Bangladesh Pharmaceutical Sector Overview - July 2010

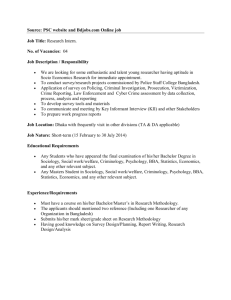

advertisement

Parvez M Chowdhury Analyst: Pharmaceuticals and Consumer Goods parvez@bracepl.com An overview of the pharmaceutical sector in Bangladesh July 2010 Introduction The pharmaceutical market in Bangladesh remains tiny compared to the population Table 1: Health expenditure as a % of GDP Total expenditure on size because of the lack of spending power of the population. Pharmaceutical health as % of GDP spending is also amongst the lowest in the world in per capita terms. Healthcare expenditures consist of only 3.4% of GDP. However, the increased awareness of 2000 2007 healthcare and the government’s increased expenditure in this sector is causing the 7.0 8.4 demand to increase in this sector. In addition to the demand of therapeutic drugs, UK the demand for “wellness” drugs such as vitamins and minerals are increasing USA 13.4 15.7 gradually and the future growth of the sector lies in it. Japan 7.7 8.0 Surprisingly, the pharmaceutical sector, which is widely regarded as a “hi-tech” industry, is the most developed among the manufacturing industries in Bangladesh. Roughly 250 companies are operating in the market. According to IMS, a US-based market research firm, the retail market size is estimated to be around BDT 55 billion, which grew by 16.8% in 2009. The market size in 2008 was BDT 47 billion with a growth of 6.9%. The actual size of the market may vary slightly since IMS does not include the rural market in their survey. However, the deviation is estimated to be not more than 5-10% in either direction. Unfortunately, there is no solid information source in Bangladesh other than IMS. The retail market is about 90% of the total market. In that respect, the total market size is more than BDT 60 billion. India 4.4 4.1 Sri Lanka 3.7 4.2 Pakistan 3.0 2.7 Malaysia 3.2 4.4 Thailand 3.4 3.7 Indonesia 2.0 2.2 Bangladesh 2.7 3.4 Source: World Health Statistics 2010, WHO One of the fastest growing sectors with an annual average growth rate consistently Table 2: Pharmaceutical sector growth rate in the double digits, Bangladesh’s pharmaceutical industry contributes almost 1% Growth Rate of GDP. It is the third largest tax paying industry in the country. Bangladeshi Year 22.46% pharmaceutical firms focus primarily on branded generic final formulations using 2001 10.18% imported APIs (Active Pharmaceutical Ingredients). Branded generics are a 2002 category of drugs including prescription products that are either novel dosage 2003 5.90% forms of off-patent products produced by a manufacturer that is not the originator 2004 8.60% of the molecule, or a molecule copy of an off-patent product with a trade name. This 2005 17.50% definition is used by both the FDA and the United Kingdom's National Health 2006 4.08% Service (NHS). About 80% of the drugs sold in Bangladesh are generics and 20% 15.80% are patented drugs. The country manufactures about 450 generic drugs for 5,300 2007 2008 6.91% registered brands which have 8,300 different forms of dosages and strengths. These 2009 16.80% include a wide range of products from anti-ulcerants, flouroquinolones, antirheumatic non-steroid drugs, non-narcotic analgesics, antihistamines, and oral anti- Source: Bangladesh Association of Pharmaceutical diabetic drugs. Some larger firms are also starting to produce anti-cancer and anti- Industries (BAPI) retroviral drugs. We initiate this sector research in an attempt to present an overview of the sector. Within this research we will cover the state of the sector, it’s strengths and weaknesses, and finally the overview of some leading pharmaceutical companies. Pharmaceutical Sector: Bangladesh Although the sector has a long way to go, the reasons we are optimistic about the sector can be summarized in Figure 1. We believe that the strengths outweigh the weaknesses. Figure 1: Strengths and weaknesses of the pharmaceutical sector in Bangladesh Growth potential of the domestic drug market In order to get a sense of what might potentially be the size of the drug market let us consider a simple model. Here we assume that the economy will have an average GDP growth of 6%. The economy will witness an uptrend in healthcare expenditure because of the growing health consciousness and the increased demand for “wellness” drugs as well as government expenditure. This means that drug and nondrug healthcare expenditure will increase at about the same pace. So, we also assume that the percentage spent on drug as part of total healthcare expenditure will remain similar current level, which is about 28%. These simple assumptions present an impressive growth upside of 83.6% by 2015 with a 6 year CAGR of 10.7%. Recent growth figures have proved to be better than the projection, which demonstrates that the growth prospect of the sector is justified. Table 3: Growth potential for domestic drug market GDP (MM BDT) Healthcare Expenditure % of GDP Healthcare Expenditure (MM BDT) Drug/Medicine Sales (MM BDT) Average GDP Growth Rate Growth Upside CAGR 2009 6,149,432 3.4% 209,081 60,000 2010 6,518,398 3.6% 234,662 67,341 2011 6,909,502 3.8% 262,561 75,347 6.0% 83.6% 10.7% Source: Bangladesh Bank, WHO, IMS Health and analyst’s estimate 2 2012 7,324,072 4.0% 292,963 84,072 2013 7,763,516 4.2% 326,068 93,572 2014 8,229,327 4.3% 353,861 101,548 2015 8,723,087 4.4% 383,816 110,144 Pharmaceutical Sector: Bangladesh Market players Domestically, Bangladeshi companies including the locally based MNCs Figure 2: Market share concentration produce 95%-97% of the drugs and the rest are imported. Although about 250 pharmaceutical companies are registered in Bangladesh, less than 100 are actively producing drugs. The domestic market is highly concentrated and competitive. However, the local manufacturers dominate the industry as they enjoy approximately 87% of market share, while multinationals hold a 13% share. Another notable feature of this sector is the concentration of sales among a very small number of top companies. The top 10 players control around two-third of the market share while the top 15 companies cover 77% of the market. In comparison, the top ten Japanese firms generated approximately 45% of the domestic industry revenue, while the top ten UK firms generated approximately 50%, and the top ten German firms generated approximately 60%. Square Pharmaceuticals is the stand out market leader with a market share of 19.3% which posted domestic revenue of BDT 11.2 billion in the last four quarters (Apr 09 - Mar 10). Their nearest competitors are Incepta Pharmaceuticals and Beximco Pharmaceuticals with market shares of 8.5% and 7.6% Figure 3: Domestic market share of companies Top Ten Company Growth Apr 09 - Mar 10 ACI Limited 7.9% Acme Laboratories 8.0% Aristopharma 13.6% Square Pharmaceuticals 13.9% Sector Beximco Pharmaceuticals Eskayef Pharmaceuticals Renata Limited Incepta Pharmaceuticals Opsonin Pharmaceuticals Drug International 18.4% 22.0% 27.3% 28.5% 31.0% 31.7% 39.2% Others 20% MNCs 13% Top Ten 67% Source: BAPI and newspaper reports Table 4: Domestic market share of companies Top Companies Revenue April 09 Revenue March 10 Market 2009 Market (MM BDT) Share (MM BDT) Share Square Pharmaceuticals 11,158 19.3% 10,701 19.5% Incepta Pharmaceuticals 4,919 8.5% 4,524 8.2% Beximco Pharmaceuticals 4,415 7.6% 4,239 7.7% Opsonin Pharmaceuticals 2,817 4.9% 2,614 4.8% Eskayef Pharmaceuticals 2,788 4.8% 2,520 4.6% Acme Laboratories 2,717 4.7% 2,640 4.8% Renata Limited 2,623 4.5% 2,495 4.5% ACI Limited 2,466 4.3% 2,460 4.5% Aristopharma 2,355 4.1% 2,240 4.1% Drug International 2,283 3.9% 2,132 3.9% Sanofi-Aventis 1,700 2.9% 1,634 3.0% GlaxoSmithKline 1,266 2.2% 1,229 2.2% Novo Nordisk 1,005 1.7% 878 1.6% Sandoz 936 1.6% 908 1.7% Novartis 675 1.2% 558 1.0% 13,691 57,815 23.7% 100.0% 13,158 54,929 24.0% 100.0% Others Total Source: BAPI and newspaper reports Source: Newspaper reports respectively. Incepta and Beximco had BDT 4.9 billion and BDT 4.4 billion in domestic sales for the last four quarters. Although a number of MNCs are operational in Bangladesh market, no MNCs are in the top ten in terms of domestic sales. Because Bangladesh API capacity is insignificant, pharmaceutical companies import approximately 80% of their APIs. Fifteen to twenty Bangladeshi firms are involved in the manufacture of about twenty APIs, but they usually run the relatively easier final chemical synthesis stage with API intermediaries, instead of the complete chemical synthesis. The other 1,000 required APIs are imported. Approximately 75-80% of the imported APIs are generic. 3 Pharmaceutical Sector: Bangladesh Table 5: Pharmaceutical Import to Bangladesh (USD Million) All Products Pharmaceutical Product Import Pharma % of Total 2000-01 2001-02 2002-03 2003-04 2004-05 2005-06 2006-07 2007-08 2008-09 9335 8540 9658 10903 13147 14746 17157 21629 22507 33 39 44 45 41 50 49 62 80 0.35% 0.46% 18.18% 0.46% 12.82% 0.41% 2.27% 0.31% -8.89% 0.34% 21.95% 0.29% -2.00% 0.29% 26.53% 0.36% 29.03% YoY Growth for Pharma Source: Bangladesh Bank, Bangladesh Bureau of Statistics Sourcing of APIs and raw materials Bangladesh has a competitive disadvantage when compared to India, since pharmaceutical manufacturing is not backward-integrated. Most APIs have to be imported, and even if the API is manufactured in Bangladesh, the raw materials have to be imported. This generates higher factor costs, especially in cases where the provider of the API is a competitor in selling the finished product. Building up backwards-integration for all relevant APIs is not a realistic option: scale disadvantages and infrastructure constraints are more relevant in the early stages of the value chain, where the products have a strong commodity character. Figures 5, 6: Organic Chemicals and Pharmaceutical Products Import to Bangladesh Pharmaceutical Products Import to Bangladesh Organic Chemicals Import to Bangladesh Others Others Indonesia Hungary U.S.A India Japan Italy Taiwan Belgium Germany 2007-08 Malaysia 2008-09 Netherlands 2007-08 Germany 2008-09 Republic of Korea France Singapore Denmark China Spain India MM BDT 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 MM BDT Switzerland 8,000 0 200 400 600 800 1,000 Source: Bangladesh Bank, Bangladesh Bureau of Statistics Availability of machinery, know-how and human resources The machinery for pharmaceutical manufacturing does also have to be imported. This places Bangladeshi companies at a cost disadvantage compared with Indian manufacturers who can source the machinery nationally. The leading manufacturers import most of their equipment from Europe or Japan, a fact they claim ensures quality advantages over their Indian competitors. Other manufacturers import machinery e.g. from China or India. Part of the cost may be compensated by export subsidies these countries are giving. However, when competing in international markets, it becomes a question of comparative export subsidizing in these countries: whether machinery exports being more or less subsidized than drug exports. Current drug market The therapeutic groups The most important therapeutic group in the Bangladeshi market are Systemic Antibiotics. They account for almost 30% of the market. The second therapeutic group, Anti-acids, are much less relevant in terms of 4 1,200 Pharmaceutical Sector: Bangladesh market, as well as from a public health perspective. Vitamins, Analgesics, Mineral supplements, Cough and Cold preparations and muscle relaxants also figure prominently. It is to be noted, that typical developed market therapeutic groups like those addressing diabetes, cardiovascular diseases, allergies or psychological disorders also are among the most important in Bangladesh, whereas HIV/AIDS and Anti-malarial drugs are not. API manufacturing In most cases, APIs have to be imported from abroad, which, together with the necessity to import machines, is one of the main disadvantages in terms of cost when compared to India. The leading manufacturers are therefore going into API manufacturing, focusing mainly on Antibiotics, but also other drugs, such as anticancer drugs. However, Antibiotics are particularly demanding in terms of manufacturing conditions, as GMP procedures require special care to avoid cross-contamination. For example, each API manufacturing line has to be in a separate building. For many APIs, the domestic market is too small to justify an API manufacturing plant. This stresses the fact that whereas several Bangladeshi manufacturers have the know-how to manufacture APIs, the initial investment and the production scale required are high. This means that in order to establish API manufacturing e.g. for Antiretroviral APIs in Bangladesh, the manufacturers would need to be sure of their access to several export markets. This barrier is unlikely to be taken without external support. Distribution channels Basically, there are three distribution channel systems in Bangladesh: public hospitals, private hospitals and private pharmacies. Public hospitals source mainly from the state-owned Essential Drugs Company Limited (EDCL), whereas private hospitals and pharmacies source from the private sector. However, public hospitals can also source from private pharmaceuticals through tender bids. As for the private Sector, there is a network of wholesalers, comprising of around 1200 wholesale medicine shops. Whereas small and medium scaled pharmaceutical companies sell to those wholesalers directly from the factory, the large companies usually have a complementing distribution network of their own: from their factories, the drugs are taken to a central depot in Dhaka, then to the zonal depots in the different regions and from there, they are sold both to wholesalers and to retailers through trained sales representatives or distribution assistants. Retail-sales of drugs in Bangladesh are allowed only under direct supervision of a pharmacist registered with the Pharmacy Council of Bangladesh. The licenses for retail pharmacies and for wholesalers are also being controlled by the Drug Administration of Bangladesh. There are close to 76,000 licensed retail pharmacies in the country, and an estimated 125,000 unregistered retail pharmacies. In addition, drugs like antibiotics can also be found in village shops etc. without proper supervision. Whereas the law foresees no OTC drugs, requiring all drugs to be dispensed through a prescription, in fact all medicines are available without any prescription. Bangladesh’s drug distribution marketplace is composed of small independent pharmacies. Pharmaceutical firms can sell their products to private sector pharmacies, the government and its public health care facilities, or to international organizations operating in Bangladesh (e.g., UNICEF). Government sales are not as profitable as private sector sales because the government pays less, on consignment, and at times, after considerable delay. Pharmaceutical firms nevertheless still target pubic facilities because doctors become acquainted with the firms’ drugs and then prescribe them in their private practices. And, because drugs are not readily available at public facilities, patients receiving treatment there may still go to a private pharmacy to procure the required drugs. Without these public sector connections, many firms would turn more attention to the private sector. 5 Pharmaceutical Sector: Bangladesh Although there are approximately over 200,000 private pharmacies in Bangladesh, the government lists officially around 76,000 pharmacies. The rest are illegal, without a license or a licensed pharmacist on staff. Pharmacists have varying education levels and many lack adequate training. Most pharmacies are individual shops, though some chains are starting to develop, especially in urban areas. Large pharmacies generally buy medicines according to sales trends, e.g., what sells the most. The medium and small pharmacies generally have affiliation with a medical doctor. Their sales are therefore usually skewed towards that medical professional’s preferences. Several brands of each drug, with variable quality levels, are on the market. In urban areas, the pharmacies tend to sell higher quality brands, whereas in more rural areas, pharmacies tend to sell lower quality, lower cost brands. This may be due to a district’s local influences swaying brand selection. The pharmacies tend to have brands associated with people who hold power in that district. Those more distant from the city center consume increasingly more indigenous medicines such as ayurvedic and herbal medicines. Indigenous medicine has a sizeable market size of an estimated BDT 10 billion (about 15% of the total market). Majority of the users are from low-income bracket with little or no education. However, indigenous medicine is a niche market and it is generally not considered as a competitive threat to mainstream medicine. The top twenty pharmaceutical manufacturing firms have established extensive sales and distribution networks. Most pharmacies have 10-50 pharmaceutical firms supplying their medicines daily. Hundreds of medical representatives of top pharmaceutical companies visit pharmacies daily to take drug orders. The success in sales for pharmaceutical companies have become extremely marketing oriented. They usually boost their sales by giving incentives to pharmacies and to doctors in the form of higher commission so that they would recommend their products to patients. On an average, a company incurs 10-15% of their total costs in this process. However, they usually hide these costs in their cost of goods sold. Since Bangladeshi firms produce low cost products, the gross margin actually is more than 60% for most of the companies. But because of this widespread practice, they usually report 45-50% in gross margin. Each pharmacy may receive approximately 12-15 shipments per month from a particular company. Pharmacies do not usually restock any medicine that does not sell well. The small pharmacies keep a medicine for a maximum of six months. Who decides on the drugs to be consumed A significant number of drug consumers obtain drugs without a prescription. When consumers lack a prescription, they will usually either ask a pharmacist for a specific drug or describe their ailment to a pharmacist who diagnoses the problem and recommends a drug on the spot. Popular products include a variety of antibiotics, painkillers, and gastric remedies. Consumers purchase one to ten tablets or capsules at a time. The quantity of drugs purchased often depends more on the consumer’s finances than on the required dose of medicine. Drug regulation The Directorate of Drug Administration (DDA), the national drug regulative authority, regulates drug manufacturing, import and quality control of drugs in Bangladesh. It belongs to the Ministry of Health and Family Welfare. The Directorate issues licenses for import of raw materials for different drugs and packed drugs from a 6 Pharmaceutical Sector: Bangladesh selected list to pharmaceutical companies and importers. It also monitors quality control parameters of marketed drugs through an agency called the Drug Testing Laboratory. DDA also administers vaccines and the indigenous systems of medicine called Ayurvedic and Unani systems. The Homeopathic system of medicine is not, however, under the regulatory control of the Directorate. There is, in fact, no regulatory body in the country for homoeopathic medicine perhaps for the practical reason that testing and monitoring methods are not standardized because of inadequate scientific understanding of the system. The system, indeed, has attained the status of a handy home remedy in Bangladesh and in other countries where it is practiced. According to executives of leading Bangladeshi drug exporters, administrative barriers to exports have been largely eliminated in close cooperation between the pharmaceutical industry and the Drug Administration. However, in order to export, a drug still has to be licensed in Bangladesh. Prevailing laws regarding drug regulations are as follows: National Drug Policy 1940 Drug Act 1940 Drug Control Ordinance 1982 Drug Control Ordinance 2004 National Drug Policy 1982 Drug Act 1940 The Drugs Act, 1940 is a law that regulates the import, export, manufacture, distribution, and sale of drugs in the country. It was originally enacted by the Government of India in 1940 and adopted by the Pakistan Government in 1957 in its modified form. It was adopted in Bangladesh in 1974. This Act seeks to regulate the import of drugs into the country, the manufacture of drugs, as well as sale and distribution of drugs. The Drugs Act permits the import of certain classes of drugs only under the licenses or permits issued by the relevant authority appointed by Government. In contrast to the control of the drugs manufactured in the country, quality requirements on imported drugs are very strictly controlled, thus successfully preventing Indian manufacturers, who could serve the Bangladeshi market at competitive prices, from entering the market. Licenses are also required for the manufacture and for the sale or distribution of drugs in the country. Regular control over manufacturing and sales is exercised by periodic inspection of licensed premises by drug inspectors who are specially appointed under the Act. Surveillance over the standards of drugs is maintained by taking samples from drugs, manufactured or offered for sale, and by testing in the Central Drugs Laboratory. Drug Control Ordinance 1982 The Drug Control Ordinance 1982 is an Ordinance which controls the manufacture, import, distribution, and sale of drugs in Bangladesh. It was promulgated in 1982 as additional to the Drug Act 1940. Through this Ordinance, the Drug Control Committee and the National Drug Advisory Council are constituted. Both gremia consist of a Chairman and a varying number of members appointed by the government according to necessity. Under this Ordinance, (i) no medicine of any kind can be manufactured for sale or be imported, distributed or sold unless it is registered with the licensing authority; (ii) no drug or pharmaceutical raw material can be 7 Pharmaceutical Sector: Bangladesh imported into the country except with the prior approval of the licensing authority; (iii) the licensing authority cannot register a medicine unless such registration is recommended by the Drug Control Committee; (iv) the licensing authority may cancel the registration of any medicine if such cancellation is recommended by the Drug Control Committee on finding that such a medicine is not safe, efficacious or useful; (v) the licensing authority is also empowered to temporarily suspend the registration of any medicine if it is satisfied that such a medicine is substandard; (vi) the government may, by notification in the official gazette, fix the maximum price at which any medicine may be sold and at which any pharmaceutical raw material may be imported or sold; (vii) no person is allowed to manufacture any drug except under the personal supervision of a pharmacist registered in the Pharmacy Council of Bangladesh; (viii) no person, being a retailer, is allowed to sell any drug without the personal supervision of a pharmacist registered in any Register of the Pharmacy Council of Bangladesh; and (ix) the government may, by notification in the official Gazette, establish Drug Courts as and when it considers necessary. The National Drug Advisory Council advises the government on the implementation of the national drug policy; on the promotion of local pharmaceutical industries and the production and supply of essential drugs for meeting the needs of the country and on matters relating to the import of drugs and pharmaceutical raw materials. Intellectual property legislation Bangladesh is a signatory of the GATT Uruguay Round and World Trade Organization (WTO) agreements, including the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS). It is also a least developed country (LDC) and thereby is exempted by the Doha declaration from implementing patent protection for pharmaceutical patents until 2016. This only holds for countries that have not yet implemented a legislation that provides for such patent protection, though. It is therefore necessary to look at the Bangladeshi law: The Bangladeshi patent law dates from 1911 and was amended in 1985. The responsible government institution is the Ministry of Industries, Department of Patents, Designs and Trade Marks. The patent law is thereby largely the same as in India before adapting to the requirements of TRIPS in 2005. Although there have been disputes about the patentability of pharmaceutical products according to this law, it is reasonable to assume that the interpretation that was chosen in India, namely the patentability of pharmaceutical processes but not of pharmaceutical substances, can also be adopted in Bangladesh. Bangladesh is a member of the World Intellectual Property Organization (WIPO), and adhered to the Paris Convention on Intellectual Property in 1991. Although its intellectual property laws are often considered as outdated and enforcement as being weak, Bangladesh has never been on the US trade representatives "Special 301 Watch List”. This List identifies countries that deny what the US trade representative considers adequate and effective protection for intellectual property rights. The industry after 1982 Bangladesh formulated its National Drug Policy (NDP) and established the Drugs Control Ordinance in 1982, to ensure availability, affordability and safety of essential drugs. The Drugs Control ordinance bans certain types of drugs from the market, limits the marketing rights of foreign companies and establishes a price control for both finished drugs and their raw materials: • Bans: Combination drugs are only allowed in cases where single drugs are not available or not costeffective; Sale and manufacturing of drugs with limited therapeutic usefulness (e.g. cough mixtures, throat lozenges) or with abuse potential are prohibited. • Foreign Companies: foreign brands are not allowed to be manufactured under license in Bangladesh if similar products are being manufactured in the country. Multinational companies that do not have an own production facility in Bangladesh are not allowed to market their products even if manufactured in the 8 Pharmaceutical Sector: Bangladesh country by toll / contract manufacturing (manufacturing by a Bangladeshi company on behalf of the multinational). • Price Control: 150 drugs were defined as essential drugs. For those, level prices are fixed for the finished drugs as well as for their corresponding raw materials. No manufacturer can set maximum retail prices for their goods beyond that limit. Changes in these level prices are decided by the Drug Control Committee. Since 1993, the number of price-controlled drugs has been reduced to 117 primary health care drugs. However, currently there are 209 drugs on the essential drugs list. For drugs that do not fall into this “Controlled Category”, the manufacturer can set their own price, which must, however, be approved by the Drug Control Committee. This resulted in withdrawal of many foreign companies from the market in which they had had a share of around 70% in 1970, and strong growth in local production. This also created a boon for local pharmaceutical manufacturers. According to the Directorate of Drug Administration records, in the year 2002, all the essential drugs were produced locally and about 45% of the local drugs production concerned essential drugs. Locally produced drugs amount to over 80% of the market share and meet over 90% of the local drug demand. There are over 200 licensed pharmaceutical factories in the country, six of them are owned by multinational companies producing about 13% of the local production. 85% of the raw materials used in the local production are imported. Only about 1 % of the locally produced drugs is exported. Global export market Due to cost pressures, MNCs increasingly seek to manufacture pharmaceuticals in developing countries. Pharmaceutical contract manufacturing and research services is a large and growing business. Worldwide revenues totaled $100 billion in 2004. With a predicted average annual growth rate of 10.8%, revenues are estimated to reach $168 billion by 2009. Pharmaceutical firms in Bangladesh exported approximately $45.67 million (approximately 0.03% of the estimated global pharmaceutical market revenue) in products to 73 countries during 2008-09. Bangladesh’s exports are growing rapidly, as shown in the table below. Table 6: Pharmaceutical Exports from Bangladesh (USD Million) July-June 2005-06 July-June 2006-07 July-June 2007-08 July-June 2008-09 July-April 2009-10 All Export 10,526.2 12,177.9 14,110.8 15,565.2 12,940.1 27.5 28.2 43.0 45.7 35.4 0.26% 0.23% 0.30% 0.29% 0.27% 2.51% 52.75% 6.21% 13.39% Pharmaceuticals Pharma % of Total YoY Growth for Pharma Source: Export Promotion Bureau Bangladeshi firms are trying export to the following markets: Regulated: Square Pharmaceuticals, the only Bangladeshi pharmaceutical firm accredited in a regulated market, received the UK’s regulatory approval in May 2007. The largest barriers to regulated markets are modern manufacturing facilities which come at a cost of at least $50 million, and know-how. Moderately Regulated: Some markets, such as Pakistan, Sri Lanka, Tanzania and Malaysia, are moderately regulated. While countries do not always require stringent certification, a certification from a regulated market signifies quality and provides a firm with a competitive advantage. 9 Pharmaceutical Sector: Bangladesh Unregulated: Most Bangladeshi pharmaceuticals are exported to less than fully regulated markets such as Bhutan, Nepal, Vietnam, Myanmar and African countries such as Ivory Coast, Male, etc. Major exporters The majority of Bangladesh’s pharmaceutical exports are from MNCs such as Sandoz. Sandoz, an MNC operating in Bangladesh, has approximately 25 manufacturing sites globally. Bangladesh is one of its smaller sites. The Bangladeshi manufacturing site is an EU certified plant which produces about 500 million tablets a year and generates about USD 35-40 million in sales. It has been growing rapidly—15-18% per year—and is responsible for a significant portion of Bangladesh’s pharmaceutical export growth. It imports APIs, acquires packaging domestically, and manufactures final formulations in Bangladesh for export of USD 12 million or for sale to the domestic market ranging from USD 23-28 million. Exporting pharmaceutical products is not accessible for all companies. Each country has its own product regulations, registration requirements, language requirements, cultural preferences, national packaging requirements, and industry protection mechanisms. Sales on the global market are quite competitive with firms from around the world vying for business. Furthermore, initiating exports requires a significant investment in money, time and paperwork to register the product in the target country. As generic products are branded in less regulated markets, pharmaceutical firms also need to make significant investments in sales and marketing to create product demand. All these investments are made without a guarantee of future sales. Most pharmaceutical firms in Bangladesh are family owned. While many have the capacity to export, some do not have the in-house expertise. As a result, only sixteen firms export products. There are no “majority exporters,” e.g., companies that sell more than 50% of their output in export markets. Beximco, for example, is one of the leading exporters. Its 2009 exports were about USD 4.0 million or 5.9% of total sales. However, many companies initiated the process of product registration in international markets only in the last few years. The export situation is evolving. For example, Square Pharmaceuticals increased exports by 58% from 2007-08 to 2008-09. Indirect benefits of export Bangladeshi firms that export are slightly more productive than non-exporting firms. Some possible reasons for this advantage may be due to: 1. Technological lessons learned from foreign buyers. 2. Exporters improved their own technological capabilities to exploit profitable opportunities in export markets. For example, exporters need to adopt stringent technical standards to satisfy more sophisticated consumers, and/or they are under more pressure to fill orders in a timely fashion and to ensure product quality for export markets which are more competitive than domestic market. 3. Better firms self-selected to enter export markets for the prestige rather than the effects of exporting necessarily improving the firms. The pharmaceutical industry in Bangladesh has been aggressively investing in infrastructure. Most of the companies invested heavily in the 1990s and the late 2000s most likely to upgrade their facilities to obtain international export certifications. The top ten firms accounted for most of the investments. MNCs can operate in a country in multiple ways, including foreign direct investment (FDI), contract 10 Pharmaceutical Sector: Bangladesh manufacturing, joint ventures and strategic partnerships or licensing. Each arrangement varies in terms of which partner contributes more resources and technical knowledge, which partner assumes more risk, and which partner accrues more benefits and profits. Contract manufacturing Contract manufacturing is a good business opportunity for Bangladeshi firms, and if well done, it can enable technology transfers to domestic firms. As a result, they can acquire world-class experience in finished dosage manufacturing, APIs or other aspects of pharmaceutical manufacturing. Square Pharmaceuticals, one of Bangladesh’s largest pharmaceutical firms, attributes much of its success to what it learned by working with an MNC. Bangladeshi pharmaceutical firms can make several types of contract manufacturing arrangements with MNCs, including: • Contract manufacturing with the product intended for export to a regulated market. The current National Drug Policy (NDP) permits this. Contract manufacturing for export is a significant financial opportunity, but challenging. The domestic pharmaceutical firm must have a facility accredited by the regulators of an advanced market. Square Pharmaceuticals is one of the very few Bangladeshi firms with a qualified facility. It is currently initiating a contract manufacturing arrangement with a British firm. • Contract manufacturing with the product intended for the domestic market. The Drug Control Ordinance (DCO) prohibits foreign firms from selling products in Bangladesh unless they have a manufacturing presence in the country. Thus, Bangladeshi firms can only contract manufacture for domestic distribution with MNCs that already have a presence in Bangladesh. An example of this arrangement is Beximco contract manufactures Ventolin, which is an inhaler for GlaxoSmithKline. Demand for essential drugs Bangladesh has a strong pharmaceutical industry represented by private enterprises and the state-owned EDCL. Bangladesh is largely self-sufficient with regard to drugs and has no significant drug availability problem. In fact, the availability of drugs has a stronger outreach than the availability of health care professionals. Due to widespread vaccination schemes, successful eradication of leprosy and widespread use of oral rehydration for diarrhea, many of the traditional health problems are minimized and life expectancy has risen to around 65 years – comparable to India and Pakistan rather than to African LDCs who mostly have life expectancies below 50. The most important health issues in Bangladesh today are related to maternal health and malnutrition, vitamin and iron deficiency. AIDS, Malaria and TBC are potential health threats. Other important causes of death are cardiovascular diseases, diabetes and cancer. Mental disorders are an important reason for disability. Thus, in line with the statement that there is no significant drug availability problem in Bangladesh, the therapeutic groups do largely reflect the major health issues in the country. The health care system Bangladesh is a signatory to the Alma Ata Declaration on Primary Health Care (PHC) in 1978. In 1988, the Bangladeshi Government adopted the PHC approach as a guiding principle to the health systems development in Bangladesh. Due to resource limitations, introduction of PHC was started in selective districts. In 2004, an estimated 48 million out of Bangladesh’s 140 million population is covered by PHC. The public health expenditure, totaling 3.4% of GDP in 2001, comparing to 4.1% in India, 4.2 in Sri Lanka 11 Pharmaceutical Sector: Bangladesh and 2.7% in Pakistan. Public health expenditure accounts for roughly 33.6% of the total health expenditure. There are around 43,000 registered physicians and 40,000 nurses and midwives, resulting in about only 3 physician and 3 nurses and midwives per 10,000 population. The hospital beds per 10,000 population is only about 4. The number of public health worker is about 6,000 (less than 0.5 per 10,000 population). With 21,000 community health workers the ratio is only 1 for 10,000 population. For details and a comparison with selected other countries, see the tables 12 & 13 at the back of the report. Price and price sensitivity For those drugs that are not subject to a fixed price, there is considerable price sensitivity in Bangladesh, which is explained by the very high variation in quality with significant incidents of health-damaging spurious drugs and fake drugs that contain no active ingredient. Thus, it is not uncommon for the high quality branded generics of the leading manufacturers to have a 100% price premium over their competitors. In some cases the premium is even higher. Unmet demand The demand for essential drugs in Bangladesh is largely covered. In accordance with the above, in many cases the cheap availability of essential drugs without adequate health care infrastructure is not without problems. The global need for essential drugs is huge in theory and the actual demand depends to a large extent on financing possibilities and mechanisms, which are difficult to foresee in detail, but the creation and dedication of funds and institutions like e.g. the Global Fund to combat AIDS, Malaria and Tuberculosis, justify a significant growth expectation for the actual demand. It is also to be expected that wherever donor funds are directly used to purchase drugs (as e. g. the Global Fund or the Gates Foundation), the demand will come with such quality requirements that would put a country like Bangladesh with a good track record and a lot of experience at advantage over African LDCs that are only just entering the business of pharma manufacturing. On the other hand, the tendency of traditional donors to budget funding may lead to governments of African LDCs giving preference to lower quality local manufacturers for political reasons, creating high barriers of entry for Bangladeshi manufacturers in these market segments. Diseases that are typically considered developed country diseases like cardiovascular disorders or cancer are also on the rise in many developing countries. However, at present, both adequate diagnosis of these diseases and availability of funding for drug needs are doubtful. Investors and sources of capital In Bangladesh, there are several national investors interested in building up pharmaceutical manufacturing: many of the existing pharmaceutical corporations, like Square and Beximco, belong to large conglomerates that have proven the commercial opportunities to invest in pharmaceutical manufacturing plants. Foreign investors have not been particularly interested in setting up manufacturing plants in Bangladesh, notably the investment flow from India, expected by some industry specialist following the Doha declaration, has not materialized so far. When investing in pharmaceutical manufacturing plants, the equity rate used by Bangladeshi investors is significantly higher than the usual equity rate in transnational pharmaceutical companies. The reason lies partly in the comparatively high cost of capital and also in the necessity to group together different banks for financing a large credit sum, since the sum each bank is allowed to lend is usually not sufficient to finance a 12 Pharmaceutical Sector: Bangladesh large drug manufacturing plant. As a result, there is a large number of very small scale manufacturer present in the industry. These manufacturers focus mostly on a handful of basic and essential drugs. Specific risks of national production The dependence on import of APIs is the main risk, since the providers are also competitors. This has not affected Bangladeshi pharmaceutical manufacturers too much as they concentrated on the national market which was not deemed attractive by their providers. As long as Bangladeshi manufacturers concentrate on developing country markets, they may be able to circumvent this problem by sourcing from developed countries’ manufacturers who are not targeting these markets. However, this would probably also increase their cost. TRIPS The WTO’s Agreement on Trade Related Aspects of Intellectual Property Rights (TRIPS) requires all signatories to legislate twenty-year patent protection for pharmaceutical products into their domestic law. TRIPS is not a uniform international law, but a framework for intellectual property protection with minimum agreed standards. While signatory countries must meet its requirements through legislation, TRIPS provides significant flexibility. Until 2016, TRIPS provides Bangladesh with domestic, patent-free production rights and limited exporting advantages. Bangladesh imports approximately 80% of its APIs for domestic production, 20-25% of which are patented. These API costs will most likely rise as TRIPS phases in. Bangladesh enjoys some export advantages from TRIPS. But these advantages are somewhat offset by the pace and competitiveness of the Indian and Chinese generic markets. In both markets, companies can produce drugs at highly competitive pricing—even with higher costs associated with buying patented APIs or paying royalties. Bangladesh will have to rely on the standard business practices of producing the highest quality product at the lowest price to compete on the international market. Until 2016, however, Bangladesh has the following export advantages under TRIPS: 1. Export to any country if the drug is not under patent. Any firm in any country can benefit from this stipulation. For example, most drugs on WHO’s Model List of Essential Drugs are not patented, as affordability is one of the criteria used in designating medicines as “essential.” 2. Export to another LDC or non-WTO country that has not implemented product patent protection. It seems that most LDCs have instituted patent protection. Only two African LDCs have not provided for TRIPScompliant intellectual property protection, one of which was not yet a WTO member, according to a 2001 Intellectual Property Rights (IPR) Commission study. In Asia, Myanmar, which is engaged in the WTO accession process, is perhaps the only country that has not yet put in place a patent protection regime. TRIPS states that any country using the transitional flexibility period shall not change its laws to result in a lesser degree of consistency with TRIPS. However, Bangladeshi firms are exporting generic versions of patented drugs to many LDCs without a problem. 3. Export to a country where the patent holder has not filed for patent protection for the drug. Companies do not file drug patents in all countries, particularly where sales and profit prospects are low or there is no meaningful judicial patent protection. These gaps in patent coverage can be exploited. 4. Export to a country that has issued a compulsory drug license and awarded the production contract to 13 Pharmaceutical Sector: Bangladesh Bangladesh. TRIPS grants governments the right to issue a compulsory license for public health purposes, which occurs when a government overrides a patent and grants another entity the right to produce the patented product. Although Canada, Japan, the United States and the United Kingdom have all issued domestic compulsory pharmaceutical licenses, very few developing countries have done so. The expense and time of litigation with developed countries can act as a deterrent. Governments must also balance fully exploiting TRIPS flexibilities while maintaining good relations with MNCs, which often use domestic firms for outsourcing or manufacturing. Before 2005, many countries could fulfill a compulsory license importation request because many were manufacturing patented drugs off patent. As of 2005, Bangladesh patented drugs off patent whereas India and China, the world’s largest suppliers of generic drugs, will no longer be able to engage in this practice for any drug patented after 2005. Because firms require two to three years to reverse engineer and start producing a specific drug of quality, if any country issues an import request for a compulsory license for any drug patented after 2005, Bangladesh will have an advantage if it is already manufacturing the drug domestically. However, TRIPS has clearly stated that export for compulsory licensing is intended for health policy not industrial policy. Conclusion The essential drugs market in Bangladesh is well supplied, and there is no availability problem of essential drugs. The DDA, responsible for the safeguarding of the drug quality through licensing and control, lacks the necessary capacities, equipment (notably test laboratories) and governance to perform all its tasks effectively. WHO is supporting the DDA through capacity building and new test laboratories. Partly due to the failure of the local authorities to provide credible quality certifications, and partly due to their aspiration to increasingly target export markets, leading Bangladeshi manufacturers are already successfully working on obtaining international quality certification for their products and plants, in some cases bringing in experienced experts from MNCs or Indian competitors. The ability of the Bangladeshi drug industry to manufacture drugs for all kinds of needs is beyond doubt. While some manufacturers are already able to produce world class quality drugs, others would require considerable assistance to be able to reach that target. However, the Bangladeshi industry has been largely focused on the domestic market until recently. Knowledge about and contacts to the different players in potential export markets is still limited and constitutes a key bottleneck to expansion of manufacturing facilities. In terms of cost, Bangladeshi companies can be expected to compete successfully with African players, especially if an international quality standard is required. The ability to compete with Indian and Chinese manufacturers is limited due to the necessity to import machinery and notably the precursor substances. The ultimate competitiveness of Chinese and Indian manufacturers depends on the expected rigor of the TRIPS enforcement, the viability of voluntary or compulsory licensing for Indian and Chinese players, and the amount of license fees they would have to pay, and the competitiveness of Bangladeshi manufacturers will largely depend on the pricing of the raw materials. Still, Bangladesh is probably one of the few LDCs where under the TRIPS agreement new patent protected drugs and APIs can be cost-effectively produced and at high quality. Thus, Bangladesh is a natural candidate to supplement or substitute Indian and Chinese providers to the developing country markets of both finished drugs and APIs, notably in antibiotics, anti-ulcerants, antihypertensives and anti-depressants. However, the domestic market is large enough to be self-sustaining and lucrative for the domestic players until they become ready to take on the global pharmaceutical market. 14 Pharmaceutical Sector: Bangladesh Top Listed Pharmaceutical Companies Square Pharmaceuticals Limited (Position in terms of domestic sales: 1) Square Pharmaceuticals is the largest pharmaceuticals manufacturing company in the country. The company has consistently created value for its shareholders, with average Return on Equity (ROE) of over 20% in the last 7 years. While maintaining the profitability in its core pharma business, the company has created a number of other businesses in‐house in the past, and after profitable commercial operation of the businesses commenced, spun off such subsidiary businesses to monetize the investment. Square Pharmaceuticals has undertaken an expansion program to be completed in two phases. The first Phase will be completed in 2012 at a total cost of BDT 3.6b (we anticipate a 25% cost overrun for a final cost of 4.5b). This first phase is expected to almost double the current production capacity. The second phase starts in 2014, completing in 2017 for a total cost of 2.0b (including an estimated cost overrun of 25%). We expect the expansion programs contributing to revenue growth after 2012. Capital expenditure will be financed by internally‐generated cash as the company generates a handsome amount of cash each year Current debt‐to equity ratio is quite low at 23%; in the absence of any other major expansion plan, we do not anticipate assumption of any more debt. Some of the business units (e.g., Square Knit Farbics Ltd. and Square Cephalosporins Ltd.) are just starting to become profitable and more are on the right path (e.g., Square Hospitals Ltd.). Square will definitely benefit from this. We believe the company is still undervalued. We need to look a for the value of the company beyond 2013 as the major value addition to the company is going to take place after 2012. We believe the market has not yet identified the real value of the company. Table 7: Square Pharmaceuticals Snapshot Revenue (MM BDT) Operating Income (MM BDT) Operating Margin Net Income (MM BDT) Net Margin 5-Year Revenue Growth (CAGR) Capex (MM BDT) Debt/Equity No. of Shares (MM) Diluted EPS (BDT) Dividend (BDT) Current Price (BDT) Target Price (BDT) CAGR Return (Up to end of 2013) 2009A 2010E 2011E 2012E 2013E 11,826 2,929 25% 2,116 18% 13% 2,049 23% 12.1 140.19 40.00 3722 7000 23% 13,026 3,149 24% 2,644 17% 15,099 3,537 23% 3,306 16% 17,287 3,945 23% 4,132 16% 22,003 4,960 23% 5,165 16% 1,386 20% 15.1 175.24 50.00 1,398 18% 15.1 219.05 60.00 1,426 16% 15.1 273.82 70.00 1,451 14% 15.1 342.27 80.00 15 Pharmaceutical Sector: Bangladesh Beximco Pharmaceuticals Limited (Position in terms of domestic sales: 3) Beximco Pharmaceuticals is one of the largest pharmaceutical companies in Bangladesh. The company has featured consistently in the top five manufacturers for the last decade. Beximco is widely regarded as one of the technological leaders among the local pharmaceutical companies in the country. The company utilizes state of the art technology. All new plants are equipped with cutting edge machineries. New facilities are coming online in 5 new plants. Two of them are already operational. The company maintains many good partnerships with established players such as Bayer AG of Germany and Upjohn Inc. of USA. The company has outperformed the industry in terms of sales during 2009. The pharmaceutical industry has grown around 15% on average annually and Beximco Pharma has matched that growth before 2009. We believe they will continue to emulate the performance of 2009 for the foreseeable future. Generally the company doubles their turnover in every three years. The company expects to generate BDT 700 million per month in 2011. Despite troubled political environment during 2007 and 2008, the company has successfully weathered the conditions and bounced back strongly under more favorable condition in 2009. New production lines become operational this year which will effectively double the capacity. The company has undertaken a hugely ambitious plan for foreign market. The management has targeted to have equal revenue from domestic sales and exports. That means they would have to achieve exponential growth in exports. Although this seems quite ambitious, there are signs that the management is on the right track to delivering what they promised. Table 8: Beximco Pharmaceuticals Snapshot 2009A 2010E 2011E Revenue (MM BDT) 4,868 5,951 7,205 Operating Income (MM BDT) Operating Margin Net Income (MM BDT) Net Margin 5-Year Revenue Growth (CAGR) Capex (MM BDT) Debt/Equity No. of Shares (MM) Diluted EPS (BDT) Dividend (BDT) Current Price (BDT) Target Price (BDT) Return 1,001 21% 625 13% 15% 1,332 34% 151.1 2.98 0.00 146 175 20% 1,224 21% 764 13% 1,482 21% 925 13% 486 29% 209.8 3.64 1.10 460 24% 209.8 4.41 1.20 16 Pharmaceutical Sector: Bangladesh Renata Limited (Position in terms of domestic sales: 7) Renata is one of fastest growing pharmaceutical companies in Bangladesh. It is the seventh largest company in terms of local pharmaceutical sales. Successor of the business of Pfizer Bangladesh – still enjoys distribution relationship with Pfizer. Renata is the market leader in agrochemical business. Strong growth history; in the last five years, revenue grew by a 23% CAGR whereas net profit grew by 31%. Even if gross profit margin remained the same, the company has consistently reduced its operating costs, thus improving the bottom line. The company achieved a return on equity of over 25% on average in the past five years. 2009 seems to be on the same track. Renata boasts of the highest gross profit margin (almost 50%) among the local manufacturers. In 3Q09, Renata declared EPS of BDT 325.94 posting a 43.55% bottom line growth QoQ; reduction of operating expenses improved bottom line. Renata has a Modest dividend payment; dividend yield in 2008 was about 1%. A high retention rate is justified as the company consistently makes huge capital expenditures, financed by internal cash. This state is supposed to continue in the near future. Manageable leverage; D/E is about 50%. The entire debt is short-term. Renata has good management, disciplined growth and low leverage, and appears to be an attractive company. However, liquidity of shares is a big concern. Table 9: Renata Limited Snapshot Revenue (MM BDT) Operating Income (MM BDT) Operating Margin Net Income (MM BDT) Net Margin 5-Year Revenue Growth (CAGR) Capex (MM BDT) Debt/Equity No. of Shares (MM) Diluted EPS (BDT) Dividend (BDT) Current Price (BDT) Target Price (BDT) Return 2009A 2010E 2011E 4,103 5,128 6,154 1,020 25% 660 16% 23% 103 0% 1.4 456.52 60.00 10677 12750 19% 1,179 23% 783 15% 1,415 23% 952 15% 110 0% 1.8 541.58 65.00 117 0% 1.8 658.19 80.00 17 Pharmaceutical Sector: Bangladesh ACI Limited (Position in terms of domestic sales: 8) Advanced Chemical Industries (ACI) Limited is one of the most recognized pharmaceutical companies in Bangladesh. ACI currently lies at eighth spot in the local market. The company has expanded its business beyond pharmaceuticals encompassing agro-chemical, animal health, agro-machinery, consumer brands and retail chains. Since the company has been expanding its business horizon rather aggressively for the last few years, ACI has found itself in a cash crunch, which ultimately led the company to resort to a fair bit of leverage. However, ACI has recently issued a zero-coupon bond to improve their cash position. Despite cash constraint, ACI is one of the more consistent dividend paying companies in the local market. Although the core pharma segment and agribusiness segment are making respectable profits, consumer brands and other segments are not yet fully profitable. If and when these segments become profitable, the bottom line will see significant improvement. Although we believe ACI is a good company, we are still not totally convinced that they are a good option to invest at the moment. Table 10: ACI Limited Snapshot Revenue (MM BDT) Operating Income (MM BDT) Operating Margin Net Income (MM BDT) Net Margin 5-Year Revenue Growth (CAGR) Capex (MM BDT) Debt/Equity No. of Shares (MM) EPS (BDT) Dividend (BDT) Current Price (BDT) Target Price (BDT) Return 2009A 2010E 2011E 12,300 13,530 14,883 775 6% 553 4% 39% 571 36% 19.4 28.48 10.50 398 450 13% 853 6% 608 4% 938 6% 669 4% 400 30% 19.4 31.32 10.50 300 20% 19.4 34.46 10.50 18 Pharmaceutical Sector: Bangladesh GlaxoSmithKline Bangladesh Limited (Position in terms of domestic sales: 12) One of the pioneering pharmaceutical companies in Bangladesh, GlaxoSmithKline (GSK) started operation back in the 1960s. GSK is a secondary producer, principally packaging and distributing advanced pharmaceuticals products produced by its parent company. Consequently, local value added is low. In certain novelty products such as asthma and dermatology, GSK enjoys a clear advantage because of its parent’s excellent research efforts and product development. However, a significant part of the GSK’s pharma portfolio comprises of price-controlled “essential products”. As such, the company does not enjoy price advantage for such products. Local pharma companies in Bangladesh take advantage of the liberal patent regime for Least Developed Countries (LDCs), sanctioned by the WTO, which shall remain in place till 2016. They produce copies of patented products for the local market. As the subsidiary of a global company, GSK cannot or does not take advantage of this liberal patent regime and does not produce copy drugs. Although GSK has trailed the overall industry in sales growth for a few years at a stretch due to the dominance of local manufacturers, they have managed to recover from that with large growths in the last couple of years. However, it appears that GSK is trying to make up for the lack of sales growth through its consumer products business which brought in almost half of the total revenue in 2009. The company has reintroduced various health drink items (Horlicks etc.), which achieved almost 232% sales growth in 2009 and 500% in 2008. The reliance on consumer products may hurt the company’s profitability in the future. The health drink market is fairly competitive and is often supplied by non-pharma food companies whose core advantage is better management of retail marketing and distribution systems, promotional events and efficient inventory management. Interestingly, GSK has outsourced their distribution operation which has boosted their profitability. Although they do not have any big expansion plan, they seemingly have improved their contract manufacturing revenue dramatically. However, it would be interesting to see if that is going to be repeated in the future. GSK pays regular dividends at a high payout ratio (about 60%). Table 11: GlaxoSmithKline Snapshot 2009A 2010E 2011E Revenue (MM BDT) 3,024 3,442 3,840 Operating Income (MM BDT) Operating Margin Net Income (MM BDT) Net Margin 5-Year Revenue Growth (CAGR) Capex (MM BDT) Debt/Equity No. of Shares (MM) EPS (BDT) Dividend (BDT) Current Price (BDT) Target Price (BDT) Return 425 14% 324 11% 19% 75 0% 12.0 26.9 16 1183 1350 14% 618 18% 375 11% 684 18% 415 11% 62 0% 12.0 31.1 16 70 0% 12.0 34.4 16 19 793,648 270,371 643,520 29,499 127,859 17,020 18,987 29,499 42,881 USA Japan India Sri Lanka Pakistan Malaysia Thailand Indonesia Bangladesh 3 1 3 7 8 1 6 21 27 21 Density (per 10000 population) Source: World Health Statistics 2010, WHO 126,126 UK Number Physicians Table 12: Comparative Healthcare System 39,471 179,959 84,683 43,380 62,651 179,959 1,372,059 1,210,633 2,927,000 37,200 Number 3 8 14 18 4 8 13 95 98 6 Density (per 10000 population) Nursing and midwifery personnel 2,344 7,093 4,471 2,160 15,790 7,093 55,344 95,197 463,663 25,914 Number <0.5 <0.5 1 1 1 <0.5 1 7 16 4 9,411 7,580 7,350 2,880 8,102 7,580 592,577 241,369 249,642 … 1 <0.5 1 1 1 <0.5 6 19 9 … Density (per 10000 population) Pharmaceutical personnel Density (per Number 10000 population) 2000–2009 Dentistry personnel Health workforce 6,091 6,493 2,151 … 106 6,493 … … … … Number <0.5 <0.5 <0.5 … <0.5 <0.5 … … … … Density (per 10000 population) Environment and public health workers 21,000 … … … 65,999 … 50,393 … … … Number 1 … … … 4 … <0.5 … … … Density (per 10000 population) Community health workers 4 6 22 18 6 6 9 139 31 39 2000–2009 Hospital beds (per 10000 population) Pharmaceutical Sector: Bangladesh 13.4 7.7 4.4 3.7 3.0 3.2 3.4 2.0 2.7 USA Japan India Sri Lanka Pakistan Malaysia Thailand Indonesia Bangladesh 3.4 2.2 3.7 4.4 2.7 4.2 4.1 8.0 15.7 8.4 38.0 36.6 56.1 52.4 21.3 47.9 24.5 81.3 43.2 79.3 Source: World Health Statistics 2010, WHO 7.0 UK 63.4 62.0 33.6 43.9 47.6 78.7 52.1 75.5 18.7 56.8 20.7 2000 66.4 45.5 26.8 55.6 70.0 52.5 73.8 18.7 54.5 18.3 2007 Private exp on health as % of total exp on health 54.5 73.2 44.4 30.0 47.5 26.2 81.3 45.5 81.7 2007 2000 2000 2007 General govt exp on health as % of total exp on health Total exp on health as % of GDP Table 13: Comparative Healthcare Expenditure 7.2 4.5 10.0 6.2 2.4 6.8 3.8 16.0 17.1 14.3 2000 8.0 6.2 13.1 6.9 3.5 8.5 3.7 17.9 19.5 15.6 2007 General govt exp on health as % of total govt exp 7.0 0.0 0.0 0.6 0.8 0.3 0.5 0.0 0.0 0.0 2000 7.7 1.7 0.3 0.0 3.3 1.7 1.4 0.0 0.0 0.0 2007 External resources for health as % of total exp on health Health expenditure ratios 0.0 6.2 9.4 0.6 6.2 0.3 16.9 80.9 33.5 0.0 2000 0.0 16.0 9.7 0.8 4.2 0.1 17.2 78.7 27.9 0.0 2007 Social security exp on health as % of general govt exp on health 95.9 72.9 76.9 75.4 80.3 83.3 92.2 90.1 25.5 64.8 2000 97.4 66.2 71.7 73.2 82.1 86.7 89.9 80.8 22.6 62.7 2007 Out-of-pocket exp as % of private exp on health 0.1 6.4 12.8 11.9 0.2 12.2 1.0 1.7 60.3 15.6 2000 0.0 4.7 19.5 14.4 0.3 9.1 2.1 13.7 63.5 6.9 2007 Private prepaid plans as % of private exp on health 9 16 67 128 15 33 20 2827 4703 1769 2000 15 42 136 307 23 68 40 2751 7285 3867 2007 Per capita total exp on health at avg exchange rate (US$) 22 48 159 304 48 102 66 1967 4703 1833 2000 42 81 286 604 64 179 109 2696 7285 2992 2007 Per capita total exp on health (PPP int. $) 3 6 38 67 3 16 5 2298 2032 1403 2000 5 23 100 136 7 32 11 2237 3317 3161 2007 Per capita govt exp on health at avg exchange rate (US$) Per capita health expenditures 8 17 89 159 10 49 16 1598 2032 1454 2000 14 44 209 268 19 85 29 2193 3317 2446 2007 Per capita govt exp on health (PPP int. $) Pharmaceutical Sector: Bangladesh Pharmaceutical Sector: Bangladesh IMPORTANT DISCLOSURES Analyst Certification: Each research analyst and research associate who authored this document and whose name appears herein certifies that the recommendations and opinions expressed in the research report accurately reflect their personal views about any and all of the securities or issuers discussed therein that are within the coverage universe. Disclaimer: Estimates and projections herein are our own and are based on assumptions that we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness. Neither the information nor any opinion expressed herein constitutes a solicitation of the purchase or sale of any security. As it acts for public companies from time to time, BRAC-EPL may have a relationship with the above mentioned company(s). This report is intended for distribution in only those jurisdictions in which BRAC-EPL is registered and any distribution outside those jurisdictions is strictly prohibited. Compensation of Analysts: The compensation of research analysts is intended to reflect the value of the services they provide to the clients of BRAC-EPL. As with most other employees, the compensation of research analysts is impacted by the overall profitability of the firm, which may include revenues from corporate finance activities of the firm's Corporate Finance department. However, Research analysts' compensation is not directly related to specific corporate finance transaction. General Risk Factors: BRAC-EPL will conduct a comprehensive risk assessment for each company under coverage at the time of initiating research coverage and also revisit this assessment when subsequent update reports are published or material company events occur. Following are some general risks that can impact future operational and financial performance: (1) Industry fundamentals with respect to customer demand or product / service pricing could change expected revenues and earnings; (2) Issues relating to major competitors or market shares or new product expectations could change investor attitudes; (3) Unforeseen developments with respect to the management, financial condition or accounting policies alter the prospective valuation; or (4) Interest rates, currency or major segments of the economy could alter investor confidence and investment prospects. BRAC EPL Investments Capital Markets Group Aminul Haque Head of Capital Markets amin@bracepl.com 01730317802 Md. Monirul Islam Research Analyst monirul@bracepl.com 01730357150 Parvez Morshed Chowdhury Research Analyst parvez@bracepl.com 01730357154 Ali Imam Investment Analyst imam@bracepl.com 01730357153 Asif Khan Investment Analyst asif@bracepl.com 01730357158 Md. Ashfaque Alam Research Associate ashfaque@bracepl.com 01671020956 Khandakar Safwan Saad Research Associate safwan@bracepl.com 01911420549 BRAC EPL Research www.bracepl.com WW Tower (7th Floor) 68 Motijheel C/A, Dhaka-1000 Phone: +880 2 9514721-30 Fax: +880 2 955 3306 E-Mail: research@bracepl.com