) OTHER INCOME/(EXPENSES) Other Income Interest Expense Research & Development Gain on equity sale Total Other Income/Expenses NET PROFIT/LOSS See Accompanying Notes $ 2013 2012 1,934,672 8,208 1,942,880 24,860.00 2,702 2,702 23,794.31 23,794.31 1,940,177 1,065.69 9,106 1,607 2,150 2,538 784 18,383 6,410 695 41,671 8,091 3,085 -11,060 13,444 1,000 7,307 2,836 24,702 1,898,506 (23,636) 0 (70,630) (70,630) (59,992) (59,992) $1,827,877 $ (83,628) F-2 See Accompanying Notes Balance 9/30/2008 Share Issuance – Note 5 Adjustment Prior Period Net Loss for 9/30/09 Balance 9/30/2009 Share Issuance – Note 4 Adjustment Prior Period Net Gain for 6/30/2010 Balance 9/30/2010 Share Issuance – Note 4 Share Issuance – Note 4 Adjustment Prior Period Net Gain for 9/30/2010 Balance 9/30/2011 Share Issuance – Note 4 Adjustment Prior Period Net (Loss) for period Balance 9/30/2012 Exchanged Shares Share Issuance – Note 4 Issued Series A - Note 4 Adjustment Prior Period Net Profit (Loss) for period Balance 03/31/2013 10,669,294 25,594,726 (16,925,432) 5/21/2013 2,000,000 6/30/2013 1,950,000 $ 1,950,000 $ Exchange Exchange 1,950,000 Exchange Shares 1,950,000 Number of Number of Series A 5% Preferred Shares Preferred Stock 2,252,363 Date Shares Consideration September 1,045,000 Non-Cash 3,297,363 June 2,000,000 Convert Debt 5,297,363 10/15/10 5,000,000 Convert Debt 08/26/11 2,500,000 None Cash 12,797,363 Jun 30, 2013 12,797,363 Stock Dividend 129,244 (134,087) (6,359,618) Retained Earnings (5,788,931) 240,901 (613,678) (6,161,708) 99,921 (18,134) (6,079,921) (300,877) (6,354,775) Total 1,328,408 104,500 303,596 ( 613,678) 1,122,826 100,000 42,435 (18,134) 1,247,127 50,000 50,000 26,023 (300,877) 1,072,273 F-3 229,244 (134,087) 1,167,430 (2,025,432) 250,000 1,950,000 63,660 63,660 1,827,877 1,827,877 106,693 $ 5,644,923 $ (4,468,081) $ 3,233,535 Paid-in Common Capital Stock 22,524 7,094,815 94,050 10,450 62,695 7,251,560 32,974 20,000 80,000 (57,486) 52,974 7,274,074 50,000 25,000 25,000 127,974 7,299,074 127,974 (127,974) 100,000 -, 255,948 7,271,100 (169,255) (1,856,177) 20,000 230,000 STATEMENT OF STOCKHOLDERS EQUITY From September 30, 2007 to June 30, 2013 EPIC CORPORATION AND SUBSIDIARIES STATEMENTS OF CASH FLOWS For Nine Months As Of June 30, 2013 and 2012 2013 CASH FLOW FROM OPERATING ACTIVITIES Net Income (Loss) Adjustments to reconcile net loss to net cash provided $ 2012 1,827,865 $ (83,628) (used) by operations: (Increase) decrease in assets: Accounts Receivable Inventory Prepaid Expense 4,473 3,394 0 (4,100) 11,802 16,057 58,598 10,017.36 49,791 (144,887) 1,912,756 (163,373) (2,168,463) (350,000.00) 12,056 (12,056) (90,000.00) (10,833) (2,246,407) (372,889) 2,280 1,950,000 (95,012) (1,558,547) 325000 0 200,000 298,722 525,000 (6,773) 12,740 5,967 (11,262) 29,479 18,217 Increase (decrease) in liabilities: Accounts Payable Accrued Interest Loans Payable Net cash provided (used) by operating activities CASH FLOWS FROM INVESTING ACTIVITIES Intangible Assets Investments Equipment Note Receivable Net cash provided by investing Activities CASH FLOWS FROM FINANCING ACTIVITIES Note Payable - Convertible Preferred Stock Common Stock Paid Surplus Net cash provided by Financing Activities NET INCREASE (DECREASE) IN CASH CASH, beginning of year CASH, end of Period $ $ None Cash Transactions: See Accompanying Notes F-4 EPIC CORPORATION AND SUBSIDIARIES CONSOLIDATED NOTES TO FINANCIAL STATEMENTS June 30, 2013, AND 2012 ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Organization EPIC is dedicated to making an impact on peoples lives. We strive to provide for better healthcare through the development and commercialization of acquired technologies, and we realize, we cannot prosper in isolation. We and our strategic partners are using technologies to develop economical devices to reduce trauma, aid in diagnosing diseases, and provide comfort. We are committed to grow our business by focusing on research and development, production, marketing, and sales of Healthcare products and services. Mission Statement EPIC focus's on achieving success through research and development conducted in conjunction with our affiliates and strategic partners. Our driving force for success is innovation in our products and financial matters, both measured in human and financial terms. In seeking the fulfillment of our mission, we are guided by values that establish who we are. History EPIC was founded in October 1997, in the state of Colorado, and in September 1999 we became a full reporting company under the Securities Exchange Act of 1934 and started trading on the Bulletin Board. In December 2001 we voluntarily withdrew our registration under the Exchange Act, and have since traded on the OTC Markets. Consolidation Policy The consolidated financial statements include the accounts of the Company and all of its wholly owned and majority-owned subsidiaries. All inter-company transactions and balances have been eliminated. The Company’s investments in 20% to 50% owned affiliates in which it can exercise significant influence over operating and financial policies are accounted for using the equity method. Accordingly, the Company’s share of the earnings of these companies is included in consolidated net income. Investments in other companies are carried at cost. Product Development Costs Product development costs are expensed as incurred. Before commencing operations the Company incurred research and development costs which were also charged to operations when incurred. There were no research and development costs for the years ending September 30, 2011, and 2012. Cash and Cash Equivalents For the purposes of financial statement reporting, the Company considers all liquid investments with maturity of 3 months or less to be cash equivalents. Concentration of Credit Risk The Company maintains its operating cash accounts at commercial banks in California. The accounts at the banks are guaranteed by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per bank. At times some accounts may exceed FDIC limits. The Company limits the amount of credit exposure with any one financial institution and believes that no significant concentration of credit risks exists concerning cash and cash equivalents. Property and Equipment, Depreciation and Amortization F- 5 Property and equipment obtained in exchange for stock are carried at the fair market value of the equipment on the date of exchange. Property and equipment purchased is carried at cost as of the date of purchase. Depreciation and amortization are computed using the straight-line method over the assets’ expected useful lives. The useful lives of property and equipment for purposes of computing depreciation are: Machinery & Equipment Software 3 years 3 years Repairs and maintenance are charged to operations when incurred. Costs of betterments, which materially extend the useful lives of the assets, are capitalized. Gains and losses from sales or disposition of assets are included in the statement of operation. Use of Estimates The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates. Fair Value of Financial Instruments For the Company’s financial instruments, the carrying value is considered to approximate the fair value. Cash, prepaid expenses and accounts payable are settled so close to the balance sheet date that fair value does not differ significantly from the stated amounts. Income Taxes Income taxes are recognized during the year in which transactions enter into the determination of consolidated financial statement income, with deferred taxes being provided for temporary differences between amounts of assets and liabilities for financial reporting purposes and such amounts as measured by tax laws. The consolidated financial statements of the Company include a benefit for income taxes based on the consolidated results of operations for the parent company and its subsidiaries. For consolidated financial reporting purposes, the provision for income taxes using the consolidated results of operations was offset through the utilization of the parent company’s net operating loss carryover. Adjustments In the opinion of management the data reflects all adjustments necessary for a fair consolidated statement of results for this period. All adjustments are of a normal and recurring nature. Advertising Advertising costs, except for costs associated with direct-response advertising, are charged to operations when incurred. The costs of direct-response advertising, if any, are capitalized and amortized over the period during which future benefits are expected to be received. NOTE 1: INVESTMENT IN AMCOR FINANCIAL CORP. Amcor Financial Corp. (Amcor), a specialty finance company, provided merchant banking services as real estate financing and financing of emerging growth companies. A major shareholder of the Company is also a major shareholder of Amcor. During the year ended September 30, 2004, due to excessive litigation by the former parent company of Amcor Financial and purchasers of homes from the parent company, Amcor was forced to cease business operations, and in January 2005, it filed bankruptcy under Chapter 7. The Company has written down its investment in Amcor Financial to $286,778, which the Company believes to be the residual value. F- 6 NOTE 2: INVESTMENT IN TENSLEEP TECHNOLOGIES, INC. In July 2000 the Company exchanged net assets valued at $1,199,631 for 5,000,000 shares of Tensleep Technologies, Inc., a wholly owned subsidiary under common control in a business combination accounted as a pooling. Tensleep Technologies, Inc., completed the development of a motor controller, an Internet gateway and focused on bringing-to-market penetration through strategic relationships, joint ventures and international marketing alliances. In August 2002 the company declared a stock dividend of Tensleep Technologies common stock to its shareholders and distributed approximately 1,000,000 shares and in November 2002 the shares of Tensleep Technologies began trading. In December 2004 the company entered an agreement for the reverse acquisition of Tensleep Technologies, which was completed in March 2005; its name was later changed to Commodore International Corporation. In November 2005 the Company transferred 1,000,000 shares of its Commodore International common stock to Land & Realty, LLC (“Land & Realty”) as an investment valued at $1,000,000, which value was also based on unrealized appreciation of the Commodore common stock. Before September 30, 2006, the Company had received a return on investment of $410,000 leaving a net investment in Land & Realty of $590,000. For the year ending September 30, 2007, the company's investment in Land & Realty, due to a loss in its investment Land & Realty, was reduced by $190,000, and the remaining value of $400,000 was written off in 2008. NOTE 3: MAJORITY OWNED SUBSIDIARIES AND AFFILIATE TENSLEEP WIRELESS CORPORATION In August 2000 the Company incorporated Tensleep Wireless Corporation as a wholly owned subsidiary (“Wireless”). Wireless was organized to develop and design wireless electronic products making use of technologies owned and developed by the Company and its subsidiary Tensleep Technologies, Inc. Wireless and the company had limited funds with which to conduct its Research and Development, and was without funds to sell and market its products. In December 2002 the Company subscribed to an additional shares of common stock of Wireless in exchange for organizational costs and services paid for by the Company and the transfer of a none exclusive license to use the technology developed by the Company. In September 2003 Tensleep Technologies transfer its business to Wireless pursuant to an agreement with the Company as a capital contribution valued at $375,595, and in September 2004 the Company contributed Research and Development costs to Wireless, paid for by the company, as a capital contribution. The company on January 18, 2006, declared a stock dividend of Wireless stock and distributed approximately 1,000,000 shares to its shareholders, and holds more than 80% interest in Wireless. Wireless, in June 2006, declared a four to one stock dividend and the Company now owns 19,600,000 shares of Wireless. The Company then focused on having Wireless seeking to acquire and develop technologies in the consumer electronic products. From 2006 through 2011 the company has been seeking to develop a strategic relationship with a development stage consumer products company to augment its products. In September 2007 Wireless transferred its Research and Development business to an independent company which has continued to work on Wireless' technologies in developing RF receivers and transmitters, and electronic controllers and timers. These products have been use in deer feeders, remote controlled lights, automatic spraying systems, etc. TENSLEEP FINANCIAL CORPORATION The Company incorporated Tensleep Financial Corporation (“Financial”) on February 14, 2001, as a wholly owned subsidiary and was to be engaged in the business of providing funding for residential and commercial loans. The Company made an initial investment of $50,000 and receive 5,000,000 shares of Financial in exchange. The $50,000 was invested in an acquired mortgage banking company, which was later closed down. Financial's business plan was modified to provide commercial funding that was not provided by other financial institutions. For business reasons, the company on May 2006, declared a stock dividend of all Financial's common stock to its F- 7 stockholders and distributed approximately 4,500,000 shares to its shareholders, retaining less than a 10% ownership interest in Financial. The shares of Financial are not publicly traded. In September 2007 the company contributed the obligations of RX Healthcare Systems, Inc., in the amount of $130,000 to Tensleep Financial. The Company then held approximately a 8.76% (438,014 shares out of 5,000,000 issued and outstanding) ownership interest in Financial valued at $200,000. In September 2009 the Company contributed its investment of $200,000 in Tensleep Financial and a $134,550 promissory note of Meadow at Quail Run to RX Healthcare. RX Healthcare then simultaneously contributed the $134,550 promissory note to Tensleep Financial, thereby having an investment of $334,550 in Tensleep Financial. RX HEALTHCARE SYSTEMS, LTD. RX Healthcare Systems, is a consolidated subsidiary of the Company, was incorporated on March 29, 2006, by R Tucker & Associates, Inc., a Colorado corporation, as a wholly owned subsidiary; and was to operate as a developer, marketer and distributor of electronic products, primarily to be used in the healthcare field. In January 2007 the Company granted RX Healthcare a technology license in exchange for a license fee of $130,000 to be paid later. The obligation was later transferred to Tensleep Financial as describe above. Then in September 2007 the Company entered into a consulting agreement and received 1,000,000 shares of RX Healthcare, valued at $24,000 as a consulting fee and represented a 1/3 ownership interest. The investment is carried at cost. In September 2009 the Company contributed its investment of $200,000 in Tensleep financial and a $134,550 promissory note of Meadow at Quail Run to RX Healthcare. In exchange the Company received 3,100,000 shares of RX Healthcare's common stock. RX Healthcare then simultaneously contributed the $134,550 promissory note to Tensleep Financial, thereby increasing its investment in that company. At this time RX Healthcare redeemed the 1,000,000 shares of its common stock owned by R Tucker & Associates, Inc., in exchange for a five year convertible promissory note in the amount of $200,000 convertible at $0.05 per share. As a result of the redemption the Company owns more than 80% of RX Healthcare's common stock. The Company is to become the master distributor in North America of the AcuFAB® products, EPICpadstm, to distributors and direct to consumers. EPIC MEDICOR, LTD. EPIC Medicor, Ltd, a Colorado limited liability company, is a one member wholly owned subsidiary was incorporated on August 3, 2011. The company was formed to be the operating company for designing and producing the EPICPAD™ products from its AcuFAB® acupressure spacer fabric support overlay. The company will be selling the AcuFAB® to OEMs and to RX Healthcare Systems, its master distributor. LAGUNA BEACH CAPITAL GROUP, INC. In June 2013, the company entered into a joint venture with for the development Laguna Beach Capital Group, Inc, a California corporation, whose business is to provide financing for the sale of used cars. The Company owns a 50% interest in the Company. EPIC HEALTH PLC In June 2013, the company granted a Worldwide Exclusive License to EPIC Healthcare LPC, an Isle of Man Corporation for a one time license fee of $1,950,000 which was paid in 1,500,000 shares of its common stock with each share value at $1.30 per share. This is the conversion value of euros to dollars. NOTE 4: CAPITAL TRANSACTIONS In April 2007 the Company issued R Tucker & Associates, Inc., 10,000,000 shares of common stock pursuant to Section 4(2) of the Securities Act of 1933, such shares were restricted in accordance with Rule 144 under the Securities Act of 1934, in exchange for the payment of $100,000 of consulting services paid for by R Tucker for the benefit of the Company. F- 8 In January 2008 the Company issued 6,000,000 shares to R Tucker & Associates, Inc., for consulting services paid for by R Tucker for the benefit of the Company value at $338,500. The shares were issued pursuant to Section 4(2) of the Securities Act of 1933 and were restricted according to Rule 144 under the Securities Act of 1934. In January 2008 (mistakenly reported as March 2008 and for an amount slightly less than $500,000) the Company redeemed 15,000,000 shares of its common stock for a convertible promissory note in the face amount of $500,000 payable to R Tucker & Associates, Inc, and affiliate, and Land & Realty LLC, a non-affiliate. The shares were returned to authorized but unissued. In June 2008 the company had a reverse stock split reducing the number of shares to one share for each five outstanding shares, the result being 2,252,363 shares being issued and outstanding as of September 30, 2008. In September 2009 the Company entered into a joint venture, named Hallmark Heritage, LLC, in which the Company acquired a 50% interest in exchange for 1,045,000 shares of the Company's common stock, valued at $104,500. Hallmark's business was to locate and negotiate the acquisition of healthcare facilities. In February 2010 a conflict arose with the managing member of Hallmark Heritage and the Company rescinded the transaction and the investment was written off, but 1,000,000 shares have not been returned and continue to be accounted for as issued and outstanding. In June 2010 the Company issued R Tucker & Associates, Inc., and Tensleep Financial Corporation 1 million shares each in lieu of a cash payment of $100,000 principal on the convertible promissory note executed in January 2008. The shares issued were issued pursuant to Section 4(2) of the Securities Act of 1933 and since both parties are affiliates of the company legends were place on the certificates. In October 2010 the Company issued R Tucker & Associates, Inc., 5 million shares in lieu of a cash payment of accrued interest in the amount of $50,000 on the convertible promissory note executed in January 2008. The shares issued were issued pursuant to Section 4(2) of the Securities Act of 1933 and since R Tucker is an affiliate of the company a legend was placed on the certificates. In August 2011 the Company issued R Tucker & Associates, Inc., 1.7 million shares and 800,000 shares to 6 non-affiliates in lieu of a cash payment of accrued interest in the amount of $50,000 on the convertible promissory note executed in January 2008. The shares issued were issued pursuant to Section 4(2) of the Securities Act of 1933 and since R Tucker is an affiliate of the company a legend was placed on the certificates, but the shares issued to the non-affiliates were issued free and clear of any restrictions or legends. In May 2013 the company acquired a 50% interest in Laguna Beach Capital Group, Inc. (“LBCG”), by exchanging 2,000,000 shares of its common stock for 7,500,000 shares of LBCG common stock and a promissory note in the face amount of $100,000. LBCG is a development stage company that will provide financing to purchase used cars. In June 2013 the Company filed a Designation, Preferences and relative Rights for 8,000,000 shares of Series A 5% Convertible Preferred Stock with the Colorado Secretary of State, and issued 1,950,000 shares of the Series A 5% Convertible preferred stock for the cancellation of 16,925,434 shares of the Companies common stock valued at $1,950,000. NOTE 5: INCOME TAXES The benefit for income taxes for the years ended September 30, 2012, and 2011 consists of the following: 2012 Federal deferred tax benefit Net operating loss carry forwards $1,040,100 2011 $1,040,100 As of September 30, 2012, and 2011 the deferred tax asset consisted of the following: Non-current deferred tax asset $1,040,100 $1,040,100 F- 9 The Company has not generated any taxable income and therefore a provision for income taxes is not necessary. Similarly, a provision for deferred taxes is not necessary. For income tax purposes, the Company had available, at September 30, 2012 and 2011, net operating loss (“NOL”) carry forwards of approximately $6,986,110 and $6,868,421, respectively, which will expire in various years from 2018 through 2026. NOTE 6: PROMISSORY NOTES AND ACCRUED INTEREST The Convertible Notes, Notes Payable, accrued interest, and Note Receivable include the following: Date Executed Face Amount Payor Convertible Notes EPIC Corporation EPIC Corporation EPIC Corporation RX Healthcare Sys Loans Payable EPIC Corporation RX Healthcare Sys Accrued Interest Convertible EPIC Corporation EPIC Corporation EPIC Corporation RX Healthcare Sys Accrued Interest Notes EPIC Corporation RX Healthcare Sys Note Receivable Laguna Beach Capital Payee R Tucker & Associates Land & Realty, LLC Tucker Family Trust R Tucker & Associates Interest Rate Convert Rate Due Date 1/30/2008 1/30/2008 3/31/2012 9/30/2009 300,000 100,000 200,000 200,000 10% 10% 10% 10% $0.025 $0.05 $0.05 $0.05 1/31/16 1/31/16 1/31/15 12/31/14 Accumulated Accumulated 65,947 40,329 10% 10% 0 0 No Date No Date 1/30/2008 1/30/2008 3/31/2012 9/30/2009 131,250 43,750 25,000 46.083 10% 10% 10% 10 $0.025 $0.05 $0.05 $0.05 - Ronald S Tucker Ronald S Tucker Accumulated Accumulated 22,372 11,375 - - - EPIC Corporation 6/21/2013 100,000 - - 4/30/15 Ronald S Tucker Ronald S Tucker R Tucker & Associates Land & Realty, LLC Tucker Family Trust R Tucker & Associates NOTE 7: OTHER EVENTS IEPIC in August 2011 entered into a distribution agreement with Micro Imaging Technology, Inc., for the exclusive sale and distribution of MIT's products for a term of five years, with three automatic extensions of two years each. EPIC then formed EPIC Healthcare Systems, Ltd., now known as EPIC Medicor Ltd., which in December 2011 was transferred to the company, as was the master distribution agreement of MIT's products. In December 2011 Micro Imaging Technology, Inc., repudiated its alliance with EPIC and fails to honor its commitments made to EPIC and the Company. The Company believes that the MIT products are not yet marketable and is withholding any action regarding its distribution agreement. The Company, in June 2013, in order to focus on its primary business of acquiring and licensing technology, and providing corporate and business development and financial services sol its intangible assets, e.g. AcuFAB, etc., to a European Holding Company for $1,950,000 and applied this to half of the one time license fee for an exclusive license to sub-license those intangible assets. The other half of the license fee was paid with the issuance of 1,950,000 shares of the Series A 5% Convertible Preferred Stock. F- 10 NOTE 8: PREFERRED STOCK The Company has established a face value $1 Series A 5% Convertible Preferred Stock and its 5% dividend can be paid in cash or in common stock of the Company at the discretion of the Company, or it can be accumulated and the Preferred Shareholder can convert the cumulated dividend at a 25% discount to from the ratio of the value traded to total volume traded (“VWAP,” value-weighted average price) 10 days prior to the date of the written notice of conversion. The Shareholder can also convert the principal at a 65% discount from the VWAP traded 10 days prior to the date of the written notice is received. The Preferred Shares can elect one director of the Company. The complete description of the Preferred Stock can be downloaded from https://dl.dropboxusercontent.com/u/71480488/Preferred%20Stock%20Amendment.pdf. NOTE 9: WARRANTS The Company, on June 25, 2013, as part of the cancellation of 16,925,432 shares of its issued and outstanding common stock has issued the canceling shareholder, in addition to 1,950,000 shares of the Series A 5% Convertible Preferred Stock, 4 million warrants, consisting of 1 million each of a Series A, B, C and D. Each warrant of each series is convertible into 2.5 shares at $0.10, $0.20, $0.40 and $0.50 per shares respectively. All the warrants have an expiration dat of 6/25/2018. NOTE 10: SUBSEQUENT EVENTS The Company's strength is being a specialized financial services company specializing in creating capital. It crates capital by acquiring, selling and licensing technology and providing corporate, business and financial services to affiliated companies operated by others as part of our present subsidiary structures. In July 2013, the Company's major shareholder established an European corporation in association with experienced and qualified Europeans in operating companies and establishing product distribution and in raising capital. Our management believes that by the end of the year there will be sufficient funding for the European operations and the US operations. The plan is to have integrated operations in Europe and the US. The Company by the end of its fiscal year will have a new Chief Operating Officer for RX Healthcare Systems, Ltd., but Mr. Tucker will remain as the President and Chairman of the Board. RX Healthcare will focus on selling and distributing the AcuFAB products through sleep centers. F- 11