ADVANCING - Bank Islam Malaysia Berhad

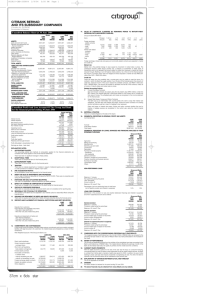

advertisement