Gov't Intervention: Price Floors & Price Ceilings / Taxes & Subsidies

Gov’t Intervention: Price Floors & Price Ceilings / Taxes & Subsidies

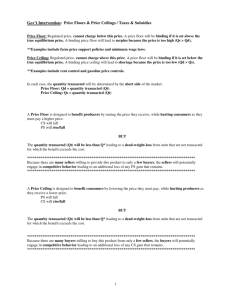

Price Floor: Regulated price such that firms cannot charge below this price.

A price floor will be binding if it is set above the true equilibrium price.

A binding price floor will lead to surplus because the price is too high

(Qs > Qd).

**Examples include farm price support policies and minimum wage laws.

Price Ceiling: Regulated price such that firms cannot charge above this price .

A price floor will be binding if it is set below the true equilibrium price . A binding price ceiling will lead to shortage because the price is too low (Qd > Qs).

**Examples include rent control and gasoline price controls.

In each case, the quantity transacted will be determined by the short side of the market.

Price Floor: Qd = quantity transacted (Qt)

Price Ceiling: Qs = quantity transacted (Qt)

A Price Floor is designed to benefit producers by raising the price they receive, while hurting consumers as they must pay a higher price.

CS will fall

PS will rise/fall

BUT

The quantity transacted (Qt) will be less than Q* leading to a dead-weight-loss from units that are not transacted for which the benefit exceeds the cost.

*****************************************************************************************

Because there are many sellers willing to provide this product to only a few buyers , the sellers will potentially engage in competitive behavior leading to an additional loss of any PS gain that remains.

*****************************************************************************************

A Price Ceiling is designed to benefit consumers by lowering the price they must pay, while hurting producers as they receive a lower price. will rise/fall

BUT

The quantity transacted (Qt) will be less than Q* leading to a dead-weight-loss from units that are not transacted for which the benefit exceeds the cost.

*****************************************************************************************

Because there are many buyers willing to buy this product from only a few sellers , the buyers will potentially engage in competitive behavior leading to an additional loss of any CS gain that remains.

*****************************************************************************************

1

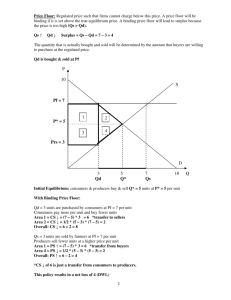

Tax Levied on Seller:

Sellers

must pay

a tax

of

$ t

for every unit sold.

Buyers pay new equilibrium price

(listed price) and then sellers pay tax to gov’t and therefore receive a net price after the tax of the listed price minus the tax (per unit).

Tax Levied on Buyer:

Buyers

must pay a tax

of

$ t

for every unit purchased.

Buyers pay new equilibrium price (listed price) and then they pay tax to gov’t and therefore pay the listed price plus the tax in total , while sellers receive the listed price (per unit).

A tax on sellers raises the supply schedule upwards by the amount of the tax as they must account for the fact that they must pay the tax on top of there existing costs of production.

The new equilibrium price (listed price) will be higher (Pt > P*). Consumers pay Pc = Pt and sellers end up receiving Ps = Pt – t after they pay the tax.

With normal upward sloping D & S curves, the burden of the tax will be split.

Consumers pay more than initially

Producers receive less than initially

Pc = Pt > P* CS

Ps = (Pt – t) < P* PS ↓

↓

The quantity transacted (Qt) will be less than Q* leading to a dead-weight-loss from units that are not transacted for which the benefit exceeds the cost.

*The tax revenue collected falls short of the combined hurt to consumers and producers

A tax on buyers lowers the demand schedule downwards by the amount of the tax as they must account for the fact that they must pay the tax on top of their existing willingness to pay.

The new equilibrium price (listed price) will be lower (Pt < P*). Consumers pay Pt and sellers receive Ps = Pt and therefore consumers end up paying Pc = Pt + t after they pay the tax.

With normal upward sloping D & S curves, the burden of the tax will be split.

Consumers pay more than initially

Producers receive less than initially

Pc = (Pt + t) > P* CS ↓

Ps = Pt < P* PS ↓

The quantity transacted (Qt) will be less than Q* leading to a dead-weight-loss from units that are not transacted for which the benefit exceeds the cost.

*The tax revenue collected falls short of the combined hurt to consumers and producers

**Note: A subsidy is just the opposite of a tax, but also leads to a dead-weight-loss**

2