NEWSLETTER - Adorna Accounting & Consulting

advertisement

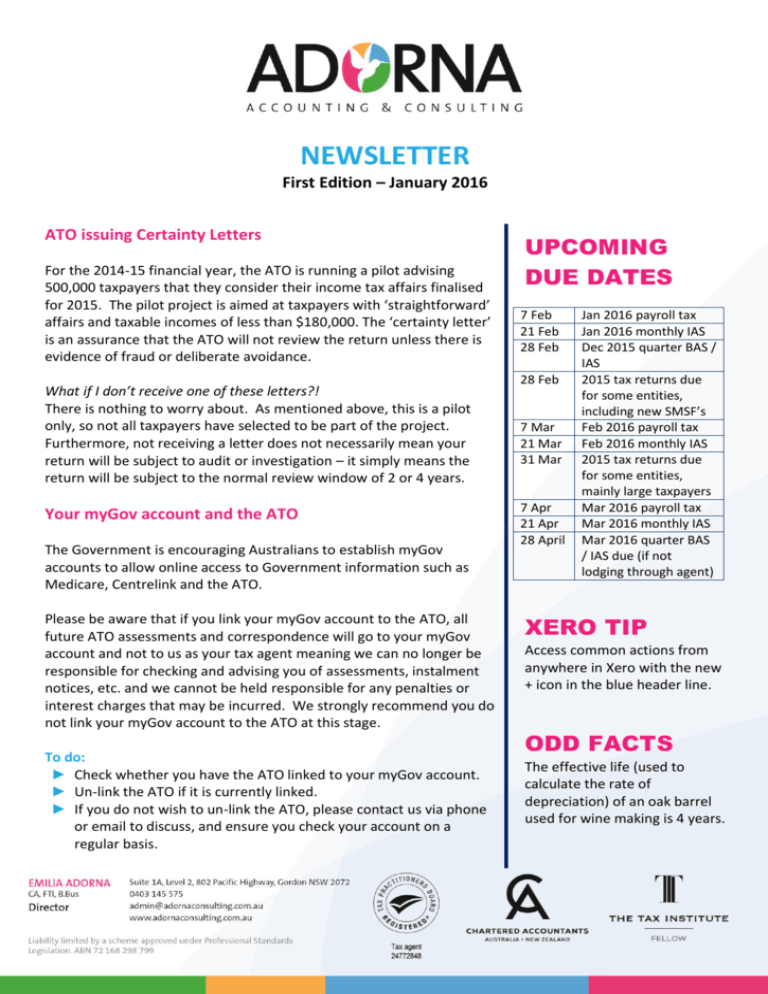

NEWSLETTER First Edition – January 2016 ATO issuing Certainty Letters For the 2014-15 financial year, the ATO is running a pilot advising 500,000 taxpayers that they consider their income tax affairs finalised for 2015. The pilot project is aimed at taxpayers with ‘straightforward’ affairs and taxable incomes of less than $180,000. The ‘certainty letter’ is an assurance that the ATO will not review the return unless there is evidence of fraud or deliberate avoidance. What if I don’t receive one of these letters?! There is nothing to worry about. As mentioned above, this is a pilot only, so not all taxpayers have selected to be part of the project. Furthermore, not receiving a letter does not necessarily mean your return will be subject to audit or investigation – it simply means the return will be subject to the normal review window of 2 or 4 years. Your myGov account and the ATO The Government is encouraging Australians to establish myGov accounts to allow online access to Government information such as Medicare, Centrelink and the ATO. Please be aware that if you link your myGov account to the ATO, all future ATO assessments and correspondence will go to your myGov account and not to us as your tax agent meaning we can no longer be responsible for checking and advising you of assessments, instalment notices, etc. and we cannot be held responsible for any penalties or interest charges that may be incurred. We strongly recommend you do not link your myGov account to the ATO at this stage. To do: ► Check whether you have the ATO linked to your myGov account. ► Un-link the ATO if it is currently linked. ► If you do not wish to un-link the ATO, please contact us via phone or email to discuss, and ensure you check your account on a regular basis. UPCOMING DUE DATES 7 Feb 21 Feb 28 Feb 28 Feb 7 Mar 21 Mar 31 Mar 7 Apr 21 Apr 28 April Jan 2016 payroll tax Jan 2016 monthly IAS Dec 2015 quarter BAS / IAS 2015 tax returns due for some entities, including new SMSF’s Feb 2016 payroll tax Feb 2016 monthly IAS 2015 tax returns due for some entities, mainly large taxpayers Mar 2016 payroll tax Mar 2016 monthly IAS Mar 2016 quarter BAS / IAS due (if not lodging through agent) XERO TIP Access common actions from anywhere in Xero with the new + icon in the blue header line. ODD FACTS The effective life (used to calculate the rate of depreciation) of an oak barrel used for wine making is 4 years. Home Office Expenses – ATO focus We have seen an increasing focus by the ATO on deductions by individuals in respect of home office costs associated with employment income, primarily office 'running expenses' and computer, internet and electronic device expenses. So here are some things to keep in mind throughout the year if you are intending to claim these deductions. Pre-requisites for a deduction: ► You must have incurred the expenses and not been reimbursed; ► There must be a connection to your income producing work; ► The income producing use is substantial, not merely incidental; and ► The expense is only deductible to the extent it is work related. Documents you need to support the claim: ► Invoices in the name of owner or service recipient or, where invoices are unavailable, corroborating evidence can be accepted. ► Itemised accounts or diary to evidence work-related portion. ► Alternatively, a deduction for running expenses can be calculated at the rate of 45 cents per hour (effective from 1 July 2014), with no need for substantiation of specific expenses. A diary over four weeks is required to establish a pattern of use for the financial year. Common pit-falls: ► Occupancy expenses (rent, mortgage interest, council and water rates etc) are only claimable if part of the taxpayer’s home qualifies as a ‘place of business’. This generally can’t be satisfied for employees. ► It is generally assumed by the ATO that where there is only one line for a home phone or internet, there must be at least some private usage. Money back in your pocket! NSW Jobs Action Plan The NSW Office of State Revenue (OSR) introduced a Jobs Action Plan a number of years ago which enables businesses who are registered for payroll tax to claim a rebate for generating new positions of employment in their business, where the employment is maintained for two years. The maximum rebate currently available for each new job is $5,000 ($2,000 on the first anniversary; $3,000 on the second anniversary) for each Full-Time Equivalent employee. The rebate is pro-rated for part-time employees. To be eligible, the taxpayer must register each new job with the OSR within 30 days of the employment commencing. Historically, the Chief Commissioner has been very lenient in accepting late registrations, however under new rules from 23 November 2015, registrations made more than 90 days after commencement will only be accepted in exceptional circumstances at the discretion of the Chief Commissioner. To do: ► Consider whether your business may be eligible for the rebate. ► If eligible, contact us to ensure you are registered on time! Questions? Get in touch! Follow us on and share with friends & colleagues. The material and contents provided in this publication are informative in nature only. It is not intended to be advice and you should not act specifically on the basis of this information alone. If expert assistance is required, professional advice should be obtained.