Burger King - Matthews Real Estate Investment Services

advertisement

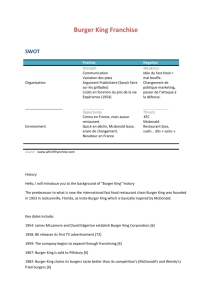

Representative Photo Burger King 9810 W 133rd Ave, Cedar Lake, IN 46303 Offering Memorandum ™ R E T A I L A D V I S O R S C O NFIDEN T IAL I T Y & DI SCL AI MER STATEMENT This Offering Memorandum contains select information pertaining to the business and affairs of Burger King located at 9810 W 133rd Ave, Cedar Lake, IN 46303 (“Property”). It has been prepared by Matthews Retail Advisors . This Offering Memorandum may not be all-inclusive or contain all of the information a prospective purchaser may desire. The information contained in this Offering Memorandum is confidential and furnished solely for the purpose of a review by a prospective purchaser of the Property. It is not to be used for any other purpose or made available to any other person without the written consent of Seller or Matthews Retail Advisors . The material is based in part upon information supplied by the Seller and in part upon financial information obtained from sources it deems reliable. Owner, nor their officers, employees, or agents makes any representation or warranty, express or implied, as to the accuracy or completeness of this Offering Memorandum or any of its contents and no legal liability is assumed or shall be implied with respect thereto. Prospective purchasers should make their own projections and form their own conclusions without reliance upon the material contained herein and conduct their own due diligence. By acknowledging your receipt of this Offering Memorandum for the Property, you agree: 1. The Offering Memorandum and its contents are confidential; 2. You will hold it and treat it in the strictest of confidence; and 3. You will not, directly or indirectly, disclose or permit anyone else to disclose this Offering Memorandum or its contents in any fashion or manner detrimental to the interest of the Seller. Owner and Matthews Retail Advisors expressly reserve the right, at their sole discretion, to reject any and all expressions of interest or offers to purchase the Property and to terminate discussions with any person or entity reviewing this Offering Memorandum or making an offer to purchase the Property unless and until a written agreement for the purchase and sale of the Property has been fully executed and delivered. If you wish not to pursue negotiations leading to the acquisition of the Property or in the future you discontinue such negotiations, then you agree to purge all materials relating to this Property including this Offering Memorandum. A prospective purchaser’s sole and exclusive rights with respect to this prospective transaction, the Property, or information provided herein or in connection with the sale of the Property shall be limited to those expressly provided in an executed Purchase Agreement and shall be subject to the terms thereof. In no event shall a prospective purchaser have any other claims against Seller or Matthews Retail Advisors or any of their affiliates or any of their res pective officers, Directors, shareholders, owners, employees, or agents for any damages, liability, or causes of action relating to this solicitation process or the marketing or sale of the Property. This Offering Memorandum shall not be deemed to represent the state of affairs of the Property or constitute an indication that there has been no change in the state of affairs of the Property since the date this Offering Memorandum. Matthews Retail Advisors Table of Contents Pricing & Financial Analysis Investment Highlights.................................................... 2 Executive Summary...................................................... 3 Company Overview .................................................... 4 Property Description Physical Description...................................................... 7 Tenant Map................................................................. 8 Regional Map.............................................................. 9 Bird’s Eye.................................................................. 10 Demographics City Overview | Cedar Lake, IN.................................. 12 Demographics Report................................................. 13 EXCLUSIVE LY LI ST ED BY: Gary Chou Director | Restaurant Practice Group direct +1.310.919.5827 MOBILE +1.714.928.8016 gary.chou@matthews.com License No. 01911222 Chris Hake Thompson Thrift Development Inc Broker of Record License No. RB14047804 Matthews Retail Advisors Representative Photo Pricing & Financial Analysis PRICING AND FINANCIAL ANALYSIS PROPERTY DESCRIPTION DEMOGRAPHICS Investment Highlights QUALITY NATIONAL TENANT AND OPERATIONS • Strong National Brand – Burger King is the second largest hamburger chain in the world with over 13,000 stores in operation • Strong Franchisee Guarantee – Tri City Foods, Inc. is the second/third largest Burger King franchisee based out of Downers Grove, IL • Absolute NNN Lease – Zero landlord responsibilities • Updated Burger King concept STRONG RETAIL CORRIDOR • This Burger King location is located across the street from the Lake County Public Library and the local high school • Large residential area within a mile radius of Burger King • National tenants in the area include: Family Dollar, Subway, Dairy Queen, McDonald’s, and Walgreens RAPIDLY GROWING COMMUNITY • 48.57% growth 2000-2010; 25.70% growth 2010-2015; projected 22.62% growth 2015-2020 within a one mile radius P. 2 Matthews Retail Advisors OFFERING MEMORANDUM | Burger King PRICING AND FINANCIAL ANALYSIS PROPERTY DESCRIPTION DEMOGRAPHICS Executive Summary Burger King 9810 W 133rd Ave Cedar Lake, IN 46303 List Price...............................................................................................$629,000 CAP Rate - Current����������������������������������������������������������������������������������� 8.75% Gross Leasable Area��������������������������������������������������������������������������3,460 SF Lot Size ....................................................................... 1.28 Acres (55,583 SF) Year Built/Renovated����������������������������������������������������������������������1986/2000 Annualized Operating Data Current - 6/30/2017 Monthly Rent Annual Rent CAP Rate $4,583.33 $55,000.00 8.75% Tenant Summary Tenant Trade Name Type of Ownership Lease Guarantor Lease Type Roof and Structure Original Lease Term Burger King | OFFERING MEMORANDUM Fee Simple Heartland Indiana LLC NNN Tenant Responsible 20 Years Lease Commencement Date 5/18/1992 Rent Commencement Date 5/18/1992 Lease Expiration Date 6/30/2017 Term Remaining on Lease Representative Photo Burger King Increases Options 1.8 Years None - Percentage Rent None Matthews Retail Advisors P. 3 PRICING AND FINANCIAL ANALYSIS PROPERTY DESCRIPTION DEMOGRAPHICS Company Overview Property Name Property Type Parent Company Trade Name Ownership Credit Rating Rating Agency Revenue Net Income Stock Symbol Burger King Net Leased Quick Service Restaurant Restaurant Brands International Inc. Public B+ Standard & Poor’s $1.97 B $117.7 M QSR NYSE Board No. of Locations ±13,000 No. of Employees ±34,000 Headquartered Miami, FL Web Site Year Founded P. 4 Matthews Retail Advisors http://www.bk.com/ Burger King is a global chain of hamburger fast food restaurants headquartered in Miami, Florida. The company began in 1953 as Insta-Burger King, but after financial difficulties in 1954, two large franchisees in Miami, purchased the company and renamed it Burger King. In 2002, a third set of owners, a partnership of TPG Capital, Bain Capital, and Goldman Sachs Capital Partners, took it public. Eight years later, 3G Capital of Brazil acquired a majority stake in BK and the new owners promptly initiated a restructuring of the company to reverse its declining market share. 3G, along with partner Berkshire Hathaway, merged the company with Canadian-based doughnut chain Tim Hortons under a new Canadian-based parent company, Restaurant Brands International which was founded on August 25, 2014. The multinational giant currently serves customers in US and Canada, Europe, Middle East and Africa, Latin America, the Caribbean, and Asia Pacific. 1953 OFFERING MEMORANDUM | Burger King Property Description PRICING AND FINANCIAL ANALYSIS PROPERTY DESCRIPTION DEMOGRAPHICS Representative Photo P. 6 Matthews Retail Advisors OFFERING MEMORANDUM | Burger King PRICING AND FINANCIAL ANALYSIS PROPERTY DESCRIPTION DEMOGRAPHICS Physical Description THE OFFERING Property Name..................................................................................... Burger King Property Address.....................................................................9810 W 133rd Ave Cedar Lake, IN 46303 Assessor’s Parcel Number.................................... 45-15-28-226-001.000-014 SITE DESCRIPTION Number of Stories���������������������������������������������������������������������������������������������One Year Built/Renovated���������������������������������������������������������������������������1986/2000 Gross Leasable Area (GLA)��������������������������������������������������������������������3,460 SF Lot Size.............................................................................. 1.28 Acres (55,583 SF) Type of Ownership................................................................................Fee Simple Landscaping.........................................................................................Professional Topography.................................................................................... Generally Level CONSTRUCTION Foundation........................................................................................Concrete Slab Framing..............................................................................................................Wood Exterior............................................................................................. Painted Stucco Parking Surface.............................................................................................Asphalt Roof.........................................................................................................................Flat Burger King | OFFERING MEMORANDUM Matthews Retail Advisors P. 7 PRICING AND FINANCIAL ANALYSIS PROPERTY DESCRIPTION DEMOGRAPHICS Tenant Map P. 8 Matthews Retail Advisors OFFERING MEMORANDUM | Burger King PRICING AND FINANCIAL ANALYSIS PROPERTY DESCRIPTION DEMOGRAPHICS Regional Map Burger King | OFFERING MEMORANDUM Matthews Retail Advisors P. 9 PRICING AND FINANCIAL ANALYSIS PROPERTY DESCRIPTION DEMOGRAPHICS Bird’s Eye P. 10 Matthews Retail Advisors OFFERING MEMORANDUM | Burger King Demographics PRICING AND FINANCIAL ANALYSIS PROPERTY DESCRIPTION DEMOGRAPHICS City Overview | Cedar Lake, IN Cedar Lake is a town located in Hanover and Center townships, just 45 minutes southeast of Chicago. The town gets its name from its lake, which is the largest natural lake in Northwest Indiana and is roughly 800 acres. The city is approximately 10 square miles and is home to over 12,000 people. Cedar Lake has long been known as a popular resort destination. In the 1880s, the Monon Railroad started bringing tourists from Chicago to vacation in the area. At one point there were more than 50 hotels surrounding the lake. Although these hotels have since been replaced by homes and businesses, Cedar Lake has remained a popular destination. Cedar Lake provides residents and visitors with countless recreational activities. Numerous parks on the lakeshore offer picnic and viewing areas, public access, a boat launch, beaches and a fishing pier. Boating and fishing are popular summer activities on the lake as well. The Cedar Lake Yacht Club hosts weekly Sunday scow sailing and regattas. For those who don’t own their own watercraft, pontoon or wave runner, rentals are available for their enjoyment. P. 12 Matthews Retail Advisors OFFERING MEMORANDUM | Burger King PRICING AND FINANCIAL ANALYSIS DEMOGRAPHICS PROPERTY DESCRIPTION Demographics Report Population 2020 Projection 2015 Estimate 2010 Census 2000 Census Growth 2015-2020 Growth 2010-2015 Growth 2000-2010 1-Mile 4,172 3,929 3,655 2,460 6.17% 7.50% 48.57% 3-Mile 15,837 15,227 14,588 11,605 4.01% 4.38% 25.70% 5-Mile 36,428 35,165 33,921 27,663 3.59% 3.67% 22.62% Households 2020 Projection 2015 Estimate 2010 Census 2000 Census Growth 2015-2020 Growth 2010-2015 Growth 2000-2010 1,485 1,415 1,339 896 4.96% 5.65% 49.48% 5,671 5,481 5,287 4,150 3.47% 3.67% 27.38% 13,001 12,585 12,183 9,785 3.30% 3.30% 24.51% 5.89% 8.56% 7.92% 15.12% 25.45% 15.33% 9.78% 4.87% 5.02% 1.35% 0.64% 0.05% $72,424 $62,284 5.89% 8.56% 7.92% 15.12% 25.45% 15.33% 9.78% 4.87% 5.02% 1.35% 0.64% 0.05% $82,455 $68,612 Income $0 - $15,000 $15,000 - $24,999 $25,000 - $34,999 $35,000 - $49,999 $50,000 - $74,999 $75,000 - $99,999 $100,000 - $124,999 $125,000 - $149,999 $150,000 - $199,999 $200,000 - $249,999 $250,000 - $499,999 $500,000+ 2015 Est. Average Household Income 2015 Est. Median Household Income Burger King | OFFERING MEMORANDUM 5.09% 8.41% 7.77% 15.83% 25.09% 15.55% 9.61% 4.59% 6.01% 1.48% 0.49% 0.00% $73,062 $62,822 Matthews Retail Advisors P. 13 Burger King 9810 W 133rd Ave Cedar Lake, IN 46303 OFFERING MEMORANDUM ™ Gary Chou Director | Restaurant Practice Group direct +1.310.919.5827 MOBILE +1.714.928.8016 gary.chou@matthews.com License No. 01911222 Chris Hake Thompson Thrift Development Inc Broker of Record License No. RB14047804 Matthews Retail Advisors | 841 Apollo Street, Suite 150 | El Segundo, CA 90245 | www.Matthews.com Representative Photo