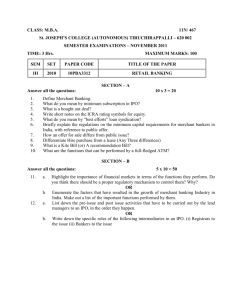

Annual Reports: 2012 - 13

advertisement