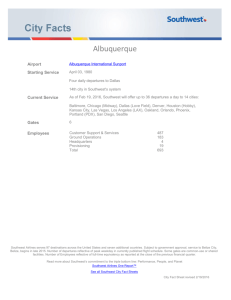

SOUTHWEST AIRLINES CO. 2013 ANNUAL REPORT TO

advertisement