Q4 2013 GLOBAL VISION - CBRE Global Investors

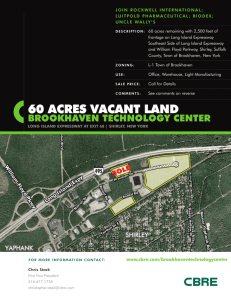

advertisement