2 Financial Markets and Transformation Functions

advertisement

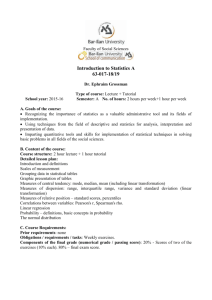

Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management 2 Financial Markets and Transformation Functions Financing and Transformation Functions financial deficit units (mainly companies) financial intermediaries financial institutions financial excess units (mainly private households) financial intermediation lot size and spatial transformation transformation functions of financial markets risk transformation issuing of financial assets capital investment Institutions: Exchanges OTC Markets Bank Markets Insurance Markets period and liquidity transformation 36 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management a) Lot Size and Spatial Transformation Spatial transformation: - Solvency at different places (monetary transactions, loans) - Capital transfers between regions financial balancing Effects of the failure of a banking system? Lot size transformation: - Matching investments of a different size - Pooling small deposits - Splitting large deposits 37 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management b) Period and Liquidity Transformation - Financing long-term investments with short-term funds (positive period transformation) and vice versa (negative period transformation) - Option to withdraw financial resources out of long-term projects prior to maturity Enabled by: Secondary markets Price and liquidity risks Possibility of hedging with particular financial products Intermediation Counter party risk for the investor Limited default risk of the financial intermediary by setting financing rules 38 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Financial Rules to Limit the Risks that Arise from Period and Liquidity Transformation Golden Banking Rule/Golden Rule of Finance: Total maturity matching Golden Rule of Balance Sheet Basis: “Schichtenbilanz” assets liabilities A1: Assets with a capital commitment of over F1: Financial resources invested longer than 4 4 years years A2: Assets with a capital commitment of 3 F2: : Financial resources invested 3 months to months to 4 years 4 years A3: Assets with a capital commitment up to 3 F3: : Financial resources invested less than 3 months months A1 ≤ F1 and A1+A2 ≤ F1+F2 “Bodensatzregel” (Principles II and III of BAKred) Rule 1: A1 ≤ F1 + 0,6 F2 + 0,1 F3 Rule 2: A2 ≤ (F1 + 0,6 F2 + 0,1 F3 - A1) + 0,4 F2 + 0,2 F3 39 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management c) Risk Transformation Via secondary markets: Portfolio diversification: (stock) exchange or funds Limiting risk by using financial derivates Via financial intermediaries: Portfolio diversification and available net equity of a bank or insurance company Banks as “delegated monitor“ and “delegated contractor“ Implementation by banks: Risk management 40 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Model Calculation Arrow-Debreu-Model: - 4 states with identical probability - 2 financial assets (A1 and A2) - Utility functions U or V - Amount of investment: 100 state: s1 s2 s3 s4 A1 x11 = 130 x12 = 130 x13 = 90 x14 = 90 A2 x21 = 160 x22 = 60 x21 = 160 x22 = 60 U x U(Al) 11,40 11,40 9,49 9,49 U(A2) 12,65 7,75 12,65 7,75 E(U(A1)) = 10,44 x V x 5 E(U(A2)) = 10,20 x 100 otherwise V(A1) 11,40 11,40 4,49 4,49 V(A2) 12,65 2,75 12,65 2,75 E(V(A1)) = 7,94 E(V(A2)) = 7,70 41 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Risk Transformation by Diversification: state: s1 s2 s3 s4 A1 x11 = 130 x12 = 130 x13 = 90 x14 = 90 A2 x21 = 160 x22 = 60 x21 = 160 x22 = 60 Portfolio formation: Purchase α = 50% of A1 and (1 – α) = 50% of A2 ½ A1 + ½ A2 xd1 = 145 xd2 = 95 xd3 = 125 xd4 = 75 U(α = 50%) 12.04 9.75 11.18 8.66 V(α = 50%) 12.04 4.75 11.18 3.66 E(U(α = 50%)) = 10,40 E(V(α = 50%)) = 7,90 (“naive” diversification, without success in this case) Portfolio formation: Purchase α = 86.52% of A1 and (1 - α) = 13.48% of A2 xd1 = 134,04 xd2 = 120.56 xd3 = 99.44 xd4 = 85.96 U(α = 86,52%) 11.58 10.98 9,97 9.27 V(α = 86,52%) 11.58 10.98 4.97 4.27 E(U(α = 86.52%)) = 10.45 E(V(α = 86.52%)) = 7.95 (optimal diversification for utility function U) Instruments: Diversification via portfolio formation Buying shares in a fund Buying bank or insurance shares 42 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Risk Transformation by Risk Splitting: state: s1 s2 s3 s4 A1 x11 = 130 x12 = 130 x13 = 90 x14 = 90 A2 x21 = 160 x22 = 60 x21 = 160 x22 = 60 xsl1 = 120 xsl2 = 120 xsl3 = 100 xsl4 = 100 10,95 10,95 10 10 “No-loss“ contract (e.g. on A1): U(SL) = V(SL) E(U(x)) = E(V(x)) = 10,47 Risk free asset: U(RF) = V(RF) xrl1 = 110 xsl2 = 110 xsl3 = 110 xsl4 = 110 10,49 10,49 10,49 10,49 E(U(x)) = E(V(x)) = 10,49 Hedging or financial engineering by: Contracting with a bank A particular fund construction Buying financial assets on the capital market 43 Prof. Dr. Hans-Peter Burghof, University of Hohenheim, Bank Management Financial Engineering on the Capital Market: E.g.: Combination of shares in A1 and a (long) put option Wealth of the investor in T Portfolio Desired Minimum Wealth in T (e.g. 100) A1 Put Option Value of the Asset in T State: A1 (α of 100) Put option with strike P on α A1 Desired cash flow 130 120 s1 s2 s3 s4 α130 α130 α90 α90 0 0 α(P – 90) α(P – 90) xsl1 = 120 xsl2 = 120 xsl3 = 100 Xsl4 = 100 12 13 90 P 90 100 P 100 100 13 108, 3 12 Costs: (risk free interest rate i = 10% and risk neutral valuation of the option) 100 92,31 Buying shares of the asset A1 : Buying a put option 1 1 1 12 1 108, 3 90 7,69 108, 3 90 on share α of the asset : 2 1,1 1 i 2 13 Total costs : 92,31 7,69 100 44