Document

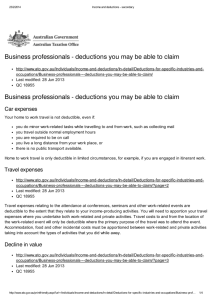

advertisement

Good records are the foundation of a good business, so it is a good idea to have a suitable record keeping system ready to go from day one. You can keep your records electronically or on paper. Setting up electronic records when you start can save you time later when you lodge your activity statements or prepare your tax return. They automatically total amounts, allow you to print invoices and provide summary details for your activity statements and tax returns. A variety of electronic record keeping packages are available. Some software allows you to lodge your activity statement and certain forms directly from your software to the ATO. These are called Standard Business Reporting - or SBR-enabled software. To lodge online, you will need an AUSkey. To find out more about SBR, visit sbr.gov.au, or ato.gov.au/onlineservices You’ll need to keep records of all your sales and expenses to prepare your activity statements, annual tax returns and to meet other tax obligations. Generally, records you need to keep include: Income and sales records of all sales and barter transactions - for example, invoices, receipt books, cash register tapes and records of cash sales. You'll also need to keep records of all business expenses, including cash purchases. Records could include receipts, invoices, cheque butts, credit card vouchers and diaries to record petty cash expenses. And you should keep all bank records, such as bank statements and loan documents. Other records you need to keep include details of what assets you buy and what you spend on those assets. An asset register can help you keep track of these expenses. You'll also need to keep copies of contracts and franchise or other agreements. As well as year-end records, including lists of creditors or debtors and worksheets for depreciating assets. For certain work, car and business travel expenses, it’s not always possible to get a receipt. But you can still claim the expenses as deductions as long as you record the details of these expenses in a diary or logbook. The main GST records you need to keep are tax invoices and adjustment notes. If you’re registered for GST, you need a tax invoice to claim GST credits included in the price of any good or service you buy for your business that cost more tha n a certain amount. Any tax invoices you issue to your customers or receive from your suppliers must contain certain information to be valid. It must show the date the document is issued and it must contain the supplier's name and ABN, as well as a brief description of what is sold, including the quantity and the price of what is sold. It must also show the extent to which each sale is a taxable sale - this can be shown separately or as a statement such as 'total price includes GST'. To work out your fuel tax credits and to support your claims, you need to keep records showing the date you acquired the fuel, the quantity and type of fuel you acquired and the business activity you used it in. You should keep records from the start of your business activity so you are ready to calculate and claim your fuel tax credits. For employees, you need to keep records of wages, allowances and other payments you made to them. As well as superannuation guarantee records, including payments you made and records that show you have met your choice of super fund obligations. You also need to keep records of Fringe Benefits Tax calculations, worksheets, declarations, elections and supporting details, as well as copies of TFN declarations or withholding declarations. You may have to keep logbooks, lease or loan documents or yearly odometer readings for motor vehicles you use in your business. I’ve got a good tip for you. I found a free record keeping evaluation tool on the ATO’s website. It’s this great interactive software program that helps me understand what records I need to keep and helps me decide whether my record keeping needs improving or not. It provides a list of records tailored specifically for my business, a report on how well the business is keeping its records and suggested improvements where appropriate. And it’s completely anonymous; the ATO can’t access the information I enter in the tool. You must keep written records in English. If you keep electronic records on your computer, they must be in a form that you can easily access and convert into written English. You must keep any account books, records or documents related to preparing your tax return for at least five years after they are prepared, obtained or the transaction is completed, whichever occurs last.