> CASE STUDY

Ideas. Insight. Impact.

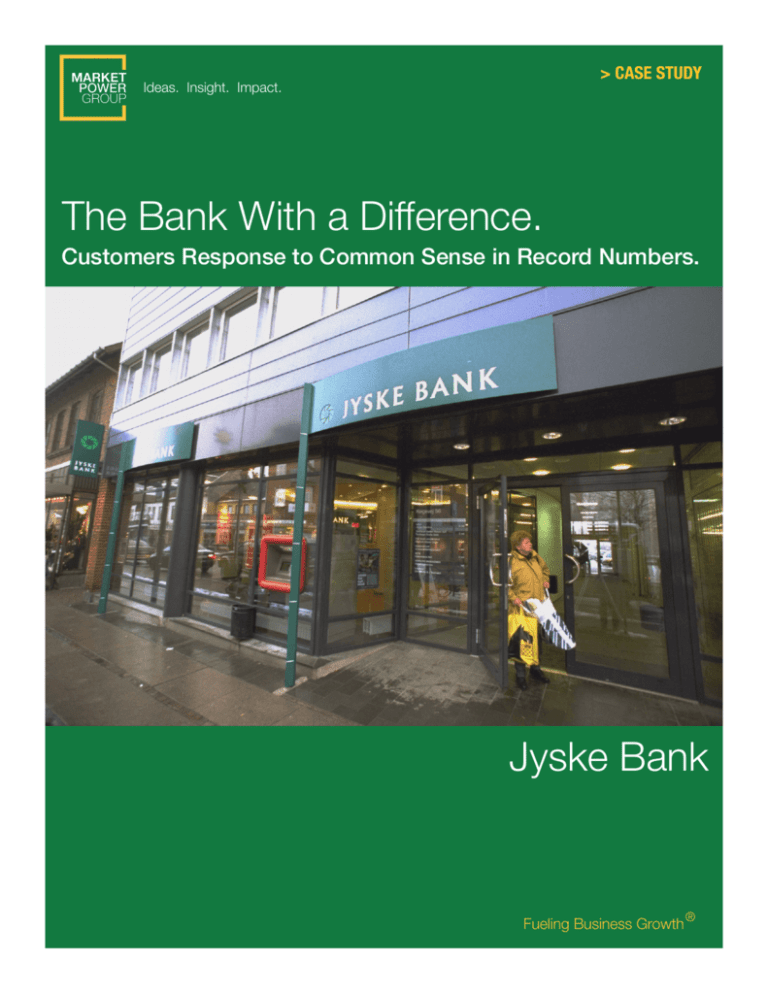

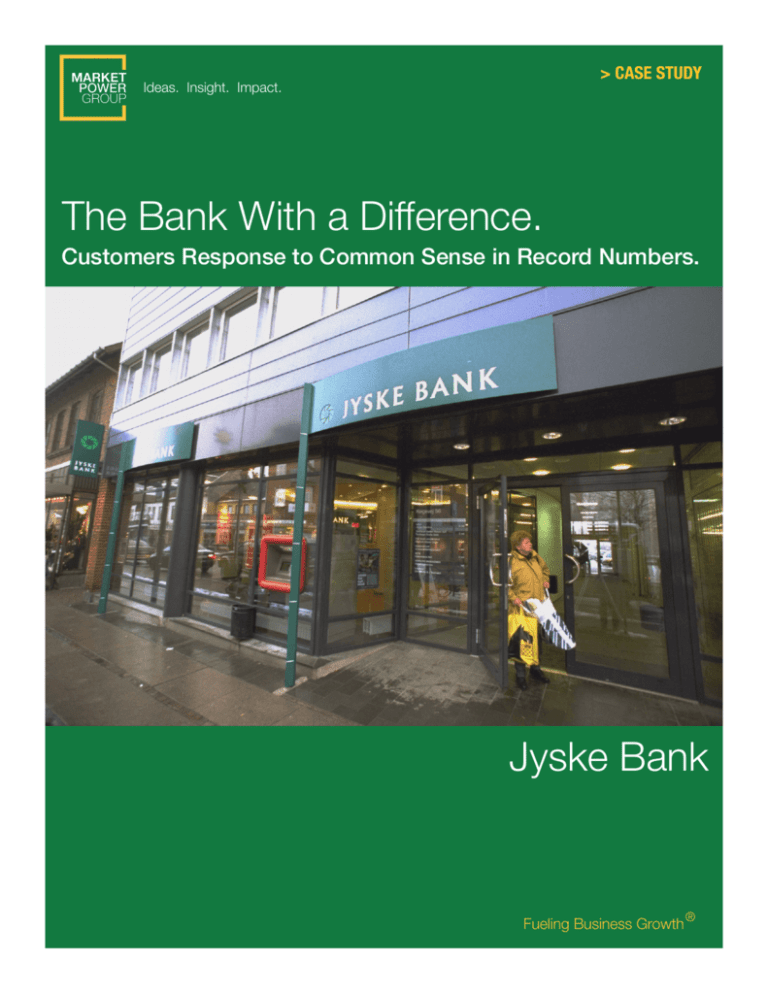

The Bank With a Difference.

Customers Response to Common Sense in Record Numbers.!

Holt Cat

Jyske Bank

®

Fueling Business Growth

On a cold December evening,

twenty bank customers in

Kansas City discussed their

negative attitudes about the way

they were treated by their banks.

Little did they know that five

thousand miles away, a company

had already heard their

complaints and was doing

something to permanently alter

the relationship between a

banking institution and its

customers by understanding the

Power of the Heart.

There have been three generations of banks. The first

was the fortress bank, simply a safe place to keep

your money. Service was sparse because there was

minimal competition. Banks could set all the rules.

They could keep their own hours, closing at three

o’clock in the afternoon, for example. It mattered little

if the customer was inconvenienced; the bank’s job

was to protect the money, not try to grow it.

The second generation was the reluctant marketer

bank. In the 1980s, banking was deregulated in an

effort to spur com- petition, and it worked. At first,

bankers didn’t know how to compete except to offer

a free premium, like a toaster, if you opened a

checking account. But as competition increased, the

level of market segmentation and sophistication did

as well.

Today, the third generation is the differentiator bank.

We have witnessed so much consolidation that it is

hard to know the players without a program. But in

Denmark there’s a bank that is paying huge

dividends. In this case, three unlikely entities merged,

entities you wouldn’t normally combine: a bank, a

butik, and a bibliotek (bank, store, and library).

Jyske (pronounced Yeeska) Bank is headquartered

in Silkeborg, Denmark. With a population of only

forty-three thousand, the city is less than a tenth of

Kansas City. But the Customer CEO changes

introduced by Jyske over the past decade have

introduced a revolution of choice in the

conservative banking industry. Jyske Bank has

been intensely studied and its innovative ideas are

rippling across the globe. Jyske realized that it had

an opportunity to reinvent itself, even though the

business was doing well. But executives felt the

bigger risk was to rest on their laurels and do

nothing.

To set themselves apart, the bank created Jyske

Differences, which focused on four areas: people,

facilities, marketing, and customer counseling

tools. The bank collaborated with the Copenhagen

Institute for Future Studies, a social science think

tank, to explore emerging trends for customers. Jyske teams spent time in the field studying

Starbucks and Apple Stores, and observed

that they were making deep, emotional

connections to their customers. This was

unlike anything banks had ever done.

Customers also felt that personal financial

decisions were hard because the product

choices were often too abstract. People

needed more concrete and tangible ways to

understand the wide array of bank products

and services. Customer interviews found

that, to most people, banks were cold,

detached places that did little to understand

the needs of their customers.

The bank wrote a manifesto called Our

Foundations to publicly outline what Jyske

really stood for. This document sent a clear

message both internally and externally that

this bank was really different. Here’s just a

brief portion:

“Our core values are carved in stone. They

are common to us all and govern the way

we behave towards each other. In the eyes

of both customers and employees, our

values are what make us special.

Our values are:

• Common sense

• Being open and honest

• Being different and unpretentious

• Showing genuine interest and equal

respect

• Being efficient and persevering”

To get it right, Jyske knew that the bank and

its employees had to sincerely “demonstrate

insight and respect for other people.”

Employees were trained to provide the

customer with an “experience” like none

other. This meant supporting their

customers and helping them fulfill their

dreams. Some customers were recent

university graduates beginning new careers.

Others needed help maximizing savings as

they built their families. Some were working

toward a more secure retirement. The bank

The bank switched to using a team concept, with

specialists trained to help solve specific financial

problems and provide advice for every need.

Jyske started calling each branch a “shop.” Upon

entering a shop, you see a wide-open, well-lit store

that pulls you inside. You are greeted by a concierge

who directs you to the area you need. At the entry

you also see a large, ugly catfish, a whimsical icon for

Jyske since 1982. Instead of a teller’s window, you

find a MoneyBar for quick bank services. The

Market Square features banking products packaged

in boxes, similar to the way software is displayed at

computer stores. The boxes can be scanned—when

they are, a video pops up on a flat screen and

explains features and benefits. Every shop features

an “Oasis,” which looks like a library and has current

magazines and books about personal finance. And of

course there is the Jyske CoffeeBar. The bank wants

to have the world’s best coffee. Jyske customers

loved this mix of places. Shops became special

community gathering places.

The bank’s success with these changes has been

remarkable. Deposits and customers soared over the

past decade because Jyske successfully tapped into

the Power of the Heart by engaging customers with

empathy. It has created a culture and a place that

truly cater to what its customers need.

Portions of this article are adapted with permission from Customer CEO: How to Profit from the Power of Your Customers by Chuck Wall

(Bibliomotion, April 2013)..

Ideas. Insight. Impact.

Portions of this article are adapted with permission from

Customer CEO: How to Profit from the Power of Your

Customers by Chuck Wall (Bibliomotion, April 2013).

MarketPower Group LLC

512.358-9090

marketpowergroup.com

© 2013, All rights reserved.