Abstracts for Case Studies and Readings

advertisement

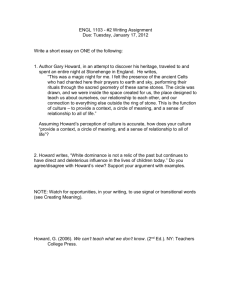

Abstracts for Case Studies and Readings Case studies 1. Dell’s Dilemma in Brazil: Negotiating at the State Level Dell has recently concluded a site selection process in Brazil to determine where it will locate its manufacturing plant in that country; it will be its first manufacturing plant in Latin America. After a lengthy site selection process in the first half of 1998, involving five states in Brazil—São Paulo, Rio de Janeiro, Paraná, Minas Gerais, and Rio Grande do Sul—Dell has decided to locate the plant in the state of Rio Grande do Sul, Brazil. Although a number of factors influence Dell’s decision, one of them is the generous incentives that Governor Antonio Britto of the relatively centrist Partido do Movimento Democratico Brasileiro (PMDB) has offered the company. However, after Dell makes this decision a new governor, Olivio Dutra of the Partido dos Trabalhadores (PT, or Workers’ Party) is elected in October 1998 and takes office in January 1999. The PT is a socialist party. Having made an issue of what he considered to be overly generous incentives offered to transnational corporations during his campaign, Governor Dutra seems likely to rescind the incentives that the Britto government had offered. Given this situation, Keith Maxwell, Dell’s Senior Vice President for Worldwide Operations, must make a recommendation to Michael Dell. The case presents three possible options for Dell: (1) leave Brazil entirely; (2) move the plant to another state within Brazil; (3) try to renegotiate with Governor Dutra. xviii abstracts for case studies and readings 2. Kmart De México S.A. De C.V. (Abridged) El Puerto de Liverpool, S.A. de C.V., one of Mexico’s oldest and largest retail department store chains, has entered into an agreement with U.S. retail giant Kmart Corporation to open and operate a series of Super Kmart Centers throughout Mexico. The new CEO of Kmart de Mexico must create the new Mexican organization. He must consider all elements of the Mexican business environment and assess how, separately and collectively, these elements will impact the transferability of the U.S. retail concept. Specifically, he must consider issues of store layout and design, food, management hiring, training programs, and corporate culture. 3. Unicord PLC: The Bumble Bee Acquisition This case pertains to a rags-to-riches-to-rags saga of a Thai firm whose acquisition of an American competitor both enabled it to become a global leader in the tuna fish processing industry and, shortly thereafter, led to its competitive demise. Although Unicord’s acquisition was supported by an apparently sound logic, various changes in its internal, external, and managerial domains proved too much for the firm to handle. Less than five years after Unicord acquired Bumble Bee, the company filed for bankruptcy. Dr. Juanjai Ajanant, special advisor to Unicord’s board, is charged with the daunting task of engineering Unicord’s turnaround. However, to do so, he must first analyze what had gone so wrong for the firm. The case provides a detailed history of pre- and post-acquisition events that would assist Dr. Juanjai in his task. 4. Nora-Sakari: A Proposed JV in Malaysia (Revised) This case presents the perspective of a Malaysian company, Nora Bhd, which was in the process of trying to establish a telecommunications joint venture with a Finnish firm, Sakari Oy. Negotiations have broken down between the firms, and students are asked to try to restructure a win-win deal. The case examines some of the most common issues involved in partner selection and design in international joint ventures. 5. Red Star China: Discovering the Essence of Guanxi (A) Set in September 2002, this case revolves around Howard Zhao, Senior VP (Brokerage) of Red Star China Shipping Company. Howard’s mandate is to secure future business with Nanjing ZP Chemical Company (NCC), a Sino-German joint venture. Howard believes he must first establish guanxi (i.e. a personal connection) with Pan Weidong, NCC’s Director of Logistics, to compete successfully against SSK Shipping, which is also striving for NCC’s lucrative business. If Red Star earns NCC’s business, it will ensure its own future in China. If SSK obtains the business, it will open an office in Shanghai and probably win over Red Star China’s existing customers. Howard abstracts for case studies and readings xix therefore needs to build guanxi with someone influential at NCC in order to differentiate Red Star China from SSK. That way, if the two competitors’ price and service levels are reasonably close to each other, the guanxi will favor Red Star. Case A describes Howard’s guanxi-building activities and suggests how guanxi can be used to offset a firm’s strategic weaknesses. Just as the relationship between Howard and Pan seems secure, Pan is apparently demoted. Howard has to decide whether to: (1) continue building guanxi with Pan, who appears to have lost his usefulness for satisfying Howard’s purposes; (2) switch his attention to NCC’s new Director of Logistics, Hans Hol, who is a German; (3) start all over again by finding a new person at NCC to build guanxi with. Case B outlines developments that aggravate Howard’s dilemma. After Howard makes his decision (above), Pan is re-transferred to NCC, albeit in a different role. Pan is visibly cold to Howard, who wonders how to repair the breach with Pan. Is such repair necessary to get NCC’s business? Should Howard make an effort to reintegrate himself with Pan, or should he work with Hans or someone else at NCC? 6. Hero Honda Motors (India) Ltd.: Is it Honda that Made it a Hero? The case focuses on a joint venture between Honda Motor Company (HMC) of Japan and the Hero Group, a conglomerate of Indian companies held by the Munjal family. Hero is the largest manufacturer of bicycles in the world and at that time had already dabbled in the motorized two-wheeler market with its mopeds. HMC entered into a 50/50 alliance with Hero to manufacture motorcycles for the Indian market. It assumed product design and technology transfer responsibilities, while Hero was in charge of manufacturing and marketing. The venture performed very well until the contract renewal period when Hero felt that HMC was slowing down its technology transfers. The agreement was extended for another ten years after protracted negotiations. Just as the relationship appeared to get better, HMC announced the setting up of a subsidiary in India to manufacture scooters. It said that the subsidiary would enter the motorcycle market in 2004. This grew from a split between Honda and its Indian partner in a venture that was manufacturing scooters. Having exited the venture, HMC wanted to go it alone. This caused serious concerns for Hero since HMC’s entry into the motorcycle market would threaten its very survival. The case closes with a set of issues that face Hero, and sets the stage for exploring alternative paths that Hero could take in managing its future. 7. Strategic Crossroads at Matáv: Hungary’s Telecommunications Powerhouse In September 2004, four months after Hungary joined the European Union, the strategy group of Matáv—Hungary’s largest communications company—is working on its mid-term strategic plan. Since being privatized from the state in 1993, the company has seen several changes in its strategy, structure and culture. Nearly 15 years later, the company is a fully integrated telecommunications company involved xx abstracts for case studies and readings in a broad range of services including fixed-line telephony, mobile communications, Internet services, data transmission and outsourcing. The company’s latest acquisition of a state-run telecommunications company is considered a success, and management believes that international expansion is necessary to realize dynamic growth as its domestic fixed-line business is declining. In addition, Hungary’s mobile market is highly competitive and saturated, with 80 percent of the country having a mobile phone. The management team feels that Matáv is at a crossroads with three main options: (1) expansion in Hungary; (2) regional expansion; (3) focusing on organic growth in existing product lines. The team has to consider all of the lines of business in forming a strategy and whether Matáv’s resources and organization are suitable for a healthy future. 8. Managing Pibrex Russia (A): New Crisis, Old Grievances Pibrex is one of the world’s largest developers of petrochemical-based polymers for the plastics market. The company has purchased a plant in Russia and after three years of serious operating losses has appointed a new general manager of the plant. The plant lacks a strong organizational culture; communications within and between departments are poor; inequity in wages, working conditions, and training exist but motivation and retention problems are prevalent; Pibrex headquarters is losing interest in the Russian operation, and two sub-cultures exist within the Pibrex Russia organization. The general manager must develop an action plan that can turn operations around with minimal expense to Pibrex. 9. Olly Racela in Bangkok A recent MBA graduate describes the joys and frustrations of an expatriate life— both at personal and professional levels—as experienced by a young, single woman. She has been living in Bangkok for three years and is slowly adjusting to the local way of life when she receives a job offer that will relocate her back to her home in Hawaii. Reaching a decision, however, is not easy given career-related uncertainties in both countries, as well as the array of conflicting emotions that confront her. She must decide how to sort through these issues. Should she remain in Bangkok or return home? Her decision is complicated by the fact that she had not entertained the idea of returning to the United States. Readings 10. Distance Still Matters: The Hard Reality of Global Expansion Companies routinely overestimate the attractiveness of foreign markets. Dazzled by the sheer size of untapped markets, they lose sight of the difficulties of pioneering new, often very different territories. The problem is rooted in the analytic tools (the abstracts for case studies and readings xxi most prominent being country portfolio analysis, or CPA) that managers use to judge international investments. By focusing on national wealth, consumer income, and people’s propensity to consume, CPA emphasizes potential sales, ignoring the costs and risks of doing business in a new market. Most of these costs and risks result from the barriers created by distance. “Distance,” however, does not refer only to geography; its other dimensions can make foreign markets considerably more or less attractive. The CAGE framework of distance presented here considers four attributes: cultural distance (religious beliefs, race, social norms, and language that are different for the target country and the country of the company considering expansion); administrative or political distance (colony–colonizer links, common currency, and trade arrangements); geographic distance (the physical distance between the two countries, the size of the target country, access to waterways and the ocean, internal topography, and transportation and communications infrastructures); and economic distance (disparities in the two countries’ wealth or consumer income, and variations in the cost and quality of financial and other resources). This framework can help to identify the ways in which potential markets may be distant from existing ones. The article explores how (and by how much) various types of distance can affect different types of industries, and shows how dramatically an explicit consideration of distance can change a company’s picture of its strategic options. 11. Strategy Under Uncertainty At the heart of the traditional approach to strategy lies the assumption that by applying a set of powerful analytic tools, executives can predict the future of any business accurately enough to allow them to choose a clear strategic direction. But what happens when the environment is so uncertain that no amount of analysis will allow us to predict the future? What makes for a good strategy in highly uncertain business environments? The authors, consultants at McKinsey & Company, argue that uncertainty requires a new way of thinking about strategy. All too often, they say, executives take a binary view: either they underestimate uncertainty to come up with the forecasts required by their companies’ planning or capital-budging processes, or they overestimate it, abandon all analysis, and go with their gut instinct. The authors outline a new approach that begins by making a crucial distinction among four discrete levels of uncertainty that any company might face. They then explain how a set of generic strategies—shaping the market, adapting to it, or reserving the right to play at a later time—can be used in each of the four levels. And they illustrate how these strategies can be implemented through a combination of three basic types of actions: big bets, options, and no-regrets moves. The framework can help managers determine which analytic tools can inform decision making under uncertainty—and which cannot. At a broader level, it offers xxii abstracts for case studies and readings executives a discipline for thinking rigorously and systematically about uncertainty and its implications for strategy. 12. Harnessing the Science of Persuasion If leadership, at its most basic, consists of getting things done through others, then persuasion is one of the leader’s essential tools. Many executives have assumed that this tool is beyond their grasp, available only to the charismatic and the eloquent. Over the past several decades, though, experimental psychologists have learned which methods reliably lead people to concede, comply, or change. Their research shows that persuasion is governed by several principles that can be taught and applied. The first principle is that people are more likely to follow someone who is similar to them than someone who is not. Wise managers, then, enlist peers to help make their cases. Second, people are more willing to cooperate with those who are not only like them but who like them, as well. So it’s worth taking the time to uncover real similarities and offer genuine praise. Third, experiments confirm the intuitive truth that people tend to treat you the way you treat them. It’s sound policy to do a favor before seeking one. Fourth, individuals are more likely to keep promises they make voluntarily and explicitly. The message for managers here is to get commitments in writing. Fifth, studies show that people really do defer to experts. So before they attempt to exert influence, executives should take pains to establish their own expertise and not assume that it’s self-evident. Finally, people want more of a commodity when it’s scarce; it follows, then, that exclusive information is more persuasive than widely available data. By mastering these principles—and, the author stresses, using them judiciously and ethically—executives can learn the elusive art of capturing an audience, swaying the undecided, and converting the opposition. 13. Achieving Business Success in Confucian Societies: The Importance of Guanxi (Connections) The web of interpersonal connections plays a key role in East and Southeast Asia business dealings. New research shows why and how. 14. The Role of Family Conglomerates in Emerging Markets: What Western Companies Should Know Large, diversified, family-owned businesses are dominant players in the economies of most emerging markets and can be excellent business partners for Western companies. This article highlights the evolutionary patterns of family conglomerates (FCs) and delineates principal drivers of their growth, expansion, and internationalization. Those aspects of FCs examined in this study include early mover advantages, abstracts for case studies and readings xxiii foreign alliances, competitive market positioning, and diversification. Also discussed are entry-mode considerations for Western companies contemplating doing business in the fast-growth markets of East Asia, Latin America, and elsewhere. 15. Transferring Management Knowledge to Russia: A Culturally Based Approach Russian managers entered the decade of the 1990s ill-prepared to manage their companies in the country’s chaotic transition to a market economy. This article draws lessons for transferring Western management knowledge to Russian managers from programs conducted over a ten-year period by the Rayter Group, a crosscultural training organization. The group’s experience underscores the transitional nature of business values among Russian managers, including the need to recognize the barriers and potential opportunities that traditional culture and values can create, as well as the potential for newly developing ones to support the transfer of Western knowledge. These two sets of values must be understood and appreciated by those transferring knowledge through the design and execution of management education programs, as well as in other situations like joint ventures and parent– subsidiary operations. The lessons presented in this article are grounded in the context of a culturally based approach to transferring knowledge that includes the culture, values, attitudes, and behaviors of Russian managers. These factors affect the capabilities of both transferors and receivers of knowledge to engage in effective knowledge transfer. The article concludes with recommendations for knowledge transfer in Russia that may also be useful in other transitional economies.