North America Equity Research

23 March 2006

Downgrade

Neutral

EMC

Previous Rating: Overweight

Downgrading to Neutral, Lowering Estimates

$13.93

22 March 2006

• We are downgrading EMC to Neutral from Overweight. This is

not a call on the March quarter, as we expect the company should

have little difficulty posting results in-line with current consensus

expectations.

IT Hardware

• Nevertheless, we are somewhat concerned with the remainder of

2006 and suspect that shifting competitive dynamics, software

integration issues, and limited margin leverage may make it

difficult for the company to exceed investor expectations.

Unfortunately, we believe upside is a necessary prerequisite for

further appreciation in the shares.

Elizabeth Borbolla

Bill Shope, CFA

(1-212) 622-6607

bill.c.shope@jpmorgan.com

(1-212) 622-6608

elizabeth.borbolla@jpmorgan.com

• We are lowering our full year estimates for 2006 and 2007, though

we are maintaining our first quarter estimates for revenues of

$2.58 billion and EPS including options of $0.11. For all of 2006,

we are lowering our revenues to $11.06 billion from $11.12 billion

and our EPS including options to $0.55 from $0.58. For 2007, we

are reducing our revenues to $12.63 billion from $12.79 billion

and our EPS including options to $0.70 from $0.74.

• With our revisions, EMC is currently trading at 22x our 2006 EPS

estimate, excluding options expense, versus the peer group average

of 20x. Including options expense, the company is trading at 25x

earnings. At this point, with a lower probability for upside to

current expectations, the stock is likely to remain range bound

over the next several quarters.

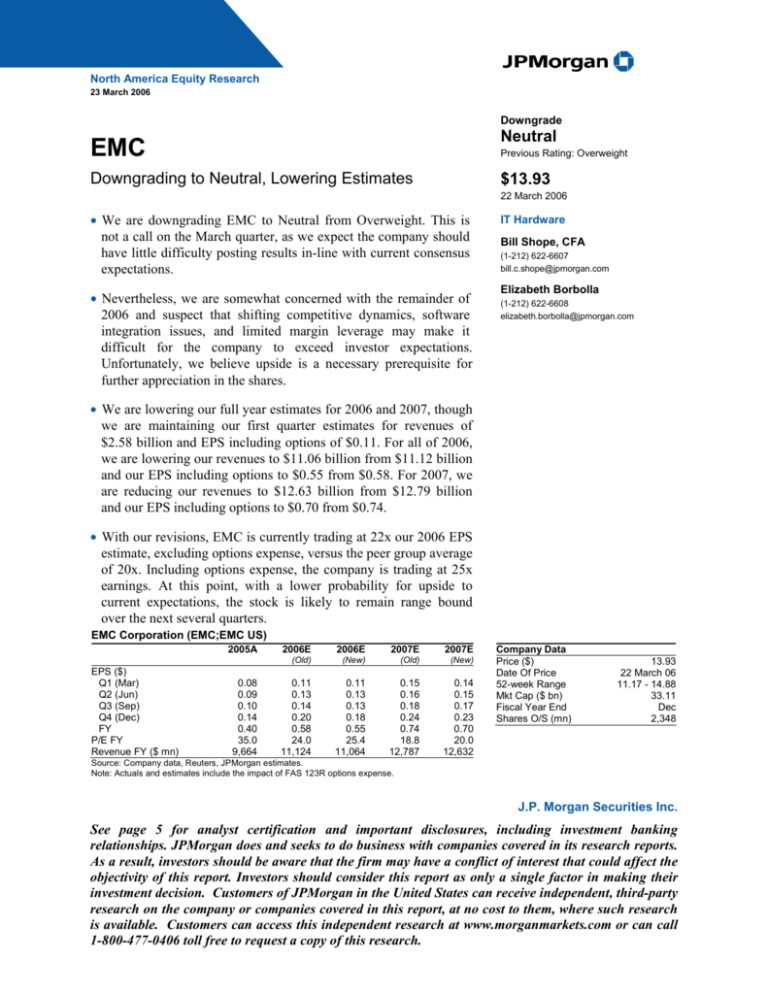

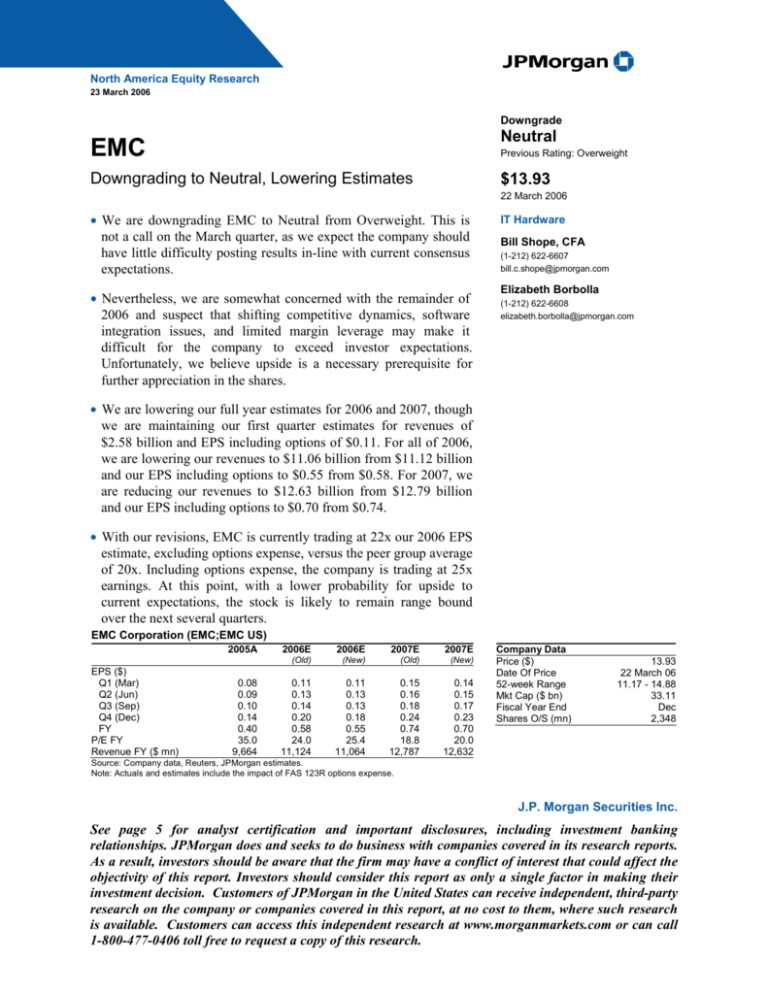

EMC Corporation (EMC;EMC US)

2005A

EPS ($)

Q1 (Mar)

Q2 (Jun)

Q3 (Sep)

Q4 (Dec)

FY

P/E FY

Revenue FY ($ mn)

0.08

0.09

0.10

0.14

0.40

35.0

9,664

2006E

2006E

2007E

2007E

(Old)

(New)

(Old)

(New)

0.11

0.13

0.14

0.20

0.58

24.0

11,124

0.11

0.13

0.13

0.18

0.55

25.4

11,064

0.15

0.16

0.18

0.24

0.74

18.8

12,787

0.14

0.15

0.17

0.23

0.70

20.0

12,632

Company Data

Price ($)

Date Of Price

52-week Range

Mkt Cap ($ bn)

Fiscal Year End

Shares O/S (mn)

13.93

22 March 06

11.17 - 14.88

33.11

Dec

2,348

Source: Company data, Reuters, JPMorgan estimates.

Note: Actuals and estimates include the impact of FAS 123R options expense.

J.P. Morgan Securities Inc.

See page 5 for analyst certification and important disclosures, including investment banking

relationships. JPMorgan does and seeks to do business with companies covered in its research reports.

As a result, investors should be aware that the firm may have a conflict of interest that could affect the

objectivity of this report. Investors should consider this report as only a single factor in making their

investment decision. Customers of JPMorgan in the United States can receive independent, third-party

research on the company or companies covered in this report, at no cost to them, where such research

is available. Customers can access this independent research at www.morganmarkets.com or can call

1-800-477-0406 toll free to request a copy of this research.

Bill Shope, CFA

(1-212) 622-6607

bill.c.shope@jpmorgan.com

North America Equity Research

23 March 2006

Overview

We are downgrading EMC to Neutral from Overweight. This is not a call on the

March quarter, as we expect the company should have little difficulty posting results

in-line with current consensus expectations. Nevertheless, we are somewhat

concerned with the remainder of 2006 and suspect that shifting competitive

dynamics, software integration issues, and limited margin leverage may make it

difficult for the company to exceed investor expectations. Unfortunately, we believe

upside is a necessary prerequisite for further appreciation in the shares.

We are lowering our full year estimates for 2006 and 2007, though we are

maintaining our first quarter estimates for revenues of $2.58 billion and EPS

including options of $0.11. This is in-line with consensus, which excludes $0.03 of

options expenses. For all of 2006, we are lowering our revenues to $11.06 billion

from $11.12 billion and our EPS including options to $0.55 from $0.58. Our 2006

EPS estimate excluding options expense is now $0.64, which compares with

consensus of $0.66 and our prior estimate of $0.67. For 2007, we are reducing our

revenues to $12.63 billion from $12.79 billion and our EPS including options to

$0.70 from $0.74. Our 2007 EPS estimate excluding options is now $0.76 versus

consensus of $0.77 and our prior estimate of $0.80.

With our revisions, EMC is currently trading at 22x our 2006 EPS estimate,

excluding options expense, versus the peer group average of 20x. Including options

expense, the company is trading at 25x earnings. At this point, with a lower

probability for upside to current expectations, the stock is likely to continue to

remain range bound over the next several quarters. We detail our fundamental

concerns below.

Competitive Environment May Be More Difficult in 2006

We continue to believe that EMC’s ILM strategy and broad technology portfolio will

allow it to maintain its lead in the networked storage market over the long-term.

Nevertheless, we believe it may be difficult for the company to maintain its current

market share momentum, in terms of relative revenue growth, in 2006 for several

reasons.

First, while EMC’s battle with Network Appliance continues to be a “two horse

race,” NetApp’s growth rate has exceeded our expectations, and our previous

expectation for a shift in balance towards EMC has not materialized. We do not

expect this to change in the near-term. Second, HDS appears to be regaining

momentum in the high-end array segment of the market, putting pressure on the ramp

of EMC’s new DMX-3 systems. Indeed, Hitachi grew its networked storage business

by 35% in the December quarter and by 18% in the September quarter, versus singledigit growth rates in prior quarters. Third, in the past EMC has steadily taken share

from HP in the enterprise storage segment, but HP’s recent operational

improvements and new storage products may be dampening this trend. In fact, HP’s

storage revenues grew by 5.4% in fiscal 2005, versus a 7.3% decline in the prior year

(Figure 1). We expect HP to at least maintain share in coming quarters, and this

chokes a key source of market share gains for EMC.

2

North America Equity Research

23 March 2006

Figure 1: HP’s Storage Revenues Have Begun to Recover

Hewlett-Packard Y/Y % change in enterprise storage revenues

20%

10%

0%

-10%

-20%

Ja

n06

Se

p05

Ja

n05

M

ay

-0

5

Se

p04

Ja

n04

M

ay

-0

4

Se

p03

Ja

n03

M

ay

-0

3

Se

p02

-30%

Ja

n02

M

ay

-0

2

Bill Shope, CFA

(1-212) 622-6607

bill.c.shope@jpmorgan.com

Source: Company reports.

Work Remains with Software Integration

EMC has acquired eight software companies in the past three years. Most of the

acquisitions have filled critical gaps in EMC’s technology portfolio, and as a result,

we have applauded the company’s moves. Unfortunately, it will take quite some time

for EMC to fully integrate these acquisitions into its core technology portfolio. With

so many disparate businesses under one roof, there is a risk that EMC’s overall

software portfolio will be difficult to manage over the near-term, resulting in choppy

performance for this critical business segment in coming quarters.

As for VMWare, we continue to believe EMC’s $625 million acquisition of the

company provided it with one of the most valuable early-stage assets in the software

industry. Nevertheless, it is unlikely that the value of this asset will be unleashed in a

spin-off any time soon. And though we remain very optimistic about VMWare’s

long-term industry potential, our sense is that expectations for the segment’s revenue

growth may have become unrealistic.

Margin Leverage Could Be More Muted

EMC’s gross margins have expanded by more than 15 percentage points since 2002,

and operating margins have expanded from a loss by nearly 24 percentage points.

This margin improvement is testament to EMC’s remarkable turnaround following

the collapse of the technology bubble. Of course, these types of improvements can’t

last forever, and we suspect 2006 will mark the year EMC approaches a steady-state

in terms of its margin leverage. Part of this will likely be due to pressures on the

gross margin line due to the aforementioned competitive dynamics. From an

operating margin perspective, the company can still generate some leverage from

operating expense reductions. Unfortunately, there is little fat left to cut, and cost

cutting is unlikely to produce material profit upside over time. As a result of these

factors, we expect the gap between earnings growth and revenue growth to narrow

over the course of the year.

Earnings Outlook

We are lowering our full year estimates for 2006 and 2007, though we are

maintaining our first quarter estimates for revenues of $2.58 billion and EPS

3

Bill Shope, CFA

(1-212) 622-6607

bill.c.shope@jpmorgan.com

North America Equity Research

23 March 2006

including options of $0.11. This is in-line with consensus, which excludes $0.03 of

options expenses. For all of 2006, we are lowering our revenues to $11.06 billion

from $11.12 billion and our EPS including options to $0.55 from $0.58. Our 2006

EPS estimate excluding options expense is now $0.64, which compares with

consensus of $0.66 and our prior estimate of $0.67. For 2007, our changes are only

minor, as we are reducing our revenues to $12.63 billion from $12.79 billion and our

EPS including options to $0.70 from $0.74. Our 2007 EPS estimates excluding

options is now $0.76 versus consensus of $0.77 and our prior estimate of $0.80.

Valuation and Rating Analysis

With our revisions, EMC is currently trading at 22x our 2006 EPS estimate,

excluding options expense, versus the peer group average of 20x. Including options

expense, the company is trading at 25x earnings. While we expect the company to

have little difficulty posting in-line March quarter results, we are somewhat

concerned with the remainder of the year. We suspect that shifting competitive

dynamics, software integration issues, and limited margin leverage may make it

difficult for EMC to exceed investor expectations. With a lower probability for

upside to current expectations, the stock is likely to continue to remain range bound

over the next several quarters. We are downgrading EMC to Neutral from

Overweight.

Risks to Our Rating

Our Neutral rating is based in part on the assumption that storage spending will

remain robust in 2006. If spending should differ significantly from our expectation,

then our rating could be at risk. We also assume that EMC will see increasing

competition from Hewlett-Packard and HDS in addition to Network Appliance.

Should this fail to materialize, our rating could be at risk to the upside. If this

competition is greater than we currently anticipate, and results in unusually

aggressive pricing or market share losses, our rating could be at risk to the downside.

Our Neutral rating is also based in part on our view that EMC will have limited

margin leverage as it seeks to integrate recent acquisitions into its technology

portfolio. If the company is able to produce greater than anticipated operating

expense improvements, our estimates could increase.

4

Bill Shope, CFA

(1-212) 622-6607

bill.c.shope@jpmorgan.com

North America Equity Research

23 March 2006

Companies Recommended in This Report (as of COB 21 March 2006)

EMC (EMC/$14.04/Neutral), Hewlett-Packard (HPQ/$33.54/Overweight), Network Appliance (NTAP/$34.54/Neutral)

Analyst Certification

The research analyst who is primarily responsible for this research and whose name is listed first on the front cover certifies

(or in a case where multiple research analysts are primarily responsible for this research, the research analyst named first in

each group on the front cover or named within the document individually certifies, with respect to each security or issuer

that the research analyst covered in this research) that: (1) all of the views expressed in this research accurately reflect his or

her personal views about any and all of the subject securities or issuers; and (2) no part of any of the research analyst's

compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed by the

research analyst in this research.

Important Disclosures:

•

•

•

•

•

•

•

Market Maker: JPMSI makes a market in the stock of Network Appliance.

Liquidity Provider: JPMSI and/or one of its affiliates normally provides liquidity in the stock of EMC, HewlettPackard.

Lead or Co-manager: JPMSI or its affiliates acted as lead or co-manager in a public offering of equity and/or

debt securities for Hewlett-Packard within the past 12 months.

Client of the Firm: EMC is or was in the past 12 months a client of JPMSI; during the past 12 months, JPMSI

provided to the company non-investment banking securities-related service and non-securities-related services.

Hewlett-Packard is or was in the past 12 months a client of JPMSI; during the past 12 months, JPMSI provided

to the company investment banking services and non-investment banking securities-related service. Network

Appliance is or was in the past 12 months a client of JPMSI; during the past 12 months, JPMSI provided to the

company non-investment banking securities-related service.

Investment Banking (past 12 months): JPMSI or its affiliates received in the past 12 months compensation for

investment banking services from Hewlett-Packard.

Investment Banking (next 3 months): JPMSI or its affiliates expect to receive, or intend to seek, compensation

for investment banking services in the next three months from EMC, Hewlett-Packard.

Non-Investment Banking Compensation: JPMSI has received compensation in the past 12 months for products

or services other than investment banking from EMC, Hewlett-Packard, Network Appliance. An affiliate of

JPMSI has received compensation in the past 12 months for products or services other than investment banking

from EMC, Hewlett-Packard, Network Appliance.

EMC (EMC) Price Chart

30

Date

25

Rating Share Price

($)

31-Jul-03 OW

10.05

Price Target

($)

-

20

OW

OW $17

Price($) 15

10

5

0

Mar

03

Jun

03

Sep

03

Dec

03

Mar

04

Jun

04

Sep

04

Dec

04

Mar

05

Jun

05

Sep

05

Dec

05

Mar

06

Source: Reuters and JPMorgan; price data adjusted for stock splits and dividends.

This chart shows JPMorgan's continuing coverage of this stock; the current analyst may or may not have covered it over

the entire period. As of Aug. 30, 2002, the firm discontinued price targets in all markets where they were used. They

were reinstated at JPMSI as of May 19th, 2003, for Focus List (FL) and selected Latin stocks. For non-JPMSI covered

stocks, price targets are required for regional FL stocks and may be set for other stocks at analysts' discretion.

JPMorgan ratings: OW = Overweight, N = Neutral, UW = Underweight.

5

Bill Shope, CFA

(1-212) 622-6607

bill.c.shope@jpmorgan.com

North America Equity Research

23 March 2006

Explanation of Ratings and Analyst(s) Coverage Universe: JPMorgan uses the following rating system: Overweight

[Over the next six to twelve months, we expect this stock will outperform the average total return of the stocks in the

analyst’s (or the analyst’s team’s) coverage universe.] Neutral [Over the next six to twelve months, we expect this stock

will perform in line with the average total return of the stocks in the analyst’s (or the analyst’s team’s) coverage universe.]

Underweight [Over the next six to twelve months, we expect this stock will underperform the average total return of the

stocks in the analyst’s (or the analyst’s team’s) coverage universe.] The analyst or analyst’s team’s coverage universe is the

sector and/or country shown on the cover of each publication. See below for the specific stocks in the certifying analyst(s)

coverage universe.

Coverage Universe: Bill Shope, CFA: Apple Computer Inc. (AAPL), Dell Inc. (DELL), EMC (EMC), Hewlett-Packard

(HPQ), IBM (IBM), Lexmark International (LXK), Network Appliance (NTAP), Sun Microsystems (SUNW), Xerox

(XRX)

JPMorgan Equity Research Ratings Distribution, as of January 3, 2006

JPM Global Equity Research Coverage

IB clients*

JPMSI Equity Research Coverage

IB clients*

Overweight

(buy)

41%

46%

35%

63%

Neutral

(hold)

42%

45%

49%

55%

Underweight

(sell)

17%

38%

17%

43%

*Percentage of investment banking clients in each rating category.

For purposes only of NASD/NYSE ratings distribution rules, our Overweight rating falls into a buy rating category, our Neutral rating falls into a hold

rating category, and our Underweight rating falls into a sell rating category.

Valuation and Risks: Company notes and reports include a discussion of valuation methods used, including methods used

to determine a price target (if any), and a discussion of risks to the price target.

Analysts’ Compensation: The equity research analysts responsible for the preparation of this report receive compensation

based upon various factors, including the quality and accuracy of research, client feedback, competitive factors, and overall

firm revenues, which include revenues from, among other business units, Institutional Equities and Investment Banking.

Other Disclosures:

Legal Entities: Equity Research is a product of J.P. Morgan Securities Inc. (JPMSI) and/or its affiliates worldwide. JPMSI is a member of NYSE, NASD

and SIPC. The analysts who write global equity research are employees of JPMSI or its affiliated companies worldwide, including the following

companies. J.P. Morgan Securities Ltd. (JPMSL) is a member of the London Stock Exchange and is authorised and regulated by the Financial Services

Authority. J.P. Morgan Equities Limited is a member of the Johannesburg Securities Exchange and is regulated by the FSB. J.P. Morgan Securities Asia

Private Limited (Co. Reg. No.: 197300590K) is regulated by the Monetary Authority of Singapore (MAS) and the Japan Financial Services Agency

(FSA). J.P. Morgan Securities (Asia Pacific) Limited (CE number AAJ321) and J.P. Morgan Securities (Far East) Limited (CE number AAB026) are

regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission in Hong Kong respectively. J.P. Morgan Securities

Singapore Private Limited (Co. Reg. No.: 199405335R) is a member of Singapore Exchange Securities Trading Limited and is regulated by the MAS.

JPMorgan Securities (Malaysia) Sdn Bhd (18146-X) (formerly known as J.P. Morgan Malaysia Sdn Bhd) is a Participating Organization of Bursa Malaysia

Securities Bhd and is licensed as a dealer by the Securities Commission in Malaysia. J.P. Morgan Australia Limited (ABN 52 002 888 011/AFS Licence

No: 238188) and J.P. Morgan Securities Australia Limited (ABN 61 003 245 234/AFS Licence No: 238066, a Market Participant with the ASX)

(JPMSAL) are licensed securities dealers. J.P. Morgan Securities New Zealand Limited is a New Zealand Exchange Limited Market Participant.

J.P.Morgan Securities (Taiwan) Limited is a participant of the Taiwan Stock Exchange (company-type) and regulated by the Taiwan Securities and Futures

Commission. J.P. Morgan India Private Limited is a member of the National Stock Exchange of India Limited and The Stock Exchange, Mumbai and is

regulated by the Securities and Exchange Board of India. JPMorgan Securities (Thailand) Limited is a member of the Stock Exchange of Thailand and is

regulated by the Ministry of Finance and the Securities and Exchange Commission PT. J.P. Morgan Securities Indonesia is a member of the Jakarta Stock

Exchange and Surabaya Stock Exchange and is regulated by the BAPEPAM. This report is distributed in the Philippines by J.P. Morgan Securities

Philippines, Inc. Banco J.P. Morgan S.A. is regulated by the Comissao de Valores Mobiliarios (CVM) and by the Central Bank of Brazil.

Options related research: If the information contained herein regards options related research, such information is available only to persons who

have received the proper option risk disclosure documents. For a copy of the Option Clearing Corporation’s Characteristics and Risks of

Standardized Options, please contact your JPMorgan Representative or visit the OCC’s website at

http://www.optionsclearing.com/publications/risks/riskstoc.pdf.

6

Bill Shope, CFA

(1-212) 622-6607

bill.c.shope@jpmorgan.com

North America Equity Research

23 March 2006

General: Information has been obtained from sources believed to be reliable but JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively

JPMorgan) do not warrant its completeness or accuracy except with respect to any disclosures relative to JPMSI and/or its affiliates and the analyst’s

involvement with the issuer. Opinions and estimates constitute our judgement as of the date of this material and are subject to change without notice. Past

performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument.

Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The opinions and recommendations herein do not take

into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or

strategies to particular clients. The recipient of this report must make its own independent decisions regarding any securities or financial instruments

mentioned herein. JPMSI distributes in the U.S. research published by non-U.S. affiliates and accepts responsibility for its contents. Clients should

contact analysts and execute transactions through a JPMorgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

Planned Frequency of Updates: JPMorgan provides periodic updates on companies/industries based on company-specific developments or

announcements, market conditions or any other publicly available information.

U.K. and European Economic Area (EEA): Issued and approved for distribution in the U.K. and the EEA by JPMSL. Investment research issued by

JPMSL has been prepared in accordance with JPMSL’s Policies for Managing Conflicts of Interest in Connection with Investment Research which can be

found at http://www.jpmorgan.com/pdfdoc/research/ConflictManagementPolicy.pdf. All research issued to private clients in the U.K. is subject to the

following: the investments and strategies discussed here may not be suitable for all investors; if you have any doubts you should consult your investment

advisor. The investments discussed may fluctuate in price or value. Investors may get back less than they invested. Changes in rates of exchange may

have an adverse effect on the value of investments.

Germany: This material is distributed in Germany by J.P. Morgan Securities Ltd. Frankfurt Branch and JPMorgan Chase Bank, N.A., Frankfurt Branch

who are regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht. Australia: This material is issued and distributed by JPMSAL in Australia to

“wholesale clients” only. JPMSAL does not issue or distribute this material to “retail clients.” The recipient of this material must not distribute it to any

third party or outside Australia without the prior written consent of JPMSAL. For the purposes of this paragraph the terms “wholesale client” and “retail

client” have the meanings given to them in section 761G of the Corporations Act 2001. Hong Kong: The 1% ownership disclosure as of the previous

month end satisfies the requirements under Paragraph 16.5(a) of the Hong Kong Code of Conduct for persons licensed by or registered with the Securities

and Futures Commission. (For research published within the first ten days of the month, the disclosure may be based on the month end data from two

months’ prior.) J.P. Morgan Broking (Hong Kong) Limited is the liquidity provider for derivative warrants issued by J.P. Morgan International Derivatives

Ltd and listed on The Stock Exchange of Hong Kong Limited. An updated list can be found on HKEx website: http://www.hkex.com.hk/prod/dw/Lp.htm.

Korea: This report may have been edited or contributed to from time to time by affiliates of J.P. Morgan Securities (Far East) Ltd, Seoul branch.

Singapore: JPMSI and/or its affiliates may have a holding in any of the securities discussed in this report; for securities where the holding is 1% or

greater, the specific holding is disclosed in the Legal Disclosures section above. India: FOR PRIVATE CIRCULATION ONLY NOT FOR SALE.

Revised January 3, 2006.

THIS MATERIAL IS DISTRIBUTED IN JAPAN BY J.P. MORGAN SECURITIES ASIA PTE LIMITED.

THIS MATERIAL IS ISSUED AND DISTRIBUTED IN SINGAPORE BY J.P. MORGAN SECURITIES SINGAPORE

PRIVATE LIMITED [MICA (P) 235/09/2005].

THIS MATERIAL IS ISSUED AND DISTRIBUTED IN MALAYSIA BY JPMORGAN SECURITIES (MALAYSIA) SDN. BHD.

(18146-X) (FORMERLY KNOWN AS J.P. MORGAN MALAYSIA SDN BHD).

Copyright 2006 JPMorgan Chase & Co. All rights reserved. Additional information available upon request.

7

Bill Shope, CFA

(1-212) 622-6607

bill.c.shope@jpmorgan.com

North America Equity Research

23 March 2006