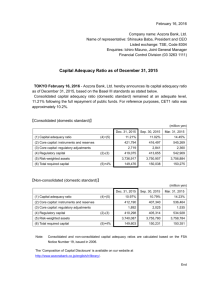

Status of Capital Adequacy

advertisement