U.S. Bottled Water Market

advertisement

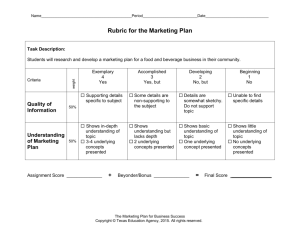

IBWA 2014 U.S. Bottled Water Market Market Trends November 13, 2014 Beverage Marketing Capabilities Beverage Marketing Corporation utilizes an integrated model for providing information, analysis and advice to beverage industry clients Unique Beverage Industry Expertise for Providing “Added-Value” to Selected Clients Cutting Edge Insights: New Age Emergence, Multiple Beverage Competition, Specialty Beer Opportunity, Bottled Water Dominance, Hyper-Category Competition Micro-Marketing Age Competition, Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market Trends The Agenda Overview of U.S. U S Beverage Market U.S. Bottled Water Market Projections j -3- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market State of the Industry – The Good and the Bad Beverage Headlines -4- o Liquid refreshment beverage market essentially flat in 2013 after three years of growth, but has rebounded in first half of 2014 o Niche categories are outperforming traditional mass-market categories o Bottled water strongest performing of mass-market categories o Steadily-improving Steadily improving economy remains best impetus for beverage category success o Outlook for modest g growth in 2014 Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market The economy continues to move in a positive direction with modest GDP growth for 21 straight quarters and unemployment now under 6% 6%, but improvement has been slow Quarterly GDP Change 2009 – 2014 Q3 Unemployment Rate 2000 – 2014* 10% 3.9% 3.8% 3.8% 2.5% 2.3% 1 7% 1.7% 4.6% 4.1% 3.5% 3.1% 2.5% 2.6% 1.8% 2.0% 2 0% 2.0% 1.1% 1.3% 1.3% 0.4% 0.4% 4.1% 8% 6% -0.7% 4% 2% -6.7% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 0% '00 '01 '02 '03 '04 '05 '06 '07 '08 '09 '10 '11 '12 '13 '14 2009 2010 2011 2012 2013 2014 * YTD through September 2014 Source: Beverage Marketing Corporation; Bureau of Economic Analysis, Department of Commerce, Department of Labor -5- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market Total beverage volume will grow modestly in 2014, a slight improvement from 2013 • Both h non-alcohol l h l and d alcohol l h l are experiencing growth h • Modest improvement in the economy has helped to boost beverage sales U.S. Beverage Market (Billions of Gallons) 2000 – 2014(P) 55.00 Non-Alcohol Growth 12/13 Growth 13/14(P) -0.8% 0.8% Non-Alcohol 0.4% 1.4% TOTAL 1.3% Alcohol 50.00 Alcohol 45.00 40.00 35.00 30.00 25.00 20.00 0.2% 15.00 10.00 5.00 ) 20 14 (P 20 13 20 12 20 11 20 10 20 09 20 08 20 07 20 06 20 05 20 04 20 03 20 02 20 01 20 00 0.00 P: Projected Source: Beverage Marketing Corporation -6- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market As the number of product categories has increased, so have the number of new product introductions New Beverage Product Introductions 2001 – 2013 5 3.8 4 Thousands off SKUs 39 3.9 4.0 4.4 4.7 3.2 2.9 9 3 2.6 27 2.7 2.6 2.0 2 1.7 1.6 2001 2002 1 0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Source: Beverage Marketing Corporation; Mintel -7- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market Despite negative publicity on refreshment beverages and especially CSDs, caloric intake from them has been steadily declining over the last decade, and is likely to continue to decline • The growth of bottled water and lower-calorie options have contributed to the caloric decline Calories Perr Capita Pe C er Day U.S. LRB Calories Per Capita Per Day 1990 – 2013 251.6 263.0 241.7 235.9 228.0 220.4 212.4 210.1 205.7 202.3 197.9 212.5 1990 1995 2000 2005 2006 2007 2008 2009 2010 2011 2012 2013 Source: Beverage Marketing Corporation -8- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market The carbonated soft drink category continues to struggle as consumers opt for both variety and healthier refreshment options CSD Volume Growth 2009 – 1H 2014 -0.8% -0.9% 0 9% -1.0% -1.2% -1.8% CAGR 08/13: -2.0% -1.8% -2 2.2% 2% -3.2% -4.0% 2008/09 2009/10 2010/11 2011/12 2012/13 Q1 13/14 Q2 13/14 1H 13/14 Source: Beverage Marketing Corporation -9- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market Fruit beverage volume has been declining in recent years because products are relatively expensive and high in calories Fruit Beverage Volume Growth 2009 – 1H 2014 0.0% -0.6% -1.0% -1.3% -2.0% -1.9% -2.3% -2.4% CAGR 08/13: -2.6% -3.0% 3 0% -3.4% -4.0% -4.1% -4.1% -5.0% 2008/09 2009/10 2010/11 2011/12 2012/13 Q1 13/14 Q2 13/14 1H 13/14 Source: Beverage Marketing Corporation -10- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market After experiencing strong growth in 2010 and 2011, sports drink consumption has been increasing at a more modest pace Sports Drink Volume Growth 2009 – 1H 2014 15.0% 10.3% 10.0% 7.6% 5.0% 2.3% 2.4% 3.7% 3.2% CAGR 08/13: +1.4% 0.6% 0.0% -5.0% -10.0% -15.0% -12.3% 2008/09 2009/10 2010/11 2011/12 2012/13 Q1 13/14 Q2 13/14 1H 13/14 Source: Beverage Marketing Corporation -11- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market Energy drinks have continued with solid growth in the first half of 2014, but weaker than the growth experienced 2010 through 2012 Energy Drink Volume Growth 2009 – 1H 2014 20.0% 17.2% 14.3% 10.0% CAGR 08/13: +9.0% 8.5% 7.6% 6.3% 5.5% 5.1% 0 2% 0.2% 0.0% 2008/09 2009/10 2010/11 2011/12 2012/13 Q1 13/14 Q2 13/14 1H 13/14 Source: Beverage Marketing Corporation -12- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market RTD tea category continues to grow but at a slower pace • In recent years, the category has benefited from its innovation and healthy positioning RTD Tea Volume Growth 2009 – 1H 2014 12.0% 10.1% 10.0% 8.0% 6.0% 5.3% CAGR 08/13: +4.5% 5.2% 4.0% 2.0% 2.8% 2.3% 1.7% 1.3% 0.7% 0.0% 2008/09 2009/10 2010/11 2011/12 2012/13 Q1 13/14 Q2 13/14 1H 13/14 Source: Beverage Marketing Corporation -13- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market RTD coffee has experienced continued solid growth since the recession • Nevertheless, the category remains the smallest of traditional LRB categories RTD Coffee Volume Growth 2009 – 1H 2014 15.0% 9.9% 10.0% 11.1% 9.5% 9.1% 8 3% 8.3% 7.1% CAGR 08/13: +6.0% 5.0% 2.4% 0.0% -2.2% -5.0% 2008/09 2009/10 2010/11 2011/12 2012/13 Q1 13/14 Q2 13/14 1H 13/14 Source: Beverage Marketing Corporation -14- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market Fluid milk volume continues to decline • After a modest 0.8% increase in 2009, declines have been in excess of 1% since • Pricing can often mean the difference between category growth and decline Milk Volume Growth 2009 – 1H 2014 0.0% 0.8% -1.0% -1.1% -1.7% -2.0% CAGR 08/13: -1.2% -1.5% -1.6% -2.3% -2.4% -3.0% -3.5% 3 5% -4.0% 2008/09 2009/10 2010/11 2011/12 2012/13 Q1 13/14 Q2 13/14 1H 13/14 Source: Beverage Marketing Corporation -15- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market The beer category has experienced lackluster performance over the last five years • Craft beers have been the category’s greatest bright spot Beer Volume Growth 2009 – 1H 2014 2.0% 1.2% 1.0% CAGR 08/13: -0.7% 0.0% -0.6% 0 6% -1.0% -0.9% -1.3% -1.2% -1.3% -1.5% -2.0% -2.1% -3.0% 2008/09 2009/10 2010/11 2011/12 2012/13 Q1 13/14 Q2 13/14 1H 13/14 Source: Beverage Marketing Corporation -16- Copyright © 2014 Beverage Marketing Corp. Overview of U.S. Beverage Market Wine and spirits have experienced consistent growth in recent years • Both have outperformed beer over the last five years Wine and Distilled Spirits Volume Growth 2009 – 1H 2014 4.0% Wine 3.2% 3.0% 3.0% 2.5%2.6% 2.6% 2.4% 2.1% 1.9% 2.0% 1.0% Spirits 2.4% Wine CAGR 08/13: +2.0% 2.1% 0.8% 0.7% Spirits CAGR 08/13: +2.8% 0.0% 2008/09 2009/10 2010/11 2011/12 2012/13 1H 13/14 Source: Beverage Marketing Corporation -17- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market Trends Agenda • Overview of U.S. Beverage Market • U.S. Bottled Water Market • Projections -18- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market State of the Industry Bottled Water Headlines • Most successful mass-market beverage category in the U. S. • Every segment is growing – a rare feat • Projections j show bottled water will surpass p CSDs by 2016 • With exception p of retail PET segment, g ,p pricing g is strong • Pricing g is at all-time low for retail PET • Category is best positioned since pre-recession -19- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market Bottled water already outsells CSDs in food stores in 17 cities • Wi With h bottled b l d water growing i and d CSDs CSD d declining, li i other h markets k are lik likely l to join this group 160 155 144 140 132 127 123 118 Total U.S. Food Index 80 108 105 103 102 102 102 101 97 Orland do Albany Washington, D.C. Tampa Houstton Hartfo ord/N. Haven n Dallass/Ft. Worth Phoen nix Sacramento Philad delphia Los Angeles San D Diego Miami San F Francisco Bosto on New Y York Las Ve egas 86 * Nielsen Food Markets 52 weeks ending 9/7/13; Bottled Water does not include flavored/enhanced water Source: AC Nielsen; NWNA -20- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market While carbonated soft drink pricing has risen, bottled water pricing has dipped. This is likely impacting the performance of both categories Wholesaler Dollars Per Gallon 2000 – 2013 4.5 2013 Absolute Price $3 99 $3.99 Price per Gallon 40 4.0 3.5 3.0 2.5 2.0 1.5 $1.26 1.0 2000 2001 2002 2003 2004 2005 CSDs 2006 2007 2008 2009 2010 2011 2012 2013 PET Single Serve Bottled Water Source: BMC Strategic Associates -21- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market Bottled water volume has rebounded since the depths of the recession with accelerating growth in recent years • The category is aided by its positioning as the ultimate health beverage • Additionally, it has gotten a boost from aggressive pricing Bottled Water Volume Growth 2009 – 1H 2014 8.2% 8.0% 7.5% 6.9% 6.2% 6.0% 4 7% 4.7% G Growth 4.1% 4.0% CAGR 08/13: +3.2% 3.5% 2.0% 0.0% -2.0% -2.5% -4.0% 2008/09 2009/10 2010/11 2011/12 2012/13 Q1 13/14 Q2 13/14 1H 13/14 Source: Beverage Marketing Corporation -22- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market On a quarterly basis, the bottled water category has shown consistently strong growth since 2011 • Growth in the first half of 2014 has accelerated over 2014 growth U.S. Bottled Water Market Quarterly Volume Growth 2011 – 1H 2014 10% 8.8% 8.2% Growth 8% 6% 7.5% 5.8% 5.5% 3.1% 4.7% 4.8% 4.8% 4.5% 4.5% 4.1% 4% 6.9% 6.4% 3.1% 2% 0% Q1 Q2 Q3 Q4 2011 Q1 Q2 Q3 2012 Q4 Q1 Q2 Q3 2013 Q4 Q1 Q2 1H 2014 Source: Beverage Marketing Corporation -23- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market Total bottled water revenues in 1H14 grew at a rate slightly under volume growth U.S. Bottled Water Market Quarterly Revenue Growth 2011 – 1H 2014 12% 10.1% 10% G Growth 8% 6.4% 6% 5.3% 5.6% 6.3% 5.3% 5.2% 3.6% 3.0% 2.5% 2.0% 2% 0% Q1 Q2 5.8% 4.5% 4.3% 4% 5.4% Q3 Q4 2011 Q1 Q2 Q3 2012 Q4 Q1 Q2 Q3 2013 Q4 Q1 Q2 1H 2014 Source: Beverage Marketing Corporation -24- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market Nestle Waters remains the leading bottled water company with a 30% share in 2013 • Private label powerhouse Niagara has gained the greatest share in the last five years U.S. Bottled Water Market Leading Companies by Volume Share 2008 All Other 36.9% Niagara 6.0% 2013 NWNA 32.5% Pepsi/Aquafina 6.2% DS Waters 6.4% CG Roxane 5.8% Coke/Dasani 6.2% All Other 29.4% NWNA 30.2% Pepsi/Aquafina 4.3% Niagara 19.1% DS Waters 5.5% Coke/Dasa 5.7% CG Roxane 5.8% Source: Beverage Marketing Corporation -25- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market Retail PET’s healthy positioning and aggressive pricing have combined to boost the segment in recent years • Private label has taken on an increasingly important role in the segment Retail PET Water Volume Growth 2009 – 1H 2014 12.0% 10.1% 10.0% 8.9% 8.1% G Growth 8.0% 8.1% 6.8% CAGR 08/13: +5.0% 6.1% 5.3% 6.0% 4.0% 2.0% 0.0% -2.0% -0.9% 2008/09 2009/10 2010/11 2011/12 2012/13 Q1 13/14 Q2 13/14 1H 13/14 *Includes single-serve sizes of bottled water 1.5 liters and smaller Source: Beverage Marketing Corporation -26- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market PET water dollars per gallon have continued to drop into the first half of 2014 • Stable cost environment and production efficiencies have contributed to pricing declines PET Waters Wholesale Dollars Per Gallon 2001 – 2014 1H Price Per Gallon Dollars Per Gallon Amount % 2001 YE $1.95 $0.00 0.00% 2002 YE $1.94 $ ($0.01)) ($ -0.51% 2003 YE $1.90 ($0.04) -2.06% 2004 YE $1.75 ($0.15) -7.89% 2005 YE $1.63 ($0.12) -6.86% 2006 YE $1.54 ($0.09) -5.52% 2007 YE $1.48 ($0.06) -3.90% 2008 YE $1.44 ($0.04) -2.70% 2009 YE $1.40 ($0.04) -2.78% 2010 YE $1.30 ($0.10) -7.14% 2011 YE $1.31 $0.01 0.77% 2012 YE $1.29 ($0.02) -1.53% 2013 YE $1.26 ($0.03) -2.33% 2014 Q1 $1.24 ($0.05) -3.70% 2014 Q2 $1 22 $1.22 ($0 04) ($0.04) -3.30% 3 30% 2014 1H $1.23 ($0.04) -3.50% $2.00 $1.94 $1.90 $1.90 Dollars Per Gallon Year Ch Change $1.80 $1.70 $1.60 $1.50 2001 YE to 2014 1H -$0.67 or -63.1% $1.75 $1.63 $1.54 $1.48 $1.44 $1.40 $1.40 $1.36 $1.29 $1.30 $1.30 $1 20 $1.20 $1.26 $1.24 $1.23 $1.29 $ $1.22 $1.10 Year Source: Beverage Marketing Corporation -27- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market While increasingly stable, PET water pricing continues to be historically aggressive and is likely likel to remain emain so at least into 2015 • Every-day pricing as low as $2.49-2.99 for 24-packs at retail Advances in Supply Chain Costs • High-speed bottle filling in a range of 1,500-1,800 bottles per minute • Stable resin costs • Continued bottle light-weighting -28- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market The growth of private label has resulted in purified water now outselling spring water in retail PET category Retail PET Bottled Water by SOURCE 1993 – 2013 1993 2003 2013 Purified 3.0% Purified 36.0% Spring 97.0% Spring 64.0% Purified 52.7% Spring 47.3% Source: -29- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market While branded water outsells private label in the retail PET segment, private label has made significant inroads over the last five years U.S. U S R Retail t il PET Water W t Market M k t Branded vs. Private Label 2008 2013 Private Label 12.8% Private Label 38.3% Branded 61.7% Branded 87.2% Source: Beverage Marketing Corporation -30- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market Economically-priced vended water has experienced growth ranging from modest to solid in recent years • Vended water serves as a value-priced bottled water option for consumers Vended Water Volume Growth 2011 – 2014 1H 6% 4.6% 4.5% 4.6% 4.7% 4.6% 4.1% 4.4% G Growth 4% % 2% 2.0% 2.1% 2.3% 2.8% 2.5% 1.5% 1.3% 1.2% 0% Q1 Q2 Q3 2011 Q4 Q1 Q2 Q3 2012 Q4 Q1 Q2 Q3 2013 Q4 Q1 Q2 1H 2014 Source: Beverage Marketing Corporation -31- Copyright © 2014 Beverage Marketing Corp. U.S. Bottled Water Market Trends Agenda • Overview of U.S. Beverage Market • U.S. Bottled Water Market • Projections -32- Copyright © 2014 Beverage Marketing Corp. Projections In the future, the marketplace will be characterized by numerous high-value, low relative volume opportunities (2008-2013 CAGR) High Growth Alc Pouches Hard Cider Coconut Water Enhanced RTD Teas 20% 0% Craft Beer Organic J i Juices Malterna Energy gy tives RTD Tequila Coffee SPFJ Vodka RTD Tea PET Water Domestic Wine Sports $10 Billion Drinks $5 Billion Enhanced 0% F it Fruit $1 Billion Waters Drinks 100% Imported Imported Premium Enhanced Juices Wine Beer CSDs Bulk/HOD Water Fruit Drinks -5% SS Dairyy Flavored Drinks Water $250 Million Projected Value Straight Whiskey 10% $500 Million Soy $25 Billion $35 Billion Milk Diet CSDs $50 Billion Regular CSDs Low Growth -33- Copyright © 2014 Beverage Marketing Corp. Projections Among LRBs, the strongest growth is projected for bottled water, sports beverages, energy g drinks and RTD tea and coffees • CSDs, milk and fruit beverages will need to innovate and provide healthier options to rekindle growth U S Beverage Market Projections by Category U.S. 2013 – 2015(P) Categories Non-Alcoholic CSDs Bottled Water PET F it B Fruit Beverages* * RTD Tea Sports Beverages Energy Drinks Value Added Water Value-Added RTD Coffee Subtotal Alcoholic Beer Wine Spirits Subtotal TOTAL Share 2014(P) 2015(P) 34.0% 26.7% 17.6% 8 5% 8.5% 4.0% 3.6% 1.4% 1 1% 1.1% 0.2% 79.8% 33.1% 28.2% 18.8% 8 2% 8.2% 4.1% 3.7% 1.5% 1 1% 1.1% 0.2% 80.0% 32.3% 29.3% 19.8% 7 9% 7.9% 4.1% 3.7% 1.6% 1 0% 1.0% 0.2% 80.2% -1.0% 7.1% 8.5% -2.8% 2 8% 2.6% 3.5% 6.8% -4.9% 4 9% 8.0% 2.0% -1.2% 5.6% 6.5% -2.3% 2 3% 2.7% 2.8% 6.0% -2.9% 2 9% 7.0% 1.6% 16.9% 16 9% 2.0% 1.3% 20.2% 100.0% 16.6% 16 6% 2.1% 1.3% 20.0% 100.0% 16.4% 16 4% 2.1% 1.3% 19.8% 100.0% 0.0% 0 0% 2.0% 1.5% 0.3% 1.7% 0.5% 0 5% 2.5% 2.0% 0.8% 1.4% 2013 Growth 13/14(P) 14(P)/15(P) P: Projected Source: Beverage Marketing Corporation -34- Copyright © 2014 Beverage Marketing Corp. Thank You Beverage Marketing Corporation • Consulting • Research • Advisory Services -35- Copyright © 2014 Beverage Marketing Corp.