Chapter 7 Case studies

advertisement

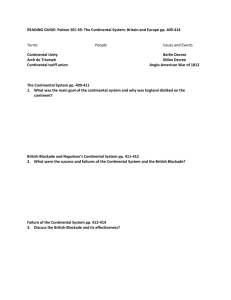

Author: Somers (ed.) www.europeancompetition.noordhoff.nl isbn: 978-90-01-77128-7 © 2012 Noordhoff Uitgevers bv Chapter 7 Case studies Case 1 United – Continental Merger Continental Airlines was a major American airline that merged with United Airlines. On May 3, 2010, Continental Airlines, Inc. and UAL, Inc. (the parent company of United Airlines) announced a merger via a stock swap, and on October 1, 2010, the merger closed and UAL changed its name to United Continental Holdings, Inc. During the integration period, both airlines were running separate operations under direction of a combined leadership team of the new parent company based in Chicago. On November 30, 2011, United Airlines was issued a single operating certificate. From a technical regulatory standpoint, Continental Airlines then ceased to exist as a separate air carrier. United and Continental are now considered one airline by the Federal Aviation Administration (FAA), and Continental pilots now use the "United" call sign in air traffic control. The reservations systems were merged at 1 am on March 3, 2012 and Continental.com was rebranded to be the new united.com. Ground operations will remain somewhat separate until early in 2012. The airline's last flight, Continental Flight 1267 occurred on March 2, 2012. Brussels, 27 July 2010 Mergers: Commission approves merger between United Air Lines and Continental Airlines The European Commission has cleared under the EU Merger Regulation the proposed merger between United Air Lines and Continental Airlines, both US carriers. After examining the operation, the Commission concluded that the transaction would not significantly impede effective competition in the European Economic Area (EEA) or any substantial part of it. United is a network airline providing domestic and international scheduled air passenger and cargo transport. United operates network hubs in Los Angeles, San Francisco, Denver, Washington and Chicago. It is a member of the Star Alliance and serves more than 230 US domestic and international destinations, 9 of which to the EEA/Switzerland. Continental is also a network airline providing domestic and international scheduled air passenger and cargo transport. Continental operates network hubs in Newark, Houston, Cleveland and Guam. It is also a member of the Star Alliance and serves 132 domestic and 137 international destinations, 26 of which to the EEA/Switzerland. The activities of the parties overlap in the provision of scheduled air passenger and cargo transport between the EEA and the US. The proposed merger only has a limited impact on air cargo transport because of the parties' limited presence in this market. Chapter 7 Case studies | 1 Author: Somers (ed.) www.europeancompetition.noordhoff.nl isbn: 978-90-01-77128-7 © 2012 Noordhoff Uitgevers bv As regards air passenger transport, United and Continental's networks are complementary as they have hubs in different US cities. The proposed merger therefore only leads to small, incremental increases in the market shares of the parties, where one airline markets seats on flights operated by another carrier or offers an indirect service in competition with a nonstop service operated by the other airline from its US hub. The Commission's investigation confirmed the complementary nature of United's and Continental's respective networks as regards transatlantic EEA-US routes and the fact that their combination will not give rise to concerns on any specific route. Both companies are members of the Star Alliance and cooperate extensively with Lufthansa and Air Canada through the A++ joint venture. The Commission's assessment focused on the impact of the proposed merger between United and Continental and is without prejudice to its ongoing investigation of the A++ joint venture (case 39.595 – AC/CO/LH/UA). Questions 1 Why is the European Commission concerned about the merger of nonEuropean companies? 2 Continental Airlines and United Airlines are both US based carriers. They are therefore American companies and are not registered in the European Union. Why does the European Commission have any authority to approve a merger of American companies? 3 How does the Commission establish if there is a violation of the merger rules (102 TFEU and Merger Control Regulation) in non-EU merger cases? Chapter 7 Case studies | 2