Ford Motor Company 2005 Annual Report Driving Innovation

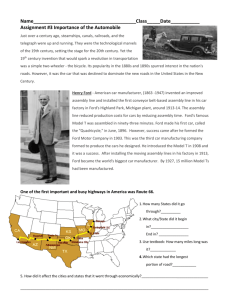

advertisement