Int. J. Production Economics 129 (2011) 277–283

Contents lists available at ScienceDirect

Int. J. Production Economics

journal homepage: www.elsevier.com/locate/ijpe

Supplier development and the relationship life-cycle

Stephan M. Wagner n

Chair of Logistics Management, Department of Management, Technology, and Economics, Swiss Federal Institute of Technology Zurich, Scheuchzerstrasse 7, 8092 Zurich, Switzerland

a r t i c l e in f o

abstract

Article history:

Received 7 July 2008

Accepted 22 October 2010

Available online 27 October 2010

The mainstream view holds that over time buyer–supplier relationships evolve through a number of

phases. As a consequence, supplier development as a buyer–supplier relationship management practice

should also be adapted to the life-cycle phase. Supplier development activities matching the buyer–

supplier relationship life-cycle phase will lead to more favorable performance improvements. However,

prior studies have neglected the relationship life-cycle perspective. This empirical study shows how the

length of the buyer–supplier relationship can be used to improve the explanatory power of models

investigating the performance outcomes of supplier development activities. The results show that

supplier development is more effective in mature as opposed to initial and declining life-cycles phases.

& 2010 Elsevier B.V. All rights reserved.

Keywords:

Supplier development

Buyer–supplier relationship

Relationship life-cycle

Social capital theory

Regression analysis

Curvilinear relationship

1. Introduction

There is ample anecdotal evidence in corporate practice and

academic research that supplier development as any set of

activities a buying firm expends on a supplier to improve supplier

performance and/or supplier capabilities (Krause et al., 2000) can

help to meet supply needs and generate favorable results for the

buying firm. Recognizing the long-term and strategic benefits of

supplier development, many companies have established supplier

development programs and teams. Honda of America, for example,

has adopted the BP (‘‘Best Practice, Best Process, and Best Performance’’) supplier development program to help suppliers in

implementing the Kaizen philosophy for continuous improvement

and organizational change (MacDuffie and Helper, 1997; Sako,

2004). John Deere built up a systematic supplier development

approach to upgrade suppliers’ just-in-time capabilities. Working

with John Deere’s supplier development teams, suppliers were able

to achieve dramatic reductions in cycle time (Golden, 1999).

Several aerospace and defense companies, including Boeing, Lockheed, Northrop Grumman, Rockwell Collins, Parker Aerospace, and

United Technologies, joined forces and established a program

called the ‘‘Supplier Excellence Alliance’’ with the goal to share

best practices with suppliers and to realize improvements in

quality, on-time delivery, and inventory levels at the suppliers.

After a few years into the program the tier-one suppliers now began

to share with their own suppliers what they have learned from the

aerospace and defense companies (Avery, 2008). By consulting

with the problem solving teams of Toyota’s Operations

n

Tel.: + 41 44 632 3259; fax: + 41 44 632 1526.

E-mail address: stwagner@ethz.ch

0925-5273/$ - see front matter & 2010 Elsevier B.V. All rights reserved.

doi:10.1016/j.ijpe.2010.10.020

Management Consulting Division (OMCD) in Japan and the Toyota

Supplier Support Center (TSSC) in the United States, many suppliers

have received assistance in building up lean manufacturing

capabilities. These organizational capabilities benefited both the

suppliers and Toyota in the long run (Dyer and Hatch, 2006; Dyer

and Nobeoka, 2000). Wal-Mart set up a supplier development

group and a series of strategies that help the retailer to better serve

customers. This group fosters close collaboration between WalMart and its suppliers and joint business planning. Consequences of

these efforts include significant improvement in customer awareness of brands, successful key item launches, and increased sales

(Hahn, 2005).

In line with the bigger prominence of supplier development in

corporate practice, scholars have lately paid increased attention to

supplier development activities and programs. In 2007 alone, nine

articles focusing on supplier development were published in

production- and operations management-related journals (Araz

and Ozkarahan, 2007; Carr and Kaynak, 2007; Chan and Kumar,

2007; Krause et al., 2007; Lee and Humphreys, 2007; Li et al., 2007;

Modi and Mabert, 2007; Rogers et al., 2007; Wouters et al., 2007).

All these studies and previous research on supplier development

have investigated the buying firms’ supplier development activities

at a single point in time and ignored the life-cycle of the buyer–

supplier relationship.

Scholars pointed out that suppliers with strategic partnershiplike relationships with the buying firm should be considered as

potential candidates for supplier development (Araz and

Ozkarahan, 2007; Talluri and Narasimhan, 2004). Likewise, Li

et al. (2007, p. 231) remarked that ‘‘[i]mprovements in performance will happen within the unique exchange relationships

developed between the buyer and supplier firms.’’ Since such

‘strategic partnership-like relationships’ or ‘unique exchange

278

S.M. Wagner / Int. J. Production Economics 129 (2011) 277–283

relationships’ which influence the effectiveness of buying firms’

supplier development activities develop over time, I contend that it

is necessary to go beyond the study of supplier development

activities at a single point in time and to take the stage of the buyer–

supplier relationship into account.

My study draws on social capital theory (e.g., Adler and Kwon,

2002; Inkpen and Tsang, 2005; Nahapiet and Ghoshal, 1998) to

explore the performance improvements of buying firms willing to

develop social capital with key suppliers through supplier development. The primary goal of the study is to explore the impact of

the dynamic nature of buyer–supplier relationships on the outcome of buying firms’ supplier development activities. I test my

proposed model in a cross-sectional sample by means of a quasilongitudinal analysis. More specifically, I show that different stages

of the buyer–supplier relationship life-cycle moderate the relationship between supplier development and the buying firm’s performance. As such, my research refines and extends previous

empirical studies on supplier development and asserts that the

life-cycle of the buyer–supplier relationship should be included as

a moderator in models studying the impact of supplier development and other models investigating buyer–supplier relationship

practices.

I next provide a review of the current literature on buyer–

supplier relationship dynamics embedded within the theoretical

constructs of social capital theory and previous research in

management and relationship marketing. This includes the delineation of my hypothesis. Next, I describe the data and the

measures, and present the analysis and results. Finally, I discuss

implications for further research.

2. Theory and development of hypothesis

2.1. Time contingent value of social capital

Social capital theory is an emerging concept that acknowledges

the inherent value of social structures such as relationships,

networks, and groups. Social capital refers to ‘‘the sum of the

actual and potential resources embedded within, available

through, and derived from the network of relationships possessed

by an individual or social unit’’ (Nahapiet and Ghoshal, 1998, p.

243). Central to the studies using social capital theory is the idea

that networks of relationships and interactions between individuals can facilitate the creation of value within firms (Inkpen and

Tsang, 2005; Tsai and Ghoshal, 1998).

Social capital can be defined and applied on different levels of

analysis, such as individuals, groups, and organizations (Adler and

Kwon, 2002). Whereas some relationships only require relationships between certain boundary spanning individuals, others need

group- or organization-level social capital to enable collaboration

in teams. One can distinguish between three components of social

capital: (1) relational capital (trust, identification and obligation),

(2) cognitive capital (shared ambition, vision, and values) and

(3) structural capital (strength and number of ties between actors).

Each dimension relates to a specific and identifiable aspect of social

capital (Nahapiet and Ghoshal, 1998). In the context of this study, I am

specifically concerned with the relational dimension of social capital.

While the explanatory power of social capital theory and the

central value and importance of social capital to organizations have

been popularized within the management literature (e.g., Adler

and Kwon, 2002; Lin, 2001; Nahapiet and Ghoshal, 1998; Tsai and

Ghoshal, 1998), social capital theory is particularly applicable to

better understanding buyer–supplier relationships. First, social

capital has been described as the ‘‘relational glue’’ underpinning

effective supply chains (McGrath and Sparks, 2005). Second, social

capital theory acknowledges that buyer–supplier relationships

are embedded within a larger social, environmental, political,

and legal context (Håkansson, 1982). Third, social capital enhances

the efficiency of buyer–supplier relationships resulting in the

creation of opportunities that may not otherwise have been

possible (Cousins et al., 2006; Krause et al., 2007; Lawson et al.,

2008).

Historically, it has been common to look at the transactional

nature of buyer–supplier exchanges, masking the embedded social

and behavioral aspects. However, just recently social capital has

received increasing attention as a theoretical lens through which to

understand buyer–supplier relationships and the value creation

process—resulting in four articles: drawing on social capital as

theoretical underpinning, Cousins et al. (2006) studied inter-organizational socialization processes that create relational value in supply

chains. Through case studies with six firms from the European food

industry, Knoppen and Christiaanse (2007) investigated the behavioral dimensions of inter-organizational adaptation in buyer–

supplier relationships along the lines of social capital theory and

delineated adaptation into a cognitive, relational, and structural

dimension. Krause et al. (2007) used social capital theory as the

explanatory framework for the relationship between buying firms’

supplier development efforts, the accumulation of three types of

social capital, and buying firm performance. Lawson et al. (2008) draw

on social capital theory to support their model linking relational

embeddedness and structural embeddedness to buyer performance

improvements within strategic buyer–supplier relationships.

Only two of the studies refer briefly to the time contingent value

of social capital. To capture relational capital, Krause et al. (2007)

included relationship length (i.e., years of the buyer–supplier

relationship) as a measure and suggested a simple positive linear

relationship between relationship length and improvement in the

buying firm’s performance. Knoppen and Christiaanse (2007) were

aware that the relationship stage has an influence on interorganizational adaptation. However, the authors did neither

investigate the influence of relationship length nor relationshiplife cycle in much detail. They merely concluded from their case

studies that ‘‘[p]artners admitted that trust had grown over the

years, by living through good and bad times together.’’ (Knoppen

and Christiaanse, 2007, p. 217) The authors realized that the crosssectional assessment of inter-organizational adaptation is a limitation and that future research should ideally apply a longitudinal

approach.

Both studies did not capture path dependence in the evolution

of social capital. Krause et al. (2007, p. 534) pointed out in the

discussion of relational capital that ‘‘past transactions may alter the

calculus for further transactions’’ and that ‘‘prior history of

cooperation between firms’’ has an impact on buyer–supplier

relationship outcomes. However, the authors did not factor the

path dependence of buyer–supplier relationships into their model.

Path dependence could have been modeled by including some

measure of relationship length or relationship life-cycle as a

moderator between a buyer–supplier relationship management

practice and performance. In a nutshell, I suggest to account for the

dynamic nature of buyer–supplier relationships over the relationship life-cycle in studies on supplier development.

2.2. Dynamic nature of buyer–supplier relationships

Krause et al. (2007) posited simple positive linear relationships

between relationship length and the improvement in two categories of buying firm performance. Both relationships were not

supported, which is not surprising given the recent hints of social

capital theorists to the path dependence of social capital.

Kotabe et al. (2003) studied two forms of knowledge exchange

between a buying firm and a supplier – which can be considered as

S.M. Wagner / Int. J. Production Economics 129 (2011) 277–283

a means of supplier development (Krause et al., 2000; Wagner,

2006) – and its impact on supplier performance and included the

length of the relationship as a moderator. The results show that the

hypotheses were only partially supported: relationship length did

not moderate the link between technical exchanges and supplier

performance improvements, while relationship length did moderate the link between efforts to transfer technology and supplier

performance improvements. These findings caused them to argue

that simple technical exchanges can enhance supplier performance

independent of the history of the relationship.

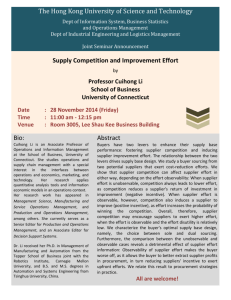

I argue that a more accurate model of supplier development

activities should account for the life-cycle of the buyer–supplier

relationship by including a squared term for relationship length as

a moderator for the relationship between the buying firm’s supplier

development activities and the improvement in the buying firm’s

performance. The inclusion of a squared term for relationship

length as a moderator is a much better reflection of the dynamic

nature of buyer–supplier relationships over the relationship lifecycle. Fig. 1 depicts the possible approaches to include relationship

length in a model on supplier development.

The marketing literature emphasizes the importance of the

dynamic nature of buyer–supplier relationships and encourages

researchers to include the relationship life-cycle in their analysis.

Several marketing scholars insist that the interactions between

buyers and suppliers and their outcomes are contingent on the

stage of the buyer–supplier relationship (e.g., Dwyer et al., 1987;

Frazier et al., 1988; Jap and Ganesan, 2000; Medlin, 2004; Wilson,

1995). Researchers have proposed several ways of categorizing the

phases in the buyer–supplier relationship. Aside from the number

of phases and their labels, in all relationship models the phases

are characterized by their direction and strength of growth

(e.g., initiation, maturity, and decline).

Buyer–supplier relationships are built up over time through

legal, formal and informal exchange processes, and relation-specific

investments (Ring and Van De Ven, 1994). The relationship life-cycle

influences the development of central relationship marketing constructs, such as cooperation, adaptation, information sharing, or

Source

279

commitment (Jap and Ganesan, 2000; Wilson, 1995). Supplier

development will be more successful if the relationship is in a stage

where the levels of cooperation, adaptation, information sharing,

commitment, etc. are high (maturity) rather than low (initiation and

decline).

Trust is a central organizing construct in buyer–supplier

relationships. Trust builds slowly from experience as the relationship progresses and vanishes as the firms seek to leave the

relationship (Dwyer et al., 1987; Zaheer et al., 1998). Firms in

buyer–supplier relationships are more willing to work with other

firms they can trust. When trust prevails, employees involved in

supplier development activities will be more open to knowledge

sharing with employees of the other party. Therefore, the outcome

of supplier development activities in trust-based and reliable

relationships will be more positive.

The low impact of supplier development at the early and late

stages and the high impact at the intermediate stages of the buyer–

supplier relationship life-cycle are also supported by research

of Jap and Anderson (2007). They found that relationship properties – such as goal congruence, idiosyncratic time investments,

idiosyncratic adaptation investments, willingness to take risk, or

information exchange – are low in the exploration and decline

phases of the relationship and high in the build-up and maturity

phases. The effectiveness of supplier development activities will

follow such a pattern of increase, zenith, and decline because many

of these relationship properties are supportive or necessary for

supplier development activities.

In sum, in established buyer–supplier relationships, a buying

firm’s supplier development activities will have the highest impact

on its performance improvement. In contrast, supplier development in newer and older buyer–supplier relationships will be

detrimental to the buying firm’s performance. As a refinement and

extension of the work of Krause et al. (2007) and Kotabe et al.

(2003) I therefore posit:

Hypothesis. The linear relationship between supplier development and performance is maximized at a moderate level of

Proposed relationship

Model

P

Proposed by

Krause, Handfield,

and Tyler (2007)

Supplier development

Performance

Relationship length

RL

P

Proposed by

Kotabe, Martin, and

Domoto (2003)

High SD

Relationship length

Supplier development

Performance

Low SD

RL

P

Relationship length 2

High SD

Proposed in this

research

Supplier development

Performance

Low SD

RL: Relationship length; P: Performance; SD: Supplier development

Fig. 1. Approaches to include relationship length in a model on supplier development.

RL

280

S.M. Wagner / Int. J. Production Economics 129 (2011) 277–283

relationship length. Low and high levels of relationship length have

a detrimental effect.

3. Methods

3.1. Data collection and sample

To test this hypothesis, data were collected through a survey,

which was administered to 251 firms in Germany, Switzerland, and

Austria. From these 251 targeted firms, the responses of 60 were

finally used for this study, yielding an effective response rate

of 23.9%. A variety of industries is represented in the sample,

including high-tech, automotive, machinery and plant construction,

construction, chemicals and pharmaceuticals, food, and textiles.

About 30.9% of the responding firms had an annual sales volume

of US $100 million or less, 18.2% had between US $100 million and

US $250 million, 21.8% between US $250 million and US $ 1 billion,

21.8% between US $1 billion and US $5 billion, and 7.3% of more than

US $5 billion. The average annual sales volume was US $1.56 billion.

Purchasing or supply chain management executives were the key

informants. These informants are likely to have an overarching,

boundary-spanning view of their companies’ supplier development

activities (Jemison, 1984). The majority of informants in this sample

were heads of purchasing (61.7%) and heads of supply chain management, logistics or materials management (20.0%). The remainder

described themselves as purchasing or commodity managers (11.7%),

heads of supplier development, procurement information managers,

or quality managers (6.7%). All had held their position for an average

of 5.3 years and had been with the firm for an average of 7.0 years.

The respondents were asked to answer the questions with respect

to the development of one particular supplier. Therefore, the units of

analysis in this research are not the buying firms’ supplier development activities in general, but rather the activities performed and the

performance improvements achieved through the development of an

individual supplier (‘‘Supplier X’’). On average, the firms have

maintained relationships with the suppliers for about 10.2 years

prior to their development, which ranged from 1 to 22 years.

Furthermore, from the total of 60 supplier development incidents

in my sample, 50 pertain to suppliers of products, such as printed

circuit boards, electronic assemblies, mobile phone handsets, plastics

moldings, hydraulic power units, chemicals, flavoring, or tomato

puree. The remaining ten were suppliers of services, such as logistics

services, mechanical processing, electric installation, or facility management. As can be seen, the supplier development activities included

in this study cover a broad spectrum of products and services, thus

enhancing the robustness and generalizability of the results.

3.2. Measures

The measures used in my study tie in with the measures used by

Krause et al. (2007). Multiple-item measures assess the two main

constructs on five-point Likert scales. Translated descriptions of the

specific measures and items used are included in Appendix A.

Descriptive statistics, correlations of summated composites, and

scale reliabilities are summarized in Table 1.

Supplier development can be categorized as either ‘‘indirect’’

(also called ‘‘externalized’’) or ‘‘direct’’ (also called ‘‘internalized’’).

When a buying firm engages in indirect supplier development, the

firm commits no or only limited resources to a specific supplier. In

case of direct supplier development, the buying firm plays an active

role and dedicates considerable relation-specific resources to a

supplier (Krause et al., 2000; Monczka et al., 1993). The supplier

development construct used in this study consists of direct supplier

development activities. There are two reasons why my supplier

development measure taps direct supplier development activities.

First, strategic buyer–supplier relationships and social capital

accumulation are more relevant for direct supplier development

than for indirect supplier development. Second, Kotabe et al.’s

(2003) and Krause et al.’s (2007) supplier development construct

also pertains to direct supplier development activities. The five

items were selected from prior studies, which have assigned a

range of activities to direct development (Krause et al., 2000;

Wagner, 2006). Thus, the measures used for supplier development

focus on the allocation of buyer personnel to the supplier and the

transfer of tacit knowledge in order to improve the supplier’s

skill base with respect to technology, product development and

manufacturing, and training of supplier personnel. The supplier

development scale shows a satisfactory level of reliability with a

Cronbach’s alpha of 0.81.

To capture the impact of the supplier development activities on

the buying firm’s performance improvement I developed a sevenitem scale based on prevailing supplier performance goals, and

competitive priorities in operations, supply chain management,

and purchasing (Krause et al., 2001; Ward et al., 1998) as well as on

the operationalization of Krause et al. (2007) ‘‘quality, delivery, and

flexibility’’ performance improvement construct. The items indicate the effect of the supplier development activities on the buying

firm’s own product and service performance. The performance

improvement construct turned out to be reliable with a favorable

Cronbach’s alpha of 0.90.

To ensure discriminant validity, principal component factor

analysis (as shown in Appendix A) was conducted. The analysis

resulted in two uniquely interpretable factors, with all supplier

development items clearly loading together on one factor, and all

performance improvement items loading together on another

factor. The explained variance of these two factors was 61%.

To capture the dynamics of a buyer–supplier relationship over

the life-cycle would require the collection of longitudinal data on

the relationship over several years. Since such longitudinal studies

are very difficult to perform, researchers typically examine buyer–

supplier relationships at a single point in time. To overcome this

challenge one can classify the relationships by their phase and use

this information for quasi-longitudinal analysis (Anderson, 1995).

Table 1

Descriptive statistics and correlations.

Variable

Items

Scale

Alpha

Mean

S.D.

(1)

(2)

(3)

(4)

(5)

(1)

(2)

(3)

(4)

(5)

1

1

5

1

7

US $

5-point

5-point

Years

5-point

–

–

0.81

–

0.90

1.56 bn

3.82

2.63

10.2

3.53

4.14 bn

1.24

1.03

5.9

1.06

1.00

0.04

0.26*

0.03

0.11

1.00

0.03

0.13

0.32**

1.00

0.02

0.30**

1.00

0.15

1.00

Annual sales

Strategic importance

Supplier development

Relationship length

Performance improvement

Notes: N ¼60.

n

Correlation significant at the 0.10 level.

Correlation significant at the 0.05 level.

nn

S.M. Wagner / Int. J. Production Economics 129 (2011) 277–283

In my study, I applied the squared term for relationship length as a

proxy for the relationship life-cycle stage.

In order to eliminate undesired sources of variance that confound research findings, two control variables were included in the

analysis. First, since the financial resources of larger firms could

make them more successful in their supplier development activities, firm size can be a potential source of variance. Therefore,

I included firm size – measured by a single item asking respondents

for their firms’ annual sales volume in US dollars – as control

variable in my analysis when I tested the effect of supplier

development activities on supplier firm improvements. Second,

since buying firms might pay particular attention to suppliers of

strategic items and initiate supplier development in different

situations (e.g., even in case of minor supplier deficiencies)

and support supplier development activities more intensively

(as opposed to suppliers of non-strategic items), another control

variable was included. The respondents had to indicate in a single

item to which degree the ‘‘delivery of Supplier X was of strategic

importance for my firm.’’

281

the linear by curvilinear interaction by including the product of

supplier development and the squared term for relationship length.

To support the linear by curvilinear interaction, the standard

estimate should be negative and significant, with a significant

change in the model’s explained variance. The results in Model 3 in

Table 2 support my hypothesis (b¼ 1.91, po0.05) and show that

the degree of linearity of the relationship of supplier development

to performance improvement depends curvilinearly upon relationship length. This relationship is depicted in Fig. 2 for medium

(mean), low ( 1 standard deviation) and high (+ 1 standard

deviation) levels of supplier development. Upon entering the linear

by curvilinear interaction term, the overall model is highly

significant (p o0.01), and the explained variance increases by

0.07 (p o0.05).

5. Discussion and managerial implications

The analysis presented in this article refines and extends

previous work on the performance implications of supplier

Following the procedure proposed by Cohen et al. (2003,

pp. 292–295) and Jaccard and Turrisi (2003, pp. 60–65) I employed

hierarchical regression analysis and estimated three models in

order to test my research hypothesis that a linear by curvilinear

interaction exists among supplier development, relationship

length, and performance improvement. Since interactions are

involved, the variables were standardized prior to the analysis

(Bauer and Curran, 2005; Cohen et al., 2003). Table 2 presents the

standardized parameter estimates and t-values resulting from

these models.

Model 1 – the baseline model – includes the control variables

and is significant (p o0.05). The strategic importance of the

purchased item is significantly related to performance improvement (b¼0.32, po0.05). Model 2 estimates the main and linear

interaction effects of the buying firm’s supplier development

activities and relationship length. Supplier development is significantly related to performance improvement (b¼ 0.35, p o0.05).

Relationship length in itself is not related to performance improvement. The overall model is significant (p o0.05). In Model 3 I tested

Performance

improvement

4. Analysis and results

High

Medium

Low

Relationship length

Fig. 2. Performance improvements depending on relationship length at different

levels of supplier development.

Table 2

Regression analysis.

Independent variables

Controls

Annual sales

Strategic importance

Model 1

Model 2

b

t-value

b

t-value

b

t-value

0.12

0.32nn

0.91

2.38

0.19

0.28nn

1.39

2.17

0.28nn

0.30nn

2.06

2.36

0.35nn

0.07

0.06

0.14

2.62

0.13

0.11

1.07

1.70nn

0.07

0.19

1.14n

2.61

0.14

0.36

1.84

1.91nn

2.11

Lower order components

Supplier development

Relationship length

Relationship length2

Supplier development Relationship length

Linear by curvilinear component

Supplier development Relationship length2

R2

R2 change

F

n

0.10.

0.05.

nnn

0.01.

nn

Model 3

0.11

0.11nn

3.17nn

0.26

0.15n

2.63nn

0.33

0.07nn

3.07nnn

282

S.M. Wagner / Int. J. Production Economics 129 (2011) 277–283

development by supporting my hypothesis that the linear relationship between supplier development and performance is maximized at intermediate relationship life-cycle stages. As such,

drawing on social capital theory and the relationship marketing

literature, I show that neither relationship length as a direct

antecedent of performance (Krause et al., 2007) nor as a moderator

in the link between supplier development and performance

(Kotabe et al., 2003) account sufficiently for the dynamics of

buyer–supplier relationships (Dwyer et al., 1987) and the path

dependence of social capital evolution (Rhee, 2007).

Instead, given that I used the squared term of relationship

length as a proxy for the life-cycle of the buyer–supplier relationship I show that the effectiveness of a buying firm’s supplier

development activities is moderated by the relationship life-cycle.

Using the relationship life-cycle as a moderator, I account for the

fact that for supplier development to be successful, established and

partnership-like buyer–supplier relationships are required (Araz

and Ozkarahan, 2007; Talluri and Narasimhan, 2004). Critical

constituent and building-blocks of supplier development are trust,

communication and information exchange, and relation-specific

investments (time, resources, know-how). In buyer–supplier relationships, establishing trust, strong communication and information links, and building up relation-specific assets is time bound

(Fichman and Levinthal, 1991; Jap and Anderson, 2007; Kogut and

Zander, 1992). In an initial acquaintance phase (initiation phase),

the buyer and supplier develop relation-specific routines so that

they are better able to engage in supplier development activities

(e.g., exchange of tacit knowledge) (Dwyer et al., 1987; Ring and

Van De Ven, 1994). When a buyer–supplier relationship is in the

decline phase (e.g., due to a discomfort, discontent or disagreement

about the collaboration, or simply because of the phase-out of a

product sourced from the supplier) and approaches the termination of the relationship, both parties will engage less in relationspecific routine and reduce relation-specific investments. That is,

the critical constitutes of supplier development vanish and supplier

development will become less effective (Dwyer et al., 1987; Ring

and Van De Ven, 1994).

My study has several important implications for managerial

practice. First, prior to investing in supplier development activities,

the buying firm should carefully assess the status of the buyer–

supplier relationship, because the effectiveness of supplier development depends on the life-cycle (e.g., initiation, maturity, or

decline) of the buyer–supplier relationship. Second, the buying

firm should stay away from direct supplier development (which

I investigate in the present study) in the very early and very late

stages of the relationship with a supplier. My life-cycle perspective

confirms previous recommendations that direct supplier development activities should be preceded by indirect supplier development activities (Giunipero, 1990; Krause et al., 2000; Wagner,

2006). That is, in the early stage of a buyer–supplier relationship

the buying firm should consider indirect supplier development

(e.g., supplier assessment, evaluation, or feedback) and then

gradually move into direct development activities (e.g., training,

consulting, or staff transfer). On the contrary, in declining buyer–

supplier relationships the buying firm should gradually move from

direct to indirect development activities.

6. Methodological implications and recommendations

From my research I can draw some valuable implications and

recommendations for future studies. First, I show that it is vital to

account properly for the path dependence in the evolution of social

capital and the theoretically well-established dynamic nature of

buyer–supplier relationships in studies on supplier development,

because the relationship life-cycle might moderate the relationship

between supplier relationship management practices and performance outcomes. Second, the quasi-longitudinal study design put

forward in this research is a useful way to account for the dynamics

of buyer–supplier relationships in light of the resource and time

constraints of academic research. Third, by having used the squared

term for relationship length as a proxy for relationship life-cycle

stage I want to point out that a curvilinear interaction effect of

relationship length is equivalent to a linear interaction effect of

relationship life-cycle. As a consequence, future research could

either use objective measures of relationship length or subjective

measures of relationship life-cycle in order to account for the

dynamic nature of the buyer–supplier relationship in studies on

supplier development practices and its effects on performance.

Both measures have their strengths and shortcomings. While

researchers might obtain objective relationship length measures

from a second data source (e.g., a firm’s ERP system), thus reducing

the threat of common source bias, such data might not be available.

A subjective assessment of the relationship life-cycle can be

obtained by collecting information about the strength and direction of growth. More specifically, measuring the intention to

expand the business with a supplier (e.g., the purchasing volume

with a supplier) can serve as a reverse coded proxy for the maturity

of the buyer–supplier relationship. A high intention to expand

business with a supplier would indicate a buyer–supplier relationship in its initiation phase, a low intention to expand business with

a supplier would indicate a mature relationship, and the intention

to reduce business would indicate a declining buyer–supplier

relationship.

I hope that my findings will encourage other scholars in

production and operations management to embark on research

into the life-cycle of buyer–supplier relationships.

Appendix A

See Table A1.

Table A1

Exploratory factor analysis.

Survey items

Supplier

Performance

development improvement

Our firm has undertaken supplier development

Giving manufacturing related advice (e.g.,

processes, machining process, machine set

up).

Training of employees from Supplier X.

Giving product development related advice

(e.g., processes, project management).

The transfer of employees to Supplier X.

Giving technological advice (e.g., materials,

software).

with Supplier X through y

0.800

0.097

0.793

0.718

0.003

0.202

0.699

0.690

0.080

0.128

Through the development of Supplier X our firm was able to y

Improve our delivery reliability.

0.076

0.847

Reduce time-to-market.

0.017

0.843

Reduce production downtimes.

0.349

0.782

Increase the satisfaction of our customers.

0.162

0.773

Improve the reliability of our products.

0.188

0.733

Improve the quality of our products.

0.292

0.724

Offer more innovative products to our

0.033

0.721

customers.

Notes: All items were measured on five-point Likert scales ranging from 1 (‘‘strongly

disagree’’) to 5 (‘‘strongly agree’’).

S.M. Wagner / Int. J. Production Economics 129 (2011) 277–283

References

Adler, P.S., Kwon, S.-W., 2002. Social capital: prospects for a new concept. Academy

of Management Review 27 (1), 17–40.

Anderson, J.C., 1995. Relationships in business markets: exchange episodes, value

creation, and their empirical assessment. Journal of the Academy of Marketing

Science 23 (4), 346–350.

Araz, C., Ozkarahan, I., 2007. Supplier evaluation and management system for

strategic sourcing based on a new multicriteria sorting procedure. International

Journal of Production Economics 106 (2), 585–606.

Avery, S., 2008. Suppliers follow a road map to LEAN. Purchasing 137 (4), 53–55.

Bauer, D.J., Curran, P.J., 2005. Probing interactions in fixed and multilevel regression:

inferential and graphical techniques. Multivariate Behavioral Research 40 (3),

373–400.

Carr, A.S., Kaynak, H., 2007. Communication methods, information sharing, supplier

development and performance: an empirical study of their relationships.

International Journal of Operations and Production Management 27 (4),

346–370.

Chan, F.T.S., Kumar, N., 2007. Global supplier development considering risk factors

using fuzzy extended AHP-based approach. Omega 35 (4), 417–431.

Cohen, J., Cohen, P., West, S.G., Aiken, L.S., 2003. Applied Multiple Regression/

Correlation Analysis for the Behavioral Sciences third ed. Lawrence Erlbaum

Associates, Mahwah, NJ.

Cousins, P.D., Handfield, R.B., Lawson, B., Petersen, K.J., 2006. Creating supply chain

relational capital: the impact of formal and informal socialization processes.

Journal of Operations Management 24 (6), 851–863.

Dwyer, F.R., Schurr, P.H., Oh, S., 1987. Developing buyer–supplier relationships.

Journal of Marketing 51 (2), 11–27.

Dyer, J.H., Hatch, N.W., 2006. Relation-specific capabilities and barriers to knowledge transfers: creating advantage through network relationships. Strategic

Management Journal 27 (8), 701–719.

Dyer, J.H., Nobeoka, K., 2000. Creating and managing a high-performance knowledge-sharing network: the Toyota case. Strategic Management Journal 21 (3),

345–367.

Fichman, M., Levinthal, D.A., 1991. Honeymoons and the liability of adolescence: a

new perspective on duration dependence in social and organizational relationships. Academy of Management Review 16 (2), 442–468.

Frazier, G.L., Spekman, R.E., O’Neal, C.R., 1988. Just-in-time exchange relationships

in industrial markets. Journal of Marketing 52 (4), 52–67.

Giunipero, L.C., 1990. Motivating and monitoring JIT supplier performance. Journal

of Purchasing and Materials Management 26 (3), 19–24.

Golden, P., 1999. Deere on the run: quick response manufacturing drives supplier

development at John Deere. IIE Solutions 31 (7), 24–31.

Hahn, G., 2005. Supplier development serves customers worldwide. DSN Retailing

Today 44 (December 19), 6.

Håkansson, H. (Ed.), 1982. International Marketing and Purchasing of Industrial

Goods: An Interactive Approach. John Wiley & Sons, New York.

Inkpen, A.C., Tsang, E.W.K., 2005. Social capital, networks and knowledge transfer.

Academy of Management Review 30 (1), 146–165.

Jaccard, J., Turrisi, R., 2003. Interaction Effects in Multiple Regression second ed. Sage

Publications, Newbury Park, CA.

Jap, S.D., Anderson, E., 2007. Testing a life-cycle theory of cooperative interorganizational relationships: movement across stages and performance. Management

Science 53 (2), 260–275.

Jap, S.D., Ganesan, S., 2000. Control mechanisms in the relationship life cycle:

implications for safeguarding specific investments and developing commitment. Journal of Marketing Research 37 (2), 227–245.

Jemison, D.B., 1984. The importance of boundary spanning roles in strategic

decision-making. Journal of Management Studies 21 (2), 131–152.

Knoppen, D., Christiaanse, E., 2007. Interorganizational adaptation in supply chains:

a behavioral perspective. International Journal of Logistics Management 18 (2),

217–237.

Kogut, B., Zander, U., 1992. Knowledge of the firm, combinative capabilities, and the

replication of technology. Organization Science 3 (3), 383–397.

283

Kotabe, M., Martin, X., Domoto, H., 2003. Gaining from vertical partnerships:

knowledge transfer, relationship duration, and supplier performance improvement in the U.S. and Japanese automotive industries. Strategic Management

Journal 24 (4), 293–316.

Krause, D.R., Handfield, R.B., Tyler, B.B., 2007. The relationships between supplier

development, commitment, social capital accumulation and performance

improvement. Journal of Operations Management 25 (2), 528–545.

Krause, D.R., Pagell, M., Curkovic, S., 2001. Toward a measure of competitive

priorities for purchasing. Journal of Operations Management 19 (4), 497–512.

Krause, D.R., Scannell, T.V., Calantone, R.J., 2000. A structural analysis of the

effectiveness of buying firms’ strategies to improve supplier performance.

Decision Sciences 31 (1), 33–55.

Lawson, B., Tyler, B.B., Cousins, P.D., 2008. Antecedents and consequences of social

capital on buyer performance improvement. Journal of Operations Management

26 (3), 446–460.

Lee, P.K.C., Humphreys, P.K., 2007. The role of Guanxi in supply management

practices. International Journal of Production Economics 106 (2), 450–467.

Li, W., Humphreys, P.K., Yeung, A.C.L., Cheng, T.C.E., 2007. The impact of specific

supplier development efforts on buyer competitive advantage: an empirical

model. International Journal of Production Economics 106 (1), 230–247.

Lin, N., 2001. Social Capital: A Theory of Social Structure and Action. Cambridge

University Press, New York.

MacDuffie, J.P., Helper, S.R., 1997. Creating lean suppliers: diffusing lean production

throughout the supply chain. California Management Review 39 (4), 118–151.

McGrath, R., Sparks, W.L., 2005. The importance of building social capital. Quality

Progress 38 (22), 45–49.

Medlin, C.J., 2004. Interaction in business relationships: a time perspective.

Industrial Marketing Management 33 (3), 185–193.

Modi, S.B., Mabert, V.A., 2007. Supplier development: improving supplier performance through knowledge transfer. Journal of Operations Management 25 (1),

42–64.

Monczka, R.M., Trent, R., Callahan, T., 1993. Supply base strategies to maximize

supplier performance. International Journal of Physical Distribution and Logistics Management 23 (4), 42–54.

Nahapiet, J., Ghoshal, S., 1998. Social capital, intellectual capital and the organizational advantage. Academy of Management Review 23 (2), 242–266.

Rhee, M., 2007. The time relevance of social capital. Rationality and Society 19 (3),

367–389.

Ring, P.S., Van De Ven, A.H., 1994. Developmental processes of cooperative

interorganizational relationships. Academy of Management Review 19 (1),

90–118.

Rogers, K.W., Purdy, L., Safayeni, F., Duimering, P.R., 2007. A supplier development

program: rational process or institutional image construction? Journal of

Operations Management 25 (2) 556–572.

Sako, M., 2004. Supplier development at Honda, Nissan and Toyota: comparative

case studies of organizational capability enhancement. Industrial and Corporate

Change 13 (2), 281–308.

Talluri, S., Narasimhan, R., 2004. A methodology for strategic sourcing. European

Journal of Operational Research 154 (1), 236–250.

Tsai, W., Ghoshal, S., 1998. Social capital and value creation: the role of intrafirm

networks. Academy of Management Journal 41 (4), 464–476.

Wagner, S.M., 2006. Supplier development practices: an exploratory study. European Journal of Marketing 40 (5/6), 554–571.

Ward, P.T., McCreery, J.K., Ritzman, L.P., Sharma, D., 1998. Competitive priorities in

operations management. Decision Sciences 29 (4), 1035–1046.

Wilson, D.T., 1995. An integrated model of buyer–seller relationships. Journal of the

Academy of Marketing Science 23 (4), 335–345.

Wouters, M., van Jarwaarde, E., Groen, B., 2007. Supplier development and cost

management in Southeast Asia—results from a field study. Journal of Purchasing

and Supply Management 13 (4), 228–244.

Zaheer, A., McEvily, B., Perrone, V., 1998. Does trust matter? Exploring the effects of

interorganizational and interpersonal trust on performance. Organization

Science 9 (2), 141–159.