SAP Note 1455103 - Excise - Year End Activities Summary Incoming

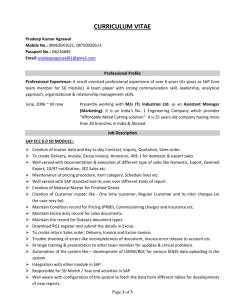

advertisement

SAP Note 1455103 Note Language: English Excise - Year End Activities Version: 1 Validity: Valid Since 01.04.2010 Summary Symptom While creating the Excise Invoice in the new the fiscal year, there is a need to post the Excise documents in the previous fiscal year. Other terms Fiscal Year, Year End, previous year, number range Reason and Prerequisites Consulting Solution Following are some of the frequently asked questions for transactions during year end processing. We have listed down the expected system behavior and fixes as relevant. Depot invoice - Incoming : o MIGO- System will determine the excise year as per the vendor excise date while creating using t-code 'migo ' o J1IG - System should determine the folio number/excise invoice number range from the year based on the vendor excise invoice date. If it does not then please make the changes in note - 1357678 . Outgoing: o J1IJ - Number range year is determined based on the delivery creation date. Manufacturing plant - Incoming o MIGO - Excise year & hence the number range is based on GR's posting date. This is when EI capture and post option is used in MIGO. o J1IEX - Excise year will be determined based on the posting date of the excise invoice. This is when EI is posted through J1IEX irrespective of how it was captured. Outgoing o J1IIN - System will pick excise year (number range) based on the posting date which can be changed in the initial screen. o J1IS - Excise year would be determined based on the posting date entered in the screen in J1IS. Currently if the excise invoice creation is based on two step process (J1IS create and J1IV post) then please make the changes as per the note - 1455065, so that 19.01.2011 Page 1 of 3 SAP Note 1455103 - Excise - Year End Activities you will be able to enter the posting and not when posting. System does not changed in J1IV, hence the above note customers to input/change the posting o date during creation of EI consider the posting date was released to allow date in J1IS itself. J1IH > If the error "F5 702 for balance in transaction currency is received" or When the system posts all the duty to PLA. This means that the system is not able to find adequate balances in the selected register. Solution - Carry forward balance & then post. Open the current period (MM and FI) and change the posting date to previous period - note - 839224, part 2 will be posted to previous period. Utilization - J2IUN o Part 2 serial number will be picked up based on the posting date. o PLA balances would not be visible till such time as the balances are carried forward to the current fiscal year. o Use the transaction FAGLGVTR for balance carry forward (please read the documentation of this program in SE38) if New G/L is used. o The current balance for PLA must be visible in the current fiscal year through FAGLB03 for New G/L and FS10N for those not using New G/L. o G/L account balance for registers RG23A and C are always fetched from the period for which the utilization program is run. o The G/L balances are fetched from the company code level and not as per business area or excise group or plant. Header Data Release Status: Released on: Master Language: Priority: Category: Primary Component: Released for Customer 01.04.2010 13:10:40 English Recommendations/additional info Consulting XX-CSC-IN India Valid Releases 19.01.2011 Page 2 of 3 SAP Note 1455103 - Excise - Year End Activities Software Component Release SAP_APPL SAP_APPL SAP_APPL SAP_APPL SAP_APPL SAP_APPL SAP_APPL SAP_APPL 46C 470 500 600 602 603 604 605 19.01.2011 From Release 46C 470 500 600 602 603 604 605 To Release 46C 470 500 600 602 603 604 605 and Subsequent Page 3 of 3