oaf 621 financial markets and institutions

advertisement

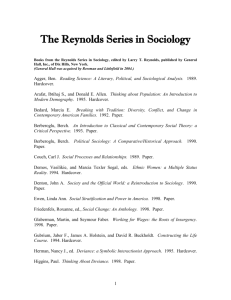

THE OPEN UNIVERSITY OF TANZANIA FACULTY OF BUSINESS MANAGEMENT DEPARTMENT OF ACCOUNTING AND FINANCE OAF 621 1.0 FINANCIAL MARKETS AND INSTITUTIONS COURSE OUTLINE Introduction: Financial markets and institutions are at the heart of the financial system – a network of markets and institutions to bring savers and borrowers together – of every economy. Together they play a vital role in the flow of funds. Financial markets such as the stock or bond markets provide a means for transferring funds from savers to borrowers while financial institutions act as intermediaries between savers and borrowers. The main objective of the course is to give students a solid understanding of the concepts, theories, practice and operations of financial markets and institutions. The course aims at introducing how the financial system works. The students will be introduced to Financial Markets and Institutions and learn how they operate in the Financial System. The course introduces several concepts about the Financial Markets and Institutions for the purpose of promoting understanding, skills and capabilities for dealing with them. Since the financial markets and institutions are the most important sources of short medium and long term financing in Tanzania, it is then imperative that financial managers to whom you all are aspiring become comfortable in dealing with their operations and challenges. This course is designed to help you achieve such a goal. Course Objectives: At the end of the course students will be able to: (i) Review role, functions and mechanisms of the financial system in an economy (ii) Review the legal and regulatory environment governing financial markets and institutions. (iii) Review interest structure, trends and their impact on the economy. (iv) Examine the role/functions/workings of banks, financial institutions, and financial markets and their relationship to economic activities with particular reference to Tanzania and other parts of the world. (v) Evaluate their effectiveness and efficiency in offering the intermediation function including micro financing to the economy. 1 (vi) Search and suggest ways which may enable these institutions to improve their operations. (vii) Review risk management in banks and financial institutions. (viii) make decisions about portfolio choices for making investments (ix) distinguish the differences of dealing with deposit taking and non deposit taking institutions. (x) deal with convertibility of foreign exchange with the general effects of derivatives as well as the aspects of financial innovation and financial engineering. 2.0 Course Content 2.1 Overview of the Financial System Function and Structure of Financial Markets Primary and Secondary Markets Regulations of the Financial System The Internationalization of Financial Markets • • • • 2.2 • • Fundamentals of Financial Markets: Functions of the Financial Markets Structure of the Financial markets Money and Capital Markets Debt Markets o Corporate debt securities o Government securities o Intermediary securities o Global debt securities Equity markets Exchanges and Over the Counter Markets • • • • Financial Intermediaries: Depository Institutions (Banks) Contractual Saving Institutions Investment Intermediaries Government Financial Intermediation • • • Financial Market Instruments: Financial Market Instruments Money Markets Instruments Capital Market Instruments • • • • 2.3 2.4 2 • 2.5 Mortgage Backed Securities o Agency mortgage backed securities o Collateralized mortgage obligations o Stripped mortgage backed securities o Non-agency mortgage backed securities o Commercial mortgage backed securities o Asset backed securities o Collateral debt instruments o Analysis of assets-backed securities • • • • • • • Managing Portfolio Choice: Determinants of Asset Demand (Wealth, Expected Returns, Risk, and Liquidity) The Theory of Asset Demand The Loanable Funds Theory Liquidity Preference Theory Interest Rates Theory Risk and Term Structure of Interest Rates. Measurement of Interest Rates • • • • • • • • • Deposit Taking Instructions: Banks: Definition and Functions Dual Banking System The process of Money Creation by banks Bank Lending and Demand for Money Bank Capital Requirement Branching Regulations International Banking Bank Regulation System Mutual Savings Banks • • • • • • • • Non Depository Institutions Insurance Companies\ Pension Funds Unit Trusts Saving and |Loan Associations Credit Unions and SACCOS Security Market Institutions Finance Companies Mutual Funds 2.6 2.7 3 2.8 • • • • • • Money and Capital Markets Fundamental Functions Financial Tools Market Significance Market Efficiency Market Similarities Market Differences • • • • • Foreign Exchange Markets Nature of Forex Markets Efficient Market Hypothesis Interest Rate Parity Difference in Interest Rates-(Fisher Effect) Fixed Exchange Rate Systems 2.9 2.10 • • • • • • 3.0 Financial Innovation: Economic Analysis of Innovation Financial Innovation- Risk Avoidance Future and Options for Financial Instruments Swaps o Interest rate swaps o Currency/foreign exchange swaps o Valuing swaps o Credit default in swaps Securitization Foreign Exchange Hedging ASSESSMENT The course will be assessed by three items as follows Compulsory student progressive portfolio (ungraded) Timed test 30% Final examination 70% Total 100% Pass mark shall be 50% 4 LIST OF REFERENCES 1. Roy Crum, Eugene Fundamentals of International Finance (with Thomson ONE and InfoTrac ) (Hardcover - Sep 8, 2004) 2. Brigham, and Joel F. Houston Fundamentals of International Finance (with Thomson ONE and InfoTrac ) (Hardcover - Sep 8, 2004) 3.David S. Kidwell, David W. Blackwell, David A. Whidbee and Richard L. Peterson and Richard L. Peterson- Financial Institutions, Markets, and Money (Hardcover - Jan 14, 2008) 4. Foundations of Financial Markets and Institutions (4th Edition) by Frank J. Fabozzi, Franco P. Modigliani, and Frank J. Jones (Hardcover - Feb 1, 2009) 5. Study Guide for Financial Markets and Institutions by Frederic S. Mishkin and Stanley G. Eakins (Paperback - Feb 16, 2008) 6. Financial Markets and Institutions: Customized: Selected Chapters and Study Guide, Eighth (8th) Edition by Jeff Madura (Paperback - 2008) 7. Financial Institutions, Markets And Money, 9th (Hardcover - Jan 1, 2005) 8. The Origin and Development of Financial Markets and Institutions: From the Seventeenth Century to the Present by Jeremy Atack and Larry Neal (Hardcover - Mar 16, 2009) 9. The Origin and Development of Financial Markets and Institutions: From the Seventeenth Century to the Present by Jeremy Atack and Larry Neal (Hardcover - Mar 16, 2009) 10.Financial Markets and Institutions: A Modern Perspective (The Mcgraw-Hill/Irwin Series in Finance, Insurance, and Real Estate) by Anthony Saunders (Hardcover - Feb 2003) 11.The U.S. Financial System: Money, Markets, and Institutions by George G. Kaufman (Hardcover - Feb 1995) 5 12 The U.S. Financial System: Money, Markets, and Institutions by George G. Kaufman (Hardcover - Feb 1995) 13. Financial Markets and Institutions in the Arab Economy by Nidal Rashid Sabri (Hardcover - May 2008) 14. Money and Capital Markets with S&P Bind-in Card (McGraw-Hill/Irwin Series in Finance, Insurance, and Real Est) by Peter Rose and Milton Marquis (Hardcover - Dec 7, 2007) 15. Capital Markets: Institutions and Instruments (4th Edition) by Frank J Fabozzi (Hardcover - Aug 4, 2008) 16.Money and Capital Markets by Miles Livingston (Paperback - Jun 13, 1996) 17.Investing From the Top Down: A Macro Approach to Capital Markets by Anthony Crescenzi (Hardcover - Sep 12, 2008) 18. Trading Strategies for Capital Markets by Joseph Benning (Hardcover - Aug 7, 2007) 19. Chaos and Order in the Capital Markets: A New View of Cycles, Prices, and Market Volatility (Wiley Finance) by Edgar E. Peters (Hardcover - Aug 1996) 20. Emerging Capital Markets and Globalization: The Latin American Experience (Latin American Development Forum) by Augusto de la Torre and Sergio Schmukler (Hardcover - Oct 30, 2006) 21. Economics of Money, Banking and Financial Markets (9th Edition) by Frederic S. Mishkin (Hardcover - Jul 25, 2009) 22. Stigum's Money Market, 4E by Marcia Stigum and Anthony Crescenzi (Hardcover Feb 9, 2007) 23. Principles of Money, Banking & Financial Markets plus MyEconLab plus eBook 1semester Student Access Kit (12th Edition) by Lawrence S. Ritter, William L. Silber, and Gregory F. Udell (Hardcover - Sep 28, 2008) 24. The Money Market by Marcia Stigum (Hardcover - Dec 1, 1989) 25. Commodity Market Money Management by Fred Gehm (Hardcover - Jan 1, 1983) 6 26. Bond and Money Markets: Strategy, Trading, Analysis (Paperback) by Moorad Choudhry 27. The Treasury Bond Basis: An in-Depth Analysis for Hedgers, Speculators, and Arbitrageurs (McGraw-Hill Library of Investment and Finance) (Hardcover) by Galen Burghardt 7