Capital Investment Agenda

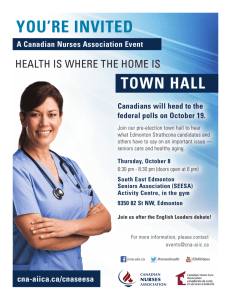

advertisement