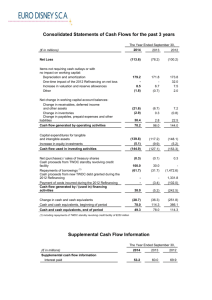

statement of cash flows

advertisement

F I N AN C I AL S T AT E M E N T S General Electric Company and consolidated affiliates 2014 2013 STATEMENT OF CASH FLOWS For the years ended December 31 (In millions) Cash flows – operating activities Net earnings Less net earnings (loss) attributable to noncontrolling interests Net earnings attributable to the Company (Earnings) loss from discontinued operations Adjustments to reconcile net earnings attributable to the Company to cash provided from operating activities Depreciation and amortization of property, plant and equipment Earnings from continuing operations retained by GECC Deferred income taxes Decrease (increase) in GE current receivables Decrease (increase) in inventories Increase (decrease) in accounts payable Increase (decrease) in GE progress collections Provision for losses on GECC financing receivables All other operating activities Cash from (used for) operating activities – continuing operations Cash from (used for) operating activities – discontinued operations Cash from (used for) operating activities $ Cash flows – investing activities Additions to property, plant and equipment Dispositions of property, plant and equipment Net decrease (increase) in GECC financing receivables Proceeds from sale of discontinued operations Proceeds from principal business dispositions Proceeds from sale of equity interest in NBCU LLC Net cash from (payments for) principal businesses purchased All other investing activities Cash from (used for) investing activities – continuing operations Cash from (used for) investing activities – discontinued operations Cash from (used for) investing activities Cash flows – financing activities Net increase (decrease) in borrowings (maturities of 90 days or less) Net increase (decrease) in bank deposits Newly issued debt (maturities longer than 90 days) Repayments and other reductions (maturities longer than 90 days) Proceeds from issuance of GECC preferred stock Net dispositions (purchases) of GE shares for treasury Dividends paid to shareowners Proceeds from initial public offering of Synchrony Financial All other financing activities Cash from (used for) financing activities – continuing operations Cash from (used for) financing activities – discontinued operations Cash from (used for) financing activities Effect of currency exchange rate changes on cash and equivalents Increase (decrease) in cash and equivalents Cash and equivalents at beginning of year Cash and equivalents at end of year Less cash and equivalents of discontinued operations at end of year Cash and equivalents of continuing operations at end of year Supplemental disclosure of cash flows information Cash paid during the year for interest Cash recovered (paid) during the year for income taxes See accompanying notes. 134 GE 2014 FORM 10-K $ $ 2012 15,345 $ 112 15,233 112 13,355 $ 298 13,057 2,120 13,864 223 13,641 983 9,283 (1,186) (1,913) (872) 305 (515) 3,993 3,075 27,515 195 27,710 9,762 (3,295) (485) (1,368) 360 1,893 4,818 2,175 29,037 (458) 28,579 9,192 (1,152) (879) (1,274) (437) (920) 3,832 8,029 31,015 316 31,331 (13,727) 6,262 (4,267) 232 2,950 (2,639) 6,447 (4,742) (288) (5,030) (13,458) 5,883 2,715 528 3,324 16,699 (1,642) 14,625 28,674 443 29,117 (15,119) 6,184 6,979 227 3,618 (1,456) 11,157 11,590 (288) 11,302 (6,112) 13,286 37,548 (53,380) (1,218) (8,851) 2,842 (1,067) (16,952) (6) (16,958) (3,492) 2,230 88,787 91,017 (14,230) 2,197 45,392 (61,461) 990 (9,278) (7,821) (1,418) (45,629) 56 (45,573) (795) 11,328 77,459 88,787 (2,231) 2,450 63,019 (103,942) 3,960 (4,164) (7,189) (2,958) (51,055) (19) (51,074) 1,278 (7,163) 84,622 77,459 133 90,884 $ 232 88,555 $ 191 77,268 (9,560) $ (2,955) (8,988) $ (2,487) (12,717) (3,237) F I N A N C I A L S T AT E M E N T S STATEMENT OF CASH FLOWS (CONTINUED) For the years ended December 31 (In millions) Cash flows – operating activities $ Net earnings Less net earnings (loss) attributable to noncontrolling interests Net earnings attributable to the Company (Earnings) loss from discontinued operations Adjustments to reconcile net earnings attributable to the Company to cash provided from operating activities Depreciation and amortization of property, plant and equipment Earnings from continuing operations retained by GECC(b) Deferred income taxes Decrease (increase) in GE current receivables Decrease (increase) in inventories Increase (decrease) in accounts payable Increase (decrease) in GE progress collections Provision for losses on GECC financing receivables All other operating activities Cash from (used for) operating activities – continuing operations Cash from (used for) operating activities – discontinued operations Cash from (used for) operating activities Cash flows – investing activities Additions to property, plant and equipment Dispositions of property, plant and equipment Net decrease (increase) in GECC financing receivables Proceeds from sale of discontinued operations Proceeds from principal business dispositions Proceeds from sale of equity interest in NBCU LLC Net cash from (payments for) principal businesses purchased All other investing activities Cash from (used for) investing activities – continuing operations Cash from (used for) investing activities – discontinued operations Cash from (used for) investing activities Cash flows – financing activities Net increase (decrease) in borrowings (maturities of 90 days or less) Net increase (decrease) in bank deposits Newly issued debt (maturities longer than 90 days) Repayments and other reductions (maturities longer than 90 days) Proceeds from issuance of GECC preferred stock Net dispositions (purchases) of GE shares for treasury Dividends paid to shareowners Proceeds from initial public offering of Synchrony Financial All other financing activities Cash from (used for) financing activities – continuing operations Cash from (used for) financing activities – discontinued operations Cash from (used for) financing activities Effect of currency exchange rate changes on cash and equivalents Increase (decrease) in cash and equivalents Cash and equivalents at beginning of year Cash and equivalents at end of year Less cash and equivalents of discontinued operations at end of year Cash and equivalents of continuing operations at end of year $ Supplemental disclosure of cash flows information Cash paid during the year for interest $ Cash recovered (paid) during the year for income taxes 2014 GE(a) 2013 2012 Financial Services (GECC) 2014 2013 7,396 $ 162 7,234 107 6,257 $ 53 6,204 2,054 2012 15,183 $ (50) 15,233 112 13,302 $ 245 13,057 2,120 13,801 $ 160 13,641 983 6,278 63 6,215 1,130 2,508 (4,341) (476) (473) (877) 884 (528) 3,129 15,171 (2) 15,169 2,449 (2,273) (2,571) (1,432) (1,351) 809 1,919 1,528 14,255 (2) 14,253 2,291 (919) (294) 1,105 (1,204) 158 (920) 2,985 17,826 17,826 6,859 (710) 27 (2) 3,993 240 17,748 197 17,945 7,313 (724) 33 73 4,818 99 19,870 (456) 19,414 6,901 (858) (27) (880) 3,832 5,418 21,731 316 22,047 (3,970) 602 (2,091) (447) (5,906) 2 (5,904) (3,680) 1,316 16,699 (8,026) (1,488) 4,821 2 4,823 (3,937) 540 (1,456) (564) (5,417) (5,417) (10,410) 6,284 (5,689) 232 2,320 (548) 6,997 (814) (290) (1,104) (9,978) 5,883 3,589 528 1,983 6,384 14,972 23,361 441 23,802 (11,879) 6,184 5,490 227 2,863 11,794 14,679 (288) 14,391 243 3,084 (323) (1,218) (8,851) 346 (6,719) (6,719) (312) 2,234 13,682 15,916 949 512 (5,032) (9,278) (7,821) (211) (20,881) (20,881) (22) (1,827) 15,509 13,682 (890) 6,961 (34) (4,164) (7,189) 32 (5,284) (5,284) 2 7,127 8,382 15,509 (6,781) 13,286 34,464 (53,057) (3,322) 2,842 (1,091) (13,659) (6) (13,665) (3,180) (4) 75,105 75,101 (13,892) 2,197 44,888 (56,429) 990 (6,283) (909) (29,438) 56 (29,382) (773) 13,061 62,044 75,105 (1,401) 2,450 55,841 (103,908) 3,960 (6,549) (2,867) (52,474) (19) (52,493) 1,276 (14,779) 76,823 62,044 15,916 $ 13,682 $ 15,509 $ 133 74,968 $ 232 74,873 $ 191 61,853 (1,215) $ (1,337) (1,132) $ (4,753) (1,182) $ (2,987) (8,910) $ (1,618) (8,146) $ 2,266 (12,172) (250) (a) Represents the adding together of all affiliated companies except General Electric Capital Corporation (GECC or Financial Services), which is presented on a one-line basis. (b) Represents GECC earnings from continuing operations attributable to the Company, net of GECC dividends paid to GE. In the consolidating data on this page, "GE" means the basis of consolidation as described in Note 1 to the consolidated financial statements; "GECC" means General Electric Capital Corporation and all of its affiliates and associated companies. Separate information is shown for “GE” and “GECC.” Transactions between GE and GECC have been eliminated from the “General Electric Company and consolidated affiliates” columns on the prior page and are discussed in Note 26. See Note 25 for supplemental information regarding the Statement of Cash Flows GE 2014 FORM 10-K 135