FRS 102 guide - Accountancy Magazine

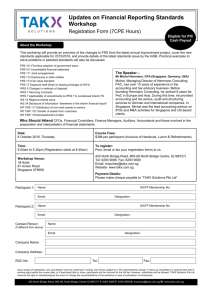

advertisement