The One Minute Manager Prepares for Mediation: A

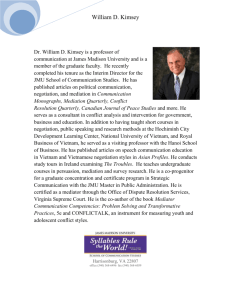

advertisement