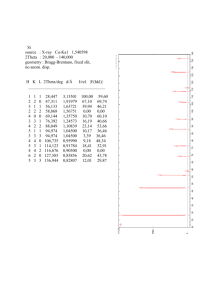

Competition in the Telecommunications Industry

advertisement