Corporate Governance Report (Updated on Dec.1, 2015)

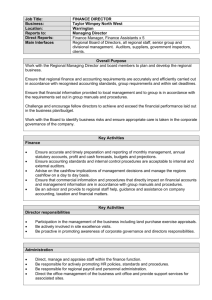

advertisement

Corporate Governance Report (Updated on Dec.1, 2015) Sony Financial Holdings Inc. The status of corporate governance of Sony Financial Holdings Inc. (hereinafter, the “Company”) is as follows: I. Basic Stance on Corporate Governance, Capital Structure, Company Type and Other Basic Information 1. Basic Stance Corporate Vision and Philosophy The Sony Financial Group (hereinafter, the “Group”) positions its corporate vision and corporate philosophy as the basic policy for formulating management strategies and decision making. <Corporate Vision> The Group seeks to become the most highly trusted financial services group by customers. To this end, the Group will combine many different financial functions (savings, investment, borrowing, and protection) to provide high-value-added financial products and high-quality services that meet every customer’s financial needs. <Corporate Philosophy> Put the Customer First We will provide financial products and services that satisfy customers by embracing their individual views, to ensure that we help them lead prosperous lives with financial security. Give Back to Society We believe that a special commitment to the public good is demanded of a financial services company. Conscious of this, we will realize our vision by upholding the highest level of ethics and a strong sense of purpose, and thereby give back to society. In addition, we will fulfill our responsibilities as a good corporate citizen and member of society. Strive for Originality We will constantly strive to come up with fresh ideas from basic principles as we pursue creativity and innovation, instead of merely following customs and convention. Foster an Open Corporate Culture We believe that every employee’s contribution is important to develop our ideal of a financial services company. We will thus foster an open corporate culture where employees can freely express their individuality and demonstrate their abilities to the fullest. Basic Stance on Corporate Governance The Company strives to meet the expectations and earn the trust of stakeholders, realize sustainable corporate growth and increase corporate value over the medium to long term by making effective use of the Group’s various management resources and by realizing its corporate vision and philosophy. 1 As a financial holding company, the Company is aware of the highly public nature of its financial business. Accordingly, the Company has in place a governance structure that emphasizes ensuring the Group’s management soundness and appropriateness. The Company is a listed subsidiary of Sony Corporation, its parent company. As such, the Company maintains managerial independence from its parent company and strives to ensure highly transparent management. [Reasons for not implementing the following principles of the Corporate Governance Code] The Company has implemented all the principles of the Code except the following two principles that are scheduled for later introduction. [Principle 3.1 (iii)] Board Policies and Procedures in Determining the Remuneration of the Directors The Company currently employs a retirement benefit system as a part of its remuneration system. However, we plan to discontinue this system and are considering the introduction of a new medium- to long- term incentive compensation plan, assuming that approval is received at the Ordinary General Meeting of Shareholders scheduled for June 2016. Information on our current compensation policy and procedures is described in this document in “II. 1 [Compensation of Directors] Disclosure of policy on determining compensation amount and its calculation method [Principle 4.11 (3)] Evaluating Effectiveness of the Board At least once each year, the Board of Directors conducts self-evaluations, evaluating the effectiveness of its decision making and oversight, as well as its operation of meetings. Toward the end of the current fiscal year, the Company will evaluate the effectiveness of the Board of Directors and plans to disclose a summary of these results in the Corporate Governance Report. [Disclosure based on each principle of the Corporate Governance Code] [Principle 1.4] Policy on Business-related Shareholdings The Company and its Group companies do not hold shares for the purpose of business-related investment (hereinafter, “Business-related Shareholdings”). However, this excludes investments having a recognized strategic significance, such as business tie-ups, that contribute to enhancing the corporate value of individual Group companies. In the event that the Company and its Group companies hold Business-related Shareholdings, they regularly consider the objectives of such holdings and the effect of investment, and report these results to their respective Boards of Directors. Based on these reports, the companies’ Boards of Directors consider the liquidation of such holdings through such methods as sale or transfer in the event the significance of holding them has been lost. With regard to the exercise of voting rights in relation to Business-related Shareholdings, the Company and its Group companies make comprehensive decisions to vote for or against individual proposals from the perspective of whether appropriate governance structures are in place at investee companies, whether appropriate decisions are being made to enhance corporate value over the medium to long term, and from the perspective of enhancing the corporate value of individual Group companies. [Principle 1.7] Ensuring the Appropriateness of Group Management The Company requires resolution by the Board of Directors in the event of any competitive and conflict-of-interest transactions by directors. Furthermore, in the event of internal Group transactions 2 (including transactions with its parent company, Sony Corporation and other Sony Group companies) that have the potential for individual Group companies to affect Group management, after the appropriateness and legality of such transactions are confirmed, they are resolved by or reported to the Board of Directors. [Principle 3.1] (i) Corporate Philosophy and Business Plans The Group’s Corporate Vision and Corporate Philosophy are as written in “I. 1. Basic Stance” of this report. The Company has disclosed the medium-term corporate strategy on the Company’s website. http://www.sonyfh.co.jp/en/financial_info/management_vision/ (ii) Basic Stance and Policies on Corporate Governance The Company’s basic view is as written in “I. 1.Basic Stance” of this report. The Company has disclosed Basic Policy on Corporate Governance on the Company’s website. http://www.sonyfh.co.jp/en/company/data/governance_policy.pdf (iv) Board Policies and Procedures in the Nomination of Director and Statutory Auditor Candidates The Company has formulated the Basic Policy on the Selection of Director and Statutory Auditor Candidates. Reflecting this policy, the Company selects as director and statutory auditor candidates people who have suitable knowledge, experience, capacity for judgment and other characteristics suiting them to conduct decision making and perform management oversight in relation to overall Group management. To reinforce the transparency and objectivity of the process of selecting director and statutory auditor candidates, the Nomination Advisory Committee deliberates on candidates in response to inquiries by the Board of Directors. After receiving the committee’s reports, the Board of Directors decides on candidates to propose at the General Meeting of Shareholders. The Company has disclosed Basic Policy on the Selection of Director and Statutory Auditor Candidates on the Company’s website. http://www.sonyfh.co.jp/en/company/data/nomination_policy.pdf (v) Explanations with Respect to the Individual Appointment and Nomination of Director and Statutory Auditor Candidates based on (iv) The reasons for appointment of directors and statutory auditors are as follows: Katsumi Ihara, President, Representative Director Over many years, Mr. Ihara has been involved in the management of Sony Corporation, Sony Life Insurance Co., Ltd., and other companies. Since June 2010, he has fulfilled his role adequately in the Group’s management as a president and representative director of the Company. As a representative director of the Company, he has the wisdom, experience and capacity for judgment to engage in appropriate decision making and management oversight in relation to overall Group management. Shigeru Ishii, Executive Vice President, Representative Director Since the establishment of Sony Bank Inc. in April 2001, Mr. Ishii has been involved in its management as president and representative director. Since April 2004, he has served concurrently as a director of the Company. As representative director of the Company, he has the wisdom, experience and capacity for judgment to engage in appropriate decision making and management oversight in relation to overall Group management. Hiroaki Kiyomiya, Managing Director During his extensive tenure at Sony Life Insurance Co., Ltd., Mr. Kiyomiya has been in charge of such 3 activities as actuarial, accounting and investment management. As a director of the Company, he has the wisdom, experience and capacity for judgment to engage in appropriate decision making and management oversight in relation to overall Group management. Tomoo Hagimoto, Director Mr. Hagimoto was in charge of the Lifeplanner Sales Group at Sony Life Insurance Co., Ltd. for several years. Since April 2015, he has been contributing to the growth of Sony Life Insurance as its president and representative director. As a director of the Company, he has the wisdom, experience and capacity for judgment to engage in appropriate decision making and management oversight in relation to overall Group management. Yutaka Ito, Director Since June 2014, as a director of the Company, Mr. Ito has been involved in the Group’s management, taking charge of accounting, risk management and other areas. As president and representative director of Sony Bank Inc. since June 2015, Mr. Ito has made use of his extensive knowledge of corporate management and demonstrated his leadership. As a director of the Company, he has the wisdom, experience and capacity for judgment to engage in appropriate decision making and management oversight in relation to overall Group management. Atsuo Niwa, Director Mr. Niwa was in charge of corporate planning at Sony Assurance Inc. Since April 2013, he has served as Sony Assurance’s president and representative director, contributing to its growth. Since June 2013, he has served concurrently as a director of the Company. As a director of the Company, he has the wisdom, experience and capacity for judgment to engage in appropriate decision making and management oversight in relation to overall Group management. Shiro Kambe, Director Over many years, Mr. Kambe has been in charge of legal affairs, compliance, corporate communications and CSR, and other areas at Sony Corporation. Since June 2014, he has been involved in that company’s management, serving as corporate executive officer. As a director of the Company, he has the wisdom, experience and capacity for judgment to engage in appropriate decision making and management oversight in relation to overall Group management. Isao Yamamoto, Director (Outside and Independent) See “II.1. [Directors] Relationships with the Company (2)” of this report. Shiro Kuniya, Director (Outside and Independent) See “II.1. [Directors] Relationships with the Company (2)” of this report. Yasuyuki Hayase, Standing Statutory Auditor (Outside) See “II.1. [Directors] Relationships with the Company (2)” of this report. Yoshimichi Makiyama, Statutory Auditor (Outside) See “II.1. [Directors] Relationships with the Company (2)” of this report. Hirotoshi Korenaga, Statutory Auditor (Outside) See “II.1. [Directors] Relationships with the Company (2)” of this report. 4 Mitsuhiro Koizumi, Statutory Auditor Mr. Koizumi is a certified tax accountant with considerable knowledge of finance and accounting. He was in charge of finance, corporate planning, human resources and others as a director of Sony Life Insurance Co., Ltd. The Company has determined that he will use this rich experience and insight to properly fulfill the duties of a statutory auditor. See individual executives’ biography in the Notice of Convocation of the General Meeting of Shareholders. http://www.sonyfh.co.jp/en/financial_info/shareholder/meeting/ [Principle 4.1 (1)] Summary of Scope of Delegation to Management In addition to items stipulated in laws and regulations and the Articles of Incorporation, the Board of Directors makes important decisions regarding management of the Group such as (i) formulation of Group corporate strategies and business plans, (ii) appointment and dismissal of directors, statutory auditors and other executives of subsidiaries in which the Company holds shares directly, (iii) entry into new businesses and withdrawal from businesses, and (iv) organizational restructuring. The Board of Directors sets up an Executive Committee, to which it delegates the execution of important routine business of the Company. [Principle 4.8] Effective Use of Independent Directors To reinforce its supervisory function and receive general advice on the management of the Group, the Company has appointed multiple highly independent outside directors, with two such directors in place as of November 2015. In addition, to increase management transparency the Company has established the Nomination Advisory Committee and the Compensation Advisory Committee as advisory bodies to the Board of Directors, and the two outside directors are members of both committees. [Principle 4.9] Independence Standards and Qualification for Independent Outside Directors In addition to the independence requirements of the Companies Act and the standards for independent directors provided by the Tokyo Stock Exchange, outside directors are people who satisfy the independence standards provided in the Company’s Basic Policy on the Selection of Director and Statutory Auditor Candidates. Outside statutory auditors are people who satisfy the independence standards provided in the Company’s Basic Policy on the Selection of Director and Statutory Auditor Candidates. The Company has disclosed Basic Policy on the Selection of Director and Statutory Auditor Candidates on the Company’s website. http://www.sonyfh.co.jp/en/company/data/nomination_policy.pdf [Principle 4.11 (1)] Composition of the Board of Directors The Board of Directors comprises 12 or fewer members (with one-year terms of office). The Board of Directors is composed of members who have a broad range of knowledge and experience. To promote efficient Group management, in principle, the representative directors of principal Group subsidiaries serve concurrently as the Company’s directors. To reinforce the supervisory function and obtain general management advice for the Group, the Company appoints multiple highly independent outside directors. The current composition is as written in “II. 1. 1. Board Composition and Operations of Organizational Structure” of this report. [Principle 4.11 (2)] Status of Concurrent Positions at Other Organizations of Directors and Statutory Auditors With regard to the status of concurrent positions at other organizations of directors and statutory auditors, the Company discloses the information on reference materials of the General Meetings of Shareholders. http://www.sonyfh.co.jp/en/financial_info/shareholder/meeting/ 5 [Principle 4.14 (2)] Training Policy for Directors and Statutory Auditors Upon their appointment, the Company provides opportunities for directors and statutory auditors to acquire knowledge related to laws and regulations, corporate governance and other areas necessary for appropriately fulfilling their roles and responsibilities. In particular, when outside directors and statutory auditors are newly appointed, the Company creates opportunities to provide the information necessary to promote an understanding of the Group’s businesses, management strategy, management issues and other areas. The Company also creates such opportunities as necessary following their appointment. [Principle 5.1] Policy for Constructive Dialogue with Shareholders The Company conducts sincere and proactive IR activities, led by the president and representative director, to forge trust-based relationships with shareholders, investors and other parties. Useful opinions and requests obtained from shareholders, investors and other parties through IR activities are regularly provided as feedback mainly to the Board of Directors. The Company has established its IR Policy based on this stance. IR Policy is as written in “V. 2. Other Corporate Governance Structures” of this report. 2. Capital Structure Ratio of shares owned by foreign shareholders: 20% or more and less than 30% [Major Shareholders] Number of shares held Name Sony Corporation Percentage of ownership (%) 261,000,000 60.00 GOLDMAN, SACHS & CO. REG 12,695,232 2.91 STATE STREET BANK AND TRUST COMPANY 505223 11,775,455 2.70 The Master Trust Bank of Japan, Ltd. (Trust Account) 9,110,600 2.09 Japan Trustee Services Bank, Ltd. (Trust Account) 7,531,437 1.73 STATE STREET BANK AND TRUST COMPANY 6,481,265 1.48 JP MORGAN CHASE BANK 385632 6,130,720 1.40 SAJAP 3,877,300 0.89 STATE STREET BANK AND TRUST COMPANY 505001 3,405,876 0.78 CBNY-GOVERNMENT OF NORWAY 3,162,600 0.72 Parent company: Sony Corporation (Listed on the Tokyo Stock Exchange, and Overseas) (Code: 6758) 3. Company Type Stock Exchange: The First Section of the Tokyo Stock Exchange Fiscal Year End: March Industry: Insurance Number of employees (consolidated): more than 1,000 (Updated) Sales (consolidated): more than ¥1 trillion Number of subsidiaries: Fewer than 10 4. Policy Concerning the Measures to Protect Minority Shareholders in Transactions with the Controlling Shareholder 6 The Sony Financial Group’s policy is to develop its business while maintaining a cooperative ties with the Sony Group. However, the Sony Financial Group believes that it has secured a degree of independence from the Sony Group, because it conducts independent business activities in line with its own corporate strategies, and operates in different business fields than the Sony Group. When entering into transactions with Sony Corporation (the controlling shareholder), the Sony Financial Group adequately confirms the necessity for such transactions and ensures that the conditions of such transactions do not differ markedly from the terms of ordinary transactions with third parties. 5. Other Special Issues That May Significantly Influence Corporate Governance (1) Capital relationships with Sony Corporation Sony Corporation holds 60.00% of Sony Financial Holdings’ shares outstanding (common stock). As a result of capital relationships, Sony Financial Holdings may be subject to the influence of Sony Corporation, irrespective of the intensions and interests of other shareholders with regard to all matters requiring shareholder approval. These matters include the appointment and dismissal of Sony Financial Holdings’ directors and statutory auditors, mergers and other organizational restructuring, transfer of all of or a part of material asset and business, amendments to Articles of Incorporation, and the appropriation of surplus. (2) Senior management’s concurrent positions with the Sony Group Sony Financial Holdings has assigned Mr. Shiro Kambe (EVP, Corporate Executive Officer of Sony Corporation) as its director and has assigned Mr. Hirotoshi Korenaga (Senior General Manager, Global Accounting Division of Sony Corporate Services (Japan) Corporation) as its statutory auditor. Moreover, as for Sony Financial Holdings’ subsidiaries, Sony Assurance Inc. has assigned Mr. Takayuki Nakagawa (Senior Manager, Japan Tax Planning Section, Tax Planning Office, Global Accounting Division of Sony Corporate Services (Japan) Corporation) as its statutory auditor. Also, Sony Bank Inc. has assigned Mr. Hidemichi Takenaka (Deputy General Manager, Tax Planning Office, Global Accounting Division of Sony Corporate Services (Japan) Corporation) as its statutory auditor. If the relationships between the Sony Financial Group and the Sony Group change due to such reasons including changes in the ratio of Sony Financial Holdings’ shares held by Sony Corporation, such personnel relationships may change. (Sony Corporate Services (Japan) Corporation is a subsidiary of Sony Corporation). (3) Use of the “Sony” trade name and trademark Sony Financial Holdings and Group companies have entered into royalty agreements with Sony Corporation to use the “Sony” trade name and trademark. The Sony Financial Group’s rights under these agreements to use the “Sony” name are conditioned upon, among other things, Sony Corporation’s continued ownership of the majority of Sony Financial Holdings’ voting rights and, no decrease in Sony Financial Holdings’ percentage ownership of the voting rights of such operating subsidiaries. Pursuant to these agreements, the Sony Financial Group pays royalty fees to Sony Corporation and Sony Corporation retains pre-approval rights with respect to, among other things, any use of the relevant trademarks for purposes other than those expressly provided for in the agreements. Sony Financial Holdings believes the “Sony” name has contributed to the Sony Financial Group’s brand recognition and its growth. The termination of these royalty agreements to use the “Sony” trade name and trademark led primarily by a decrease in Sony Corporation’s equity ownership in Sony Financial Holdings could adversely affect its business operations, marketing and operating results. If reputations of other Sony Group Companies excluding Sony Corporation and Sony Financial Group Companies were damaged due to loses of creditworthiness or drop in earnings, operating results of 7 Sony Financial Group Companies may be affected by worsening corporate image. II. Management Control Structure Pertaining to Management Decision Making, Execution and Supervision and Other Corporate Governance Structure 1. Board Composition and Operations of Organizational Structure; Type of structure: Company with Board of Auditors [Directors] Number of members of the Board of Directors stipulated in the Articles of Incorporation: 12 Term of members of the Board of Directors stipulated in the Articles of Incorporation: One year Chairman of the Board of Directors: President Number of the Board of Directors: Nine Election of Outside Directors: Yes Number of Outside Directors: Two Number of Outside Directors who are appointed as Independent Directors: Two Relationships with the Company (1) Name Isao Yamamoto Shiro Kuniya Attribute a b Relationship with the Company* c d e f g h i j k From another company Attorney *Choices relating to relationships with the Company *○ indicates the relevant item that the person falls under as of “today or recently” △ indicates the relevant item that the person falls under as of “previously.” *● indicates the relevant item that the person’s close family member falls under as of “today or recently” ▲ indicates the relevant item that the person’s close family member falls under as of “previously.” (a) A person who is an executive or employee of the Company or its subsidiary (b) A person who is an executive, employee or non-executive director of the Company’s parent company (c) A person who is an executive or employee of a subsidiary of the Company’s parent company (d) A person who is an entity or, if that entity is a corporation, etc., its executive or employee for which the Company is a major client (e) A person who is a major client or if that client is a corporation, etc., its executives or employees (f) A person who in addition to executive compensation is receiving significant amounts of money or other property from the Company as consultant, accounting specialist or legal specialist (g) A person who is a major shareholder of the Company (or if that major shareholder is a corporation, etc., its executives or employees) (h) A person who is an executive or employee of an entity which is a client of the Company (does not fall under d, e and f) (only with respect to the person) (i) A person who is an executive or employee of a company whose outside director assumes the post on a reciprocal basis with the Company (only with respect to the person) (j) A person who is an executive or employee of an entity receiving contributions from the Company (only with respect to the person) (k) Other 8 Relationships with the Company (2) Independent Director Name Isao Yamamoto Supplementary Information Reason for appointment ― Mr. Yamamoto possesses many years of experience as a securities analyst and an advisor for corporate finance and M&As, and has no conflict of special interest with the Company. Accordingly, the Company determined that Mr. Yamamoto can properly fulfill the duties of an outside director and an independent director. ― Mr. Kuniya works as a Managing Partner at Oh-Ebashi LPC & Partners and has specialized knowledge and experience as a lawyer, and has no conflict of special interest with the Company. the Company has determined that Mr. Kuniya can properly fulfill the duties of as an outside director and independent director. ○ Shiro Kuniya ○ Establishment or non-establishment of an optional committee which corresponds to the Nominating Committee or Compensation Committee: Established Status of the Establishment of a Discretionary Committee, Composition and Attributes of Chairperson Committee’s name Committee corresponding to Nomination Committee Committee corresponding to Compensation Committee All Full-time Internal Outside Outside members Directors Directors Experts 4 0 2 2 0 0 4 0 2 2 0 0 committees members Others Nomination Advisory Committee Compensation Advisory Committee Chair-per son Outside Director Outside Director Supplementary Explanation Role of Nomination Advisory Committee: This committee deliberates the appointment and dismissal of directors and statutory auditors of the Company, as well as the presidents of Group subsidiaries, and deliberates succession planning and other activities with regard to the Company and Group subsidiary presidents in response to inquiries by individual companies’ Boards of Directors or requests by committee members and reports to the respective Boards of Directors, if necessary. Role of Compensation Advisory Committee: This committee deliberates compensation and other payments to directors of the Company and the representative directors of Group subsidiaries in response to inquiries by the individual companies’ Boards of Directors and reports to the respective Boards of Directors. 9 [Statutory Auditors] Existence of a Board of Statutory Auditors: Yes Number of Statutory Auditors stipulated by the Articles of Incorporation: Five Number of Statutory Auditors: Four Cooperation between Statutory Auditors, Independent Auditors and the Internal Audit Division Statutory auditors receive regular reports on audit plans and audit results from the Company’s independent auditor (PricewaterhouseCoopers Aarata) and exchange information with the independent auditor in a timely and appropriate manner. Statutory auditors of the Company receive regular reports of internal audit plans and internal audit results from the internal audit division (Audit Department) and exchange information with this division in a timely and appropriate manner. The statutory auditors also receive reports on each subsidiary’s internal audit results from subsidiaries’ internal audit divisions. Election of Outside Statutory Auditors: Yes Number of Outside Statutory Auditors: Three Number of Outside Statutory Auditors who are appointed as Independent Directors: None Relationships with the Company (1): Relationship with the Company* Name Attribute a b c d e f g h i j k Yasuyuki From another company Hayase Yoshimichi Attorney Makiyama Hirotoshi From another company △ ○ Korenaga m *Choices relating to relationships with the Company *○ indicates the relevant item that the person falls under as of “today or recently” △ indicates the relevant item that the person falls under as of “previously.” *● indicates the relevant item that the person’s close family member falls under as of “today or recently” ▲ indicates the relevant item that the person’s close family member falls under as of “previously.” (a) A person who is an executive or employee of the Company or its subsidiary (b) A person who is a non- executive director or accounting advisor of the Company or its subsidiary (c) A person who is an executive, employee or non-executive director of the Company’s parent company (d) A person who is a statutory auditor of the Company’s parent company (e) A person who is an executive or employee of a subsidiary of the Company’s parent company (f) A person who is an entity, if that entity is a corporation, etc., its executive or employee for which the Company is a major client (g) A person who is a major client of the Company or if that client is a corporation, etc., its executives or employees (h) A person who is in addition to executive or compensation is receiving money or other property as a consultant, accounting specialist or legal specialist from the Company (i) A person who is a major shareholder of the Company (or if that major shareholder is a corporation, etc., its executives or employees) (j) A person who is an executive or employee of an entity which is a major client of the Company (does not fall under f, g and h) (only with respect to the person) (k) A person who is an executive or employee of a company whose outside director assumes the post on a 10 reciprocal basis with the Company (only with respect to the person) (l) A person who is an executive or employee of an entity receiving contributions from the Company (only with respect to the person) (m) Other Relationships with the Company (2): Supplementary Information Reason for appointment ― Mr. Hayase possesses many years of experience at a financial institution, and as a standing statutory auditor there. Accordingly, the Company has determined that Mr. Hayase will use his professional experience to fulfill his role as an outside statutory auditor. Yoshimichi Makiyama ― Mr. Makiyama qualified as an attorney and patent attorney in Japan and as an attorney in the U.S. state of New York, with expertise in many areas including information security and compliance, and has a breadth of professional experience both at home and abroad. Accordingly, the Company has determined that Mr. Makiyama will draw on his professional experience to fulfill his role as an outside statutory auditor. Hirotoshi Korenaga Mr. Korenaga works as Senior General Manager, Global Accounting Division, Sony Corporate Services (Japan) Corporation, a subsidiary of Sony Corporation (parent company). Name Yasuyuki Hayase Independent Director Mr. Korenaga has extensive knowledge about finance and accounting acquired over many years of working in accounting at Sony Corporation and Sony Corporate Services (Japan) Corporation. Accordingly, the Company has determined that Mr. Korenaga will use his professional experience to fulfill his role as an outside statutory auditor. [Independent Directors] Number of independent directors: Two The Company has appointed two outside directors as independent directors. [Incentive-related Matters] Status of incentives granted to directors: Other Supplementary explanations: The Company has established internal rules as to retirement benefits. Retirement benefits are based on 20% of the annual remuneration being received during the term of office. A defined portion of this 11 amount (70% for representative directors, 80% for non-representative directors) is calculated as the regular retirement benefit paid in cash. The remainder (30% for representative directors, 20% for non-representative directors) is calculated as a number of shares in the Company that is paid in cash by multiplying that number of shares by the average stock price during the year prior to the director’s retirement. The Company plans to discontinue this system and are considering the introduction of a new medium- to long-term incentive compensation plan, assuming that approval is received at the Ordinary General Meeting of Shareholders scheduled for June 2016. [Compensation of Directors] Disclosure for compensation of individual directors: The Company does not disclose the compensation of individual directors except for the compensation of directors who received ¥100 million or more for the fiscal year. Policy on compensation amount or calculation method: Yes Disclosure of policy on determining compensation amount and its calculation method: The policy for determining the compensation of executive directors and outside directors stipulated by resolution of the Board of Directors are as follows. Directors with no executive duties, except outside directors are, in principle, paid no compensation. The compensation of individual executive directors and outside directors is deliberated by the Compensation Advisory Committee in response to inquiries by the Board of Directors and determined by resolution of the Board of Directors based on the committee’s report. Meanwhile, the compensation of individual statutory auditors is determined through discussion by statutory auditors. (1) Executive Directors The main responsibility of executive directors is to continuously increase corporate value as corporate managers of the Company and the Group as a whole. Consequently, the Company’s basic policy is to determine compensation for executive directors, considering a balance between a fixed portion and a results-linked portion with a focus on securing talented human resources and ensuring that compensation serves as an effective incentive for improving business performance. a. Compensation Compensation comprises of a fixed portion depending on position, such as president, representative director and executive vice president, representative director, and a results-linked portion depending on the performance of the Company and the Group as a whole, and individual responsibilities. The results-linked portion could range from 0% to 200% of the standard amount subject to achievement of management targets for the Company and the Group and fulfillment of responsibilities. b. Level A suitable level of compensation shall be paid in order to secure talented individuals. In determining the level, consideration is given to the results of third-party surveys of the compensation levels of corporate managers and other relevant information. c. Retirement benefits The Company sets aside an amount equivalent to a defined portion of compensation for every fiscal year in office and pays the full amount upon retirement. A defined portion of the reserved 12 amount is calculated as a number of shares of the Company, which is quasi-granted. A cash payment, made upon retirement, is calculated by multiplying that number of shares by the market price at that time. (2) Outside Directors The main responsibility of outside directors is to enhance the transparency and objectivity of corporate management through the oversight and supervision of the executive directors’ execution of duties. Consequently, compensation for outside directors is determined as fixed compensation with a focus on securing talented human resources and ensuring that supervision and oversight function effectively. a. Compensation A fixed amount is paid according to the role. b. Level A suitable level of compensation shall be paid in order to secure talented individuals. In determining the level, consideration is given to the results of third-party surveys of the compensation levels of corporate managers and other relevant information. c. Retirement benefits None paid (3) Statutory Auditors The main responsibility of statutory auditors is to ensure the transparency and objectivity of corporate management by conducting operational and accounting audits. Consequently, compensation for statutory auditors is determined as fixed compensation with a focus on securing talented individuals and ensuring that the audit function is working effectively. a. Compensation A fixed amount is paid according to the respective roles of standing statutory auditors and part-time statutory auditors. b. Level A suitable level of compensation shall be paid in order to secure talented individuals. The level is determined through discussion of statutory auditors by giving consideration to the results of third-party surveys of the compensation levels of statutory auditors and other relevant information. c. Retirement benefits Based on regulation on retirement benefits for standing statutory auditors set out by the Board of Statutory Auditors, the Company determines the fixed amount commensurate with the number of years in office as at the time of retirement, subject to resolution of the General Meeting of Shareholders. No retirement benefits are paid to part-time statutory auditors. * The Companay plans to discontinue retirement benefit system and are considering the introduction of a new medium- to long-term incentive compensation plan, assuming that approval is received at the Ordinary General Meeting of Shareholders scheduled for June 2016. 13 [Support Structure of Outside Directors/Statutory Auditors] The Corporate Planning Department of the Company provides information to outside directors and outside statutory auditors and distributes Board of Directors meeting materials prior to the meetings. 2. Functions on Execution of Operation, Audits and Supervision, Nomination, Determining Compensation and Other The Company has adopted the statutory auditor system. The Company appoints outside directors who work with the statutory auditors to strengthen corporate governance. An overview of the current corporate governance system is provided below. (1) Board of Directors a. The Company is a pure holding company that owns direct subsidiaries, Sony Life Insurance Co., Ltd., Sony Assurance Inc., Sony Bank Inc. and Sony Lifecare Inc. From the perspective of group-wide efficiency in business operations, two of the Company representative directors and one executive director out of nine directors serve as directors of its subsidiaries. Furthermore, the three representative directors of its subsidiaries (Sony Life Insurance Co., Ltd., Sony Assurance Inc. and Sony Bank Inc.) serve as non-executive directors of the Company. b. The Company has appointed two highly independent outside directors out of nine directors to introduce external perspectives and to protect minority shareholders’ interests. These outside directors also serve as independent directors as prescribed by the Tokyo Stock Exchange. c. The Board of Directors of the Company delegates to the Executive Committee the authority to deliberate and determine the execution of certain daily activities. The Executive Committee is composed of standing directors as well as executives and employees who are selected by resolution of the Board of Directors. This committee meets twice a month, in principle. Non-executive directors and statutory auditors may also attend meetings of the Executive Committee. (2) Statutory Auditors a. The Board of Statutory Auditors of the Company has four members, of whom three are outside auditors. We elect one substitute statutory auditor in case of a vacancy. b. The standing statutory auditor of the Company cooperates with outside directors (independent directors), the corporate executive in charge of its Audit Department and employees in the Audit Department to enhance the supervisory function in corporate management. (3) Internal Audits The Company has established an Audit Department, which is independent of the Company’s operating divisions and is composed of dedicated internal audit personnel. (4) Accounting Audits The Company has appointed PricewaterhouseCoopers Aarata as its independent auditor. (5) Establishment of Optional Committees To increase management transparency, the Company has established the Nomination Advisory Committee and the Compensation Advisory Committee as advisory bodies to the Board of Directors. The composition of these committees is described in this report in “II. 1 [Directors] Status of the Establishment of a Discretionary Committee, Composition and Attributes of Chairperson” 3. Reason for choosing current corporate governance structure 14 As the Company is a pure holding company, the Group believes that the current structure, in which directors and statutory auditors hold concurrent positions in the parent company and subsidiaries, is efficient from the perspective of Group management. As the Company is also a subsidiary of a listed parent company, Sony Corporation, the Company has appointed two highly independent outside directors (independent directors as also prescribed by the Tokyo Stock Exchange) to ensure an outside perspective and to protect the interests of minority shareholders. Furthermore, the Company also has established a Nomination Advisory Committee and a Compensation Advisory Committee as advisory bodies to the Board of Directors to increase management transparency. In addition to protecting the interests of minority shareholders, the Company believes that the current structure is optimal from the standpoints of ensuring Group management efficiency and enhancing corporate value. III. Implementation of Measures for Shareholders and Other Stakeholders 1. Efforts Towards Activation of Shareholders’ Meeting and Facilitation of Exercising Voting Rights (1) Early Delivery of Notice of Convocation for the General Meeting of Shareholders The Company sent the Notice of Convocation for the General Meeting of Shareholders 23 days before the meeting. (The Company held its General Meeting of Shareholders on June 24, 2015, and sent the Notice of Convocation on June 1, 2015, for the fiscal year ended March 31, 2015.) (2) Setting the Date for the General Meeting of Shareholders on a Date That Avoids the Day When General Meetings Tend to be Concentrated The Company held its General Meeting of Shareholders on June 24, 2015 and avoided the day when general meetings tend to be concentrated. (3) Exercise of Voting Rights via Electronic Means a. The Company has introduced the exercise of voting rights over the Internet. b. The Company has introduced the exercise of voting rights via the electronic voting platform for institutional investors operated by ICJ, Inc. (4) Participation in a Platform for the Electronic Exercise of Voting Rights and Other Initiatives to Enhance the Environment for the Exercise of Voting Rights by Institutional Investors The Company participates in a platform for the electronic exercise of voting rights in order to enhance the environment for the exercise of voting rights by institutional investors. Furthermore, a portion of the convocation notice is translated into English, and the convocation notice is disseminated early. (5) Provision of a Convocation Notice (Summary) in English A portion of the convocation notice is translated into English. 2. IR Activities (1) Disclosure Policy The Company has established the “IR Policy” which indicates the Purpose of IR Activities, Basic Approach to IR Activities, Disclosure of IR Information, Framework for Disclosure of IR Information and Quiet Period for IR Activities. The Company has also disclosed the IR Policy onto its website. 15 (2) Regular Meetings for Individual Investors Explanations by representatives: Yes The Company holds a conference for individual investors correspondingly. Furthermore, the Company will continue to hold meetings for individual investors. (3) Regular Meetings for Analysts and Institutional Investors Explanations by representatives: Yes Every quarter, the Company holds a teleconference with analysts and institutional investors on the day it announces quarterly financial results. The teleconference is hosted by a director of the Company and subsidiaries’ senior executives in charge of finance. In addition, Sony Financial Holding holds a Corporate Strategy Meeting once a year, hosted by the Group top managements. (4) Regular Meetings for Overseas Investors Explanations by representatives: Yes The Company top managements visit overseas investors in each region once a year to hold one-on-one meetings in Europe, North America and Asia. (5) Uploading IR Materials onto Website The Company uploads earnings releases, annual reports and other disclosure materials onto its website. The Company has also enhanced disclosure in English to ensure there are no material disclosure gaps between the English and Japanese languages. (6) IR-related Division The Company has established the Corporate Communications & Investor Relations Department. 3. Efforts to Adopt a Stakeholder Standpoint (1) Provisions within Internal Regulations for Respecting the Standpoint of Stakeholders The Group recognizes that taking stakeholders’ concerns into account in management decision making is an important part of ensuring sound business operations. Accordingly, the Group has established an activity charter that it endeavors to follow in its operations. (2) Environmental Protection and CSR Activities The Company has established a CSR Basic Policy. Each of the companies in the Group conducts voluntary and fund-raising activities, has acquired ISO 14001 certification (the international standard for environmental management systems), has introduced a Green Power Certification system and participates in various other social contribution and environmental activities. IV. Basic Stance on Internal Control System and the Status of Establishment 1. Basic Policy on an Internal Control System The Company’ Board of Directors formulated a Basic Policy on Establishing an Internal Control System in compliance with Companies Act of Japan and associated enforcement regulations to ensure the appropriateness of the Group company business activities. The Company has implemented and operates an internal control system in line with this policy. The basic policy was partially revised, and approved at a Board of Directors meeting taking into account revisions in line with the revised Companies Act of Japan and associated enforcement regulations of Japan promulgated on May 1, 2015. (The revisions include specifying the system for ensuring the 16 appropriateness of the Group business activities, as well as enhancing and specifying of structure to support auditing and for the gathering of information by auditors.) [Basic Policy on Establishing an Internal Control System] (1) System to ensure that the execution of duties by directors and employees complies with laws and the Articles of Incorporation i. The Board of Directors establishes a code of conduct as a basic policy for compliance and makes this code clear to the Company' executives, employees and subsidiaries. ii. The Board of Directors creates a compliance manual that provides specific compliance guidelines and a compliance program that defines specific plans. iii. The Board of Directors creates a compliance supervisory department to promote its compliance program. The compliance supervisory department regularly reports to the Board of Directors on the progress of the compliance program. iv. The Board of Directors formulates the Basic Group Policy on Eradicating Anti-social Forces. This policy describes the firm stance the Group takes to counter anti-social forces and build the structure necessary to fulfill this policy. v. The Board of Directors establishes an internal hotline system and informs the Company' executives, employees and subsidiaries about the system. This system allows employees or others who become aware of corporate strategies, operations or other activities that contravene (or are in danger of contravening) laws and regulations to report directly to a hotline desk. The system prohibits any action from being taken against employees or others who provide such notification. vi. The Board of Directors creates the Group Information Security Policies and streamlines a structure to properly control Group information assets, including customer information. vii. The Board of Directors creates the Conflicts of Interest Policy within the Group and ensures that the necessary formats are in place to properly control transactions which have the potential to harm the interests of customers. viii. The Board of Directors establishes an internal audit supervisory department, which is independent from other operating departments. The internal audit supervisory department liaises and cooperates with the statutory auditors and the accounting auditor; monitors and verifies, from an independent and objective viewpoint, the implementation and operational status of the internal control system; and reports regularly to the Board of Directors the status of internal audits. ix. The Board of Directors formulates the Basic Policy related to Group’s Internal Audits as well as Internal Audit, and informs the Company’s executives and employees and subsidiaries of these. (2) System for storing and managing information related to the execution of duties by directors The Company establishes the Record-keeping Regulations to ensure that documents pertaining to the execution of duties by directors, such as records of decisions at Board of Directors and Executive Committee meetings, are appropriately stored and managed in accordance with these laws and regulations. (3) Systems of regulations related to risk management i. The Board of Directors formulates the Fundamental Principles for Risk Management Activities as a basic policy on Group risk management and informs the Company’s executives, employees and subsidiaries of these. ii. The Board of Directors establishes a risk management supervisory department to manage risks appropriately for the Company and its subsidiaries, in accordance with each entity's scale, characteristics and type of business model. This department reports regularly to the Board of 17 iii. iv. Directors on the status of risk management. The Board of Directors evaluates the capital adequacy of subsidiaries to ensure that their levels of capitalization are sufficient in light of the risks the Group directly faces and to implement appropriate capital allocations. If necessary, the Board of Directors takes measures designed to strengthen capital bases. The Board of Directors creates the Basic Policy related to Group Business Continuity Risk Management, as well as contingency plans, to build a system that enables the Group to respond rapidly to a crisis and put in place measures to minimize the impact of these risks. The Board of Directors makes these plans known to the Company’s executives, employees and subsidiaries. (4) Systems to ensure the efficient execution of duties by directors i. The Board of Directors establishes approval regulations, organizational and task-sharing regulations and other internal rules, and creates an appropriate structure for the efficient execution of duties. ii. The Board of Directors sets up an executive committee and delegates to this committee the discussion and decision-making authority regarding execution of important corporate day-to-day business activities. iii. The Board of Directors establishes the Business Plan Control Regulations, formulates and executes non-consolidated and consolidated medium-term business plans and annual business plans, and regularly confirms progress on business plans. (5) System to ensure reliability of financial reporting The Company maintains the necessary system to ensure reliability of financial reports, in accordance with the Basic Policy regarding Group Financial Reporting. (6) System to ensure the appropriateness of operations by the Company and the corporate group, including the Company’s parent company and subsidiaries i. In addition to exercising shareholder rights as a financial holding company, the Company makes management control agreements with its subsidiaries, under which the Company manages subsidiaries by requiring them to comply with the Group wide Basic Policy and to report and obtain prior approval of the Company on matters necessary for ensuring the appropriateness of operations of the Group, including subsidiaries. ii. Based on its Basic Policy on Management of Transactions within the Group, the Company deliberates and examines the appropriateness and compliance of intra-Group transactions with subsidiaries that have the potential to significantly impact the operations of the Group before the commencement of those transactions. Such issues are resolved at or reported to the Board of Directors. In addition, to protect minority interests, when conducting transactions with parent company Sony Corporation (controlling shareholder) and its group companies, Sony Financial Holdings and its subsidiaries duly confirm that these transactions are necessary and are entered into under conditions that are not conspicuously divergent from those of typical transactions with third parties. iii. The Company’s Audit Department takes responsibility for ensuring that subsidiaries have appropriate internal control systems in place and monitors and verifies the results of internal and third-party audits of subsidiaries. iv. The Company and its subsidiaries submit management information about the Group as needed to the Company’s parent company and interact with the parent company's internal audit supervisory department. (7) Items pertaining to employees who are requested to assist statutory auditors in their duties 18 If directors receive requests from statutory auditors for employees to be allocated to assist them in their duties, the directors assign such personnel without delay. (8) Independence from directors of employees assigned to assist statutory auditors referred to in (7) above i. Statutory auditors must agree to the appointment, removal and evaluations of employees assigned to assist them in their duties. ii. Employees assigned to assist statutory auditors in their duties must exclusively follow the instructions and directives of statutory auditors, once they are given. (9) System for directors and employees to report to statutory auditors, and other reporting system i. If directors or employees are requested to provide reports regarding the execution of their business to statutory auditors, they must do so immediately. ii. If directors or employees discover facts that could significantly affect the operations or financial condition of the Company or its subsidiaries, they must report such discovery to the statutory auditors immediately. No actions may be taken against persons providing such reports, while the information provided via such report shall be shared among the Company’s executives, employees and subsidiaries. iii. If directors or employees receive notification via the internal hotline system, they must report immediately to the statutory auditors. (10) Other systems to ensure the effectiveness of audits by statutory auditors i. Representative directors endeavor to forge and deepen relationships with statutory auditors based on mutual understanding and trust by creating the environment that is necessary for audits by statutory auditors. ii. When statutory auditors request, the Company shall pay expenses or discharge obligations attendant to requests for counsel, studies, expert opinion or other activities by attorneys, certified public accountants or other outside specialists for the execution of statutory auditors’ duties, unless the Company proves that such activities were not necessary to the execution. 2. Basic Policy on Eradicating Anti-social Forces [Basic Group Policy on Eradicating Anti-social Forces] The Group recognizes the importance of strictly avoiding any association with anti-social elements from the perspectives of social responsibility, compliance and corporate defense. Accordingly, the Group has formulated this basic policy to enforce its initiatives to shut out anti-social forces. (1) Organizational response Rather than at the individual or departmental level, the Group responds to anti-social forces at an all-organizational level, from top management downward, and ensures the safety for all executives and employees who respond. (2) Cooperation with external organizations To obtain appropriate counsel and cooperation, the Group collaborates closely on an ongoing basis with outside specialists, including the police, centers for the elimination of violent groups and attorneys. (3) Refusal of all relationships, including transactions 19 The Group refuses to have any relationships with anti-social forces, including transactional relationships. (4) Civil and criminal legal approaches to emergency situations The Group strictly rejects unfounded demands by anti-social forces. Furthermore, the Group takes both civil and criminal legal approaches, as necessary. (5) Prohibition on backroom deals and provision of funds The Group conducts absolutely no backroom deals with nor provides funds to anti-social forces. [Structures for Eradicating Anti-social Forces] ・The Company sets up a department for dealing with anti-social forces and appointed a person responsible for thwarting unreasonable demands. ・The Company collects information on anti-social forces by cooperating with specialized external organizations. V. Other 1. Takeover Defense: No 2. Other Corporate Governance Structures The Company’s IR Policy is as follows: [Purpose of IR Activities] The Company strives to provide members of the investment community, including its shareholders, investors, securities analysts and other market participants, with information related to the assessment of corporate value in a timely, accurate and fair manner, as well as to facilitate sufficient dialogue. By enhancing disclosure of management strategies and financial position, the Company makes efforts to gain the trust of the investment community and obtain a fair corporate valuation from stakeholders. Furthermore, the Company feeds market dialogue, evaluations and other information back to its senior management and makes use of this information in its management in the aim of increasing corporate value. [Basic Approach to IR Activities] 1. The Company will clearly disclose the information necessary to assess its corporate value based on the principles of promptness, accuracy, fairness and consistency. 2. The Company will engage with members of the investment community such as its shareholders, investors, securities analysts and other market participants, in a sincere and direct manner in order to establish relationships of trust. 3. The Company will promote IR activities led by the president and representative director, based on the concerted effort of the entire the Group. The Company places importance on constructive dialogue with its shareholders, investors, securities analysts and other market participants, and will strive to take advantage of various opportunities to engage in dialogue, centered on senior management. In addition to holding individual meetings, the Company will participate actively in events targeting investors and securities analysts (including Company briefings, financial results briefings and IR fairs) and enhance its disclosure of information through various IR tools (including corporate website and 20 annual reports), thereby promoting efforts to deepen their understanding of the Company. Furthermore, the Company will seek to expand opportunities for dialogue, taking into consideration the medium- to long-term interests of its shareholders, investors, securities analysts and other market participants. 4. The Company will periodically feed requests and evaluations from shareholders, investors, securities analysts and other market participants through its IR activities back to its senior management by reporting this information mainly to the Board of Directors. [IR Organizational Structure] The Company assigns a corporate executive to oversee IR activities and has established the Corporate Communications & Investor Relations Department as the department in charge of IR activities. Through this structure, the Company seeks to enhance its disclosure of information and dialogue. The department in charge of IR activities shares information appropriately with the Company’s operating departments, as well as Group companies. [Disclosure of IR Information] (1) Basic Stance The Company will engage in timely disclosure in accordance with the Securities Listing Regulations approved by the Tokyo Stock Exchange. The Company will also proactively disclose other information of substantial interest to shareholders, investors, securities analysts and other market participants, as well as information intended to promote an understanding of the Group. Furthermore, the Company will maintain continuity and consistency in the information it discloses. (2) Method of Disclosure The Company will provide timely disclosure based on the Securities Listing Regulations through the Timely Disclosure network (TDnet) of the Tokyo Stock Exchange, and will promptly make such information available on the Company corporate website. The Company strives to provide fair disclosure worldwide by making a full range of information available on its corporate website, including information that is not required under disclosure regulations. (3) Framework for Disclosure In order to promote timely disclosure, the Company has established the Rules and Regulations Related to Timely Disclosure, and set up a Disclosure Committee (DC). In the event that material information comes to light, the Company has a framework in place whereby the Company’s corporate executives and employees, as well as managers responsible for the disclosure of material information (hereinafter, the “Disclosure Managers”) of its subsidiaries, promptly report on this information to the DC. Furthermore, material corporate information that the Company must disclose is set forth in the Group Guidelines for Reporting Important Information. These guidelines are made known to the Company’s corporate executives and employees, as well as the Disclosure Managers of its subsidiaries. Notes: Roles of the DC 1. Assist the decision making of the President and Representative Director regarding the design, introduction, evaluation and maintenance of the timely disclosure system. 2. Promptly and comprehensively collect material corporate information of Group companies. Discuss the 21 necessity of timely disclosure along with the accuracy, completeness, clarity and level of internal approval of the content of timely disclosure, as well as the fairness and proactiveness of the announcement. Provide the necessary information when authorized personnel must make decisions on the disclosure of said information. Members and Secretariat of the DC It comprises members of the Executive Committee, including executive directors and general managers from each division. The Company has set up Secretariat at the Corporate Communications & Investor Relations Department. [Framework for Disclosure of IR Information] With regard to framework for disclosure of IR Information, please refer to the last page of this report. [Quiet Period for IR Activities] In order to ensure fair disclosure of information and prevent the leak of material information regarding the Group’s financial results prior to earnings announcements, the Company has established a quiet period for IR activities. The Company observes a quiet period for IR activities from the second Monday of the month following the end of every quarter until the earnings announcement. During this period, the Company shall not, in principle, hold individual meetings, presentations about the Company and other such events, and shall refrain from answering inquiries regarding the financial results. [Control of Insider Information] The Company has formulated the Basic Group Policy on Prevention of Insider Trading for the Group to prevent leaks of information for timely disclosure. In addition, when engaging in dialogue individually with shareholders, investors, securities analysts and other market participants, the Company has a policy of always engaging multiple members to ensure thorough control in the handling of information. The Company has also established the above-mentioned quiet period for IR activities, during which to prevent disclosing selectively unannounced material information only to a specific number of people. 22 23