Notes to the Financial Statements

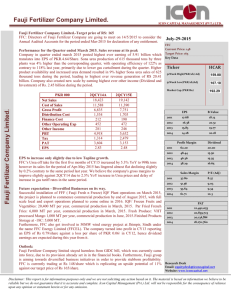

advertisement