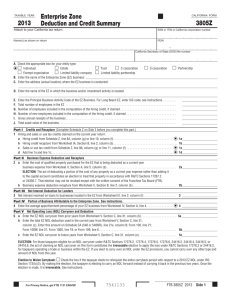

2012-FTB3805Z-booklet - Santa Clarita Valley Enterprise Zone

advertisement