Ocean Container Transport Logistics: Making Global Supply Chain

advertisement

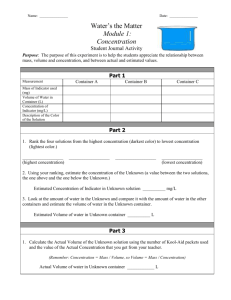

Ocean Container Transport Logistics: Making Global Supply Chain Effective Chung-Yee Lee Logistics and Supply Chain Management Institute Dept. of Industrial Engineering & Logistics Management Hong Kong University of Science & Technology IFSPA 2014 May 19, 2014 Why is ocean container transport important? Global supply chain outsourced and move offshore. Transportation ocean transport containerized World container traffic has been growing at almost 3 times world GDP growth* (since 1990s) Air cargo: (3.1% in 2000 1.7 % in 2013) ** (modal shift to sea and surface transport) In the Chinese export supply chain only, we estimate that at least $85B is caught up in inventory during container transport from China to destinations abroad***. (This is more than total inventory in all US department stores) *UN-ESCAP 2005 **: International Air Transport Association ***:http://www.funggroup.com/eng/knowledge/research/ChinaTradeQuarterly1Q13.pdf 2 An Understudied Area in OR/MS • Maritime Economics (Theo Notteboom …) • OR/MS: container terminal operations management Steenken et al. 2004, Stahlbock et al., 2008, Günther and Kim, 2006, and others. Contract, variability, capacity, pricing, reliability, disruption, …., ---- extremely important problems in ocean container transport. Fransoo and Lee(2013) 3 • Current Status and Trends of Ocean Container Transport • Challenges and Opportunities: Research Issues 4 Containerization: Revolutionizes Ocean Shipping Marc Levinson, The Box: How the Shipping Container Made the World Smaller and the World Economy Bigger, Princeton University Press, 2006, New Jersey, U.S. 5 Bill Gates’ Top 7 Books In 2013 Box is the top one Gates says: “You might think you don’t want to read a whole book about shipping containers… But he makes a good case that the move to containerized shipping had an enormous impact on the global economy and changed the way the world does business. And he turns it into a very readable narrative. I won’t look at a cargo ship in quite the same way again.” 6 Source: http://www.buzzfeed.com/mattlynley/bill-gates-top-7-books-in-2013 Consignee Factory FF(W/H) FF(W/H) Inland Delivery Inland delivery Vessel Container terminal A 7 Container terminal B Container Shipping Industry Value Chain and Segment 2007 Segment Percentage 1 Shipment and capacity procurement $32B 16% 2 Provide containers $8B 4% 3 Provide and operate vessels $102B 50% 4 Terminal operation $35B 17% 5 Inland Delivery $28B 13% *: source: Merge Global (2007) 8 Revenue Top 10 Carriers (May 17, 2014) Rank Liner Mkt share 1 A.P. Möller-Maersk (DK) 2,682,386 14.8% 2 Mediterranean Shg Co (IT) 2,439,358 13.5% 3 CMA CGM Group (FR) 1,528,052 8.4% 4 Evergreen Group (TW) 893,818 4.9% 5 COSCO Container (CN) 789,245 4.4% 6 Hapag-Lloyd (DE) 772,410 4.3% 7 CSCL (CN) 618,583 3.4% 8 APL (Singapore) 617,841 3.4% 9 MOL (Japan) 592,725 3.3% 10 Hanjin (KR) 583,717 3.2% OOCL: # 12 (2.7%) 9 LTEU Top 20 Carriers Total (MTEU) Percentage Year -----------------------------------------------------2 54% 1995 4 71% 2001 11.7 82% 2010 14.9 85% 2013 2014/5; 10 Top 5: Top 10: Top 20: 46.0% 63.2% 84.3% 10 Vessel Size Main vessel sizes – Under-Panamax (< 3000 TEU) – Panamax (3000 – 6000 TEU) – Post-Panamax (Over 6000 TEU) – (Emma Maersk 2006): 15200 TEU/vessel • Triple E Class (2013): 18,000TEU 11 Characteristics of Shipping Line Industry Capital Intense High Fixed Cost Limited Differentiation in Service Low Demand Elasticity Volatility of Freight Price 12 Pricing Issues Shipping line industry lost $15B in 2009, earned 14B in 2010. Spot rates from Hong Kong to Los Angeles • $871 per FEU (July: Lowest in 2009) • $2,838 per FEU (August 2010) (225.7% increase): high volatility • 13 Drewry Shipper Consultants’ Container Rate Benchmark,March 31, 2011 2013 Result In US$ Revenue Op. Profit Margin Maersk CMACGM Wan Hai Hapag-Lloyd OOCL K Line 26,196 15,902 2,006 8,718 6,205 6,116 1,524 756 75 89 57 29 5.8% 4.8% 3.7% 1.0% 0.9% 0.5% Source: Alphaliner Weekly Newsletter (2014, Issue 14) 14 14 NYK CCNI MOL COSCON APL HMM EMC Zim Hanjin Shg RCL CSCL CSAV Yang Ming 15 5,807 841 7,061 7,795 7,329 4,632 4,679 3,682 7,695 427 5,472 3,206 3,995 -29 -8 -124 -159 -231 -156 -172 -139 -290 -23 -387 -238 -327 -0.5% -1.0% -1.8% -2.0% -3.2% -3.4% -3.7% -3.8% -3.8% -5.3% -7.1% -7.4% -8.2% 15 Alliance Grand + New world + CKYH G6 (Grand Alliance + New World Alliance) (18.5%) Grand Alliance: Hapag-Lloyd, NYK and OOCL (9.7%) New World Alliance: APL, MOL, HMM (8.8%) Maserk, CMA-CGM and MSC (36.7%): VSA (Vessel Sharing Agreement) (P3 Network: Asia-NA; Asia-Europe; NA-Europe) CKYHE Alliance (Green Alliance) : COSCO, K-Line, Yang Ming, Hanjin + Evergreen (start from April 2014) (16.6%) Total: 71.8% 16 Top 10 World Container Terminals: 1995-2004 000 TEUS Order 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 Hong Kong 19 144 Hong Kong 20 449 Hong Kong 21 984 1 HongKong 12 550 HongKong 13 460 HongKong 14 567 Singapore 15 100 HongKong 16 211 Hong Kong 18 098 Hong Kong 17 826 2 Singapore 11 846 Singapore 12 944 Singapore 14 140 HongKong 14 582 Singapore 15 945 Singapore 17 087 Singapore 15 571 Singapore 16 941 Singapore 18 411 Singapore 21 329 3 Kaohsiung 4 900 Kaohsiung 5 063 Kaohsiung 5 693 Kaohsiung 6 271 Kaohsiun 6 985 Pusan 7 540 Pusan 8 073 Pusan 9 453 Shanghai 11 280 Shanghai 14 557 4 Rotterdam 4 787 Rotterdam 5 007 Rotterdam 5 340 Rotterdam 6 011 Pusan 6 440 Kaohsiung 7 426 Kaohsiung 7 541 Shanghai 8 610 Shenzhen 10 650 Shenzhen 13 626 5 Pusan 4 503 Pusan 4 684 Pusan 5 234 Pusan 5 946 Rotterdam 6 400 Rotterdam 6 275 Shanghai 6 340 Kaohsiung 8 493 Pusan 10 408 Pusan 11 442 6 Hamburg 2 890 Hamburg 3 054 Long Beach 3 505 Long Beach 4 098 Long Beach 4 408 Shanghai 5 612 Rotterdam 6 096 Shenzhen 7 614 Kaohsiun g 8 843 Kaohsiung 9 714 Long Beach 2 844 Long Beach 3 007 Hamburg 3 337 Hamburg 3 550 Shanghai 4 210 Los Angeles 4 879 Los Angeles 5 184 Rotterdam 6 506 Los Angeles 7 179 Rotterdam 8 281 Yokohama 2 757 Los Angeles 2 683 Anterwp 2 969 Los Angeles 3 378 Los Angeles 3 829 Long Beach 4 601 Shenzhen 5 043 Los Angeles 6 106 Rotterda m 7 107 Los Angeles 7 321 Los Angeles 2 555 Anterwp 2 620 Los Angeles 2 960 Anterwp 3 266 Hamburg 3 750 Hamburg 4 248 Hamburg 4 689 Hamburg 5 374 Hamburg 6 138 Hamburg 7 003 Anterwp 2 329 Yokohama 2 400 Dubai 2 600 Shanghai 3 066 Anterwp 3 614 Anterwp 4 082 Long Beach 4 463 Anterwp 4 777 Anterwp 5 445 17Dubai 7 8 9 10 Source : Marine Department, Port and Maritime Statistics 6 429 Top 10 World Container Terminals: 2005-2012 Rank 1 2 3 4 5 6 7 8 9 2005 2006 2007 2008 2009 2010 2011 2012 Singapore Singapore Singapore Singapore Singapore Shanghai 23.2 24.8 27.9 29.9 25.9 29.1 Shanghai 31.7 Shanghai 32.6 Hong Kong Hong Kong Shanghai Shanghai Shanghai Singapore Singapore Singapore 22.3 23.2 26.1 28.0 25.0 28.4 29.9 31.7 Shanghai Shanghai Hong Kong Hong Kong Hong Kong Hong Kong Hong Kong Hong Kong 18.1 21.7 24.0 24.5 21.0 23.7 24.4 23.1 Shenzhen Shenzhen Shenzhen Shenzhen Shenzhen Shenzhen Shenzhen Shenzhen 16.2 18.5 21.1 21.4 18.3 22.5 22.6 23.0 Pusan Pusan Pusan Busan Busan Busan Busan Busan 11.8 12.0 13.3 13.4 11.9 14.2 16.2 17.0 Kaohsiung Kaohsiung Rotterdam Dubai LA/LB LA/LB Ningbo Ningbo 9.5 9.8 10.8 11.8 11.8 14.1 14.7 16.8 Rotterdam Rotterdam Dubai Guangzhou Dubai Ningbo Guangzhou Guangzhou 9.3 9.7 10.6 11.0 11.1 13.1 14.4 14.7 Hamburg Dubai Kaoshsiung Ningb Guangzhou Guangzhou 8.1 8.9 10.3 10.9 11.0 12.6 LA/LB 14.0 Qingdao 14.5 Dubai Hamburg Hamburg Rotterdam Ningbo 7.6 8.8 9.9 10.8 10.5 Qingdao 12.0 Qingdao 13.0 LA/LB 14. Los Angeles 8.5 Qingdao 9.5 Qingdao 10.3 Qingdao 10.3 Dubai 11.6 Rotterdam Dubai 11.9 13.3 18 Los Angeles 10 7.5 Remark on Throughput The worldwide containerized trade*: 126 M TEU (2009) Worldwide container throughput: 450M TEU (2009)** Transit: In and out Transshipment, Empty container, Barge …. • • 19 *: Source : Ding, D. and C.-P. Teo, 2009. World Container Port Throughput Follows Lognormal Distribution, **: Source: http://www.xpgco.com.cn/web/newsdetail.aspx?id=7761 Nonvessel-operating Common Carrier (NVOCC) Serves primarily as wholesales of ocean vessel capacity Booking large blocks of container space Selling these out in small quantities to shippers. 20 Direct Customer vs. Freight Forwarder Freight Forwarder: Nonvessel-operating common carrier (NVOCC) Shipper Type Asia /Europe trade: 70% Freight Forwarder (DHL, Kuehne + Nagel and Schenker are strongest in Asia/Europe sale) Transpacific: 70% Direct Customer 21 *: source: http://en.wikipedia.org/wiki/Shipbuilding#cite_note-11 Top Three Ship Builders Hyundai Heavy Industries, Samsung Heavy Industries, Daewoo Shipbuilding & Marine Engineering, all in Korea. World shipbuilding production by countries (2013) China: 45% Korea: 29% Japan: 18% 22 *: source: http://en.wikipedia.org/wiki/Shipbuilding#cite_note-11 Container Manufacturers China is the world leading container manufacturer. The biggest container manufacturer is China International Marine Containers Ltd. (CIMC) . 23 *: source: http://en.wikipedia.org/wiki/Shipbuilding#cite_note-11 • Current Status and Trends of Ocean Container Transport • Challenges and Opportunities: Research Issues 24 Theme-Based Research Project: Transforming Hong Kong’s Ocean Container Transport Logistics Network Project Coordinator: Chung-Yee Lee (HKUST) Co-PIs: Albert Ha, Jeff Hong, Qian Liu, Ho-Yin Mak, Xiangtong Qi, Hongtao Zhang, Jiheng Zhang, Rachel Zhang (IELM & ISOM at HKUST), James Wang (Geography at HKU) Houmin Yan (School of Business at City U) Collaborators: Jan Fransoo (Eindhoven U of Tech, Netherlands) Kap Hwan Kim (Pusan Univ. Korea) Zhou Xu (HK Poly-U) … NUS, UK,…………. Project Management Regular seminar every two months Management team meeting semi-annually Project Coordinator (Chung-Yee Lee) Tactical Planning Area Coordinator: (Chung-Yee Lee) Strategic Planning Area Coordinator: (Albert Ha) Strategic Future Direction Area Coordinator: (James Wang) Industry Advisory Board Integrated Decision Support System Area Coordinator: (Houmin Yan) 2 Research Issues • Container port productivity improvement • Empty container • Pricing • Slow streaming • Competition between ports, carriers and container terminals • Safety and disruption management 27 Container Port Productivity Improvement Motivation: Port congestion contributed to 65.5% of the schedule unreliability. (Notteboom 2006) “Bigger ships and tighter supply chains shine a new light on port productivity and its importance to shippers”. (JOC July 22, 2013) Terminal Operation System Steenken et al. 2004 29 Terminal Operation Systems • • • • • • • 30 Berth allocation Quay crane operation Shuttle carrier operation Seaside operation Reshuffle and housekeeping Landside operation External trucks operation Key Performance Index (KPI) Throughput: Quay Crane Productivity: 31 Quay side operation and multi-lift QC 32 www.zpmc.com Research Progress Yard Operations: Yu and Qi, (2012);Akyuz and Lee (2013) Berth Allocation: Xu and Lee (2013) (New lower bound: 10 times better ) (Heuristic: 20-40% better) (Exact: 25% larger problem with only 25% time) Quay Crane Double-Cycling With Hatch Covers: Lee, Liu and Chu (2013) (The first optimal algorithm in polynomial time) 33 Research Issues • Container port productivity improvement • Empty container repositioning 34 Major Causes of Empty Container Imbalance • Trade imbalances • Repositioning costs vs. container manufacturing and leasing costs • Usage preferences (i. Companies use containers to promote name-brand, ii. Lack of shared information on container positions and numbers.) An extremely challenging issue, and a very important and emerging research topic for the supply chain community 35 Our Works Many papers have been published in this area. Zhou and Lee (2009) Chen, Chang and Lee (2013) Tsang and Mak (2013) Xie and Yan (2013) * Gao, Lee and Mak (2013) Chen, Chang and Lee (2014) …….. The empty container management is an extremely challenging issue, and a very important and emerging research topic for the supply chain 36 community. Trade lane • In the prevalent organization of a shipping line: – trade lanes independently manage business between market sectors – headquarters control high-level repositioning • Order acceptance affects empty container repositioning Asia Europe N. America Research Issues • Container port productivity improvement • Empty container repositioning • Pricing 38 Pricing Issues Shipping line industry lost $15B in 2009, earned 14B in 2010. Spot rates from Hong Kong to Los Angeles • $871 per FEU (July: Lowest in 2009) • $2,838 per FEU (August 2010) (225.7% increase): high volatility • 39 Drewry Shipper Consultants’ Container Rate Benchmark,March 31, 2011 Pricing Issue NVOCC vs. BCO Nonvessel-operating common carrier (NVOCC) Beneficial container owner (BCO):Direct customer Spot price vs. Fixed price 40 Contract Systems Long term contract (BCO) 3PL (NVOCC) Carrier Spot market Long term contract (BCO) Shipper Spot market Long term contract (BCO) Spot market Pricing Issues Freight forwarders may not make binding commitments to a contract price when the spot market price is lower 42 Research Question: Knowing that freight forwarders may not credibly commit to freight services they may have contracted for, how should a carrier set negotiated prices and allocate capacity when designing service contracts with different types of shippers? Contract Theory, Pricing policy….. 43 Research Progress (Revenue Management) An, Lee and Tang (2013) (Fractional Price Matching Policies) Lee, Liu and Zheng (2013) (Dynamic Contract Design) …. 44 Research Issues • Container port productivity improvement • Empty container repositioning • Pricing • Slow streaming 45 Slow Steaming Issues 2009: Reduce the capacity by idling vessels Decrease the vessel speed (Slow Steaming): to absorb capacity and cut costs. 46 Idle aircraft parked in the desert at Victorville 47 SOURCE: Airliners.net Idling Vessels Outside Singapore 48 SOURCE: “Ghost Fleet of Recession”, Daily Mail, Sept13, 2009 Slow Steaming 1 Knot = 1.852 km/h =1.151 mph 23-25 20-22 17-19 14-16 49 Full Speed Steaming Slow Steaming Extra Slow Steaming Super Slow Steaming Fuel consumption cost per container per nautical mile, indexed (18 knots and 5,000 TEU vessel =100), (Fransoo and Lee 2009) 50 Slow Steaming: Slow Steaming: • Introduced during the recession to absorb capacity and cut costs. • Slow steaming still prevalent because it i) reduces fuel costs, ii) reduces the carriers' carbon footprint, and iii) improves scheduled reliability?? 51 Impact Concern: (Slow Steaming: Challenges of Supply Chain Sustainability; Globalization or localization?) 52 Literature • Qi and Song (2012) • Lee, Lee and Zhang (2012) …….. 53 OOCL Optimal Schedule Planning Data, Computing and Service Research Issues • Container port productivity improvement • Empty container • Slow steaming issues • Pricing • The coordination of container shipments across the container supply chain 56 Coordination Issues operation: contract: FF (W/H) FF(W/H) Inland delivery Inland delivery Vessel 57 Container terminal A Container terminal B Research Question: To coordinate a container supply chain, it is necessary to consider contracting at multiple levels that involve several agents. How to coordinate inland delivery and terminal operator? Should the LSP or the ocean carrier takes the lead in coordinating the supply chain? What is the value of information sharing? 58 Our Works Yu, Kim and Lee (2013) (Free Time Limit vs. Free Space Limit) Xiao and Ha (2013) (Unloading and Storage Pricing Strategies) Zhang and Lee (2013) : (The Value of Information Sharing) Lu, Fransoo and Lee (2013) (Carrier Portfolio Management: Shipper’s Viewpoint) Wang, Meng and Lee(2013) (Liner Container Assignment Model: Carrier’s Viewpoint) 59 Research Issues • Container port efficiency improvement • Empty container • Slow Steaming • Pricing • The coordination of container shipments across the container supply chain • Competition between ports, carriers and 60 container terminals Port Competition: Who selects the port/terminal? HK: origin-destination flow transshipment flow Time Service Quality Cost … 61 World Bank Global Logistics Performance Ranking (2012) 1.Customs 2.Infrastructure 3.International Shipment Singapore: 1 Hong Kong: 2 Finland : 3 Germany : 4 Netherland: 5 Taiwan: 19 China: 26 4.Logistics Quality and Competence 5.Tracking and Tracing 6.Timeliness … http://siteresources.worldbank.org/TRADE/Resources/2390701336654966193/LPI_2012_final.pdf 62 Country World Bank Global Logistics Performance Ranking(2010) Rank Score France 17 3.84 Portugal 34 3.34 Germany 1 4.11 Australia 18 3.84 Thailand 35 3.29 Singapore 2 4.09 Austria 19 3.76 Kuwait 36 3.28 Sweden 3 4.08 Taiwan 20 3.71 Latvia 37 3.25 Netherlands 4 4.07 New Zealand 21 3.65 Slovak Republic 38 3.24 Luxembourg 5 3.98 Italy 22 3.64 Turkey 39 3.22 Switzerland 6 3.97 Korea 23 3.64 Saudi Arabia 40 3.22 Japan 7 3.97 United Arab 24 3.63 Brazil 41 3.20 United Kingdom 8 3.95 Spain 25 3.63 Iceland 42 3.20 Belgium 9 3.94 Czech Republic 26 3.51 Estonia 43 3.16 Norway 10 3.93 China 27 3.49 Philippines 44 3.14 Ireland 11 3.89 South Africa 28 3.46 Lithuania 45 3.13 Finland 12 3.89 Malaysia 29 3.44 Cyprus 46 3.13 Hong Kong 13 3.88 Poland 30 3.44 India 47 3.12 Canada 14 3.87 Israel 31 3.41 Argentina 48 3.10 United States 15 3.86 Bahrain 32 3.37 Chile 49 3.00 Denmark 16 3.85 Lebanon 33 3.34 Mexico 50 3.05 Source : www.worldbank.org/lpi 63 World Bank Global Logistics Performance Ranking(2007) Country Rank Score Australia 17 3.79 Turkey 34 3.15 Singapore 1 4.19 France 18 3.76 Hungary 35 3.15 Netherlands 2 4.18 New Zealand 19 3.75 Bahrain 36 3.15 Germany 3 4.10 United Arab Emirates 20 3.73 Slovenia 37 3.14 Sweden 4 4.08 Taiwan, China 21 3.64 Crech Republic 38 3.13 Austria 5 4.06 Italy 22 3.58 India 39 3.07 Japan 6 4.02 Luxembourg 23 3.54 Poland 40 3.04 Switzerland 7 4.02 South Africa 24 3.53 South Arabia 41 3.02 Hong Kong, China 8 4.00 Korea, Rep. 25 3.52 Latvia 42 3.02 United Kingdom 9 3.99 Spain 26 3.52 Indonesia 43 3.01 Canada 10 3.92 Malaysia 27 3.48 Kuwait 44 2.99 Ireland 11 3.91 Portugal 28 3.38 Argentina 45 2.98 Belgium 12 3.89 Greece 29 3.36 Qatar 46 2.98 Denmark 13 3.86 China 30 3.32 Estonia 47 2.96 United States 14 3.84 Thailand 31 3.31 Oman 48 2.92 Finland 15 3.82 Chile 32 3.25 Cyprus 49 64 2.92 Norway 16 3.81 Israel 33 3.21 Source : www.worldbank.org/lpi Slovakia Republic 50 2.92 Port Competition: Lee and Wang (2006) Li and Zhang (2013) Yu, Lee and Wang (2013) Shan, Yu and Lee (2013) 65 Research Issues • • • • Container port productivity improvement Empty container Pricing and capacity The coordination of container shipments across the container supply chain • Competition between ports, carriers and container terminals • Safety and disruption management 66 Piracy Where does it take place ? Policy: Hire security guard from India Changing its route and speeding up (Wang and Qi) 69 Policy “Britney Spears songs used to scare off pirates in Somalia” (METRO: 27 Oct 2013) Invoice? 70 Disruption Management Disruptions: weather, terminal congestion, … etc. Strategies: speed up, change route, skip a port,…etc. Li, Qi and Lee(2013) LI, Qi and Song (2014) Research Issues • • • • Container port productivity improvement Empty container Pricing and capacity The coordination of container shipments across the container supply chain • Competition between ports, carriers and container terminals • Safety and disruption management • Hinterland transport (Europe: Demurrage and Detention) 72 Challenges and Opportunities Logistics Industry: (Land, Labor, Competition, overcapacity… etc.) Academic Research: (Domain Knowledge, Cross-disciplinary Areas, Industry Application/Government Policy…etc.) Book: (Lee and Meng): Springer 2015 Ocean Container Transport Logistics: Making Global Supply Chain Effective 73 Acknowledgement: RGC, OOCL, HIT, PHILIPS, HK Shippers’ Council, APL, DHL, IDS, China Merchants Group,… Thank You !!! 74